- Home

- »

- Petrochemicals

- »

-

Lubricants Market Size And Share, Industry Report, 2030GVR Report cover

![Lubricants Market Size, Share & Trends Report]()

Lubricants Market Size, Share & Trends Analysis Report By Product (Mineral Oil, Synthetic Oil), By Application (Industrial, Automotive, Marine, Aerospace), By Region (North America, Europe, APAC, Latin America, Middle East & Africa), And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-123-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Lubricants Market Summary

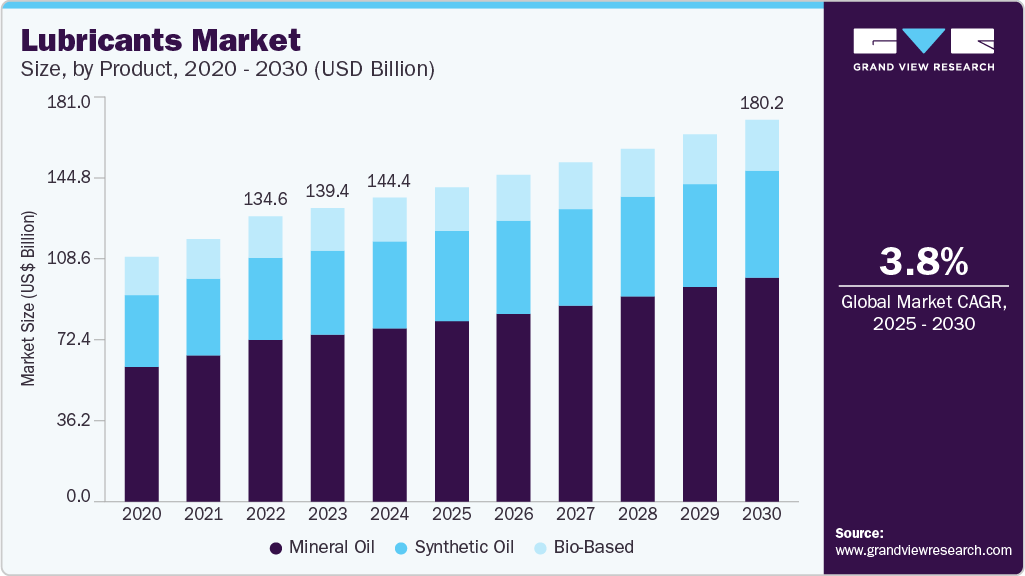

The global lubricants market size was estimated at USD 144.4 billion in 2024 and is estimated to reach USD 180.2 billion by 2030, growing at a CAGR of 3.8% from 2025 to 2030. This is attributed to the growing demand for automotive oils and greases due to the growing trade of vehicles and spare parts.

Key Market Trends & Insights

- Asia Pacific dominated the lubricants market with a revenue share of 44.9% in 2024.

- The China lubricants market is projected to grow during the forecast period.

- By product, the mineral oil segment accounted for the largest revenue share of 63.7% in 2024.

- By application, the automotive segment dominated with the largest revenue share of 53.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 144.4 Billion

- 2030 Projected Market Size: USD 180.2 Billion

- CAGR (2025-2030): 3.8%

- Asia Pacific: Largest market in 2024

Lubricants are an essential part of rapidly expanding industries. They are used between two relatively moving machinery parts to reduce friction and wear & tear. They can be either petroleum-based or water-based and are essential for proper machinery functioning. Lubricants also decrease operational downtime and eventually increase overall productivity. Lubricants are extensively used in processing industries and automobile parts, especially brakes and engines, which need lubrication for continuous, smooth functioning.

The increasing imports and exports of piston engine lubricants are contributing to market growth. The product demand is driven by the rising focus of consumers on enhancing vehicle performance, coupled with the introduction of innovative & premium product offerings. Future growth will be highly dependent on motor vehicle production and the miles covered by each vehicle. Furthermore, consumers are looking for standard and specialized lubricants for their regular vehicles to ensure the smooth functioning of their vehicles and reduce long-term maintenance costs.

Lubricant manufacturing requires crude oil, tight oil, and other additives to formulate all lubricant types. There are multiple additives incorporated in lubricants to enhance their functionality and properties. These include antioxidants, extreme pressure additives, rust- & corrosion-prevention additives, detergents, viscosity index improvers, anti-wear agents, and dispersants. Lubricants are 90% base oil and 10% additives, wherein base oils include petrochemical fractions, such as fluorocarbons, esters, polyolefins, and silicones. Base oils increase the viscosity of the lubricants and reduce wear & tear. Paraffinic and naphthenic are the two essential base oils used in lubricant formulations.

Drivers, Opportunities & Restraints

The growing demand from industrial machinery and the automotive sector is a major driver for the lubricants market. As vehicle ownership increases and industrial output rises, especially in emerging economies, there is a corresponding need for lubricants to ensure machinery efficiency and longevity. This sustained consumption supports consistent market growth across regions.

