- Home

- »

- Medical Devices

- »

-

Cyanoacrylate Surgical Sealants And Adhesives Market, 2030GVR Report cover

![Cyanoacrylate Surgical Sealants And Adhesives Market Size, Share & Trends Report]()

Cyanoacrylate Surgical Sealants And Adhesives Market Size, Share & Trends Analysis Report By Product (n-Butyl Cyanoacrylate-Based Sealants, 2-Octyl Cyanoacrylate-Based Sealants), By Application, By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-596-8

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Cyanoacrylate Surgical Sealants And Adhesives Market Summary

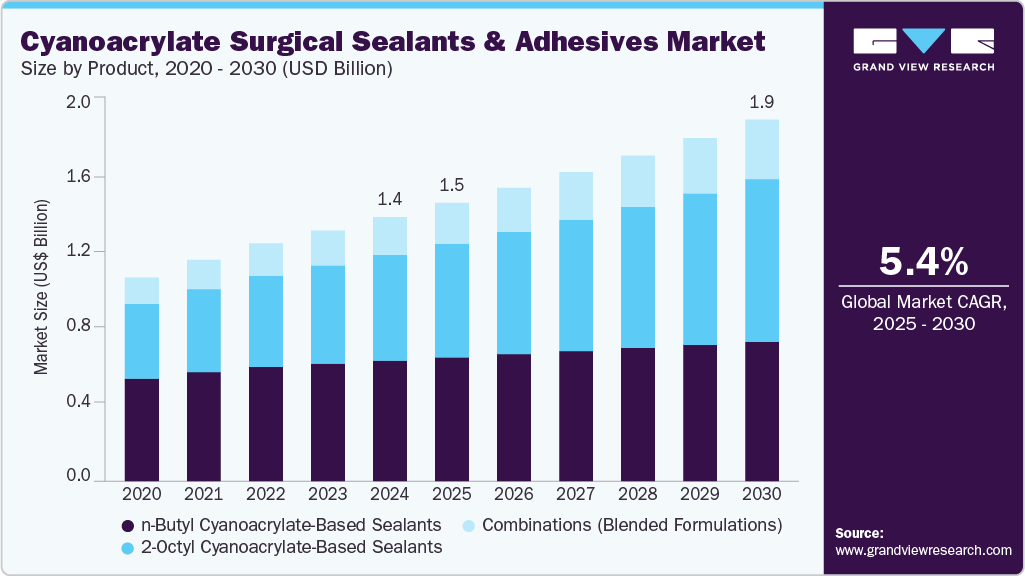

The global cyanoacrylate surgical sealants and adhesives market size was estimated at USD 1.40 billion in 2024 and is projected to reach USD 1.92 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The growth of the cyanoacrylate surgical sealants and adhesives market is driven by the increasing demand for minimally invasive surgeries, which has led to the adoption of advanced wound closure technologies, as these sealants provide quick and effective solutions.

