- Home

- »

- Plastics, Polymers & Resins

- »

-

Coalescing Agents Market Size, Share, Industry Report, 2030GVR Report cover

![Coalescing Agents Market Size, Share & Trends Report]()

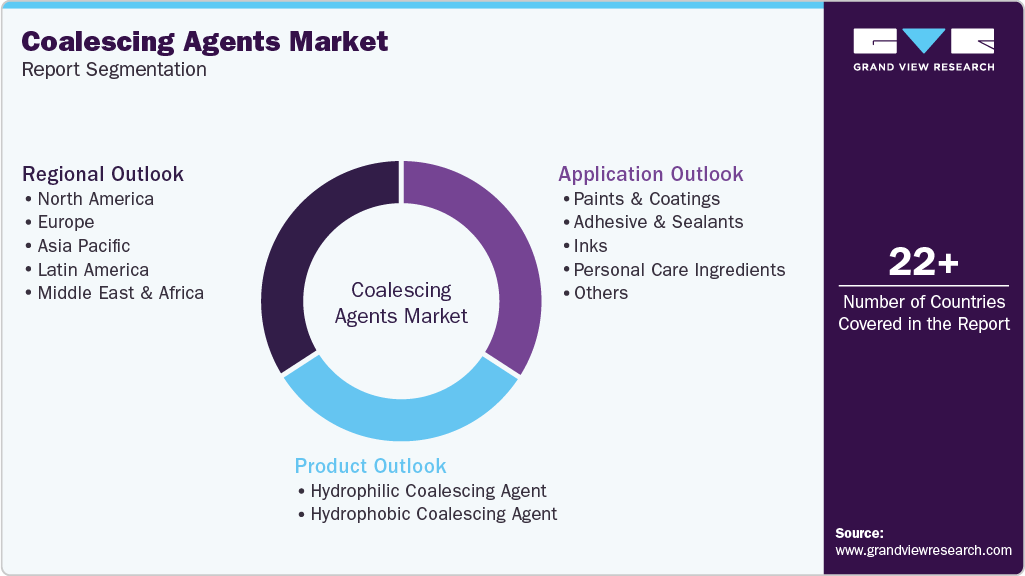

Coalescing Agents Market Size, Share & Trends Analysis Report By Product (Hydrophilic Coalescing Agent, Hydrophobic Coalescing Agent), By Application (Paints & Coatings, Adhesive & Sealants), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-380-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Coalescing Agents Market Summary

The global coalescing agents market size was valued at USD 1.45 billion in 2024 and is projected to reach USD 2.15 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. The growth is attributed to expanding construction and automotive sectors, fueling demand for high-performance coatings that enhance durability, appearance, and protection.

Key Market Trends & Insights

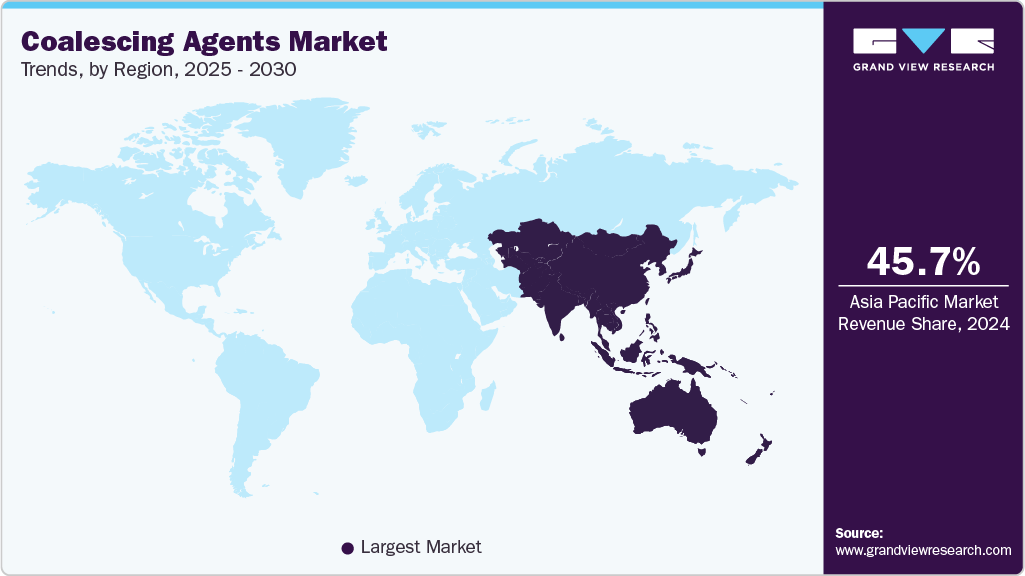

- Asia Pacific dominated the market with the largest revenue share of 45.7% in 2024.

- China coalescing agents market accounted for the largest share in the regional market in 2024.

- By product, the hydrophilic coalescing agent segment held the largest market share of 58.7% in 2024.

