- Home

- »

- Petrochemicals

- »

-

Biomethane Market Size And Share, Industry Report, 2030GVR Report cover

![Biomethane Market Size, Share & Trends Report]()

Biomethane Market Size, Share & Trends Analysis Report By Source (Energy Crops, Animal Manure, Municipal Waste, Waste Water Sludge), By End-use (Construction, Industrial, Power Generation, Transport), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-378-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Biomethane Market Size & Trends

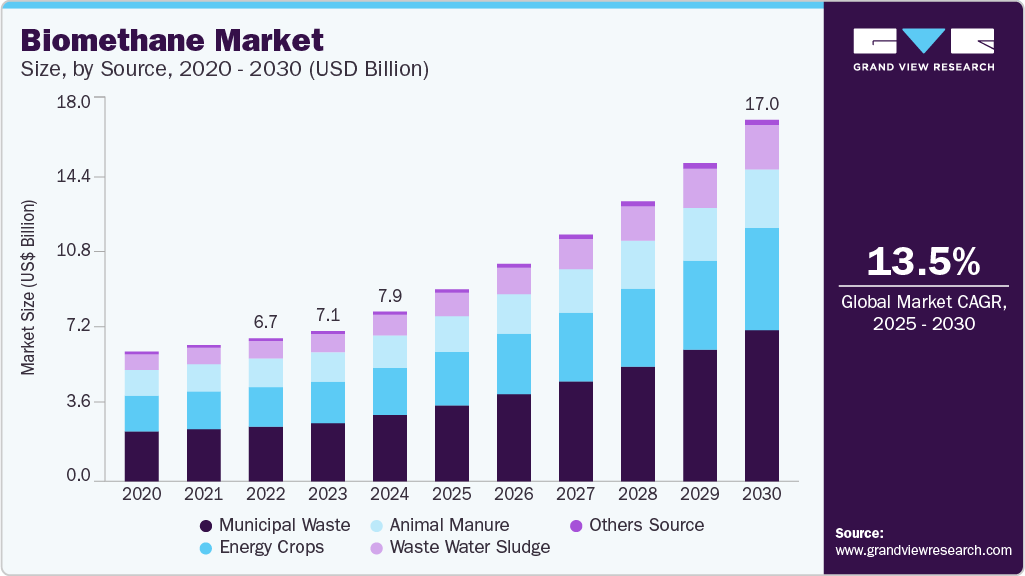

The global biomethane market size was estimated at USD 7.99 billion in 2024 and is projected to grow at a CAGR of 13.5% from 2025 to 2030. Biomethane is a renewable source that is used for diverse applications such as construction, power generation, transportation, and industrial applications.

Key Highlights:

- Europe biomethane market dominated the global industry and accounted for over 45.6% revenue share in 2024.

- The biomethane market in the U.S. is growing, as according to the American Biogas Council, about USD 1.8 billion in capital investment worth biogas projects came online in 2023.

- By source, municipal waste accounted for the highest revenue share of about 39.0% in 2024.

- By end-use, construction accounted for the highest revenue share of over 43.0% in 2024.

The growing demand for efficient power transmission is anticipated to boost the market over the forecast period. Biomethane is a type of gas derived from the biological breakdown of organic matter, such as agricultural waste, food waste, sewage, and other organic materials. It is a renewable energy source and is considered a sustainable alternative to fossil fuels. Biomethane is produced through a renewable process called anaerobic digestion, where microorganisms break down organic matter in the absence of oxygen, resulting in the production of biogas.

Drivers, Opportunities & Restraints

Energy sustainability and the net-zero decarbonization goal set forth by global governments are the key drivers for the biomethane industry. It reduces dependence on imported fossil fuels and promotes the development of a circular economy, since waste material is recycled to produce efficient and clean energy. The global transition toward the adoption of sustainable energy is anticipated to drive the market over the forecast period.

A key opportunity for the industry lies in the generation potential of sources of biomethane. Specific energy crops, which are low-cost and low-maintenance crops that are grown solely for energy production, have played a vital part in the increase of biogas production across the world. Moreover, using waste and by-products can be aligned with the sustainability goals across the world and assist in the generation of biomethane for diverse applications.

The industry faces inherent restraints, such as the high manufacturing cost due to technological advancements. Its production cost remains higher than that of conventional energy. Hence, this factor has restrained the widespread adoption and utilization of biomethane across the world, and its applications are hence limited to developed countries of Europe, where both generation and technology and widely adopted.