Key Market Trends & Insights

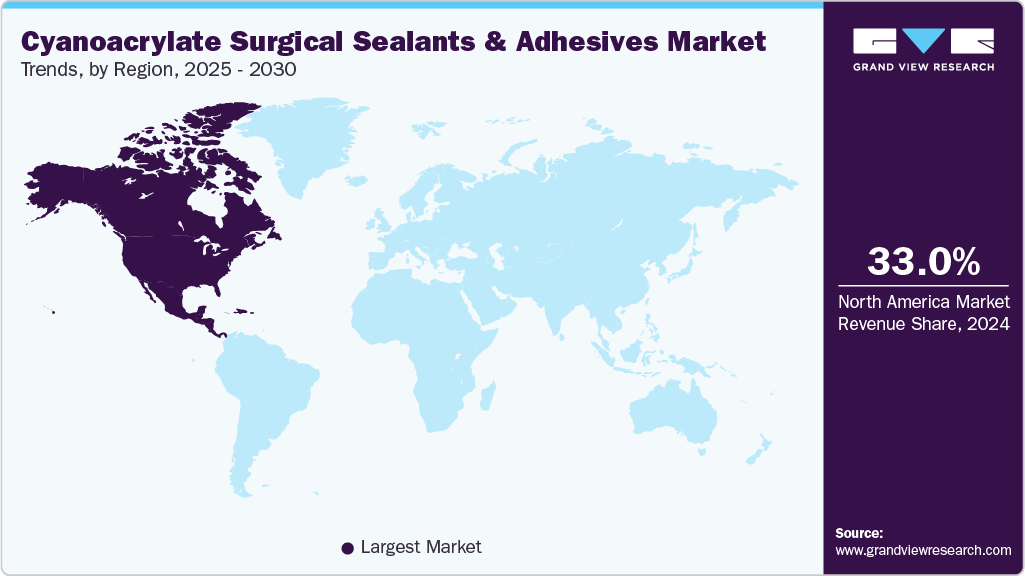

- North America cyanoacrylate surgical sealants and adhesives market dominated the global market and accounted for a 33.01% revenue share in 2024.

- The cyanoacrylate surgical sealants and adhesives market in the U.S. held a significant share of North America's industry in 2024.

- In terms of product segment, the n-butyl cyanoacrylate-based sealants segment held the largest market share of 45.66% in 2024.

- In terms of application segment, the cardiovascular surgery segment held the largest market share, 30.54%, in 2024.

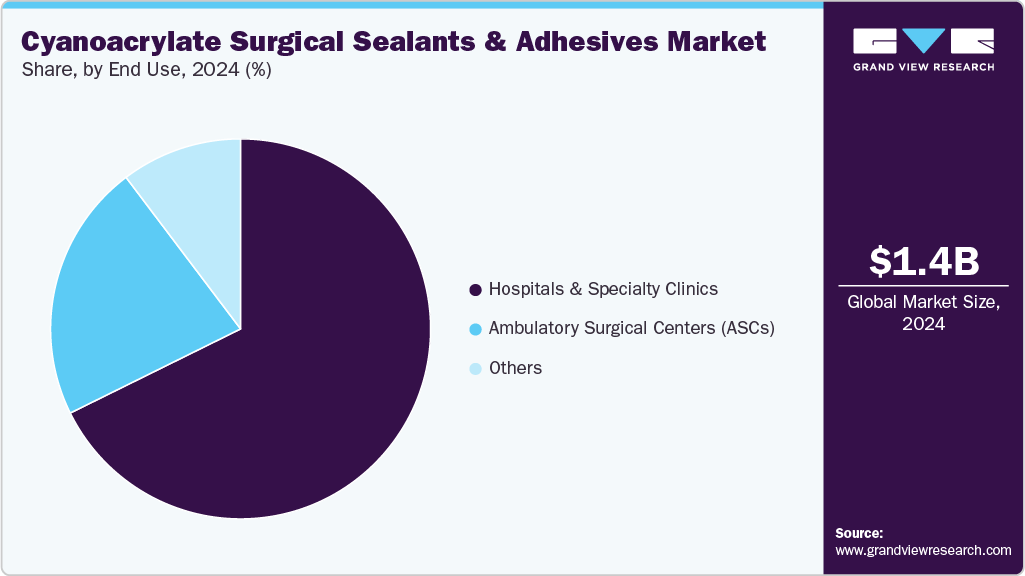

- In terms of end use segment, the hospitals segment had the largest revenue share, 67.68%, in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.40 Billion

- 2030 Projected Market Size: USD 1.92 Billion

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Moreover, the increasing prevalence of chronic diseases necessitates more surgical interventions, which further accelerates market growth. In addition, expanding investments in healthcare infrastructure worldwide enable greater availability and usage of these products. The market is witnessing significant expansion, driven by the global surge in surgical procedure volumes and the accelerating adoption of minimally invasive surgery (MIS) techniques.

There is an important shift from traditional wound closure methods such as sutures and staples, particularly in complex or delicate procedures, where cyanoacrylates offer superior sealing capabilities and reduced tissue trauma. The advantages of cyanoacrylate, such as rapid polymerization, strong adhesion to moist tissues, and the ability to create a watertight seal, are increasing their role in specialties ranging from general surgery to cardiovascular and neurosurgery.

