- Home

- »

- Communication Services

- »

-

Business Process Outsourcing Market, Industry Report, 2030GVR Report cover

![Business Process Outsourcing Market Size, Share & Trends Report]()

Business Process Outsourcing Market Size, Share & Trends Analysis Report By Service Type (Customer Services, Finance & Accounting), By Outsourcing Type, By Deployment, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-484-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

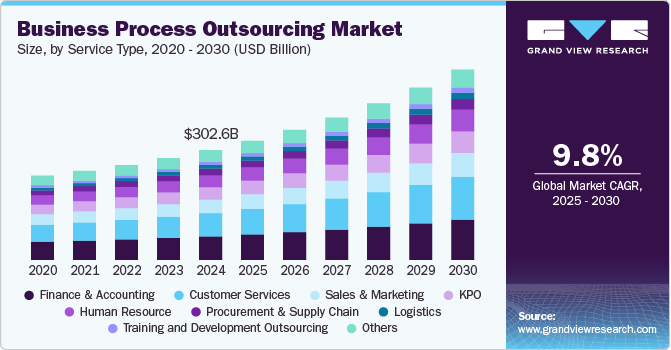

The global business process outsourcing market size was estimated at USD 302.62 billion in 2024 and is anticipated to grow at a CAGR of 9.8% from 2025 to 2030. Business Process Outsourcing (BPO) is rapidly gaining momentum across various industries and industry verticals, including BFSI, IT & telecommunications, and healthcare. The increasing need to reduce operating costs and emphasize core competencies and access to qualified talent is anticipated to drive the preference for business process outsourcing over the forecast period. Advances in Robotic Process Automation (RPA), AI, Machine Learning (ML), and big data analytics, among other latest technologies, support the market's growth.

The rise of cloud technology plays a significant role in boosting the BPO sector due to its benefits, such as scalability, affordability, dependability, and flexibility. Additionally, many businesses in the BPO industry have started offering their services through the cloud, further increasing the adoption of BPO services. For example, in September 2024, NTT DATA, a Japanese technology services company, and IBM introduced SimpliZCloud, a completely managed cloud service powered by IBM LinuxONE, tailored to meet the infrastructure demands of critical workloads, particularly in financial services. The solution supports core banking, lending, and risk management applications, offering advanced performance, high availability, and robust security. By consolidating resources and optimizing infrastructure and enterprise software license costs, SimpliZCloud helps organizations reduce expenses. Its subscription-based model eliminates the need for significant capital investment and ongoing maintenance costs.

Technological innovations drive the expansion and growth of the business process outsourcing industry, heightened global competition, and technological advancements. BPO enables organizations to enhance their profitability and minimize expenses. Advanced technologies such as process automation, cloud computing, and social networking are integrated with an organization’s existing BPO software. By capitalizing on the increasing uptake of these technologies, service providers can boost the services' efficiency. Outsourcing service providers are anticipated to utilize technological advancements to address talent shortages, enhance products and services, and tackle market challenges while keeping operational costs low.

Service Type Insights

The finance & accounting segment dominated the market and accounted for the revenue share of over 21.0% in 2024. The increasing utilization of outsourcing solutions within the finance and accounting sector drives the segment growth. This strategy is adopted to address operational issues and improve financial performance across North America, Europe, and Asia Pacific regions.

The customer services segment is anticipated to grow at a CAGR of 11.2% during the forecast period. The BPO industry leverages "customer satisfaction" as a promotional strategy for its products and services. Customer service within BPOs pertains to companies dedicated to addressing customer questions in real time via various channels such as chat, social media, email, and phone. This involves effectively resolving customer issues through digital tools such as live chat, chatbots, and co-browsing.

Outsourcing Type Insights

The onshore segment dominated the market and accounted for the revenue share of over 45.0% in 2024. Onshore outsourcing offers cost reductions by leveraging regional wage disparities within a country. Businesses can outsource operations to areas with lower living costs, where labor rates are comparatively economical, while maintaining the same legal, linguistic, and cultural framework. This approach significantly lowers expenses without the logistical challenges of managing international teams.

