- Home

- »

- Agrochemicals & Fertilizers

- »

-

Magnesium Sulfate Market Size, Share, Industry Report 2030GVR Report cover

![Magnesium Sulfate Market Size, Share & Trends Report]()

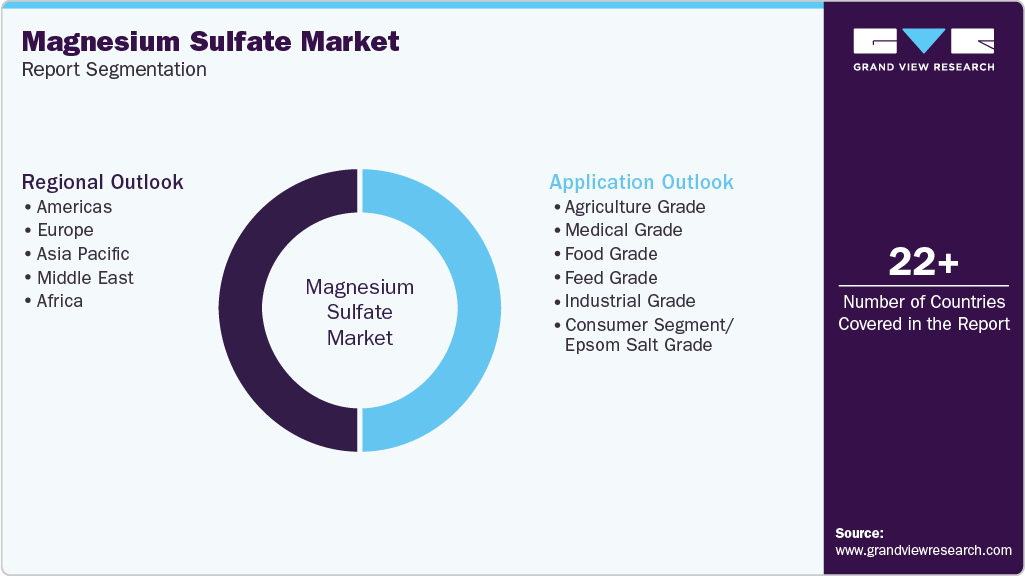

Magnesium Sulfate Market Size, Share & Trends Analysis Report By Application (Agriculture Grade, Medical Grade, Food Grade, Industrial Grade, Feed Grade, Consumer Segment/Epsom Salt Grade), By Region (North America, Europe), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-597-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Magnesium Sulfate Market Summary

The global magnesium sulfate market size was estimated at USD 950.5 million in 2024 and is projected to reach USD 1,498.3 million by 2030, growing at a CAGR of 7.8% from 2025 to 2030. The industry is being shaped by a confluence of macroeconomic trends, sector-specific demands, and sustainability imperatives.

Key Market Trends & Insights

- Europe magnesium sulfate market held the largest revenue share of 45.1% in 2024.

- Germany magnesium sulfate market is driven by its advanced agricultural practices, strong industrial base, and high demand across the pharmaceutical and personal care sectors.

- By application, agriculture grade magnesium held the largest revenue share of over 48.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 950.5 Million

- 2030 Projected Market Size: USD 1,498.3 Million

- CAGR (2025-2030): 7.8%

- Europe: Largest market in 2024

- North America: Fastest growing market

As industries and governments increasingly prioritize efficient nutrient management, clean production processes, and mineral-based health solutions, magnesium sulfate’s multifaceted functionality is positioning it as a critical input across agriculture, pharmaceuticals, personal care, and industrial manufacturing. Rising awareness about soil micronutrient deficiencies, particularly magnesium, is catalyzing the adoption of magnesium sulfate-based fertilizers in both conventional and precision farming systems.Simultaneously, the inclusion of injectable magnesium sulfate in essential drug lists and protocols for maternal health is creating a stable demand base in the medical sector. From a production standpoint, the growing viability of brine-based extraction driven by cost efficiency, resource circularity, and environmental regulations has reinforced magnesium sulfate’s competitiveness against mined alternatives. A major structural challenge in the market is the lack of uniform product standards and certification protocols across geographies, especially for agricultural and industrial grades. While pharmaceutical and food-grade magnesium sulfate is governed by stringent international standards such as USP (United States Pharmacopeia), BP (British Pharmacopoeia), or FCC (Food Chemicals Codex), the same level of oversight is not consistently applied to agro-grade and technical-grade variants.

The opportunity is especially potent in countries that heavily rely on desalination or coastal industrial infrastructure. The Middle East and North Africa (MENA) region, for example, is home to some of the world’s largest desalination capacities, with Saudi Arabia, UAE, Qatar, and Oman collectively operating over 50% of the GCC’s desalination output. These countries are investing in national circular economy visions, and brine valorization fits neatly within that framework. In an era of ESG reporting, carbon accountability, and resource sustainability, recovering magnesium sulfate from brine is more than just a technical process; it's a reputational and regulatory asset. Companies and governments alike are under pressure to demonstrate responsible water stewardship, especially in high-extraction sectors like desalination, oil & gas, and mining.

