- Home

- »

- Clinical Diagnostics

- »

-

Dengue Testing Market Size & Share, Industry Report, 2030GVR Report cover

![Dengue Testing Market Size, Share & Trends Report]()

Dengue Testing Market Size, Share & Trends Analysis Report By Product (ELISA-based Tests, Dengue IgG/IgM Detection Kits, RT-PCR Tests, Rapid Diagnostic Tests), By Service Type, By End-use (Home Healthcare, Clinical Labs), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-589-8

- Number of Report Pages: 195

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Dengue Testing Market Size & Trends

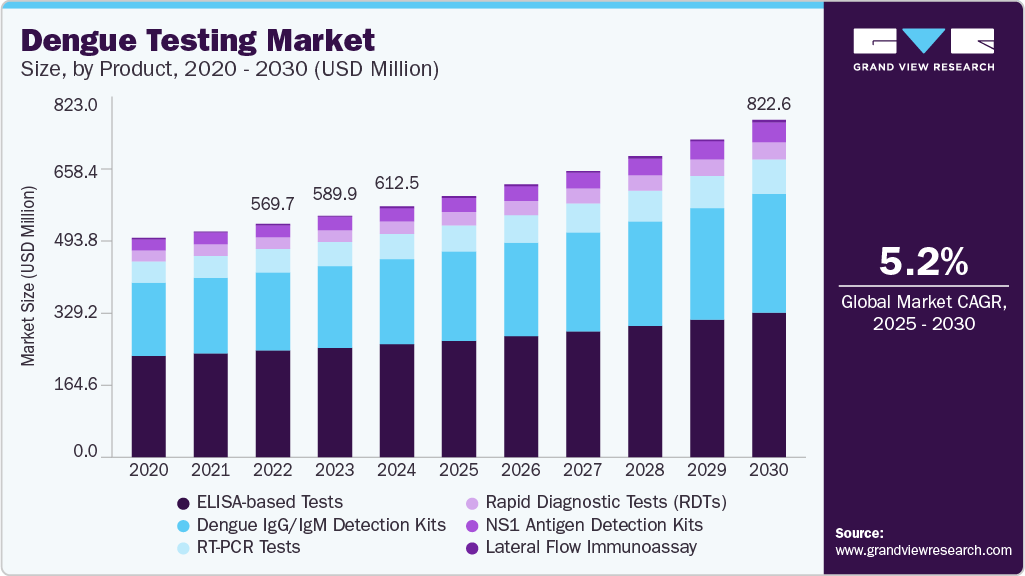

The global dengue testing market size was estimated at USD 612.53 million in 2024 and is expected to grow at a CAGR of 5.22% from 2025 to 2030, driven by escalating dengue outbreaks, technological advancements, and increased public health initiatives. The 2024 dengue epidemic in Latin America and the Caribbean, with over 13 million suspected cases and more than 8,000 deaths, underscores the urgent need for effective diagnostic solutions.

Key Highlights:

- Asia Pacific dominated the market and accounted for the largest revenue share of about 31.57% in 2024.

- Japan dengue testing market is experiencing significant growth driven by government‑funded surveillance programs enhancing RT‑PCR and automated ELISA deployment in public health labs.

- By product, the ELISA-based tests segment accounted for the largest market share of 44.94% in 2024.

- By service, the centralized service segment led the market with a 59.93% share in 2024.

- By end-use, the clinical labs segment dominated the market with a revenue share of 44.16% in 2024.

In response, companies like Abbott Laboratories and Roche Diagnostics have introduced rapid diagnostic tests and multiplex PCR assays, respectively, enhancing early detection and management of dengue infections. These developments not only improve patient outcomes but also contribute to controlling the spread of the disease.

Accurate diagnostics are central to managing dengue outbreaks effectively. Among the most widely used methods is the enzyme-linked immunosorbent assay (ELISA), which detects anti-DENV IgM/IgG antibodies and the NS1 antigen, and can differentiate between all four dengue virus serotypes. ELISA remains the gold standard in clinical laboratories with the necessary equipment and skilled personnel. Meanwhile, innovations are expanding access to diagnostics beyond traditional settings. A prime example is the 2025 launch of the AccoDengue Home Test by AccoBiotech Sdn. Bhd. in Malaysia-a user-friendly, affordable rapid diagnostic kit that detects NS1 antigens and enables early detection at the household level, particularly beneficial in low-resource environments.

