- Home

- »

- Advanced Interior Materials

- »

-

Flooring Market Size, Share & Trends, Industry Report, 2030GVR Report cover

![Flooring Market Size, Share & Trends Report]()

Flooring Market Size, Share & Trends Analysis Report By Product (Ceramic Tiles, Porcelain Tiles, Carpet, Vinyl, Wood & Laminate), By Application (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-238-9

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Flooring Market Size & Trends

The global flooring market size was estimated at USD 360.7 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. Increasing demand for aesthetic, superior, and durable floor covering solutions and changing consumer trends in floor design have aided the growth of the flooring industry over the past few years.

Key Market Highlights:

- The Asia Pacific region dominated the market, accounting for 65.4% of the total revenue share in 2024.

- The U.S. flooring market is driven by a strong housing market, high consumer spending on home improvement, and rising demand for premium products.

- The vitrified (Porcelain) tile product segment led the market and accounted for over 36.65% of revenue share in 2024.

- The residential application segment dominated the market and accounted for 50.4% of the revenue share 2024.

Expanding offices & workspaces, improving the consumer industry, and rapid urbanization have also contributed to the market growth. The fast-paced infrastructural development, owing to the rising population in developing countries, further contributes to the growth of the flooring industry.

The growing disposable income has resulted in increased investment in residential building comfort. Additionally, the market's demand is driven by the continuous growth of high-end residential housing structures and the subsequent and increasing preference for single-family housing structures.

Domestic and foreign manufacturers are heavily investing in the U.S. regional market to meet the rising demand from various application industries. Several construction projects are underway in the U.S. For instance, in 2020, Amazon started the construction of its HQ2 building, which is estimated to be worth USD 2.5 billion. The mega project continues to make headway in the construction industry, as Amazon plans completion by 2023. The increasingly large investments in such projects are expected to boost the demand for flooring, thereby increasing the U.S. flooring market size.

The advancements in easy-to-install techniques, the availability of innovative construction solutions, and the rising demand for environmentally sustainable products are expected to drive the industry’s growth. The stringent regulatory framework during the production, usage, implementation, and recycling stages is also expected to boost market growth. Furthermore, consumer preferences for aesthetically improved designs, textures, colors, and low-maintenance and easy-to-install floorings are expected to drive market growth. The growing desire for comfort and privacy due to noisier surroundings has increased the demand for insulation in the market, and insulated floors create a better acoustic environment. As a result, demand for floor insulation has increased, supporting market growth.

Market Concentration & Characteristics

The global flooring market exhibits moderate to high market concentration, with a few prominent players holding significant market shares, particularly in developed regions. The industry is characterized by continuous innovation, especially in developing sustainable and durable flooring materials such as rigid core vinyl, recycled rubber, and bio-based polymers. Technological advancements, including digital printing and improved wear resistance in luxury vinyl tiles (LVT), have enhanced product offerings and consumer appeal. Additionally, there is growing emphasis on eco-certifications and compliance with green building standards, which are influencing manufacturers to invest in environmentally friendly flooring solutions to meet regulatory and consumer demands.

Mergers, acquisitions, and strategic collaborations are increasingly common in the flooring sector, as companies aim to expand geographic reach and diversify their product portfolios. Regulatory impact remains significant, particularly regarding volatile organic compound (VOC) emissions, worker safety, and sustainable sourcing, compelling firms to adjust production methods and raw material selection. While substitutes such as floor paints, laminates, or even modular carpets are available, they typically serve niche applications and do not substantially threaten the dominant flooring categories. The end-user base is broad but concentrated in sectors like residential construction, commercial real estate, and institutional infrastructure, which drives steady and robust demand globally.

Product Insights

The vitrified (Porcelain) tile segment led the market and accounted for over 36.65% of revenue share in 2024. This is owing to the properties of porcelain tiles, such as additional strength and more durability compared to general ceramic tiles. These tiles can withstand extreme temperatures and are made from ultrafine and denser clays. Their durability also shines with features such as mold and bacteria resistance offered by impervious porcelain tiles, substantially increasing the long-term value of floor covering. In addition, this flooring product does not fade and is easy to maintain.

Vitrified (Porcelain) tiles are a little expensive compared to other flooring products, including marble, granite, limestone, sandstone, quartzite, and others. Vitrified (Porcelain) tiles and stone flooring are widely used for durability, beauty, and lasting value. These stones are excellent for bathrooms, hallways, living areas, and outdoor areas. Owing to the surge in demand for Vitrified (Porcelain) Tiles stone products, companies are investing to strengthen their position in the market.