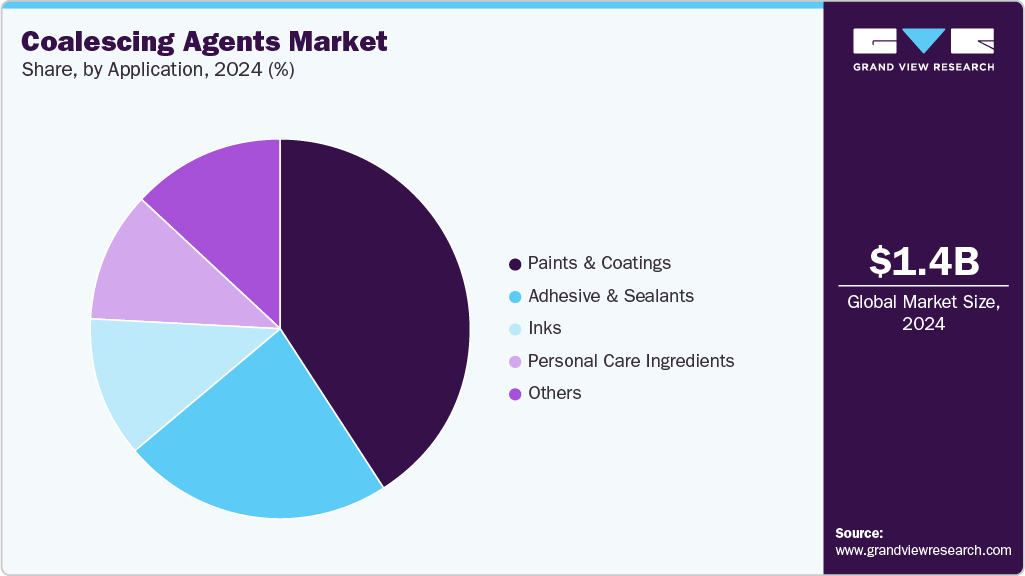

- By application, the paints and coatings segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.45 Billion

- 2030 Projected Market Size: USD 2.15 Billion

- CAGR (2025-2030): 6.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

The market is driven by coalescing agents’ rising application in the formulation of paints and coatings to enhance the formation and performance of the final film. When incorporated into water-based formulations, these agents help lower the minimum film formation temperature, making it easier for the coating to form a cohesive and continuous film upon application.In the ink industry, coalescing agents facilitate the proper dispersion of pigments and dyes in water-based formulations, ensuring smooth application and vibrant color development upon drying. They also contribute to ink adhesion, durability, and resistance to smudging or rubbing, crucial for printing applications across various substrates.

Coalescing agents are often used in personal care products such as creams, lotions, and hair care products to improve texture, spreadability, and moisturizing properties. They help stabilize emulsions, ensuring that ingredients blend uniformly and maintain their efficacy over time.

Developing and producing advanced coalescing agents-particularly low-VOC or high-performance variants-can involve significant costs. This may result in higher final product prices, potentially limiting adoption in cost-sensitive markets.

The shift toward water-based coatings and the increasing demand for high-performance coatings are pivotal drivers of the coalescing agent’s industry. Waterborne formulations, favored for their low volatile organic compound (VOC) content and reduced environmental impact, require coalescing agents to facilitate film formation and enhance coating properties. Industries such as construction, automotive, and industrial applications are adopting these coatings for durability and performance. As sustainability becomes a priority, the need for effective coalescing agents in water-based coatings is expected to rise, fueling market growth.

Product Insights

The hydrophilic coalescing agent segment held the largest market share of 58.7% in 2024, fueled by its ability to offer lower volatility than hydrophobic agents, which helps minimize material loss during application. This characteristic makes them especially valuable in water-based paints and coatings, where consistency and durability are essential. Hydrophilic coalescing agents ensure improved film formation at lower temperatures, enhancing the overall performance of coatings while maintaining environmental compliance by reducing VOC emissions.

The hydrophobic coalescing agent segment is anticipated to grow at a significant CAGR over the forecast period, attributed toits superior performance in enhancing durability and resistance to water and chemicals. These agents are particularly valuable in applications requiring high-performance coatings, such as automotive, aerospace, and industrial sectors, where coatings must withstand harsh environments. Hydrophobic coalescing agents are crucial in solvent-based formulations, improving film formation and providing long-lasting protection. With increasing demand for exceptional resilience and longevity coatings, this segment is expected to expand rapidly in the coming years.

Application Insights

The paints and coatings segment accounted for the largest revenue share in 2024, owing to its critical role in improving coating performance and durability. Coalescing agents facilitate smooth film formation and enhance paint adhesion, flexibility, and resistance, making them essential for both water-based and solvent-based formulations. With growing demand for high-quality, durable coatings in construction, automotive, and industrial industries, the paints and coatings segment continues to drive significant market growth, cementing its dominant position in the coalescing agents industry.

The personal care ingredients segment is projected to be the fastest-growing segment from 2025 to 2030.Coalescing agents enhance personal care products' texture, stability, and sensory attributes, such as lotions, creams, and sunscreens. Their ability to stabilize emulsions and improve spread ability makes them essential in formulating high-quality, long-lasting products. With the growing consumer demand for premium, eco-friendly personal care products, the adoption of coalescing agents is expected to increase, driving market growth.

