- Home

- »

- Electronic Security

- »

-

Consumer Electronic Biometrics Market Size Report, 2030GVR Report cover

![Consumer Electronic Biometrics Market Size, Share & Trends Report]()

Consumer Electronic Biometrics Market Size, Share & Trends Analysis Report By Technology (Fingerprint Recognition, Facial Recognition), By Device Type, By Security Level, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-576-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The global consumer electronic biometrics market size was estimated at USD 5.61 billion in 2024 and is expected to grow at a CAGR of 21.3% from 2025 to 2030. The widespread integration of biometric technologies such as fingerprint and facial recognition in devices such as smartphones, laptops, and wearables influences this growth.

Key Market Highlights:

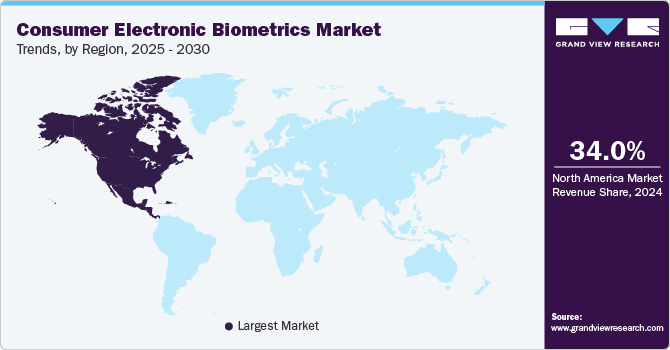

- North America dominated the consumer electronic biometrics application in 2024, accounting for a revenue share of over 34%.

- The U.S. consumer electronic biometrics application is anticipated to exhibit a significant CAGR over the forecast period.

- In terms of, the fingerprint recognition segment led the market in 2024, accounting for over 40% of global revenue.

- In terms of, the smartphones segment led the market in 2024.

- In terms of, the authentication & access control segment held the largest revenue share in 2024.

The widespread integration of biometric technologies such as fingerprint and facial recognition in devices such as smartphones, laptops, and wearables influences this growth. This integration addresses the growing consumer demand for enhanced security and convenient authentication methods, replacing traditional passwords and PINs. In addition, the rising concerns over cyber fraud and identity theft have accelerated the adoption of biometrics in consumer electronics, supported by advancements in biometric sensors and algorithms that improve accuracy and reliability.

Moreover, the market growth is supported by the expanding use of biometrics in Internet of Things (IoT) devices and smart home systems, which require secure and personalized access. Integrating artificial intelligence improves biometric recognition accuracy and reduces errors, increasing user trust. In addition, healthcare, automotive, and financial services applications broaden the demand for biometric authentication. Increasing consumer awareness about data security and convenience also drives adoption.

Furthermore, the growing emphasis on contactless authentication methods, especially in response to health and hygiene concerns, boosts the use of biometrics in consumer electronics. Enhanced mobile connectivity and cloud computing facilitate real-time biometric data processing and verification, making biometric solutions more efficient and scalable. Partnerships between technology providers and consumer electronics companies accelerate the integration of biometric features in new devices. These factors create a favorable environment for sustained growth in the consumer electronic biometrics market.

Technology Insights

The fingerprint recognition segment led the market in 2024, accounting for over 40% of global revenue due to its widespread adoption in smartphones, laptops, and other consumer devices. Fingerprint sensors offer a reliable, cost-effective, and user-friendly authentication method, leading device manufacturers to widely implement them. Their integration into mobile devices for secure unlocking and payment authentication drives significant market share. Technological improvements, such as under-display and ultrasonic fingerprint sensors, enhance performance and user convenience.

The iris recognition segment is anticipated to grow at the highest CAGR during the forecast period, driven by its high security, accuracy, and resilience to external conditions. Offering unique identification features, iris scanning is particularly suitable for sensitive applications such as access control, smartphones, and automotive systems. Its rapid adoption is further fueled by advancements in camera technology and AI algorithms, which enhance both speed and reliability. This growing adoption is encouraging companies to expand their biometric offerings with iris-based technologies. For instance, in May 2025, Mantra Softech (India) Pvt. Ltd. extended its license agreement with Fingerprint Cards (FPC) to incorporate FPC’s advanced iris recognition software into a broader range of authentication and enrollment devices, reflecting the rising demand for reliable iris-based biometric solutions.