The offshore segment is expected to grow significantly over the forecast period. The offshore outsourcing segment continues to grow due to its ability to significantly reduce costs and access a global talent pool. Companies benefit from the lower labor rates in countries such as India, the Philippines, and Eastern Europe, where skilled professionals are available at a fraction of the cost compared to onshore markets. This cost advantage extends beyond salaries to include reduced infrastructure and operational expenses.

Deployment Insights

The cloud segment dominated the market and accounted for the revenue share of over 52.0% in 2024. As organizations seek to modernize their operations and respond faster to market changes, cloud-based BPO solutions offer a compelling alternative to traditional on-premise models. Cloud deployment enables BPO providers to deliver services more efficiently, with faster implementation timelines and reduced capital expenditure for clients. This shift is particularly attractive for businesses looking to streamline operations while maintaining the ability to scale resources on demand.

The on-premise segment is expected to grow significantly over the forecast period. Data security is paramount for many businesses, especially those handling sensitive information. With on-premises BPO, businesses have complete control over their data and network infrastructure. This allows end users to implement stricter security protocols and rigorously monitor access.

End Use Insights

The IT and telecommunications segment dominated the market and accounted for a revenue share of over 24.0% in 2024. Companies in this sector increasingly outsource customer support, technical helpdesk services, and network management to BPO providers to reduce operational costs and focus on core competencies. The rapid evolution of digital infrastructure and the need for around-the-clock technical support have intensified the reliance on specialized BPO services, especially as organizations strive to maintain uptime and seamless customer experience across multiple digital channels.

The retail segment is expected to grow significantly over the forecast period. As more retailers adopt e-commerce platforms and omnichannel strategies, the demand for BPO services to manage customer interactions, supply chains, and backend operations has surged. BPO providers help retailers streamline these operations, improve customer experience, and reduce operational costs, making outsourcing a suitable option.

Regional Insights

The business process outsourcing market in North America held a significant share of nearly 37.0% in 2024. The strong emphasis the incumbents of various industries, such as BFSI, IT, telecommunication, and human resources, in the region are putting on reducing costs and enhancing operational effectiveness is driving the market's growth. For instance, mortgage processing, claims administration, credit card processing, finance and accounting, customer care, and risk management are some of the activities outsourced by BFSI companies to BPO service providers.

U.S. Business Process Outsourcing Industry Trends

The business process outsourcing market in the U.S. is expected to grow significantly at a CAGR of 9.6% from 2025 to 2030. The demand for specialized services, particularly in healthcare, finance, and IT sectors, is propelling the BPO market forward. Companies increasingly seek BPO providers with domain-specific knowledge and technical skills to handle complex processes, ensure compliance, and deliver high-quality outcomes. This trend underscores the shift towards value-added outsourcing partnerships that contribute to business growth and innovation.

Europe Business Process Outsourcing Industry Trends

The business process outsourcing market in Europe is anticipated to register considerable growth from 2025 to 2030. Several European governments are progressively investing in promoting digital transformation across various industries, including BFSI, healthcare, and defense. These investments encourage enterprises to adopt modern technologies, such as those integrated into BPO services, to improve the productivity and efficiency of the organizations.

The UK business process outsourcing market is expected to grow rapidly in the coming years. The increasing focus on enhancing customer experience is driving the growth of the market. Outsourcing customer service operations to specialized BPO providers allows companies to provide round-the-clock support, multichannel communication, and personalized service, improving customer satisfaction and loyalty.

The Germany business process outsourcing market held a substantial market share in 2024. Germany’s strict regulatory environment and data protection standards have shaped the BPO landscape. BPO providers that demonstrate strong compliance with GDPR and offer secure, transparent processes are gaining favor among German firms. This emphasis on data security is a key driver for adopting local or nearshore BPO services, especially for industries like banking, insurance, and healthcare, where regulatory compliance is non-negotiable.