This demand is further fueled by an aging global population and the rising prevalence of chronic diseases necessitating surgical interventions, increasing the overall demand for efficient and effective wound management solutions. According to the World Health Organization (WHO), the global geriatric population aged 60 years and above is expected to increase from 1.1 billion in 2023 to reach around 1.4 billion by 2030. The market's growth is also influenced by the clinical benefits these adhesives provide, including decreased operative time, reduced risk of leakage, and potentially lower rates of post-operative complications. These are critical considerations for healthcare providers aiming to improve patient outcomes and optimize resource utilization. Moreover, diversifying different types of cyanoacrylate surgical sealants and adhesives enables cyanoacrylates to penetrate new surgical domains, including ophthalmology for corneal repair and orthopedics for bone fragment stabilization, significantly broadening their applications.

The rising prevalence of chronic diseases and traumatic injuries has significantly contributed to the growing application of cyanoacrylate surgical sealants and adhesives. Globally, the increasing incidence of diabetes, vascular disorders, and obesity-related complications has led to a higher number of surgical interventions requiring efficient wound closure solutions. According to the International Diabetes Federation (IDF), around 589 people aged 20-79 were living with diabetes in 2024, and this prevalence of diabetes is expected to reach around 853 million by 2050. Similarly, cyanoacrylate surgical adhesives have become increasingly integral to trauma and emergency medicine due to their rapid application, strong tissue adhesion, and reduced infection risk. In high-pressure emergency settings, such as accident and trauma centers, these adhesives offer a fast and efficient alternative to traditional sutures for superficial lacerations, scalp wounds, and facial injuries. According to the WHO, approximately 1.19 million people lose their lives annually due to road traffic crashes, with an additional 20-50 million suffering non-fatal injuries, many of whom incur disabilities. Thus, the demand for cyanoacrylate surgical sealants and adhesives is expected to be driven by the rising number of road traffic accidents and occupational injuries, particularly in countries where trauma admissions are significantly increasing.

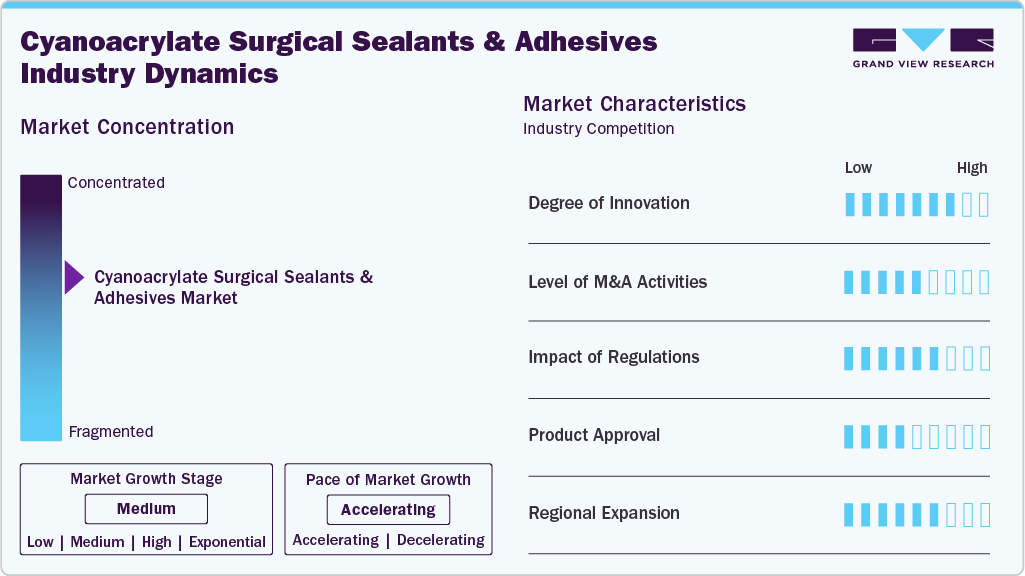

Market Concentration & Characteristics

The cyanoacrylate surgical sealants and adhesives market exhibits notable industry concentration, with key players focusing on innovation and product differentiation. Key characteristics include growing demand for minimally invasive surgeries, increased adoption in wound closure applications, and advancements in adhesive formulations enhancing efficacy and safety. The rising prevalence of chronic diseases drives market growth, as does the rise in the number of trauma injuries, the aging population, and growing investments in healthcare infrastructure globally.

