- Home

- »

- Alcohol & Tobacco

- »

-

Europe Beer Market Size & Share, Industry Report, 2030GVR Report cover

![Europe Beer Market Size, Share & Trends Report]()

Europe Beer Market Size, Share & Trends Analysis Report By Product (Ale, Lager, Stout), By Packaging (Bottles, Cans), By Production, By Distribution Channel (On-Trade, Off-Trade), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-609-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Europe Beer Market Size & Trends

The Europe beer market size was estimated at USD 219.62 billion in 2024 and is expected to grow at a CAGR of 6.7% from 2025 to 2030. The market is witnessing substantial growth, driven by a convergence of evolving consumer preferences, health-conscious behavior, and innovations within the brewing industry. A notable trend contributing to increased beer consumption is the rising demand for low-alcohol and non-alcoholic beers. As more European consumers adopt healthier lifestyles, breweries have responded by developing products that align with wellness trends, including beers enriched with vitamins and adaptogens. The United Kingdom, for instance, has seen a doubling of sales in beers with less than 3.5% alcohol by volume between 2022 and 2023, reflecting a broader continental shift toward moderation without sacrificing flavor or social experience.

The popularity of craft and artisanal beers continues to surge, driven by a consumer desire for distinctive flavors and premium quality. This movement is especially strong among younger demographics, such as millennials and Gen Z, who are gravitating toward innovative beer varieties, including fruit-flavored and experimental brews. The growing craft segment is fostering a renaissance of independent breweries across Europe, which are thriving by offering unique and localized alternatives to mass-produced options. This emphasis on flavor diversity and authenticity has invigorated beer culture and broadened the market base.

Another pivotal factor fueling the expansion of the Europe beer industry is the trend toward premiumization. With rising disposable incomes and a shift in consumer values, there is an increasing willingness among consumers to invest in high-quality, specialty beer products. Limited edition releases, artisanal brewing methods, and sophisticated packaging are all contributing to the perception of beer as a premium indulgence. Despite ongoing economic inflation, the Western European market has seen a 12% year-on-year increase in craft beer sales, underscoring strong consumer resilience and enthusiasm for elevated beer experiences.

Sustainability has also emerged as a key driver of growth in the European beer sector. Environmentally conscious consumers are encouraging breweries to adopt eco-friendly practices, such as using renewable energy sources, reducing water consumption, and embracing recyclable packaging. In response, many European breweries have significantly lowered their carbon footprints. Additionally, the use of locally sourced ingredients is gaining traction, appealing to consumers who prioritize traceability, authenticity, and reduced environmental impact in their purchasing decisions.

The rise in beverage consumption has also sparked fierce competition among beer brands in Europe, resulting in the introduction of new flavors and increased sales. Craft beers are becoming more popular because they provide a range of flavors beyond those offered by macrobreweries. These craft beers, featuring unique ingredients and innovative combinations of salty, fruity, and tart tastes, are especially favored by millennials worldwide. Additionally, some large brewers are responding to the changing preferences of consumers.

The tourism sector across Europe attracts millions of visitors each year, many of whom actively seek out local culinary experiences, including sampling regional beers. This consistent influx of tourists significantly contributes to the demand for beer products in bars, restaurants, and breweries throughout the continent. In recent years, brewery tours and tasting experiences have gained popularity in various European countries. Breweries such as Belgium’s Cantillon Brewery, Germany’s Weihenstephan Brewery, and the Czech Republic’s Pilsner Urquell have become prominent tourist attractions, offering immersive experiences that showcase the region's rich brewing heritage of the region.