Regional Insights

North America coalescing agents market is expected to witness significant CAGR from 2025 to 2030 due to increased environmental regulations and a growing preference for water-based coatings over solvent-based alternatives. Stricter environmental regulations aimed at reducing volatile organic compound (VOC) emissions are compelling manufacturers to adopt coalescing agents that facilitate the production of eco-friendly coatings. In addition, the booming construction and automotive industries are also contributing to the demand for high-performance coatings that enhance durability and aesthetic appeal.

U.S. Coalescing Agents Market Trends

TheU.S. coalescing agents market held the largest share in 2024 due to the shift toward water-based coatings and advancements in formulation technologies. Increasing environmental regulations push manufacturers to develop low-VOC, eco-friendly solutions, driving demand for coalescing agents that enhance waterborne coating performance. These agents improve film formation, adhesion, and durability in water-based systems.

Europe Coalescing Agents Market Trends

The European coalescing agents market is anticipated to experience significant expansion during the forecast period, driven byadvancements in bio-based solutions and the growth of end-use industries. The development of bio-based coalescing agents, derived from renewable sources, aligns with the region’s push for sustainability and eco-friendly products. These solutions help meet stringent environmental regulations and demand for low-VOC coatings. Furthermore, the growth of the automotive, construction, and packaging industries is increasing the need for high-performance coatings, further boosting the demand for effective coalescing agents across Europe.

Asia Pacific Coalescing Agents Market Trends

Asia Pacific dominated the market with the largest revenue share of 45.7% in 2024, attributed to the increasing demand for industrial coatings. Rapid urbanization and infrastructure development in countries such as China and India are boosting the need for durable, high-performance coatings. In addition, there is a growing emphasis on sustainability, with industries shifting towards eco-friendly, low-VOC, and bio-based coalescing agents to meet environmental regulations.

China coalescing agentsmarket accounted for the largest share in the regional market in 2024, owing to the growth in infrastructure development and the focus on sustainability. The country’s heavy investment in urbanization, construction, and public infrastructure projects is driving the demand for high-performance coatings, which in turn is increasing the need for coalescing agents.

Key Coalescing Agents Company Insights

Some of the key companies in the coalescing agents industry includeStepan Company; Runtai New Material Co., Ltd.; Dow; Cargill, Incorporated; and BASF.

-

Dow offers innovative materials science solutions, including performance materials, coatings, silicones, and plastics. It serves diverse industries like packaging, infrastructure, mobility, and consumer care, focusing on sustainability, efficiency, and enhancing product performance and daily life.

-

BASF provides advanced coalescing agents that support high-performance, low-VOC coatings. Its solutions enhance durability, appearance, and environmental compatibility in paints, coatings, adhesives, and construction applications, meeting both industry needs and environmental regulations.

Key Coalescing Agents Companies:

The following are the leading companies in the coalescing agents market. These companies collectively hold the largest market share and dictate industry trends.

- Stepan Company

- Runtai New Material Co., Ltd.

- ADDAPT Chemicals B.V.

- PATCHAM(FZC)

- Chemoxy international Ltd

- Hallstar

- Krishna Antioxidants Pvt. Ltd. (Cristol)

- Cargill, Incorporated

- Dow

- Deborn

- BASF

Recent Developments

- In June 2023, Henkel Adhesive Technologies announced its plans to establish a new adhesive manufacturing plant in the Yantai Chemical Industry Park in Shandong province, China. This expansion is anticipated to bolster market growth by enhancing production capabilities and meeting increasing demand for adhesive solutions.

Coalescing Agents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.54 billion

Revenue forecast in 2030

USD 2.15 billion

Growth Rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa.

Key companies profiled

Stepan Company; Runtai New Material Co., Ltd.; ADDAPT Chemicals B.V.; PATCHAM(FZC); Chemoxy international Ltd; Hallstar; Krishna Antioxidants Pvt. Ltd. (Cristol); Cargill, Incorporated; Dow; Deborn; and BASF.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Coalescing Agents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global coalescing agents market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrophilic Coalescing Agent

-

Hydrophobic Coalescing Agent

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Adhesive & Sealants

-

Inks

-

Personal Care Ingredients

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global coalescing agents market size was estimated at USD 1.35 billion in 2023 and is expected to reach USD 1.42 billion in 2024.

b. The global coalescing agents market is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 1.91 billion by 2030.

b. Some key players operating in the coalescing agents market include Stepan Company, Runtai New Material Co., Ltd., ADDAPT Chemicals B.V., Patcham, Chemoxy International, Hallstar, Krishna Antioxidants Pvt. Ltd., Cargill, Incorporated, Dow, Deborn, BASF SE

b. Key factors that are driving the market growth include owing to expanding construction and automotive sectors which are further fueling demand for high-performance coatings that enhance durability, appearance, and protection.

b. Asia Pacific dominated the market segment with a revenue share of 45.7% in 2023, owing to the increasing demand for industrial and architectural coatings in the region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."