Stringent environmental regulations regarding emissions and waste oil disposal are restraining the expansion of the lubricants industry. Moreover, the rising adoption of electric vehicles (EVs), which require fewer or different types of lubricants, is reducing the long-term demand from the automotive sector. These trends pose challenges for traditional lubricant manufacturers to adapt and innovate.

There is a growing opportunity in the development and commercialization of bio-based and high-performance synthetic lubricants. These products offer better thermal stability, longer service intervals, and lower environmental impact, making them attractive in both industrial and automotive applications. Increasing sustainability awareness and regulatory support further amplify this opportunity.

Product Insights

The mineral oil segment accounted for the largest revenue share of 63.7% in 2024 and is expected to continue to dominate the industry over the forecast period. Cost-effectiveness and wide availability drive the growth of the market. Mineral oil-based lubricants are significantly more affordable than their synthetic or bio-based counterparts, making them attractive for cost-sensitive industries and consumers. Derived from refining crude oil, mineral oils are abundantly available, supporting steady supply and production. This cost advantage is particularly crucial in emerging markets, where price remains a key purchasing criterion for automotive and industrial users.

The synthetic oil segment is projected to grow at a significant CAGR over the forecast period. Superior performance and efficiency drive the market growth. Synthetic oils offer enhanced thermal stability, better viscosity control, and superior lubrication across a wide temperature range compared to conventional oils. These qualities translate to improved engine performance, reduced friction, and longer oil change intervals, making them especially desirable for high-performance vehicles, heavy-duty machinery, and extreme environments. As consumers and industries seek reliability and performance, demand for synthetic lubricants continues to rise.

Application Insights

The automotive segment dominated the global industry in 2024 with the largest revenue share of 53.3%. This is attributed to the increased sales of consumer automobiles, such as buses, trucks, and other forms of passenger transport. Economic growth in emerging markets, such as China, India, and Brazil, has led to the betterment of public transportation in these regions. This trend is expected to strengthen the demand for commercial automotive lubricants further. Increasing sales of commercial vehicles, such as heavy-duty trucks, and automotive construction, such as cranes, bulldozers, and concrete mixers, are expected to complement the segment growth.

The industrial segment is expected to grow at a significant CAGR over the forecast period. Industrial lubricants are water-based or petroleum-based substances used to prevent metal-to-metal contact in dyes, tooling, or finished components by reducing friction and protecting against corrosion. These lubricants are widely utilized in numerous industrial applications such as gas engines, hydraulics, air compressors, auxiliary equipment, heat transfer systems, paper machines, turbines, metal working, bearings, food machinery, and natural gas compressors.

Regional Insights

Asia Pacific dominated the lubricants market with a revenue share of 44.9% in 2024. The government initiatives of various countries in Asia Pacific to boost domestic manufacturing activities as an attempt to reduce the reliance on imports and improve the sustainability of the industrial sector in emerging economies, such as India, Vietnam, Indonesia, and Thailand, are expected to drive the consumption of lubricants in the expanding industrial sector. For instance, the “Make in India” initiative launched by the government of India to boost innovation, growth, and investments, as well as to build good manufacturing infrastructure, is helping expand the industrial sector in the country.

The China lubricants market is projected to grow during the forecast period. china held over 42.1% revenue share of the overall asia pacific lubricants market The mining industry in China is growing at a rapid pace due to the presence of several government-owned mines. Due to the high demand, mining operations for coal, iron ore, and gold have been on the rise. This, in turn, is increasing the use of heavy equipment required for mining operations, which is expected to boost the demand for lubricants in the country.

North America Lubricants Market Trends

North America is seeing increased demand for lubricants due to expanding industrial sectors and rising automotive sales. In Mexico, growth in the automotive manufacturing industry and infrastructure development supports lubricant consumption. Canada's harsh climatic conditions also fuel demand for premium, cold-weather-resistant lubricants, particularly synthetic variants.

U.S. Lubricants Market Trends

The U.S. lubricants industry dominates North America, driven by a large and aging vehicle fleet, industrial automation, and demand for high-performance lubricants in manufacturing and aerospace. Additionally, strict emissions regulations and consumer preference for synthetic and semi-synthetic oils are pushing innovation in lubricant formulations. The country’s robust transportation and logistics sectors further contribute to sustained lubricant demand.

Europe Lubricants Market Trends

Strict environmental standards, a shift toward electric and hybrid vehicles, and strong industrial demand in Germany, France, and the UK influence Europe’s lubricant industry growth. While EV adoption may dampen traditional lubricant use, it is offset by demand for specialized thermal management fluids and industrial lubricants. In addition, technological innovation and sustainability goals are driving the transition to bio-based and low-viscosity lubricants.

Latin America Lubricants Market Trends

In Latin America, rising urbanization, expanding automotive ownership, and a recovering manufacturing base are boosting lubricant demand. Countries such as Brazil and Argentina are experiencing growth in the passenger car and commercial vehicle segments, leading to increased consumption of engine oils and transmission fluids. The agricultural and mining sectors also significantly contribute to industrial lubricant usage.