Device Type Insights

The smartphones segment led the market in 2024, driven by integrating multiple biometric modalities such as fingerprint, facial, and iris recognition in mobile devices. Smartphones are primary personal devices requiring secure and convenient access, which biometrics efficiently provide. The rising use of mobile payments and digital wallets also increases the need for smartphone biometric authentication. Continuous innovation by smartphone manufacturers in biometric technologies enhances user experience and security.

The wearables segment is anticipated to grow at the highest CAGR during the forecast period due to the increasing popularity of smartwatches, fitness trackers, and health monitoring devices. Wearables benefit from biometric authentication to secure personal health data and enable seamless user access. The miniaturization of biometric sensors and advancements in low-power technologies facilitate their integration into compact wearable devices. For instance, in March 2025, Apple, Inc. was granted a patent for a Hybrid Gaze Tracking System designed for future head-mounted displays (HMDs) that combines ultrasound and imaging data to enhance gaze tracking accuracy. This system detects multiple eye attributes using ultrasonic depth measurements and imaging, enabling precise gaze direction determination in a 3D coordinate system. In addition, the technology integrates ultrasonic biometric features with imaging biometrics to improve user authentication, offering a strong and reliable solution for next-generation wearable devices.

Security Level Insights

The single-factor authentication segment led the market in 2024, offering a simple and cost-effective security solution widely adopted across consumer devices. Fingerprint and facial recognition as standalone authentication methods provide sufficient security for most consumer applications. The ease of implementation and user convenience contribute to its dominant market share. Many devices prioritize quick and straightforward access, making single-factor biometric authentication preferable.

The multi-factor authentication segment is expected to grow at the highest CAGR during the forecast period as security requirements intensify across industries. Combining biometrics with passwords, PINs, or tokens enhances protection against unauthorized access and fraud. Increasing regulatory mandates and enterprise adoption encourage using multi-factor systems in consumer electronics. Advances in seamless integration of multiple authentication methods improve user acceptance. The rising demand for higher security levels in mobile payments, financial services, and healthcare drives this segment’s rapid growth.

Application Insights

The authentication & access control segment held the largest revenue share in 2024, reflecting the extensive use of biometrics for secure entry in consumer electronics and smart environments. Biometric access control provides faster and more reliable identification compared to traditional methods. Its application spans smartphones, laptops, smart homes, and office environments, enhancing security and user convenience. Integration with IoT and smart infrastructure further expands its market reach.

The mobile payments & digital wallets segment is estimated to grow at the highest CAGR during the forecast period due to the increasing adoption of cashless transactions and e-commerce. Biometric authentication enhances transaction security and reduces fraud in mobile payment platforms. Consumer preference for quick and secure payment methods encourages digital wallets' fingerprint and facial recognition integration. Regulatory support for secure payment authentication methods also contributes to this growth.

Regional Insights

North America dominated the consumer electronic biometrics application in 2024, accounting for a revenue share of over 34%, due to its advanced technological infrastructure and high consumer adoption. The region benefits from widespread smartphone penetration and early adoption of biometric security features. Strong presence of technology companies and innovation hubs accelerates product development and deployment. Increasing industrialization and disposable income levels enable greater consumer spending on biometric-enabled devices.

U.S. Consumer Electronic Biometrics Market Trends

The U.S. consumer electronic biometrics application is anticipated to exhibit a significant CAGR over the forecast period due to continuous innovation and strong consumer demand for secure authentication. The U.S. market benefits from AI and biometric research investments, improving technology performance. Expanding applications in healthcare, finance, and government sectors increase adoption rates. Consumer preference for convenient and secure access to devices and services drives growth.

Europe Consumer Electronic Biometrics Market Trends

The Europe consumer electronic biometrics application is expected to grow significantly over the forecast period, driven by stringent data protection regulations and rising demand for secure authentication. European countries emphasize privacy and security, encouraging biometrics in consumer electronics. The automotive and financial sectors are key contributors to market expansion in the region. Increasing adoption of biometric payment cards and smart home devices supports growth. Technological advancements and government initiatives in digital identity verification further fuel the market growth.

Asia Pacific Consumer Electronic Biometrics Market Trends

The Asia Pacific consumer electronic biometrics application is anticipated to register the highest CAGR over the forecast period, reflecting rapid digitalization and growing consumer electronics adoption. Expanding smartphone penetration and rising disposable incomes drive biometric integration in the region. Governments and enterprises invest in biometric infrastructure to enhance security and digital services. The growing e-commerce sector and mobile payment usage create strong demand for biometric authentication.