Market Concentration & Characteristics

The industry is moderately fragmented, with a few global players, such as Sinomagchem (Yingkou Magnesite Chemical Ind. Group Co., Ltd.), K+S Aktiengesellschaft, Industrias Peñoles, PQ Corporation, and Emisal, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. Their ability to supply in bulk and cater to various grades, agriculture, industrial, and food/pharmaceutical sectors reinforces their market leadership.

Most of the revenue share is occupied by numerous small and mid-sized producers across China, India, Southeast Asia, and Eastern Europe. These firms primarily supply agro-grade magnesium sulfate to local and regional markets, resulting in a fragmented competitive landscape beyond the top-tier producers.

Application Insights

Agriculture grade magnesium held the largest revenue share of over 48.0% in 2024. It is primarily due to its broader application scope and higher volume usage compared to other grades. Magnesium-based fertilizers such as magnesium sulfate (Epsom salt) and magnesium oxide are more widely used than food or medical-grade counterparts, especially in regions facing soil micronutrient deficiencies.

The rise in demand for magnesium-enriched fertilizers has been more significant in emerging economies where crop yields are more dependent on soil amendment practices. Compared to food or feed applications, agriculture-grade products are consumed in bulk, offering better scalability for manufacturers and distributors.

Furthermore, the cost-effectiveness and easier regulatory compliance associated with agriculture-grade magnesium make it more commercially viable than medical or industrial grades. Adoption is particularly stronger in Asia Pacific and Latin America, where governments are encouraging sustainable agriculture and micronutrient management. In comparison to consumer and medical applications, which require stricter purity and quality control, agricultural applications offer a faster route to market and higher return on volume, making this segment more lucrative and dominant in overall revenue contribution.

Regional Insights

Europe magnesium sulfate market held the largest revenue share of 45.1% in 2024 due to its well-established agriculture, pharmaceutical, and personal care industries, which are the primary consumers of high-quality magnesium sulfate. The region has a higher adoption rate of magnesium sulfate-based fertilizers, driven by strict environmental regulations promoting sustainable and organic farming practices, particularly in countries like Germany, France, and the Netherlands. Additionally, the demand for pharmaceutical and food-grade magnesium sulfate is comparatively stronger in Europe, owing to an aging population, a well-funded healthcare system, and growing consumer preference for mineral-based wellness products.

Germany magnesium sulfate market is driven by its advanced agricultural practices, strong industrial base, and high demand across the pharmaceutical and personal care sectors. The country has a greater utilization of magnesium sulfate fertilizers in precision farming, supported by government initiatives promoting soil health and micronutrient management. Moreover, Germany’s well-established chemical and healthcare industries drive higher consumption of medical and food-grade magnesium sulfate compared to other European nations.

Asia Pacific Magnesium Sulfate Market Trends

The magnesium sulfate market in Asia Pacific is driven by its expanding agricultural sector, growing industrialization, and rising healthcare demand. Countries like China and India are witnessing greater adoption of magnesium sulfate-based fertilizers to improve crop yield and address soil nutrient deficiencies, supported by government-led sustainable farming initiatives. Additionally, the increasing demand for pharmaceutical and personal care products, along with cost-effective manufacturing capabilities, positions the region as a major consumer and exporter of magnesium sulfate.

China magnesium sulfate market holds a dominant position in the Asia Pacific due to its high agricultural production, large-scale industrial base, and cost-efficient manufacturing ecosystem. The country has a higher consumption of magnesium sulfate fertilizers, driven by intensive farming practices and government policies promoting soil nutrient management. Additionally, China is a leading global supplier of magnesium sulfate, benefiting from abundant raw material availability and well-developed chemical processing infrastructure.

Americas Magnesium Sulfate Market Trends

Americas magnesium sulfate market is characterized by established agricultural practices, a strong pharmaceutical sector, and a growing personal care industry. The United States and Brazil demonstrated higher usage of magnesium sulfate in crop nutrition and livestock feed, supported by advanced farming technologies and large-scale agribusinesses. Moreover, the presence of well-developed healthcare and wellness markets drives demand for medical and consumer-grade magnesium sulfate.

The magnesium sulfate market in the U.S. was the largest contributor to the regional market in 2024 due to its advanced agricultural infrastructure, high per capita healthcare spending, and growing demand for wellness products. U.S. farmers increasingly rely on magnesium sulfate to enhance soil fertility and crop yield, particularly in magnesium-deficient regions. Additionally, the country’s robust pharmaceutical and personal care industries fuel demand for medical and consumer-grade products.