Asia Pacific Business Process Outsourcing Industry Trends

Asia Pacific is expected to register the highest CAGR of 11.2% from 2025 to 2030. Asia Pacific is a diversified and heterogeneous region marked by mature markets, such as Australia, Singapore, Japan, and developing nations, such as India, the Philippines, and Malaysia. The increasing penetration of digital channels, mobile devices, and social networking platforms drives the demand for seamless omnichannel customer experiences.

The Japan business process outsourcing market is expected to grow rapidly in the coming years. With the globalization of markets, Japanese enterprises are increasing their overseas footprints. Business process outsourcing services offer a standardized and adaptable solution for managing various activities across several locations while ensuring operational consistency and compliance with local requirements. Japanese organizations considering BPO should opt for service providers with strong data protection procedures and those adhering to international data privacy regulations.

The China business process outsourcing market held a substantial market share in 2024. The increasing demand for outsourcing services from domestic and international companies is driving the growth of the BPO market in China. Outsourcing provides companies a viable option as businesses strive to streamline operations, reduce costs, and focus on core competencies. Chinese BPO providers offer various services, including IT outsourcing, customer support, finance and accounting, and supply chain management. They cater to diverse industries and industry verticals and meet clients’ evolving needs worldwide.

Key Business Process Outsourcing Company Insights

Key players in the business process outsourcing industry are Teleperformance SE, TTEC Holdings, Inc., CBRE, Delta BPO Solutions, Concentrix Corporation, NCR Corporation, and Amdocs. These companies are focusing on various strategic initiatives, including new product development, partnerships and collaborations, and agreements, to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In February 2025, Amdocs and Google Cloud launched a strategic initiative to enhance the management and optimization of 5G networks through AI-driven solutions. Leveraging Google Cloud's Vertex AI and BigQuery, Amdocs is introducing its Network AIOps solution, designed to automate complex network operations, improve service reliability, and elevate customer experiences for telecom providers. This collaboration aims to drive greater efficiency and intelligence in 5G network ecosystems.

-

In January 2025,CBRE entered into a definitive agreement to acquire Industrious National Management Company, LLC, an India-based workplace solutions provider. As part of the acquisition, CBRE aims to establish a new business segment, Building Operations & Experience (BOE), integrating building operations, property management, and workplace experience. This move aims to enhance CBRE’s ability to deliver scalable solutions across data centers, offices, warehouses, and other facilities.

-

In September 2024, Concentrix Corporation launched iX Hello, a GenAI-powered self-service application designed to enhance productivity and engagement with high security. This solution enables businesses to create virtual assistants for various use cases, such as data analysis, language translations, internal self-service chatbots, and more.

Key Business Process Outsourcing Companies:

The following are the leading companies in the business process outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Amdocs

- Atos SE

- Capgemini

- Capita plc

- CBRE

- Cognizant

- Concentrix Corporation

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation (IBM)

- Sodexo

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- Teleperformance

- TTEC Holdings, Inc.

- Wipro

Business Process Outsourcing Market Report Scope

Report Attribute

Details

Market size in 2025

USD 328.37 billion

Revenue forecast in 2030

USD 525.23 billion

Growth rate

CAGR of 9.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service type, outsourcing type, deployment, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Singapore; Malaysia; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Accenture; Amdocs; Atos SE; Capgemini; Capita plc; CBRE; Cognizant; Concentrix Corporation; HCL Technologies Limited; Infosys Limited; International Business Machines Corporation (IBM); Sodexo; TATA Consultancy Services Limited; Tech Mahindra Limited; Teleperformance; TTEC Holdings, Inc.; Wipro

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Business Process Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the business process outsourcing market report based on service type, outsourcing type, deployment, end use, and region:

-

Service Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Finance & Accounting

-

Human Resource

-

KPO

-

Procurement & Supply Chain

-

Customer Services

-

Sales & Marketing

-

Logistics

-

Training and Development Outsourcing

-

Others

-

-

Outsourcing Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Onshore

-

Nearshore

-

Offshore

-

-

Deployment Outlook (Revenue, USD Billion; 2018 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Billion; 2018 - 2030)