The cyanoacrylate surgical sealants and adhesives industry is characterized by a medium pace of innovation, with most products being based on established formulations. However, there are opportunities for future innovation, particularly in developing adhesives with improved biocompatibility, biodegradability, and antimicrobial properties. Additionally, companies could focus on collaborating with research institutions and clinicians to identify unmet needs and develop novel solutions. The potential for innovation lies in developing next-generation cyanoacrylate adhesives that address the limitations of current products, such as toxicity concerns and limited flexibility.

The cyanoacrylate surgical sealants and adhesives industry is witnessing significant activity in mergers and acquisitions, reflecting the growing demand for advanced surgical solutions. Major players are consolidating to enhance their product portfolios and expand market reach. For instance, in December 2024, H.B. Fuller acquired two medical adhesive companies, GEM S.r.l. and Medifill Ltd., expanding its medical adhesive technologies business globally. Medifill specializes in medical-grade cyanoacrylate adhesives for fast, safe wound closure. These acquisitions enhance H.B. Fuller’s portfolio in high-growth tissue adhesives, building on expertise in cyanoacrylate chemistry. As competition intensifies, such strategic alliances are expected to play a crucial role in shaping the future landscape of the cyanoacrylate surgical sealants and adhesives market.

The cyanoacrylate surgical sealants and adhesives industry is significantly influenced by regulations, which impose strict guidelines to guarantee safety and effectiveness in medical applications. Agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) implement rigorous testing protocols that products must meet before entering the market. These regulations mandate comprehensive clinical evaluations and continuous post-market surveillance, enhancing patient safety and affecting market dynamics by requiring manufacturers to invest resources in research and development to adhere to compliance standards.

The cyanoacrylate surgical adhesives industry faces competition from various product substitutes that offer alternative wound closure solutions. These substitutes include sutures, staples, and other tissue adhesives like fibrin glue. Sutures, for instance, are a traditional and widely used method for wound closure, offering high tensile strength and versatility in various surgical procedures. Staples are another common substitute, particularly in surgeries where speed is crucial, such as in certain gastrointestinal or skin closure procedures. However, the competition from these substitutes drives innovation in cyanoacrylate adhesives, with manufacturers focusing on improving their products' performance, safety, and ease of use.

Regional expansion in the cyanoacrylate surgical adhesives industry is driven by the increasing healthcare investments and rising surgical procedures, which are anticipated to drive demand. As healthcare infrastructure improves and awareness of advanced surgical adhesives grows, these regions could see significant adoption rates. Furthermore, the ongoing development of innovative formulations for specific surgical applications may enhance market growth.

Product Insights

The n-butyl cyanoacrylate-based sealants segment held the largest market share of 45.66% in 2024. This is attributed to their high tensile strength, rapid adhesion, and proven clinical effectiveness in internal surgeries such as cardiovascular and general procedures. Their ability to provide strong, immediate hemostasis has made them a go-to choice for surgeons dealing with high-pressure blood vessels and internal tissue closure. In February 2024, Henkel AG & Co. KGaA launched two innovative medical-grade cyanoacrylate adhesives-Loctite 4011S and Loctite 4061S-tailored for medical device applications. These adhesives provide robust bonding capabilities on plastics, rubber, and metals, improving surgical safety and performance.

The combinations (blended formulations) segment is witnessing significant growth. These sealants offer balance, strength, and flexibility by combining n-butyl and 2-octyl cyanoacrylates. These hybrid products are gaining traction due to their improved biocompatibility and reduced brittleness, making them increasingly suitable for a broader range of surgical applications, including delicate and cosmetic procedures.

Application Insights

The cardiovascular surgery segment held the largest market share, 30.54%, in 2024. This dominance is due to the critical need for strong, reliable tissue sealing and hemostasis in high-risk, high-pressure surgical environments. Cyanoacrylate-based adhesives, particularly n-butyl variants, are especially valued for their ability to seal vascular structures and decrease operative time quickly. For instance, as of 2023, between 1 and 1.5 million cardiac surgical procedures are estimated to be performed globally annually. This encompasses a range of surgeries, including coronary artery bypass grafting (CABG), valve replacements, and congenital heart defect repairs. Cyanoacrylate-based sealants, particularly those formulated with n-butyl cyanoacrylate, are widely adopted due to their strong adhesive strength, quick polymerization, and secure seal in dynamic surgical environments. As the global burden of cardiovascular disease rises and surgical volumes increase, especially in high-growth regions like Asia-Pacific, the use of cyanoacrylate adhesives in cardiovascular applications continues to expand.