In addition to serological testing, molecular diagnostics are rapidly advancing and offering powerful new tools for early and precise detection. One such innovation is the CDC’s DENV-1-4 rRT-PCR assay, approved by the USFDA, which identifies dengue virus RNA during the initial seven days of infection. In 2025, researchers at the Institute for Global Health and Infectious Diseases unveiled a breakthrough blood test that can simultaneously detect both dengue and Zika viruses-critical for improving disease surveillance and guiding vaccine development. Another recent advancement is the anti-NS2BNS3pro antibody-based indirect ELISA, which has demonstrated strong diagnostic performance, with a sensitivity of 87% and solid specificity, providing additional options for case confirmation.

Technological innovations are also expanding the reach of dengue testing through point-of-care testing (POCT) devices, which offer fast, reliable results in decentralized settings. These tools are particularly valuable in low- and middle-income countries where access to centralized labs is limited. For example, Mylab Discovery Solutions has introduced a multiplex RT-PCR test kit capable of detecting several pathogens, including dengue, making it easier for clinicians to identify co-infections and implement timely treatment. This kind of innovation ensures faster diagnosis and contributes significantly to breaking the chain of transmission during outbreaks.

Moreover, robust government initiatives are accelerating the growth of the dengue testing market. Programs like India’s National Vector Borne Disease Control Program (NVBDCP) aim to raise awareness and expand diagnostic networks, thereby strengthening outbreak preparedness and surveillance. Similarly, targeted public health campaigns across Latin America are intensifying early detection efforts, emphasizing timely diagnosis as a core strategy for disease control. These interventions are not only saving lives but are also generating increased demand for reliable, scalable, and accessible diagnostic tools-solidifying diagnostics as a critical pillar in the global fight against dengue.

Market Concentration & Characteristics

The industry is marked by high innovation, particularly in rapid testing and molecular diagnostics. Technologies like RT-PCR, CRISPR-based assays, and home-based NS1 antigen kits are transforming early detection and outbreak management. Startups and research institutions are increasingly focusing on developing multiplex assays that can distinguish dengue from similar infections like Zika and chikungunya, making innovation a key competitive differentiator in the market.

Mergers and acquisitions are gaining traction in the dengue testing sector, with larger diagnostic firms acquiring smaller innovators to access proprietary technology and expand product portfolios. Recent examples include regional partnerships in Asia and Latin America, where companies are consolidating to streamline production and distribution. These M&A activities are driven by the rising market demand and the urgency to scale up affordable, rapid diagnostic tools in high-burden areas.

Regulations have a significant influence on market dynamics, affecting product approval timelines and commercialization. Regulatory bodies like the FDA, EMA, and WHO require stringent clinical validations for dengue tests, especially those targeting multiple serotypes. While this ensures product quality and safety, it can also delay market entry. However, emergency use authorizations during outbreaks have sometimes expedited the deployment of new diagnostic solutions, especially in resource-limited countries.

Product expansion in dengue testing includes the development of next-generation kits capable of detecting multiple arboviruses simultaneously. Companies are also introducing self-testing kits, mobile-integrated diagnostic tools, and more sensitive assays. This broadening of product lines caters to diverse settings, from centralized labs to remote clinics. As demand grows in urban and rural areas alike, product diversification is essential to meet varying diagnostic needs across healthcare ecosystems.

The industry is rapidly expanding across Asia-Pacific, Latin America, and parts of Africa due to high disease prevalence. Companies are strategically entering these regions through local partnerships, government collaborations, and regional distribution hubs. Additionally, North America and Europe are seeing increased product availability due to travel-related dengue cases. Regional expansion ensures wider access to diagnostics, bolsters outbreak response, and contributes to global dengue surveillance efforts.