-

BFSI

-

Healthcare

-

Manufacturing

-

IT & Telecommunications

-

Retail

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

Singapore

-

Malaysia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global business process outsourcing market size was estimated at USD 302.62 billion in 2024 and is expected to reach USD 328.37 billion in 2025.

b. The global business process outsourcing market is expected to expand at a compound annual growth rate of 9.8% from 2025 to 2030, reaching USD 525.23 billion by 2030.

b. The finance & accounting segment dominated the market and accounted for the revenue share of over 21.0% in 2024. The increasing utilization of outsourcing solutions within the finance and accounting sector is driving the segment growth. This strategy is adopted to address operational issues and improve financial performance across North America, Europe, and Asia Pacific regions

b. The IT & telecommunications segment dominated the market and accounted for the revenue share of over 24.0% in 2024. Companies in this sector are increasingly outsourcing customer support, technical helpdesk services, and network management to BPO providers to reduce operational costs and focus on core competencies

b. Some key players operating in the BPO market include Accenture, Amdocs, Atos SE, Capgemini, Capita plc, CBRE, Cognizant, Concentrix Corporation, HCL Technologies Limited, Infosys Limited, International Business Machines Corporation (IBM), Sodexo, TATA Consultancy Services Limited, Tech Mahindra Limited, Teleperformance, TTEC Holdings, Inc., Wipro.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Methodology segmentation & scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Business Process Outsourcing Variables, Trends & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunities

3.4. Business Process Outsourcing Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Business Process Outsourcing Market: Service Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Business Process Outsourcing: Service Type Movement Analysis, USD Billion, 2024 & 2030

4.3. Finance & Accounting

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Human Resource

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.5. KPO

4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.6. Procurement & Supply Chain

4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.7. Customer Services

4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.8. Sales & Marketing

4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.9. Logistics

4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.10. Training and Development Outsourcing

4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.11. Others

4.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Business Process Outsourcing Market: Outsourcing Type Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Business Process Outsourcing: Outsourcing Type Movement Analysis, USD Billion, 2024 & 2030

5.3. Onshore

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Nearshore

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Offshore

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Business Process Outsourcing Market: Deployment Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Business Process Outsourcing: Deployment Movement Analysis, USD Billion, 2024 & 2030

6.3. Cloud

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. On-premise

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Business Process Outsourcing Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Business Process Outsourcing: End Use Movement Analysis, USD Billion, 2024 & 2030

7.3. BFSI

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Healthcare

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Manufacturing

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. IT & Telecommunications

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Retail

7.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Government & Defense

7.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. Others

7.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Business Process Outsourcing Market: Regional Estimates & Trend Analysis

8.1. Business Process Outsourcing Share, By Region, 2024 & 2030, USD Billion

8.2. North America

8.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.2.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.2.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.2.6. U.S.

8.2.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.6.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.2.6.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.2.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.2.7. Canada

8.2.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.7.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.2.7.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.2.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.2.8. Mexico

8.2.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.8.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.2.8.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.2.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3. Europe

8.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.3.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.3.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3.6. UK

8.3.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.6.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.3.6.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.3.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3.7. Germany

8.3.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.7.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.3.7.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.3.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3.8. France

8.3.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.8.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.3.8.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.3.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4. Asia Pacific

8.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.6. China

8.4.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.6.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.6.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.7. India

8.4.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.7.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.7.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.8. Japan

8.4.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.8.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.8.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.9. Australia

8.4.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.9.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.9.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.9.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.9.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.10. Malaysia

8.4.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.10.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.10.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.10.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.10.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.11. Singapore

8.4.11.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.11.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.11.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.11.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.11.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.12. South Korea

8.4.12.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.12.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.4.12.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.4.12.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.12.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.5. Latin America

8.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.5.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.5.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.5.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.5.6. Brazil

8.5.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.6.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.5.6.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.5.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.5.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6. Middle East & Africa