Theplastic and reconstructive surgery segment is expected to witness the fastest growth of 7.1% over the forecast period. This growth is driven by the rising number of elective and cosmetic procedures globally. Surgeons in this field prioritize aesthetic outcomes and minimal scarring, making 2-octyl cyanoacrylate-based products and blended formulations highly desirable due to their superior flexibility and cosmetic finish. According to the International Society of Aesthetic Plastic Surgery (ISAPS), over 15.8 million surgical aesthetic procedures were performed worldwide in 2023, marking a 5.5% increase from the previous year. As demand for aesthetic surgeries continues to grow, particularly for minimally invasive and cosmetic procedures, so does the need for effective wound closure solutions that ensure minimal scarring and quick recovery. Cyanoacrylate-based adhesives, especially 2-octyl and blended formulations, are increasingly favored in plastic and reconstructive surgery due to their strong tissue bonding, antimicrobial properties, and superior cosmetic outcomes compared to traditional sutures.

End Use Insights

The hospitals segment had the largest revenue share, 67.68%, in 2024 and is expected to witness the fastest growth over the forecast period. In recent years, the number of hospitals and clinics utilizing surgical sealants and adhesives has increased. Advantages such as lowered infection rates, reduced operating times, enhanced cosmetic results, decreased costs, ease of use, rapid wound sealing, and reduction of needle stick injuries are some of the key factors responsible for the increasing adoption of these products.

The hospital segment is expected to grow significantly over the forecast period. This can be attributed to the rising focus on patient-centered care within hospitals and clinics, as these facilities aim to improve treatment outcomes through innovative medical devices. Furthermore, the volume and complexity of procedures conducted in hospital settings often require advanced wound closure technologies. Hospitals are typically the first to adopt innovative surgical tools and materials, including blended cyanoacrylate adhesives. Their ability to handle high patient throughput and more invasive surgeries ensures they remain the primary consumers of surgical adhesives. Additionally, ongoing investments in surgical infrastructure and rising demand for effective hemostatic agents further accelerate the adoption of cyanoacrylate sealants in hospitals worldwide.

Regional Insights

North America cyanoacrylate surgical sealants and adhesives marketdominated the global market and accounted for a 33.01% revenue share in 2024. The market growth in North America is driven by the high adoption of advanced wound closure technologies across surgical disciplines, particularly in cardiovascular, orthopedic, and cosmetic surgeries. The region benefits from well-established healthcare infrastructure, a strong presence of key manufacturers, and supportive regulatory pathways for product approvals. Rising emphasis on minimally invasive procedures, shorter hospital stays, and cost-effective surgical solutions further supports demand.

U.S. Cyanoacrylate Surgical Sealants And Adhesives Market Trends

The cyanoacrylate surgical sealants and adhesives market in the U.S. held a significant share of North America's industry in 2024. In the U.S., the cyanoacrylate surgical sealants and adhesives market is driven by the healthcare sector's emphasis on minimally invasive procedures and rapid wound closure, shaped by the country’s advanced surgical infrastructure, high surgical volumes, and strong regulatory support for innovative wound closure products. The U.S. Food and Drug Administration (FDA) has approved multiple cyanoacrylate-based adhesives, facilitating their routine use in clinical settings. U.S.-based manufacturers and distributors play a key role in maintaining consistent product availability, with domestic production capabilities supporting rapid market growth.

Europe Cyanoacrylate Surgical Sealants And Adhesives Market Trends

The European market for cyanoacrylate surgical sealants and adhesivesis driven by the region’s stringent regulatory environment, centralized procurement systems, and emphasis on standardizing surgical protocols. The European Medicines Agency (EMA) and Medical Device Regulation (MDR) frameworks have created a structured pathway for market entry, encouraging manufacturers to align with high safety and efficacy standards. Hospitals and surgical centers across Europe prioritize clinically validated and CE-marked adhesives, enhancing consistent adoption within public healthcare systems. The region's focus on reducing hospital-acquired infections and promoting minimally invasive surgical procedures drives demand.