Product Insights

The ELISA-based tests segment accounted for the largest market share of 44.94% in 2024, driven by their high sensitivity, specificity, and ability to detect both dengue antigens (NS1) and antibodies (IgM and IgG). These tests are particularly valuable in the early and late phases of infection, offering flexible diagnostic windows. In 2024, the global burden of dengue surged dramatically, leading to greater demand for accurate lab-based diagnostics. Companies like Abbott and Bio-Rad have strengthened their ELISA test offerings, introducing more rapid, multi-serotype detection kits. Furthermore, support from governments and international health agencies for centralized disease monitoring is boosting the use of ELISA as a core method for large-scale dengue surveillance.

The lateral flow immunoassay segment is projected to register the fastest CAGR during the forecast period, due to its ease of use, rapid results, and minimal infrastructure requirements. LFIAs are particularly well-suited for point-of-care testing in remote and resource-limited settings, where laboratory access is restricted. In 2024, the dengue surge across Latin America and Southeast Asia underscored the urgency for quick diagnostics, and LFIA kits like SD BIOLINE Dengue Duo (by Abbott) and Panbio Dengue Rapid Tests gained significant traction. These tests detect NS1 antigen and IgM/IgG antibodies in under 20 minutes, enabling early identification and timely intervention. The affordability, portability, and growing government procurement of LFIA kits for outbreak response further fuel this segment’s expansion, making it vital in community-based dengue surveillance and control strategies.

Service Type Insights

The centralized service segment led the market with a 59.93% share in 2024, driven by the increasing demand for accurate and comprehensive testing solutions. Centralized laboratories, primarily located in hospitals and diagnostic centers, offer advanced diagnostic capabilities, including ELISA and RT-PCR tests, which are essential for confirming dengue infections. Government initiatives and investments in healthcare infrastructure further bolster this segment, enhancing laboratory capacities and accessibility. As dengue continues to pose a significant public health challenge, the centralized service segment is poised to play a pivotal role in disease management and control.

The POC service segment is projected to register the fastest CAGR during the forecast period, as healthcare systems prioritize rapid, on-site testing to combat seasonal outbreaks. Innovations such as Abbott’s SD BIOLINE Dengue Duo deliver NS1 antigen and IgM/IgG results in under 20 minutes, enabling same‑visit clinical decisions. Additionally, mobile‑enabled POC platforms facilitate real‑time data transmission to public health dashboards, improving outbreak surveillance. Government procurement programs in endemic regions are also scaling POC deployment in remote clinics. Consequently, the POC service segment is set to outpace traditional laboratory services in dengue testing over the coming decade.

End-use Insights

The clinical labs segment dominated the market with a revenue share of 44.16% in 2024. Growth is driven by increased investments in laboratory automation, high‑throughput ELISA, and RT‑PCR platforms, enabling same‑day turnaround. Major players such as LabCorp and Quest Diagnostics in North America have integrated dengue RT‑PCR into their infectious disease panels, while networks of private labs in India and Brazil offer multiplex testing during peak seasons. Additionally, public health initiatives are consolidating surveillance testing in regional reference labs, further increasing test volumes.

The government suppliers segment is expected to grow at the fastest rate over the forecast period. This growth is underpinned by rising consumer demand for convenient, at‑home NS1 antigen and IgM/IgG rapid tests. Recent usability studies demonstrate that dengue NS1 rapid immunochromatographic assays can be effectively adapted into self‑test kits-participants with varied backgrounds successfully performed the AccoDengue Home Test under simulated home conditions. Commercial products such as the R‑test Dengue NS1 Ag Self‑Test offer 100% sensitivity and 99% specificity, enabling early detection without laboratory visits. With digital instruction modules (QR‑linked videos) and mobile apps for result interpretation, home healthcare is set to capture an increasing share of the dengue testing market.

Regional Insights

North America dengue testing market is experiencing significant growth, driven by robust public health surveillance and expanded point‑of‑care testing adoption. The U.S. and Canada lead investments in rapid NS1 antigen assays and multiplex PCR platforms. Increased travel‑related case importation has spurred laboratory upgrades, while federal initiatives bolster decentralized testing in clinics and urgent care centers, ensuring timely outbreak response and patient management.

