- Home

- »

- Plastics, Polymers & Resins

- »

-

Conductive And Anti-Static Plastics For EVs Market Report, 2030GVR Report cover

![Conductive And Anti-Static Plastics For EVs Market Size, Share & Trends Report]()

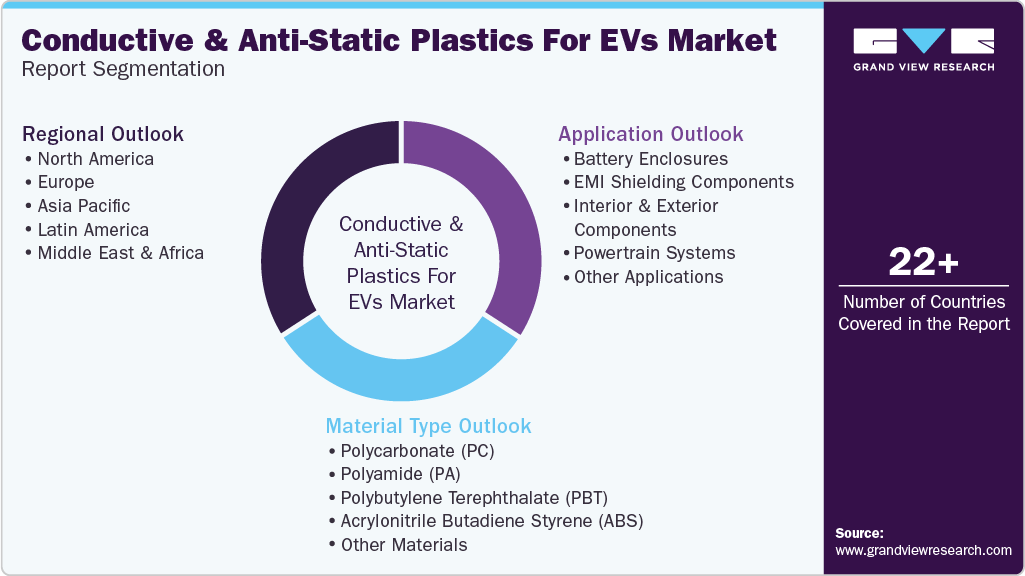

Conductive And Anti-Static Plastics For EVs Market Size, Share & Trends Analysis Report By Material Type (PC, PA, PBT, ABS), By Application (Battery Enclosures, EMI Shielding Components), By Region And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-583-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

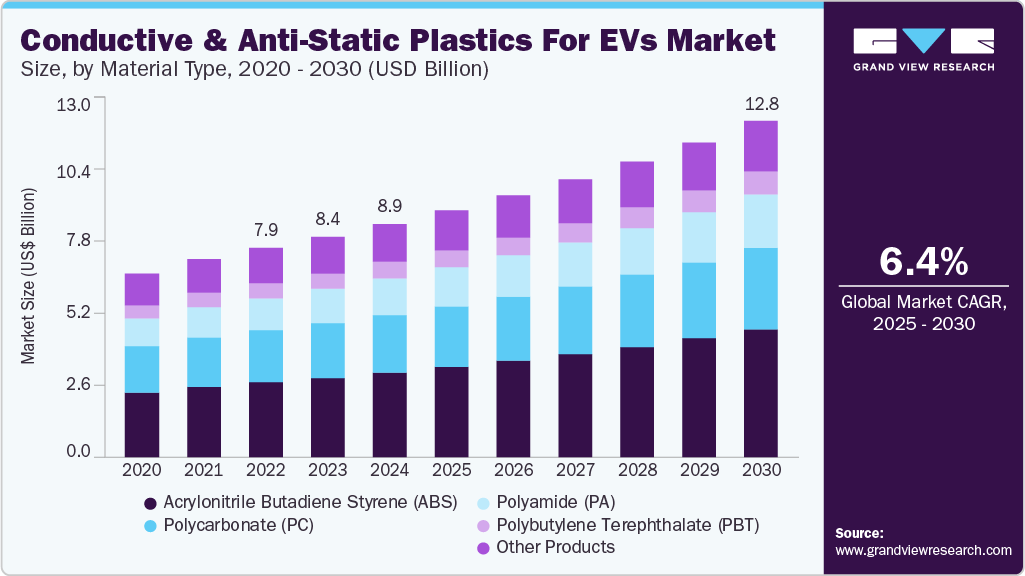

The global conductive and anti-static plastics for EVs market size was valued at USD 8.92 billion in 2024 and is expected to expand at a CAGR of 6.36% from 2025 to 2030. Growing demand for lightweight EV parts is pushing automakers to replace metals with conductive and anti-static plastics to improve energy efficiency.