Application Insights

The residential application segment dominated the market and accounted for 50.4% of the revenue share 2024. The residential end-use segment includes residential buildings, apartments, complexes, and small houses. Government subsidies for first-time homebuyers in developing and developed economies have positively affected the growth of the residential sector.

Over the past few years, the increasing construction of commercial buildings, such as drugstores, grocery stores, and big-box stores, is expected to benefit the segment's growth. Moreover, robust demand for office spaces, especially in urban areas of emerging economies, also propels demand for high-quality flooring products.

Regional Insights

North America's flooring market growth is supported by renovation and remodeling activities in the residential sector, alongside technological innovations in resilient flooring materials such as luxury vinyl tiles (LVT). Energy-efficient and sustainable building practices, driven by stringent environmental regulations and green building certifications, have increased the demand for eco-friendly flooring options across both residential and commercial projects.

U.S. Flooring Market Trends

The U.S. flooring market is driven by a strong housing market, high consumer spending on home improvement, and rising demand for premium products like hardwood and engineered wood flooring. The commercial sector-retail, office spaces, and healthcare facilities-also contributes to growth. Technological innovation and a shift toward low-maintenance, durable flooring have also bolstered the demand for advanced composite and hybrid materials.

Europe Flooring Market Trends

In Europe, the flooring market is influenced by the growing trend toward sustainable construction practices and regulatory frameworks promoting low-emission, recyclable, and energy-efficient building materials. The demand for innovative, noise-reducing, and thermally efficient flooring options is rising, particularly in countries focused on achieving climate goals. Renovation of older buildings in Western Europe also fuels consistent demand.

The UK flooring market is driven by increasing residential construction, post-pandemic housing reforms, and interior refurbishments in both the private and public sectors. Trends toward minimalist and modern aesthetics have encouraged the adoption of vinyl, laminate, and engineered wood flooring. Furthermore, the rising awareness of environmental impact has increased demand for sustainably sourced and recyclable flooring products.

Asia Pacific Flooring Market Trends

The Asia Pacific region dominated the market, accounting for 65.4% of the total revenue share in 2024. Factors such as increasing investment in affordable housing, smart city construction, upgradation & construction of infrastructure, and investment in the tourism sector are expected to boost the demand for flooring products over the forecast period.

China’s flooring market is bolstered by its vast construction sector and government-backed housing projects. As the world’s largest construction market, China exhibits high demand for vinyl, laminate, and ceramic flooring, particularly in urban areas. The country's emphasis on green building standards and energy efficiency has encouraged manufacturers to offer eco-friendly flooring products, aligning with evolving consumer and regulatory expectations.

Latin America Flooring Market Trends

In Latin America, market growth is fueled by a rebound in construction activity, particularly in Brazil, Mexico, and Colombia. Economic development, government-backed housing schemes, and commercial real estate expansion have led to a steady rise in demand for affordable and moisture-resistant flooring solutions. The market also imports more technologically advanced flooring from North America and Europe.

Middle East & Africa Flooring Market Trends

The Middle East & Africa flooring market is primarily driven by large-scale infrastructure and commercial projects, particularly in Gulf Cooperation Council (GCC) countries such as the UAE and Saudi Arabia. Ambitious initiatives like Vision 2030 and increasing tourism-driven construction bolstered the need for high-quality flooring materials. Urbanization and improving living standards in Africa are gradually increasing residential and institutional flooring demand.

Key Flooring Company Insights

Some of the key players operating in the market include Mohawk Industries, Tarkett, S.A.

-

Mohawk Industries, Inc. is one of the world's largest flooring companies headquartered in the United States. The company offers a diverse portfolio of flooring solutions including carpet, ceramic tile, laminate, wood, stone, and vinyl. Mohawk caters to both residential and commercial sectors with a focus on innovation, sustainability, and design flexibility.

-

Tarkett, S.A., based in France, is a global leader in innovative flooring and sports surface solutions. The company provides vinyl, laminate, wood, linoleum, carpet, and rubber flooring products tailored for commercial, residential, and healthcare environments. Tarkett is also recognized for its commitment to circular economy practices.

AFI Licensing, Burke Flooring Products, Inc. are some of the emerging market participants in the flooring market.

-

AFI Licensing is known for its Armstrong-branded flooring solutions, primarily offering hardwood and resilient flooring. The company provides high-quality designs for residential and commercial use, emphasizing durability, easy maintenance, and aesthetic appeal through innovative surface technologies.