8.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.6.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6.6. Saudi Arabia

8.6.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.6.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.6.6.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.6.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6.7. UAE

8.6.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.7.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.6.7.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.6.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6.8. South Africa

8.6.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.8.2. Market estimates and forecast by service type, 2018 - 2030 (Revenue, USD Billion)

8.6.8.3. Market estimates and forecast by outsourcing type, 2018 - 2030 (Revenue, USD Billion)

8.6.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Share Analysis

9.4. Company Heat Map Analysis

9.5. Strategy Mapping

9.5.1. Expansion

9.5.2. Mergers & Acquisition

9.5.3. Partnerships & Collaborations

9.5.4. New Product Launches

9.5.5. Research And Development

9.6. Company Profiles

9.6.1. Accenture

9.6.1.1. Participant’s Overview

9.6.1.2. Financial Performance

9.6.1.3. Product Benchmarking

9.6.1.4. Recent Developments

9.6.2. Amdocs

9.6.2.1. Participant’s Overview

9.6.2.2. Financial Performance

9.6.2.3. Product Benchmarking

9.6.2.4. Recent Developments

9.6.3. Atos SE

9.6.3.1. Participant’s Overview

9.6.3.2. Financial Performance

9.6.3.3. Product Benchmarking

9.6.3.4. Recent Developments

9.6.4. Capgemini

9.6.4.1. Participant’s Overview

9.6.4.2. Financial Performance

9.6.4.3. Product Benchmarking

9.6.4.4. Recent Developments

9.6.5. Capita plc

9.6.5.1. Participant’s Overview

9.6.5.2. Financial Performance

9.6.5.3. Product Benchmarking

9.6.5.4. Recent Developments

9.6.6. CBRE

9.6.6.1. Participant’s Overview

9.6.6.2. Financial Performance

9.6.6.3. Product Benchmarking

9.6.6.4. Recent Developments

9.6.7. Cognizant

9.6.7.1. Participant’s Overview

9.6.7.2. Financial Performance

9.6.7.3. Product Benchmarking

9.6.7.4. Recent Developments

9.6.8. Concentrix Corporation

9.6.8.1. Participant’s Overview

9.6.8.2. Financial Performance

9.6.8.3. Product Benchmarking

9.6.8.4. Recent Developments

9.6.9. HCL Technologies Limited

9.6.9.1. Participant’s Overview

9.6.9.2. Financial Performance

9.6.9.3. Product Benchmarking

9.6.9.4. Recent Developments

9.6.10. Infosys Limited

9.6.10.1. Participant’s Overview

9.6.10.2. Financial Performance

9.6.10.3. Product Benchmarking

9.6.10.4. Recent Developments

9.6.11. International Business Machines Corporation (IBM)

9.6.11.1. Participant’s Overview

9.6.11.2. Financial Performance

9.6.11.3. Product Benchmarking

9.6.11.4. Recent Developments

9.6.12. Sodexo

9.6.12.1. Participant’s Overview

9.6.12.2. Financial Performance

9.6.12.3. Product Benchmarking

9.6.12.4. Recent Developments

9.6.13. TATA Consultancy Services Limited

9.6.13.1. Participant’s Overview

9.6.13.2. Financial Performance

9.6.13.3. Product Benchmarking

9.6.13.4. Recent Developments

9.6.14. Tech Mahindra Limited

9.6.14.1. Participant’s Overview

9.6.14.2. Financial Performance

9.6.14.3. Product Benchmarking

9.6.14.4. Recent Developments

9.6.15. Teleperformance

9.6.15.1. Participant’s Overview

9.6.15.2. Financial Performance

9.6.15.3. Product Benchmarking

9.6.15.4. Recent Developments

9.6.16. TTEC Holdings, Inc.

9.6.16.1. Participant’s Overview

9.6.16.2. Financial Performance

9.6.16.3. Product Benchmarking

9.6.16.4. Recent Developments

9.6.17. Wipro

9.6.17.1. Participant’s Overview

9.6.17.2. Financial Performance

9.6.17.3. Product Benchmarking

9.6.17.4. Recent Developments

List of Tables

Table 1 List of Abbreviation

Table 2 Global business process outsourcing market, 2018 - 2030 (USD Billion)