The UK cyanoacrylate surgical sealants and adhesives market is driven by the National Health Service’s (NHS) push for efficiency in surgical outcomes and the wider adoption of non-invasive closure techniques across public and private healthcare facilities. The NHS’s centralized procurement practices encourage consistent product utilization, particularly those that meet stringent clinical safety and cost-effectiveness standards. Additionally, academic research collaborations and government funding for surgical innovation support the ongoing evaluation and refinement of adhesive products, reinforcing their clinical relevance.

The cyanoacrylate surgical sealants and adhesives market in Germany is driven by the country's high volume of surgical procedures, particularly in orthopedic and cardiovascular specialties, necessitating efficient wound closure solutions. The aging population contributes to an increased incidence of chronic conditions, leading to a higher demand for surgeries and surgical adhesives. Germany's advanced healthcare infrastructure and emphasis on adopting innovative medical technologies further support integrating cyanoacrylate-based products in surgical practices.

Asia Pacific Cyanoacrylate Surgical Sealants And Adhesives Market Trends

Demographic and healthcare factors drive the Asia Pacific cyanoacrylate surgical sealants and adhesives market. The rising prevalence of chronic diseases, such as cardiovascular ailments, kidney disorders, and neurological conditions, necessitates a higher number of surgical interventions, thereby increasing the demand for effective surgical adhesives. Additionally, the region faces a significant incidence of road traffic accidents, leading to a surge in emergency surgeries that require rapid and reliable wound closure solutions. The aging population further contributes to market as older individuals are more susceptible to health issues requiring surgical procedures.

Japan cyanoacrylate surgical sealants and adhesives market is expected to witness significant growth, driven by the country's aging population, which increases the demand for surgical interventions. Japan's elderly population surged to 36.25 million, accounting for a record high 29.3 percent of the population in September 2023, according to government figures released by the Ministry of Internal Affairs and Communications. The healthcare system's focus on advanced medical technologies supports the adoption of cyanoacrylate-based products, known for their rapid polymerization and antimicrobial properties.

The cyanoacrylate surgical sealants and adhesives market in China is expected to grow in the Asia Pacific region in 2024, driven by the country's increasing surgical procedures and rising healthcare expenditures. The country's growing prevalence of chronic diseases further increases the number of surgical interventions, thereby increasing the demand for effective surgical adhesives. The country's aging population also contributes to the increased need for surgical procedures, further fueling market growth.

India cyanoacrylate surgical sealants and adhesives market is driven by the increasing prevalence of chronic diseases such as cardiovascular disorders, diabetes, and cancer has led to a rise in surgical interventions, thereby boosting the demand for effective wound closure solutions. A 2023 study by the Indian Council of Medical Research – India Diabetes (ICMR INDIAB) estimates that 101 million people in India have diabetes. Furthermore, the nation’s significant rate of road traffic accidents necessitates considerable surgical interventions, thereby increasing the use of cyanoacrylate-based adhesives, which are recognized for their quick polymerization and antimicrobial characteristics.

Latin America Cyanoacrylate Surgical Sealants And Adhesives Market Trends

The rising prevalence of chronic diseases, such as cardiovascular disorders and diabetes fuels the Latin American cyanoacrylate surgical sealants and adhesives industry. Additionally, the region experiences many road traffic accidents, increasing the demand for cyanoacrylate-based adhesives known for their rapid polymerization and antimicrobial properties. Moreover, the aging population further contributes to the market's growth, as older individuals are more vulnerable to health issues requiring surgical procedures.

Brazil cyanoacrylate surgical sealants and adhesives market is driven by the country's high incidence of road traffic accidents and developing healthcare infrastructure, with growing investments in medical facilities and technologies. Moreover, the country's emphasis on minimally invasive surgeries and the need for efficient postoperative recovery further increases demand for cyanoacrylate adhesives.

Middle East and Africa Cyanoacrylate Surgical Sealants And Adhesives Market Trends

The cyanoacrylate surgical sealants and adhesives market in the MEA is witnessing significant growth, driven by region-specific healthcare challenges and infrastructural developments. The rising prevalence of chronic diseases, such as cardiovascular disorders, obesity, and diabetes, has led to an increase in surgical interventions in the region. Additionally, the region faces many road traffic accidents, increasing the demand for effective surgical sealants and adhesives. Integrating advanced medical technologies and increased healthcare investments in countries across the MEA region also significantly drive the market growth.