Key Consumer Electronic Biometrics Company Insights

Some key companies in the consumer electronic biometrics application are IDEMIA, HID Global Corporation, Aware, Inc., and Microsoft.

-

IDEMIA specializes in advanced biometric technologies, including fingerprint, facial, and iris recognition, delivering secure and contactless biometric solutions for consumer electronics and identity verification. The company serves the government, banking, and transportation sectors, providing fast and reliable authentication systems that enhance security and user convenience. IDEMIA invests heavily in research and development to improve biometric algorithms and sensor technologies, enabling innovations such as biometric payment cards and frictionless border control.

-

HID Global Corporation offers a comprehensive portfolio of biometric authentication technologies, including fingerprint, facial, and iris recognition, tailored for secure identity verification and access control. Their products cater to industries such as healthcare, finance, government, and retail, focusing on enhancing security while maintaining user convenience. HID Global integrates cutting-edge biometric sensors with identity management solutions, providing scalable and versatile contactless authentication systems.

Key Consumer Electronic Biometrics Companies:

The following are the leading companies in the consumer electronic biometrics market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- IDEMIA

- Aware, Inc.

- Synaptics Incorporated

- Qualcomm Technologies, Inc.

- Microsoft

- Suprema, Inc.

- FaceFirst, Inc.

- Precise Biometrics AB

- HID Global Corporation

Recent Developments

-

In January 2025, Mitsubishi Electric Automotive America, Inc. unveiled its FLEXConnect system at CES. This system features cloud-connected capabilities powered by QNX software and Amazon Web Services (AWS). The FLEXConnect platform integrates real-time biometric monitoring, including facial recognition, distraction detection, and fatigue tracking, to enhance driver safety and personalize the in-cabin experience.

-

In October 2024, Infineon Technologies and Rheinmetall AG introduced advanced biometric identification and authentication solutions to enhance road safety through driver monitoring systems (DMS). Infineon launched automotive-qualified fingerprint sensor ICs designed for secure driver authentication, enabling personalized vehicle settings and payment authorization, while meeting stringent automotive reliability standards.

-

In June 2024, Mastercard expanded its Biometric Checkout Program in LATAM by launching a pilot at Tienda Inglesa’s Red Express in Uruguay. In partnership with Fulcrum Biometrics, Ingenico, Fujitsu Frontech, and Scanntech, this initiative enables shoppers to pay using palm recognition technology to register their biometric data and payment credentials on-site for faster, more secure transactions.

Consumer Electronic Biometrics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 6.79 billion

Revenue forecast in 2030

USD 17.81 billion

Growth rate

CAGR of 21.3% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, device type, security level, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Apple Inc.; IDEMIA; Aware, Inc.; Synaptics Incorporated; Qualcomm Technologies, Inc.; Microsoft; Suprema, Inc.; FaceFirst, Inc.; Precise Biometrics AB; HID Global Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Consumer Electronic Biometrics Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global consumer electronic biometrics market report based on the technology, device type, security level, application, and region.

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Fingerprint Recognition

-

Facial Recognition

-

Iris Recognition

-

Voice Recognition

-

Others

-

-

Device Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones

-

Laptops

-

Tablets

-

Wearables

-

Others

-

-

Security Level Outlook (Revenue, USD Million, 2017 - 2030)

-

Single-Factor Authentication

-

Multi-Factor Authentication

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Authentication & Access Control

-

Mobile Payments & Digital Wallets

-

Device Security & Anti-Theft Measures

-

Parental Controls & Usage Restrictions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global consumer electronic biometrics market size was estimated at USD 5.61 billion in 2024 and is expected to reach USD 6.79 billion in 2025.

b. The global consumer electronic biometrics market is expected to grow at a compound annual growth rate of 21.3% from 2025 to 2030 to reach USD 17.81 billion by 2030.

b. North America dominated the market in 2024, accounting for over 34.0% share of the global revenue due to its advanced technological infrastructure and high consumer adoption. The region benefits from widespread smartphone penetration and early adoption of biometric security features.

b. Some key players operating in the consumer electronic biometrics market include Apple Inc.; IDEMIA;Aware, Inc.;Synaptics Incorporated;Qualcomm Technologies, Inc.; Microsoft;Suprema, Inc.; FaceFirst, Inc.;Precise Biometrics AB; HID Global Corporation

b. Key factors driving the consumer electronic biometrics market growth include the growing demand for secure authentication methods to protect personal data and the proliferation of smart devices

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."