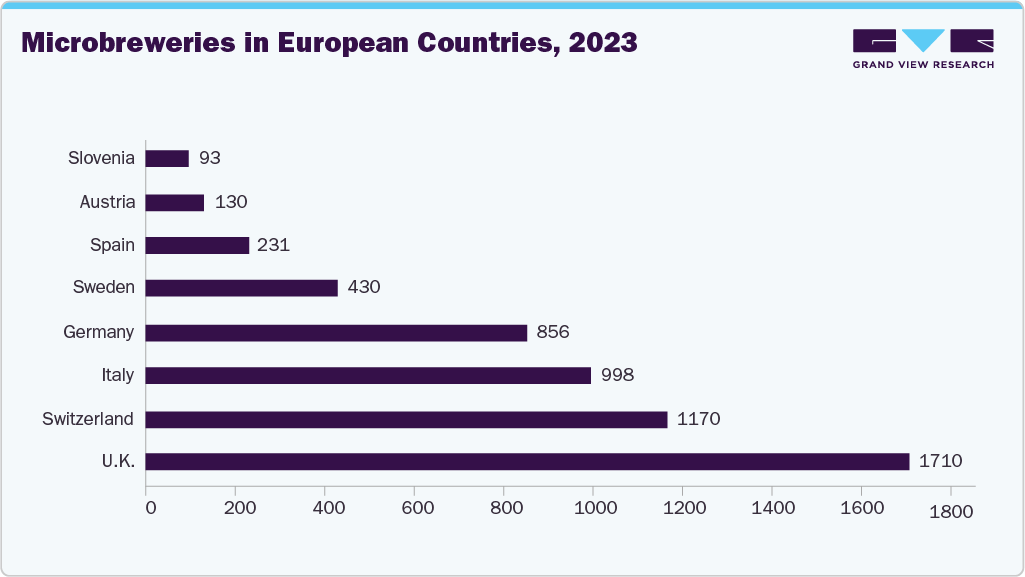

The proliferation of microbreweries throughout Europe has also played a crucial role in driving the growth of the beer market. These small-scale, often independently owned breweries offer a wide variety of innovative and locally crafted beers, appealing to consumers who seek authentic and unique products. Microbreweries in countries like Germany, Belgium, the United Kingdom, and the Netherlands are leading the way in developing experimental and creative beer offerings. By utilizing diverse ingredients, refining brewing techniques, and exploring unconventional flavor profiles, these breweries are effectively catering to evolving consumer preferences and distinguishing themselves in an increasingly competitive market.

Additionally, increased availability and improved distribution channels are making beer more accessible than ever. Supermarkets, online retailers, and specialty beer shops are expanding their selections through beer clubs and e-commerce platforms. This enhanced accessibility, combined with growing familiarity, is encouraging more consumers to make the switch.

Consumer Insights

The Europe beer market is currently navigating a complex landscape shaped by a range of external challenges, including the intensifying climate crisis, persistent inflationary pressures, and global geopolitical uncertainties. These issues, particularly extreme weather events and disruptions to agricultural supply chains, underscore the urgent need for sustainability and resilience within the brewing sector. In response, many breweries across Europe are taking proactive steps to minimize their environmental impact by adopting circular economy principles, investing in energy-efficient technologies, and promoting sustainable sourcing.

At the same time, shifting consumer trends present both challenges and significant opportunities for innovation within the Europe beer industry. There is a notable increase in demand for lower-alcohol and non-alcoholic beer options, appealing to consumers seeking balance, health-conscious alternatives, and greater variety in their drinking habits. These products are gaining popularity for their ability to suit diverse occasions without compromising flavor. Meanwhile, specialty and craft beers continue to gain traction, reflecting an increasing consumer appetite for products that emphasize local identity, artisanal quality, and unique flavor profiles. These trends urge brewers to invest in dynamic product development and focused marketing strategies to effectively engage a broad range of demographic groups.

The craft beer industry in Europe is experiencing significant growth, driven by consumers' increasing preference for unique, locally produced brews. As of 2023, the European Union boasted approximately 9,723 breweries, reflecting a continued expansion in the sector. This surge is fueled by a demand for artisanal and diverse beer options, with many consumers seeking flavors that differ from those offered by mass-produced brands.

Moreover, beer manufacturers have recognized the potential of music festivals as a lucrative marketing opportunity. Many beer companies sponsor festivals, allowing them to showcase their products through branded bars and experiential marketing activities. These initiatives increase brand visibility and create memorable experiences for attendees, associating beer with positive emotions and enjoyment.

Product Insights

The lager beer segment accounted for a revenue share of 52.3% in 2024. The demand for lager beer in Europe is experiencing sustained growth, driven by several key factors. Lager remains the most widely consumed type of beer in the region, making up approximately 60% of total beer consumption, according to data from the European Beer Association. Its crisp, clean taste and versatility make it a popular choice among consumers. Furthermore, the resurgence of interest in traditional brewing methods and the availability of high-quality craft lagers have further boosted its popularity. Marketing efforts during major events like sports tournaments and festivals also contribute to increased lager consumption across the continent.

The ale beer segment is projected to grow at a CAGR of 5.8% from 2025 to 2030. Demand for ale beer in Europe is increasing due to growing consumer interest in diverse and flavorful beer options. Ale beers, recognized for their rich taste profiles and variety of styles, such as pale ales, IPAs, and stouts, are appealing to craft beer enthusiasts seeking unique and artisanal experiences. The craft beer movement, along with heightened experimentation by brewers, has enhanced the popularity of ale. Additionally, consumers are placing greater value on quality and authenticity, driving demand for traditionally brewed ales across European markets.