-

Burke Flooring Products, Inc., a subsidiary of Mannington Mills, specializes in resilient rubber flooring and accessories. The company's offerings include stair treads, wall base, tiles, and floor finishing products, widely used in healthcare, education, and institutional applications for safety and performance.

Key Flooring Companies:

The following are the leading companies in the flooring market. These companies collectively hold the largest market share and dictate industry trends.

- Mohawk Industries, Inc.

- Tarkett, S.A.

- AFI Licensing

- Burke Flooring Products, Inc.

- Firbo Flooring

- Shaw Industries, Inc.

- Interface, Inc.

- Gerflor

- Mannington Mills, Inc.

- Polyflor

- RAK Ceramics

- Crossville Inc.

- Atlas Concorde S.P.A.

- Porcelanosa Group

- Kajaria Ceramics Limited

Recent Developments

-

In March 2023, Shaw Industries Group, Inc. announced its partnership with Encina to recycle waste generated from carpet manufacturing. Shaw Industries will provide Encina with more than USD 2.5 million of waste every year. The partnership will help the former decrease its greenhouse gas emissions and carbon footprint, which in turn will help the company achieve its sustainability target.

Flooring Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 385.6 billion

Revenue forecast in 2030

USD 534.6 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, volume in million square meters, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; Romania; Czech Republic; Portugal; Ukraine; Slovakia; Hungary; China; India; Japan; Indonesia; South Korea; Australia; Philippines; Vietnam; Saudi Arabia; UAE; Israel; Qatar; South Africa; Morocco; Brazil; Argentina; Peru; Colombia; Chile

Key companies profiled

Mohawk Industries, Inc.; Tarkett, S.A.; AFI Licensing; Burke Flooring Products, Inc.; Firbo Flooring; Shaw Industries, Inc.; Interface, Inc.; Gerflor; Mannington Mills, Inc.; Polyflor; RAK Ceramics; Crossville Inc.; Atlas Concorde S.P.A.; Porcelanosa Group; Kajaria Ceramics Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

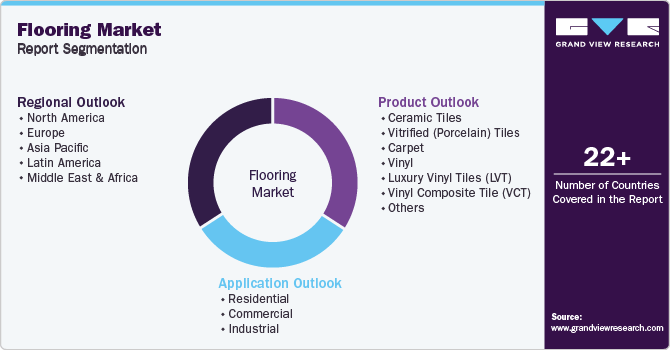

Global Flooring Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flooring market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

Ceramic Tiles

-

Vitrified (Porcelain) Tiles

-

Carpet

-

Vinyl

-

Luxury Vinyl Tiles (LVT)

-

Vinyl Composite Tile (VCT)

-

Linoleum/Rubber

-

Wood & Laminate

-

Other Flooring Materials

-

-

Application Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Romania

-

Czech Republic

-

Portugal

-

Ukraine

-

Slovakia

-

Hungary

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Philippines

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

Peru

-

Colombia

-

Chile

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Israel

-

Egypt

-

Qatar

-

South Africa

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The global flooring market size was estimated at USD 266.48 billion in 2022 and is expected to reach USD 277.67 billion in 2023.

b. The flooring market is expected to grow at a compound annual growth rate of 5.6% from 2023 to 2030 to reach USD 398.27 billion by 2030.

b. Residential construction dominated the flooring market with a share of 49.4% in 2022. This is attributed to growing population and increased spending in residential structures enhancements.

b. Some of the key players operating in the flooring market include Mohawk Industries, Inc., Tarkett, S.A., AFI Licensing, Burke Flooring Products, Inc., Firbo Flooring, Shaw Industries, Inc., Interface, Inc., Gerflor, Mannington Mills, Inc., Polyflor, RAK Creamics, Crossville Inc., Atlas Concorde S.P.A., Porcelanosa Group, Kajaria Ceramics Limited

b. The key factors that are driving the flooring market include rapidly rising construction activities in developing countries around the globe. In addition, investments in several developing countries such as India, Brazil, and South Korea towards development of the non-residential construction industry, is expected to drive the market growth over the forecast period.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."