Key Highlights:

- Asia Pacific dominated the global conductive and anti-static plastics for EVs market and accounted for the largest revenue share of 40.74% in 2024

- China’s aggressive deployment of smart and connected EV technologies is intensifying the need for advanced conductive and anti-static plastics

- In terms of segment, the polyamide (PA) is expected to grow at the fastest CAGR of 6.83% through the forecast period.

- In terms of segment, battery enclosures dominated the market across the application segmentation in terms of revenue, accounting for a market share of 32.03% in 2024

- In terms of segment, the acrylonitrile butadiene styrene (ABS) segment dominated the conductive and anti-static plastics for EVs industry

The automotive industry is undergoing a materials transformation, with a notable shift toward the integration of conductive and anti-static plastics in electric vehicle (EV) manufacturing. These materials also help reduce manufacturing costs by enabling easier molding and assembly.

A key trend is the rising adoption of functional polymer composites, such as carbon nanotube-infused polycarbonates and intrinsically conductive polymers, in sensitive electronic modules and battery enclosures. These materials are designed not only to meet stringent electrostatic discharge (ESD) requirements but also to replace traditional metals to reduce weight and manufacturing complexity.

Automakers are increasingly relying on these plastics to optimize safety, thermal stability, and EMI shielding within power electronics and battery management systems. This trend is further supported by the growing emphasis on scalable modular platforms and the miniaturization of EV components, where material performance directly influences overall vehicle efficiency and compliance with regulatory safety protocols.

Drivers, Opportunities & Restraints

The accelerating global pivot to electric mobility is driving a corresponding surge in demand for conductive and anti-static plastics across the EV value chain. As the volume and density of electronic content in EVs increase, particularly in battery packs, inverters, onboard chargers, and advanced driver-assistance systems (ADAS), so does the need for robust ESD protection to safeguard critical circuits. Traditional insulating materials are inadequate for such high-voltage environments, thereby propelling the adoption of tailored plastics that offer controlled surface resistivity and consistent conductivity.

With many countries accelerating their push for domestic EV manufacturing, there is a growing opportunity for material suppliers to establish localized production of conductive and anti-static plastics tailored to regional market needs. As OEMs and Tier 1 suppliers seek greater control over the EV component supply chain, particularly in North America, Europe, and key parts of Asia-Pacific, they are looking to partner with material innovators who can deliver application-specific solutions at scale. This localized supply strategy creates a fertile ground for developing regionally compliant formulations, optimizing logistics, and engaging in early-stage co-engineering with EV designers.

Despite the technical merits of conductive and anti-static plastics, their adoption in EV applications faces regulatory and standardization hurdles. Materials used in critical components such as battery enclosures and electronic housings must meet a complex web of automotive, environmental, and safety certifications that vary by region and application. Delays in material qualification due to evolving standards for thermal stability, flame retardancy, and chemical resistance can impede time-to-market for suppliers.

Market Concentration & Characteristics

The market growth stage of the polycarbonate films market is medium, and the pace is accelerating. The polycarbonate films market exhibits a significant level of market concentration, with key players dominating the industry landscape. Major companies like SABIC, BASF SE, DuPont, Covestro AG, Celanese Corporation, RTP Company, Ensinger, Avient Corporation, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and applications to meet evolving industry demands.

Innovation in the conductive and anti-static plastics market for EVs is being driven by rapid advancements in polymer modification techniques and nanocomposite engineering. Material developers are investing heavily in integrating carbon nanotubes, graphene, and intrinsically conductive polymers (ICPs) into thermoplastic matrices to enhance conductivity without compromising mechanical integrity. The focus has shifted from generic ESD performance to application-specific formulations that address EMI shielding, flame retardancy, and lightweighting in tandem.