U.S. Dengue Testing Market Trends

The dengue testing market in the U.S. is fueled by growing numbers of dengue cases in travelers and proactive CDC testing guidelines. Clinical laboratories and POC centers are integrating NS1 antigen and multiplex RT‑PCR assays into routine infectious disease panels. Insurance coverage for dengue testing has improved access, while public health campaigns at borders and airports enhance early detection efforts-establishing the U.S. as the leading market.

Europe Dengue Testing Market Trends

The dengue testing market in Europe is driven by increased travel to and from dengue‑endemic regions, prompting reference labs to scale up RT‑PCR and ELISA capacities. National public health agencies in France, Spain, and Italy fund specialized tropical disease centers, ensuring timely confirmation of imported cases. Private travel clinics also offer rapid NS1 and antibody tests. Combined with rising clinician awareness and cross‑border data sharing, these factors underpin the region’s growing reliance on high‑precision dengue testing.

The UK dengue testing market is being propelled as returning travelers and expatriates prompt NHS and private clinics to enhance dengue screening. Public Health England’s guidelines recommend RT‑PCR for early infection and ELISA for serosurveys, boosting laboratory test volumes. Major diagnostic companies supply CE‑marked NS1 rapid tests to both hospitals and travel health providers. Coupled with investments in centralized reference labs and digital result reporting, the UK is strengthening its capacity for rapid, accurate dengue diagnosis.

The dengue testing market in Germany is expanding through university hospital networks adopting multiplex RT‑PCR panels and automated ELISA platforms. The Robert Koch Institute issues alerts for imported infections, driving labs to maintain dengue assays year-round. Strategic partnerships between German biotech firms and global manufacturers streamline kit distribution. Meanwhile, tropical medicine clinics in major cities offer rapid NS1 antigen tests, meeting the diagnostic needs of travelers and migrant populations returning from endemic areas.

Asia Pacific Dengue Testing Market Trends

Asia Pacific dominated the market and accounted for the largest revenue share of about 31.57% in 2024. The in Asia Pacific dengue testing market dominated the market, owing to endemic dengue transmission in India, Indonesia, and Thailand. National vector control programs (e.g., India’s NVBDCP) fund ELISA and RT‑PCR in regional labs, while community health centers deploy POC NS1 rapid tests. Public‑private partnerships expand molecular testing capacity, and smartphone‑linked devices enable remote result reporting. Climate change, urbanization, and increased healthcare investment further catalyze market expansion across the region.

Japan dengue testing market is experiencing significant growth driven by government‑funded surveillance programs enhancing RT‑PCR and automated ELISA deployment in public health labs. Collaborative research between universities and biotech companies has led to multiplex assays that differentiate dengue from Zika and chikungunya. Travel clinics at major airports also offer rapid NS1 antigen tests. Combined with strong healthcare funding and digital health platforms, these elements drive steady expansion of dengue testing.

The dengue testing market in China is witnessing substantial growth. In China, periodic outbreaks in southern provinces have prompted large‑scale molecular testing initiatives led by provincial CDCs. Domestic manufacturers supply affordable ELISA and rapid test kits, while centralized labs incorporate dengue assays into broader arbovirus panels. Government investments in public health infrastructure and electronic reporting systems ensure high testing throughput. Additionally, collaborations with international diagnostic firms introduce advanced POC platforms, further boosting market capacity.

Latin America Dengue Testing Market Trends

The dengue testing market in Latin America is witnessing significant growth driven by frequent dengue epidemics in Brazil, Mexico, and Colombia. The Pan American Health Organization supports national labs in scaling up ELISA and RT‑PCR testing. Widespread procurement of NS1 rapid tests for community clinics enhances early detection. Coupled with increased funding for vector control and epidemiological surveillance, diagnostic demand remains strong, reinforcing the region’s reliance on both centralized labs and POC solutions.

Brazil dengue testing market is expanding with federal programs by Fiocruz and the Ministry of Health driving ELISA and RT‑PCR capacity. Local production of NS1 antigen kits reduces costs, while field testing campaigns in rural areas employ POC devices. Integration of dengue testing into national epidemiological reporting ensures high sample volumes. Combined with frequent outbreaks and government procurement agreements, these factors solidify Brazil’s leading position in regional dengue testing.