Table 3 Global business process outsourcing market, by region, 2018 - 2030 (USD Billion)

Table 4 Global business process outsourcing market, by service type, 2018 - 2030 (USD Billion)

Table 5 Global business process outsourcing market, by outsourcing type, 2018 - 2030 (USD Billion)

Table 6 Global business process outsourcing market, by deployment, 2018 - 2030 (USD Billion)

Table 7 Global business process outsourcing market, by end use, 2018 - 2030 (USD Billion)

Table 8 Global finance & accounting market by region, 2018 - 2030 (USD Billion)

Table 9 Global human resource market by region, 2018 - 2030 (USD Billion)

Table 10 Global KPO market by region, 2018 - 2030 (USD Billion)

Table 11 Global procurement & supply chain market by region, 2018 - 2030 (USD Billion)

Table 12 Global customer services market by region, 2018 - 2030 (USD Billion)

Table 13 Global sales & marketing market by region, 2018 - 2030 (USD Billion)

Table 14 Global logistics market by region, 2018 - 2030 (USD Billion)

Table 15 Global training and development outsourcing market by region, 2018 - 2030 (USD Billion)

Table 16 Global others market by region, 2018 - 2030 (USD Billion)

Table 17 Global onshore market by region, 2018 - 2030 (USD Billion)

Table 18 Global nearshore market by region, 2018 - 2030 (USD Billion)

Table 19 Global offshore market by region, 2018 - 2030 (USD Billion)

Table 20 Global on-premise market by region, 2018 - 2030 (USD Billion)

Table 21 Global cloud market by region, 2018 - 2030 (USD Billion)

Table 22 Global BFSI market by region, 2018 - 2030 (USD Billion)

Table 23 Global healthcare market by region, 2018 - 2030 (USD Billion)

Table 24 Global manufacturing market by region, 2018 - 2030 (USD Billion)

Table 25 Global IT & telecommunications market by region, 2018 - 2030 (USD Billion)

Table 26 Global retail market by region, 2018 - 2030 (USD Billion)

Table 27 Global government & defense market by region, 2018 - 2030 (USD Billion)

Table 28 Global others market by region, 2018 - 2030 (USD Billion)

Table 29 North America business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 30 North America business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 31 North America business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 32 North America business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 33 U.S. business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 34 U.S. business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 35 U.S. business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 36 U.S. business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 37 Canada business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 38 Canada business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 39 Canada business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 40 Canada business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 41 Mexico business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 42 Mexico business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 43 Mexico business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 44 Mexico business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 45 Europe business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 46 Europe business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 47 Europe business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 48 Europe business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 49 UK business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 50 UK business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 51 UK business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 52 UK business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 53 Germany business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 54 Germany business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 55 Germany business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 56 Germany business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 57 France business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 58 France business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 59 France business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 60 France business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 61 Asia Pacific business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 62 Asia Pacific business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 63 Asia Pacific business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 64 Asia Pacific business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 65 China business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 66 China business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 67 China business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 68 China business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 69 India business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 70 India business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 71 India business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 72 India business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 73 Japan business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 74 Japan business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 75 Japan business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 76 Japan business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 77 Australia business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 78 Australia business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 79 Australia business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 80 Australia business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 81 Singapore business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 82 Singapore business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 83 Singapore business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 84 Singapore business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 85 Malaysia business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 86 Malaysia business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 87 Malaysia business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 88 Malaysia business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 89 South Korea business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 90 South Korea business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 91 South Korea business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 92 South Korea business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 93 Latin America business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 94 Latin America business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 95 Latin America business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 96 Latin America business process outsourcing market, by application 2018 - 2030 (USD Billion)