Partnerships between polymer manufacturers and EV OEMs are accelerating co-development cycles, resulting in next-gen materials that are not only safer but also easier to process in automated production lines. This high innovation intensity is critical for keeping pace with evolving EV architectures and regulatory frameworks.

The market exhibits a high degree of end-user concentration, with a majority of demand originating from a handful of global EV manufacturers and Tier 1 automotive suppliers. Companies such as Tesla, BYD, Volkswagen, and Hyundai are setting the tone for material specifications and procurement strategies, influencing supplier portfolios and innovation pathways.

Tier 1 integrators play a pivotal role by consolidating component demand across multiple platforms and regions, making them key decision-makers in material selection. This concentration not only creates volume stability for material suppliers but also heightens the need for strategic alignment with leading players, as entry barriers remain high due to complex qualification cycles and long-term sourcing contracts.

Material Type Insights

The acrylonitrile butadiene styrene (ABS) segment dominated the conductive and anti-static plastics for EVs industry across the material types in terms of revenue, accounting for a market share of 36.40% in 2024. The rising integration of electronic features within EV interiors-such as touchscreens, sensor-rich dashboards, and infotainment hubs-is driving the use of ABS plastics with anti-static properties. ABS is preferred for its favorable balance of mechanical strength, aesthetic finish, and ease of processing, making it ideal for interior components where both electrostatic safety and design flexibility are required.

The polyamide (PA) is expected to grow at the fastest CAGR of 6.83% through the forecast period. Polyamides are gaining significant traction as EV manufacturers look for thermally stable, electrically safe materials to support high-voltage systems. The surge in adoption of polyamide-based composites stems from their ability to withstand high temperatures and aggressive chemical environments, particularly in connectors, high-voltage cables, and under-hood applications.

With OEMs focusing on long-term durability and reduced failure rates in EV powertrains, advanced PA variants with built-in conductivity and flame-retardant capabilities are seeing rapid commercialization. Their compatibility with metal-replacement strategies adds further momentum to their market uptake.

Application Insights

Battery enclosures dominated the market across the application segmentation in terms of revenue, accounting for a market share of 32.03% in 2024. In the battery enclosure segment, conductive and anti-static plastics are being adopted to address three core challenges: thermal runaway containment, EMI shielding, and lightweighting. Traditional metal enclosures, while robust, add significant weight and often limit design flexibility. Advanced plastics, such as carbon fiber-reinforced polycarbonate blends, offer comparable mechanical strength while enabling modular designs and cost-efficient mass production.

The EMI shielding components segment is projected to witness a substantial CAGR of 6.52% through the forecast period. As electric vehicles incorporate more wireless communication, radar-based safety systems, and high-frequency power electronics, the risk of electromagnetic interference (EMI) has become a major concern. This is accelerating demand for conductive plastic materials in shielding housings, sensor brackets, and inverter components. Unlike metal shielding, conductive polymer composites enable precise part geometries and support component integration, reducing assembly complexity. Material suppliers are responding by developing new grades with optimized surface resistivity and consistent conductivity over lifecycle wear, making these plastics indispensable in modern EV architectures.

Regional Insights

Asia Pacific dominated the global conductive and anti-static plastics for EVs market and accounted for the largest revenue share of 40.74% in 2024. Asia Pacific is emerging as a major growth region driven by the expansion of domestic EV production hubs in countries such as Thailand, Vietnam, and India. These markets are increasingly favoring locally available, cost-effective conductive and anti-static plastics to support rapid vehicle assembly and regulatory adherence in electronic safety systems.

Government-led initiatives, such as India’s FAME II scheme and Thailand’s EV roadmap, are catalyzing component-level innovation, especially in high-volume two- and three-wheeler segments where material scalability and low tooling costs are vital. This industrialization trend is creating sustained demand for application-optimized polymer solutions.

China Conductive And Anti-Static Plastics For EVs Market Trends

China’s aggressive deployment of smart and connected EV technologies is intensifying the need for advanced conductive and anti-static plastics that provide EMI shielding and ESD protection for densely packed electronic systems. As domestic EV leaders like NIO, Xpeng, and BYD integrate autonomous driving sensors, high-speed processors, and V2X modules, they require precision-engineered plastics that meet both performance and electromagnetic compliance benchmarks.