Packaging Insights

The bottled beer segment accounted for a revenue share of 50.4% in 2024. The demand for bottled beer in Europe is increasing due to consumers’ growing preference for premium and craft beers that offer unique flavors and local authenticity. Health-conscious trends are also fueling interest in low- and non-alcoholic bottled options. Additionally, sustainability concerns make recyclable glass bottles more attractive, while strong cultural traditions and social occasions continue to support consistent consumption.

The canned beer market is expected to grow at a CAGR of 7.1% from 2025 to 2030. The demand for canned beer in Europe is increasing due to its convenience, portability, and durability, making it a popular choice for outdoor and on-the-go consumption. Sustainability is a significant factor, as aluminum cans are highly recyclable and eco-friendly. Furthermore, the rise of craft and premium beers favors cans for better taste preservation and appealing packaging. Supportive regulations that promote recyclable packaging also boost the market growth.

Production Insights

The macrobrewery segment accounted for a revenue share of 67.7% in 2024. The demand for macrobrewery-produced beer in Europe is growing due to several key factors. Macrobreweries, including AB InBev, Heineken, and Carlsberg, dominate the market with their extensive distribution networks, strong brand recognition, and cost advantages in production, allowing them to offer affordable and consistently high-quality beers to a wide consumer base. Their capacity to produce beer on a large scale creates economies of scale, making their products accessible across various consumer segments, particularly in price-sensitive markets. Furthermore, macrobreweries have responded to changing consumer preferences by introducing premium and low-alcohol beer options, aligning with the increasing demand for healthier and more diverse beverage choices.

The craft brewery market is expected to grow at a CAGR of 9.0% from 2025 to 2030. The demand for craft beer in Europe is experiencing substantial growth, driven by several key factors. Consumers are increasingly seeking unique, high-quality beers that offer distinct flavors and artisanal craftsmanship, steering away from mass-produced options. This shift is particularly evident among younger demographics, including millennials and Gen Z, who value authenticity and are more inclined to pay a premium for locally brewed, small-batch beers. Health-conscious consumers are also contributing to the growth of the craft beer market by seeking low-alcohol and non-alcoholic options. Breweries are responding by developing products that cater to these preferences while maintaining flavor, thereby expanding their customer base.

Distribution Channel Insights

In 2024, sales of beer through on-trade channels accounted for a revenue share of 52.6%. The on-trade distribution channel encompasses bars, clubs, restaurants, hotels, and wineries. Consumers frequently search for unique and diverse beer options when visiting bars, restaurants, or pubs, resulting in a demand for a variety of craft beers and specialty brews in on-trade establishments. Additionally, on-trade venues offer consumers an experience that goes beyond just the beverage itself. Elements such as ambiance, social interactions, and food pairings contribute to the appeal of on-trade channels for beer consumption. Many on-trade establishments prioritize local or regional beer offerings to support small breweries and encourage consumers to discover unique flavors specific to certain areas. This is anticipated to drive the growth of this distribution channel.

Sales of beer through off-trade channels are expected to grow at a CAGR of 5.4% from 2025 to 2030. The rising popularity of craft beers has resulted in increased demand for these products through off-trade channels. Specialty beer shops that cater to this trend provide a diverse selection of craft beers that are not easily found in supermarkets or other general retail stores. This niche market segment has created opportunities for both independent retailers and larger chains seeking to expand their product offerings in response to changing consumer preferences.

Country Insights

Germany Beer Market Trends

The beer market in Germany is projected to grow at a CAGR of 5.3% from 2025 to 2030. Germany boasts a diverse brewery landscape, featuring a wide array of breweries producing various styles of beer. From traditional family-owned breweries to large-scale commercial operations, the range of offerings satisfies different consumer preferences and contributes to the market's overall growth of the market. Additionally, recent years have seen an increase in craft breweries and innovative beer styles in Germany. This trend attracts consumers seeking unique flavors and experiences beyond traditional brews, fostering competition and creativity within the market. In March 2023, a German brewery, Klosterbrauerei Neuzelle, unveiled the world’s first instant beer powder. This innovative product provides a convenient and portable way to enjoy beer without the need for a traditional liquid form.