Table 97 Latin America business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 98 Brazil business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 99 Brazil business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 100 Brazil business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 101 Brazil business process outsourcing market, by application 2018 - 2030 (USD Billion)

Table 102 Brazil business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 103 Middle East & Africa business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 104 Middle East & Africa business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 105 Middle East & Africa business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 106 Middle East & Africa business process outsourcing market, by application 2018 - 2030 (USD Billion)

Table 107 Middle East & Africa business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 108 UAE business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 109 UAE business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 110 UAE business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 111 UAE business process outsourcing market, by application 2018 - 2030 (USD Billion)

Table 112 UAE business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 113 Saudi Arabia business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 114 Saudi Arabia business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 115 Saudi Arabia business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 116 Saudi Arabia business process outsourcing market, by application 2018 - 2030 (USD Billion)

Table 117 Saudi Arabia business process outsourcing market, by end use 2018 - 2030 (USD Billion)

Table 118 South Africa business process outsourcing market, by service type 2018 - 2030 (USD Billion)

Table 119 South Africa business process outsourcing market, by outsourcing type 2018 - 2030 (USD Billion)

Table 120 South Africa business process outsourcing market, by deployment 2018 - 2030 (USD Billion)

Table 121 South Africa business process outsourcing market, by application 2018 - 2030 (USD Billion)

Table 122 South Africa business process outsourcing market, by end use 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Business Process Outsourcing Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Business Process Outsourcing: Industry Value Chain Analysis

Fig. 11 Business Process Outsourcing: Market Dynamics

Fig. 12 Business Process Outsourcing: PORTER’s Analysis

Fig. 13 Business Process Outsourcing: PESTEL Analysis

Fig. 14 Business Process Outsourcing Share by Service Type, 2024 & 2030 (USD Billion)

Fig. 15 Business Process Outsourcing, by Service Type: Market Share, 2024 & 2030

Fig. 16 Finance & Accounting Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 17 Human Resource Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 KPO Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Procurement & Supply Chain Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Customer Services Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Sales & Marketing Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Logistics Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 23 Training and Development Outsourcing Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 24 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Business Process Outsourcing Share by Outsourcing Type, 2024 & 2030 (USD Billion)

Fig. 26 Business Process Outsourcing, by Outsourcing Type: Market Share, 2024 & 2030

Fig. 27 Onshore Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 28 Nearshore Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 29 Offshore Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 Business Process Outsourcing Share by Deployment, 2024 & 2030 (USD Billion)

Fig. 31 Business Process Outsourcing, by Deployment: Market Share, 2024 & 2030

Fig. 32 Cloud Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 33 On-premise Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 Business Process Outsourcing Share by End Use, 2024 & 2030 (USD Billion)

Fig. 35 Business Process Outsourcing, by End Use: Market Share, 2024 & 2030

Fig. 36 BFSI Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 Healthcare Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Manufacturing Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 IT & Telecommunications Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Retail Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Government & Defense Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Regional Market place: Key Takeaways

Fig. 44 North America Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 45 U.S. Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 46 Canada Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 47 Mexico Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 48 Europe Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 49 UK Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030,) (USD Billion)

Fig. 50 Germany Business Process Outsourcing Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 51 France Business Process Outsourcing Market Estimates and Forecasts (2018 - 2030,) (USD Billion)

Fig. 52 Asia Pacific Business Process Outsourcing Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 53 China Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 54 India Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 55 Japan Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 56 Australia Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 57 Singapore Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 58 Malaysia Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 59 South Korea Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 60 Latin America Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 61 Brazil Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 62 MEA Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 63 Saudi Arabia Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 64 UAE Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 65 South Africa Business Process Outsourcing Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 66 Key Company Categorization

Fig. 67 Company Market Positioning

Fig. 68 Key Company Market Share Analysis, 2024

Fig. 69 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Business Process Outsourcing Service Type Outlook (Revenue, USD Billion; 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Business Process Outsourcing Type Outlook (Revenue, USD Billion; 2018 – 2030)

- Onshore

- Nearshore

- Offshore

- Business Process Outsourcing Deployment Outlook (Revenue, USD Billion; 2018 – 2030)

- Cloud

- On-premise

- Business Process Outsourcing End Use Outlook (Revenue, USD Billion; 2018 – 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Business Process Outsourcing Regional Outlook (Revenue, USD Billion; 2018 – 2030)

- North America

- North America Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- North America Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- North America Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- North America Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- U.S.