North America Conductive And Anti-Static Plastics For EVs Market Trends

In North America, the growing shift toward modular EV architectures and vehicle lightweighting initiatives is a major driver for the use of conductive and anti-static plastics. Automakers are increasingly relying on these materials to reduce component complexity and improve manufacturability across battery systems and electronic modules.

The U.S. conductive And anti-static plastics For EVs market is witnessing a rapid transition in commercial transportation, with companies like Amazon, FedEx, and UPS electrifying delivery fleets. This trend is boosting demand for durable, ESD-safe plastics in battery packs, control units, and onboard charging systems used in light commercial EVs.

Europe Conductive And Anti-Static Plastics For EVs Market Trends

Europe’s strong regulatory pressure on vehicle safety, sustainability, and recyclability is pushing OEMs to adopt conductive and anti-static plastics that meet strict flammability and ESD standards while aligning with circular economy principles. The EU’s Green Deal and End-of-Life Vehicle (ELV) directives are prompting material suppliers to develop low-carbon, halogen-free, and recyclable plastic solutions that support both compliance and eco-design goals.

Key Conductive And Anti-Static Plastics For EVs Company Insights

The conductive and anti-static plastics for EVs market is highly competitive, with several key players dominating the landscape. Major companies include SABIC, BASF SE, DuPont, Covestro AG, Celanese Corporation, RTP Company, Ensinger, and Avient Corporation. The market is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key Conductive And Anti-Static Plastics For EV Companies:

The following are the leading companies in the conductive and anti-static plastics for EVs market. These companies collectively hold the largest market share and dictate industry trends.

- SABIC

- BASF SE

- DuPont

- Covestro AG

- Celanese Corporation

- RTP Company

- Ensinger

- Avient Corporation

Recent Developments

-

In February 2025, IPG, a global packaging and protective solutions provider, launched its new American brand, Plastic Sheeting. The product, available in Ultra and Performance films, is a high-performance, tear-resistant, and transparent plastic sheeting designed to protect surfaces during repairs, renovations, and industrial applications.

-

In March 2024, Premix announced plans to launch a new production plant in the United States near Charlotte to manufacture electrically conductive polymers. The company, recognized as an essential supplier during the COVID-19 pandemic, secured approximately USD 80 million in funding from the U.S. government to support this expansion.

Conductive And Anti-Static Plastics For EVs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.43 billion

Revenue forecast in 2030

USD 12.83 billion

Growth rate

CAGR of 6.36% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; Spain, China; India; Japan; South Korea, Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

SABIC; BASF SE; DuPont; Covestro AG; Celanese Corporation; RTP Company; Ensinger; Avient Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Conductive And Anti-Static Plastics For EVs Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the conductive and anti-static plastics for EVs market report on the basis of material type, application, and region:

-

Material Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Polycarbonate (PC)

-

Polyamide (PA)

-

Polybutylene Terephthalate (PBT)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Other Materials

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Battery Enclosures

-

EMI Shielding Components

-

Interior & Exterior Components

-

Powertrain Systems

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global conductive and anti-static plastics for EVs market size was estimated at USD 8.92 billion in 2024 and is expected to reach USD 9.43 billion in 2025.

b. The global conductive and anti-static plastics for EVs market is expected to grow at a compound annual growth rate of 6.36% from 2025 to 2030 to reach USD 12.83 billion by 2030.

b. The acrylonitrile butadiene styrene (ABS) segment dominated the conductive and anti-static plastics for EVs market across the material types in terms of revenue, accounting for a market share of 36.40% in 2024. The rising integration of electronic features within EV interiors—such as touchscreens, sensor-rich dashboards, and infotainment hubs—is driving the use of ABS plastics with anti-static properties.

b. Some key players operating in the conductive and anti-static plastics for EVs market include SABIC, BASF SE, DuPont, Covestro AG, Celanese Corporation, RTP Company, Ensinger, and Avient Corporation.

b. Growing demand for lightweight EV parts is pushing automakers to replace metals with conductive and anti-static plastics to improve energy efficiency. These materials also help reduce manufacturing costs by enabling easier molding and assembly.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."