UK Beer Market Trends

The beer market in the UK is expected to grow at a CAGR of 6.7% from 2025 to 2030. The increasing accessibility of beer through a growing number of outlets has made it more widely available to consumers across the UK. The expansion of distribution networks, including online sales platforms and e-commerce channels, has facilitated greater access to a wider variety of beers for consumers. This heightened availability has contributed to a steady rise in the number of beer consumers in the market. Beers of Europe is Britain’s largest online beer shop, offering an extensive selection of beers, malt whiskies, spirits, and liquors for delivery throughout the UK. It specializes in beer delivery, wine delivery, and wholesale alcohol from both international and local brands.

Key Europe Beer Company Insights

The Europe beer market is characterized by the presence of several key companies with well-established brand recognition and extensive distribution networks.

Leading players have developed broad product portfolios and achieved significant penetration across mainstream retail channels. These companies continuously introduce new flavors and formats to appeal to a wide range of consumers. They are supported by strategic marketing initiatives and investments in production and distribution capabilities that enhance their competitive positioning.

Alongside the major participants, the market includes numerous smaller craft and regional brands contributing to product innovation and category diversification. The growing segment of wine producers is also influencing the market dynamics by bridging the gap between functional beverages and alcoholic drinks.

Overall, the Europe beer industry remains competitive, with companies focusing on innovation, expanded retail presence, and targeted marketing to respond to evolving consumer preferences and sustain growth.

Key Europe Beer Companies:

- AB InBev

- Heineken N.V.

- Carlsberg Breweries A/S

- Molson Coors Beverage Company

- Asahi Group Holdings, Ltd.

- Diageo

- Mahou San Miguel

- S.A. Damm

- Radeberger Gruppe International

- Oettinger Gruppe

Recent Developments

-

In April 2025, Carlsberg Sweden, in collaboration with freight technology company Einride, launched a limited-edition, alcohol-free "Electric Beer." This initiative celebrates their expanded partnership aimed at electrifying up to 40% of Carlsberg Sweden's freight operations in southern and western Sweden by the end of 2025. The beer is brewed, produced, and transported using 100% renewable energy and electric solutions. Each can features a QR code providing insights into the sustainable brewing process and the beer's electric transport journey across Sweden. This collaboration underscores Carlsberg's commitment to sustainability and innovation in the brewing industry.

-

In July 2024, Starnberger Brewery, a Bavarian craft beer producer, partnered with Germany's Krombacher Brewery to expand its presence across Europe. The collaboration aims to introduce Starnberger's flagship beer, Starnberger Hell-a 4.8% ABV Bavarian lager brewed according to the German Purity Law-to markets including France, Italy, the UK, and Southeast Europe. The timing aligns with major events like the 2024 European Football Championships and Oktoberfest, capitalizing on heightened consumer interest in regional German beer styles.

Europe Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 234.67 billion

Revenue forecast in 2030

USD 323.81 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, production, distribution channel, country

Country scope

UK; Germany; France; Italy; Spain

Key companies profiled

AB InBev; Heineken N.V.; Carlsberg Breweries A/S; Molson Coors Beverage Company; Asahi Group Holdings, Ltd.; Diageo; Mahou San Miguel; S.A. Damm; Radeberger Gruppe International; Oettinger Gruppe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Europe Beer Market Report Segmentation

This report forecasts revenue growth at the regional and country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe beer market report based on product, packaging, production, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ale

-

Lager

-

Stout

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Production Outlook (Revenue, USD Million, 2018 - 2030)

-

Macro Brewery

-

Micro Brewery

-

Craft Brewery

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe beer market size was estimated at USD 219.62 billion in 2024.

b. The Europe beer market is expected to grow at a CAGR of 6.7% from 2025 to 2030.

b. Lager beer accounted for a revenue share of 52.3% in 2024. The demand for lager beer in Europe is experiencing sustained growth, driven by several key factors. Lager remains the most widely consumed beer type in the region, accounting for approximately 60% of total beer consumption, as per data from the European Beer Association.

b. Some of the key players operating in the Europe beer market include: - • AB InBev • Heineken N.V. • Carlsberg Breweries A/S • Molson Coors Beverage Company • Asahi Group Holdings, Ltd. • Diageo • Mahou San Miguel • S.A. Damm • Radeberger Gruppe International • Oettinger Gruppe

b. The growth is attributable to a convergence of evolving consumer preferences, health-conscious behavior, and innovations within the brewing industry. A notable trend contributing to increased beer consumption is the rising demand for low-alcohol and non-alcoholic beers. As more European consumers adopt healthier lifestyles, breweries have responded by developing products that align with wellness trends, including beers enriched with vitamins and adaptogens.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."