- U.S. Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- U.S. Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- U.S. Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- U.S. Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- U.S. Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Canada

- Canada Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Canada Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Canada Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Canada Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Canada Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Mexico

- Mexico Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Mexico Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Mexico Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Mexico Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Mexico Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- North America Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Europe

- Europe Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Europe Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Europe Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Europe Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- UK

- UK Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- UK Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- UK Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- UK Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- UK Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Germany

- Germany Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Germany Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Germany Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Germany Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Germany Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- France

- France Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- France Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- France Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- France Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- France Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Europe Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific

- Asia Pacific Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Asia Pacific Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Asia Pacific Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Asia Pacific Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- China

- China Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- China Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- China Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- China Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- China Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- India

- India Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- India Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- India Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- India Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- India Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Japan

- Japan Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Japan Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Japan Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Japan Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Japan Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- South Korea

- South Korea Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- South Korea Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- South Korea Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- South Korea Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- South Korea Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Australia

- Australia Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Australia Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Australia Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Australia Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Australia Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Singapore

- Singapore Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Singapore Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Singapore Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Singapore Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Singapore Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Malaysia

- Malaysia Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Malaysia Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Malaysia Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Malaysia Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Malaysia Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Asia Pacific Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Latin America

- Latin America Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Latin America Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Latin America Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Latin America Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Brazil

- Brazil Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Brazil Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Brazil Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Brazil Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Brazil Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Latin America Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Middle East & Africa

- Middle East & Africa Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Middle East & Africa Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Middle East & Africa Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Middle East & Africa Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- UAE

- UAE Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- UAE Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- UAE Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- UAE Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- UAE Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Saudi Arabia

- Saudi Arabia Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- Saudi Arabia Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- Saudi Arabia Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- Saudi Arabia Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- Saudi Arabia Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- South Africa

- South Africa Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Finance & Accounting

- Human Resource

- KPO

- Procurement & Supply Chain

- Customer Services

- Sales & Marketing

- Logistics

- Training and Development Outsourcing

- Others

- South Africa Business Process Outsourcing, By Type (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Nearshore

- Offshore

- South Africa Business Process Outsourcing, By Deployment (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- South Africa Business Process Outsourcing, By End Use (Revenue, USD Billion, 2018 - 2030)

- BFSI

- Healthcare

- Manufacturing

- IT & Telecommunications

- Retail

- Government & Defense

- Others

- South Africa Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- Middle East & Africa Business Process Outsourcing, By Service Type (Revenue, USD Billion, 2018 - 2030)

- North America

Report content

Qualitative Analysis

- Industry overview

- Industry trends

- Market drivers and restraints

- Market size

- Growth prospects

- Porter’s analysis

- PESTEL analysis

- Key market opportunities prioritized

- Competitive landscape

- Company overview

- Financial performance

- Product benchmarking

- Latest strategic developments

Quantitative Analysis

- Market size, estimates, and forecast from 2018 to 2030

- Market estimates and forecast for product segments up to 2030

- Regional market size and forecast for product segments up to 2030

- Market estimates and forecast for application segments up to 2030

- Regional market size and forecast for application segments up to 2030

- Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

Grand View Research employs a comprehensive and iterative research methodology focused on minimizing deviance in order to provide the most accurate estimates and forecast possible. The company utilizes a combination of bottom-up and top-down approaches for segmenting and estimating quantitative aspects of the market. In Addition, a recurring theme prevalent across all our research reports is data triangulation that looks market from three different perspectives. Critical elements of the methodology employed for all our studies include:

Preliminary data mining

Raw market data is obtained and collated on a broad front. Data is continuously filtered to ensure that only validated and authenticated sources are considered. In addition, data is also mined from a host of reports in our repository, as well as a number of reputed paid databases. For a comprehensive understanding of the market, it is essential to understand the complete value chain, and in order to facilitate this; we collect data from raw material suppliers, distributors as well as buyers.