Middle East & Africa Lubricants Market Trends

The MEA lubricants industry is growing due to increasing vehicle ownership, infrastructure development, and expanding oil & gas activities, especially in Gulf countries. Industrial expansion in countries such as Saudi Arabia and the UAE, along with a growing transportation fleet, supports demand for both automotive and industrial lubricants. In addition, Africa’s emerging economies are witnessing rising demand tied to the construction and mining industries.

Key Lubricants Company Insights

Some of the key players operating in the market include Dow and Linde Plc

-

TotalEnergies is an oil & gas integrated company. The company has its business segments in upstream, refining & specialty chemicals, and marketing & services. Total Oil India Private Ltd. is an entirely owned subsidiary of TotalEnergies. It has exploration and production activities in more than 50 countries. It operates in the renewable energies and power generation sectors. The company has a presence in the Middle East, Europe & CIS, Africa, Asia Pacific, the U.S., Canada / South America, and Australia / Oceania. Its products have numerous applications in transportation, household appliances, food, industrial packaging, and other sectors. The company transports 131 million metric tons of crude oil and other refined products.

Key Lubricants Companies:

The following are the leading companies in the lubricants market. These companies collectively hold the largest market share and dictate industry trends.

- TotalEnergies

- CASTROL LIMITED

- AMSOIL INC.

- FUCHS

- Chevron Overseas Limited

- ExxonMobil Corporation

- Eurol

- ENGEN PETROLEUM LTD

- Caltex Lubricants

- Puma Energy

- Shell

- HP Lubricants

- Motul

- Petronas

- Lukoil

Recent Developments

-

In July 2024, AMSOIL INC. launched a new synthetic blend motor oil product line for installers. The latest Synthetic-Blend Motor Oil is available in three viscosities and has more than 50% synthetic content. It offers motorists better performance and protection compared to conventional oils. It is designed with high-quality components that protect modern engines, including direct injection and turbochargers. AMSOIL Synthetic-Blend Motor Oil has three viscosities: 5W-20, 5W-30, and 0W-20.

Lubricants Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 149.8 billion

Revenue forecast in 2030

USD 180.2 billion

Growth rate

CAGR of 3.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

ExxonMobil Corp.; Royal Dutch Shell Co.; BP PLC; Total Energies; Chevron Corp.; Fuchs; Castrol India Ltd.; Amsoil Inc.; JX Nippon Oil & Gas Exploration Corp.; Philips 66 Company; Valvoline LLC; PetroChina Company Ltd.; China Petrochemical Corp.; Idemitsu Kosan Co. Ltd.; Lukoil; Petrobras; Petronas Lubricant International; Quaker Chemical Corp.; PetroFer Chemie; Buhmwoo Chemical Co. Ltd.; Zeller Gmelin Gmbh & Co. KG; Blaser Swisslube Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Lubricants Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global lubricants market report based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Mineral Oil

-

Synthetic Oil

-

Bio-Based Oils

-

-

Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

Industrial

-

Process Oils

-

General Industrial Oils

-

Metalworking Fluids

-

Industrial Engine Oil

-

Greases

-

Process Oils

-

Other Industrials

-

-

Automotive

-

Engine Oil

-

Gear Oil

-

Transmission Fluids

-

Brake Fluids

-

Coolants

-

Greases

-

-

Marines

-

Engine Oil

-

Hydraulic Oil

-

Gear Oil

-

Turbine Oil

-

Greases

-

Others

-

-

Aerospace

-

Gas Turbine Oil

-

Piston Engine Oil

-

Hydraulic Fluids

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global lubricants market size was estimated at USD 144,375.8 million in 2024 and is expected to reach USD 180,211.2 million in 2030.

b. The global lubricants market is expected to grow at a compound annual growth rate of 3.8% from 2025 to 2030 to reach USD 180,211.2 million by 2030.

b. The automotive segment dominated the global lubricants market with a revenue share of 53.3% in 2024. This is attributed to the increased sales of consumer automobiles, such as buses, trucks, and other forms of passenger transport.

b. Asia Pacific region dominated the market with a revenue share of more than 44.9% in 2024. The government initiatives of various countries in the Asia Pacific region to boost domestic manufacturing activities as an attempt to reduce the reliance on imports and improve the sustainability of the industrial sector in emerging economies, such as India, Vietnam, Indonesia, and Thailand, are expected to drive the consumption of lubricants in the expanding industrial sector.

b. Some key players operating in the lubricants market include ExxonMobil Corp., Royal Dutch Shell Co., British Petroleum, Total S.A., Chevron Corporation, Fuchs Group, Pennzoil, Amsoil Inc., Philips 66 Company, Valvoline LLC, Castrol, PetroChina, Sinopec Corp, Idemitsu Kosan Co. Ltd, and Petronas Lubricant International.

b. Key factors that are driving the lubricants market growth include growing demand for automotive oils and greases due to the growing trade of vehicles and spare parts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."