Africa Magnesium Sulfate Market Trends

The magnesium sulfate market in Africa is driven primarily by the region’s growing focus on agricultural productivity and improving food security. Governments and international agencies are increasingly promoting the use of micronutrient fertilizers, including magnesium sulfate, to address widespread soil deficiencies and boost crop yields. Although consumption is comparatively lower than in developed regions, the rising adoption of sustainable farming practices and expanding awareness of balanced plant nutrition are expected to drive future demand.

Middle East Magnesium Sulfate Market Trends

The magnesium sulfate market in the Middle East is gaining momentum, supported by the region’s increasing investment in sustainable agriculture and water-efficient farming practices. Countries such as Saudi Arabia and the UAE are actively promoting soil nutrient management and modern irrigation techniques to improve crop productivity in arid environments, where magnesium sulfate is used to correct deficiencies and enhance soil quality. Additionally, the growing demand for pharmaceutical and personal care products in urban centers is contributing to the uptake of higher-grade magnesium sulfate.

Key Magnesium Sulfate Companies Insights

Key players operating in the magnesium sulfate market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Magnesium Sulfate Companies:

The following are the leading companies in the magnesium sulfate market. These companies collectively hold the largest market share and dictate industry trends.

- Mani Agro Chem

- Weifang City Huakang Magnesium Sulphate Factory

- Zibo Jinxing Chemical Co.,Ltd

- Vinipul Inorganics Private Limited.

- China Nafine Group International Co.,Ltd.

- ACURO ORGANICS LIMITED

- Global Calcium

- Richase Enterprise PTE. LTD

- ICL

- Rishi Chemical

- GROWILL AGROTECH

- Central Drug House

- HiTech Minerals and Chemicals Group

- TRIANGULUM CHEMICALS PRIVATE

- LIMITED

- ANISH CHEMICALS

Global Magnesium Sulfate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,029.8 million

Revenue forecast in 2030

USD 1,498.3 million

Growth rate

CAGR of 7.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, and region

Regional scope

Americas; Europe; Asia Pacific; Middle East; Africa

Country scope

US; Canada; Mexico; Brazil; Argentina; Chile; Germany; UK; Italy; Spain; Turkey; Poland; Russia; China; Japan; India; South Korea; Thailand; Indonesia; Malaysia; Philippines; Australia; New Zealand; Qatar; Oman; Kuwait; Saudi Arabia; UAE; Israel; Lebanon; Iran; Morocco; Egypt; Kenya; Cote d'Ivoire; South Africa

Key companies profiled

Mani Agro Chem; Weifang City Huakang Magnesium Sulphate Factory; Zibo Jinxing Chemical Co., Ltd.; Vinipul Inorganics Private Limited.; China Nafine Group International Co.,Ltd.; ACURO ORGANICS LIMITED; Global Calcium; Richase Enterprise PTE. LTD.; ICL; Rishi Chemical; GROWILL AGROTECH; Central Drug House; HiTech Minerals and Chemicals Group; TRIANGULUM CHEMICALS PRIVATE LIMITED; ANISH CHEMICALS

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Magnesium Sulfate Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global magnesium sulfate market report based on application and region.

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Agriculture Grade

-

Medical Grade

-

Food Grade

-

Feed Grade

-

Industrial Grade

-

Detergents

-

Pulp & Paper

-

ABS Polymerization

-

Sorel Cement

-

Others

-

-

Consumer Segment/Epsom Salt Grade

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Americas

-

U.S.

-

Canada

-

Mexico

-

Brazil

-

Argentina

-

Chile

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

Turkey

-

Poland

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

Malaysia

-

Philippines

-

Australia

-

New Zealand

-

-

Middle East

-

Qatar

-

Oman

-

Kuwait

-

Saudi Arabia

-

UAE

-

Israel

-

Iran

-

Lebanon

-

-

Africa

-

Morocco

-

Egypt

-

Kenya

-

Cote d'Ivoire

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global magnesium sulfate market size was estimated at USD 0.95 billion in 2024 and is expected to reach USD 1.03 billion in 2025.

b. The magnesium sulfate market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2048 to reach USD 4.79 billion by 2048.

b. The agriculture grade segment held the largest revenue share of 49.2% due to its widespread use in correcting magnesium-deficient soils and enhancing crop yield, particularly in regions with intensive farming practices.

b. Some of the key players operating in the magnesium sulfate market include K+S Aktiengesellschaft, PQ Corporation, Industrias Peñoles, Giles Chemical, Emisal (The Egyptian Minerals and Salts Company at Fayoum), Sinomagchem (YINGKOU MAGNESITE CHEMICAL IND GROUP CO.,LTD.), UMAI CHEMICAL CO.,LTD, Mani Agro Chem, Weifang City Huakang Magnesium Sulphate Factory, and Zibo Jinxing Chemical Co.,Ltd.

b. The key factors driving the market include growing demand for micronutrient-based fertilizers to boost agricultural productivity, and rising use in pharmaceuticals, food, and personal care industries due to its multifunctional properties

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."