The cyanoacrylate surgical sealants and adhesives market in Saudi Arabia is anticipated to expand in the forecast period. This can be attributed to the country's high prevalence of diabetes and related complications, which often necessitate complex wound care and frequent surgical interventions. The Kingdom’s rapid urbanization and increasing road traffic accidents drive demand for efficient surgical adhesives used in trauma and emergency surgeries. Additionally, Saudi Arabia’s healthcare system is undergoing significant modernization under Vision 2030, with substantial investments to upgrade medical infrastructure and expand access to advanced surgical technologies, which is expected to benefit the market growth over the forecast period.

Key Cyanoacrylate Surgical Sealants And Adhesives Company Insights

The competitive scenario in the cyanoacrylate surgical sealants and adhesives market is significantly competitive, with key players such as Ethicon (Johnson & Johnson); B. Braun Melsungen AG; Advanced Medical Solutions Group plc; and GEM Srl holding significant positions. The major companies are undertaking various organic and inorganic strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers. Some of the major participants in the

Key Cyanoacrylate Surgical Sealants And Adhesives Companies:

The following are the leading companies in the cyanoacrylate surgical sealants and adhesives market. These companies collectively hold the largest market share and dictate industry trends.

- Ethicon (Johnson & Johnson)

- B. Braun Melsungen AG

- Advanced Medical Solutions Group plc

- GEM Srl

- Zhejiang PerfectSeal New Material Co., Ltd.

- Adhezion Biomedical, LLC

- Medline Industries, LP

- Meyer-Haake GmbH Medical Innovations

- GluStitch Inc.

- Cartell Chemical Co., Ltd.

Recent Developments

-

In July 2023, HB Fuller acquired Adhezion Biomedical, a US-based company specializing in cyanoacrylate adhesives, expanding its medical adhesive portfolio. This acquisition enhances HB Fuller's presence in the medical industry, leveraging Adhezion's expertise in formulating cyanoacrylate adhesives for various medical applications.

-

In February 2023,Admedus' subsidiary, Admedus Surgical, acquired Connexicon Medical, a medical device company that develops innovative products, including those using cyanoacrylate, a key component in certain medical adhesives. This acquisition expands Admedus' product portfolio and enhances its presence.

Cyanoacrylate Surgical Sealants And Adhesives Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.48 billion

Revenue forecast in 2030

USD 1.92 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Ethicon (Johnson & Johnson); B. Braun Melsungen AG; Advanced Medical Solutions Group plc; GEM Srl; Zhejiang PerfectSeal New Material Co. Ltd.; Adhezion Biomedical, LLC; Medline Industries, LP; Meyer-Haake GmbH Medical Innovations; GluStitch Inc.; Cartell Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cyanoacrylate Surgical Sealants And Adhesives Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cyanoacrylate surgical sealants and adhesives market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

n-Butyl Cyanoacrylate-Based Sealants

-

2-Octyl Cyanoacrylate-Based Sealants

-

Combinations (Blended Formulations)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Surgery

-

Plastic and Reconstructive Surgery

-

Neurosurgery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Specialty Clinics

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global cyanoacrylate surgical sealants and adhesives market size was estimated at USD 1.40 billion in 2024 and is expected to reach USD 1.48 billion in 2025.

b. The global cyanoacrylate surgical sealants and adhesives market is expected to grow at a compound annual growth rate of 5.37% from 2025 to 2030 to reach USD 1.92 billion by 2030.

b. The n-butyl cyanoacrylate-based sealants segment dominated the cyanoacrylate surgical sealants and adhesives market and held the largest revenue share of 45.66% in 2024.

b. Some key players operating in the cyanoacrylate surgical sealants and adhesives market include Ethicon (Johnson & Johnson); B. Braun Melsungen AG; Advanced Medical Solutions Group plc; GEM Srl; Zhejiang PerfectSeal New Material Co., Ltd.; Adhezion Biomedical, LLC; Medline Industries, LP; Meyer-Haake GmbH Medical Innovations; GluStitch Inc.; Cartell Chemical Co., Ltd.

b. Key factors that are driving the market growth include the increasing demand for minimally invasive surgeries, which has led to the adoption of advanced wound closure technologies. Additionally, the rising prevalence of chronic diseases, and growing investments in healthcare infrastructure globally, further drives the market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."