Middle East & Africa Dengue Testing Market Trends

The dengue testing market in the Middle East and Africa (MEA) is witnessing rapid expansion, as sporadic outbreaks in the Middle East (e.g., Oman, Saudi Arabia) and increasing surveillance in Africa spur diagnostic adoption. WHO‑led initiatives fund POC NS1 and antibody tests in remote clinics. Regional reference labs in South Africa and the Gulf invest in RT‑PCR platforms. Donor‑funded programs enhance training and quality control, ensuring progressive uptake of both rapid and centralized testing services.

Saudi Arabia dengue testing market is witnessing substantial growth, driven by pilgrim health screening during Hajj, where mandatory dengue testing protocols utilize rapid NS1 and RT‑PCR assays at entry points. The Ministry of Health’s investments in mobile POC labs support remote regions. Partnerships with global diagnostic firms ensure CE‑marked kit availability. Coupled with epidemiological data integration into national health systems, these measures underpin a rapidly expanding dengue testing sector.

Key Dengue Testing Company Insights

Key players operating in the dengue testing market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Dengue Testing Companies:

The following are the leading companies in the dengue testing market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Abbott

- F. Hoffmann‑La Roche Ltd.

- InBios International, Inc.

- NovaTec Immundiagnostica GmbH

- Abnova Corporation

- PerkinElmer Inc. (Euroimmun AG)

- Certest Biotec

- DiaSorin S.p.A.

- Quest Diagnostics Incorporated

Recent Developments

-

In December 2024, bioMérieux announced that its BIOFIRE FILMARRAY Tropical Fever (TF) Panel received Special 510(k) clearance from the U.S. Food and Drug Administration (FDA). This advanced polymerase chain reaction (PCR) testing solution enables rapid and precise identification of pathogens in patients with unexplained fever, including dengue, thereby supporting more effective and timely treatment decisions.

-

In June 2024, QIAGEN introduced its new QIAcuity digital PCR assays for microbial applications, strengthening infectious disease research and surveillance by adding assays for Dengue virus serotypes 1-4.

-

In August 2024, J Mitra & Company introduced the Dengue NS1 Antigen self-test kit, India's first home-use diagnostic tool for dengue. This kit enables individuals to conduct tests independently, providing results within 20 minutes with easy visual interpretation.

Dengue Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 637.90 million

Revenue forecast in 2030

USD 822.61 million

Growth rate

CAGR of 5.22% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait,

Key companies profiled

Thermo Fisher Scientific Inc.; Abbott; F. Hoffmann‑La Roche Ltd.; InBios International, Inc.; NovaTec Immundiagnostica GmbH; Abnova Corporation; PerkinElmer Inc. (Euroimmun AG); Certest Biotec; DiaSorin S.p.A.; Quest Diagnostics Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dengue Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dengue testing market report on the basis of product, service type, end-use, and region.

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

ELISA-based Tests

-

Dengue IgG/IgM Detection Kits

-

RT-PCR Tests

-

Rapid Diagnostic Tests (RDTs)

-

NS1 Antigen Detection Kits

-

Lateral Flow Immunoassay

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Centralized Service

-

POC Service

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Labs

-

Hospitals /Clinics

-

Home Healthcare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dengue testing market size was estimated at USD 612.53 million in 2024 and is expected to reach USD 822.61 million in 2025.

b. The global dengue testing market is expected to grow at a compound annual growth rate of 5.22% from 2025 to 2030 to reach USD 822.61 billion by 2030.

b. Asia Pacific dominated the dengue testing market with a share of 31.57% in 2024. This is attributable to endemic dengue transmission in India, Indonesia, and Thailand. National vector control programs (e.g., India’s NVBDCP) fund ELISA and RT‑PCR in regional labs, while community health centers deploy POC NS1 rapid tests.

b. Some key players operating in the dengue testing market include Thermo Fisher Scientific Inc., Abbott, F. Hoffmann‑La Roche Ltd., InBios International, Inc., NovaTec Immundiagnostica GmbH, Abnova Corporation, PerkinElmer Inc. (Euroimmun AG), Certest Biotec, DiaSorin S.p.A., Quest Diagnostics Incorporated

b. Key factors that are driving the market growth include escalating dengue outbreaks, technological advancements, and increased public health initiatives

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."