Source Insights

Municipal waste accounted for the highest revenue share of about 39.0% in 2024.The municipal waste segment is expected to register the fastest CAGR of 14.7% during the forecast period. Municipal waste is a key source segment in the biomethane market, driven by increasing urbanization and the need for sustainable waste management solutions. Organic fractions of municipal solid waste (OFMSW), such as food scraps, garden waste, and biodegradable packaging, are processed through anaerobic digestion to produce biogas, which is then upgraded to biomethane. This approach not only reduces landfill dependency and methane emissions but also supports circular economy goals by converting waste into renewable energy.

Many municipalities across Europe and Asia are investing in biogas plants to meet renewable energy targets and comply with waste reduction mandates. As a result, municipal waste is emerging as a scalable and policy-supported feedstock for biomethane production.

End-use Insights

Construction accounted for the highest revenue share of over 43.0% in 2024. According to the IEA, bioenergy accounted for around 10% of the world’s primary energy demand in 2023. Most of the bioenergy is used in the form of biogas, i.e., biomethane. In the construction industry, biomethane is used for cooking and heating applications, and a vast portion is also used as an additive in the gas network as a transport fuel.

The industrial sectors, such as food, drink, and chemicals, produce byproducts with a high organic content that can be used for the production of biomethane. At the same time, the demand for biomethane within the industrial sector is anticipated to be generated by its increasing role in the reduction of greenhouse gas emissions and the focus on sustainable production methods.

Regional Insights

Europe biomethane market dominated the global industry and accounted for over 45.6% revenue share in 2024. This growth is anticipated to continue over the forecast period owing to the increasing sources of biomethane and the emphasis on alternate and renewable energy sources. To cut down on the cost of technology, European universities and research institutes are investing in conducting cutting-edge research for which they are provided grants and funding for R&D by the European Commission.

North America Biomethane Market Trends

The biomethane market in North America is anticipated to witness a CAGR of 13.6% over the forecast period. It is expected to be driven by the renewable energy transition and green material usage in industries that are the current trend in the U.S.

U.S. Biomethane Market Trends

The biomethane market in the U.S is growing, as according to the American Biogas Council, about USD 1.8 billion in capital investment worth biogas projects came online in 2023. This includes methane capture system projects for the production of biomethane. The U.S. biomethane market is being driven by the increased usage of recyclable construction infrastructure and the requirement to reduce carbon emissions.

Asia Pacific Biomethane Market Trends

According to the World Biogas Association, the Asia Pacific region has immense potential to increase the generation of biogas and subsequently improve biomethane demand. This can be aligned with its waste management policies and help combat climate change.

Key Biomethane Company Insights

Key players operating in the biomethane market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Biomethane Companies:

The following are the leading companies in the biomethane market. These companies collectively hold the largest market share and dictate industry trends.

- Air Liquide

- Engie

- Nature Energy Biogas A/S

- Gasum

- Terega Solutions

- Waga Energy

- TotalEnergies

- Chevron

- Kinder Morgan

- Archea Energy

- Envitec Biogas AG

- Future Biogas Ltd.

- E.ON SE

- Verbio Vereinigte Bioenergie AG

- South Hills RNG

Recent Developments

-

In April 2024, France-based AirLiquide announced the expansion of its production capacity of biomethane in the U.S. with the construction of two new plants in Pennsylvania and Michigan. These plants will cater to the industrial and transport sectors in the region.

-

In January 2023, France-based Arkema signed a long-term agreement with France-based ENGIE for the supply of 300 GWh/year of biomethane. This deal is considered to be one of the largest agreements in Europe in the biomethane market and is aimed at enabling the former to reduce its carbon footprint in the chemical industry.

Biomethane Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.05 billion

Revenue forecast in 2030

USD 17.03 billion

Growth rate

CAGR of 13.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Source, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Denmark; Netherlands; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia.

Key companies profiled

Air Liquide; Engie; Nature Energy Biogas A/S; Gasum; Terega Solutions; Waga Energy; TotalEnergies; Chevron; Kinder Morgan; Archea Energy; Envitec Biogas AG; Future Biogas Ltd.; E.ON SE; Verbio Vereinigte Bioenergie AG; South Hills RNG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Biomethane Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global biomethane market report on the basis of source, end use, and region.

-

Source Outlook (Revenue, USD Billion, 2018 - 2030)

-

Energy Crops

-

Animal Manure

-

Municipal Waste

-

Waste Water Sludge

-

Other Source

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Construction

-

Industrial

-

Power Generation

-

Transport

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Denmark

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."