- Home

- »

- Consumer F&B

- »

-

Netherlands Energy Drinks Market, Industry Report, 2030GVR Report cover

![Netherlands Energy Drinks Market Size, Share & Trends Report]()

Netherlands Energy Drinks Market Size, Share & Trends Analysis Report By Product (Energy Drinks, Energy Shorts), By Type (Organic, Conventional), By Packaging (Bottles, Cans), By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-599-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Netherlands Energy Drinks Market Trends

The Netherlands energy drinks market size was estimated at USD 1.22 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2030. The growth is attributable to increasing health consciousness and evolving consumer preferences for functional beverages. Dutch consumers are increasingly seeking energy drinks with natural ingredients, reduced sugar content, and added vitamins to support active lifestyles. For instance, the growing popularity of low-sugar products like those offered under the RockStar brand reflects this shift, as these products cater to consumers prioritizing both energy and health benefits.

Innovation and product diversification are key factors propelling the growth of the Netherlands energy drinks industry. Manufacturers are expanding their portfolios to include sugar-free, organic, and vitamin-enhanced energy drinks, often incorporating botanicals such as guarana and ginseng. The convenience of ready-to-drink formats combined with sustainable packaging appeals to environmentally aware consumers. In addition, the rise in e-commerce and increased availability in supermarkets and convenience stores ensure broad market access, further boosting sales.

Regulatory and social factors also influence market dynamics. While there are ongoing discussions about restricting sales of energy drinks to minors in the Netherlands, no strict legislation has been implemented yet, allowing continued market expansion. The country’s strong fitness culture and busy urban lifestyles support sustained demand, with energy drinks frequently consumed as mixers in social settings. These combined factors position the Netherlands energy drinks market for steady and robust growth through 2030.

Product Insights

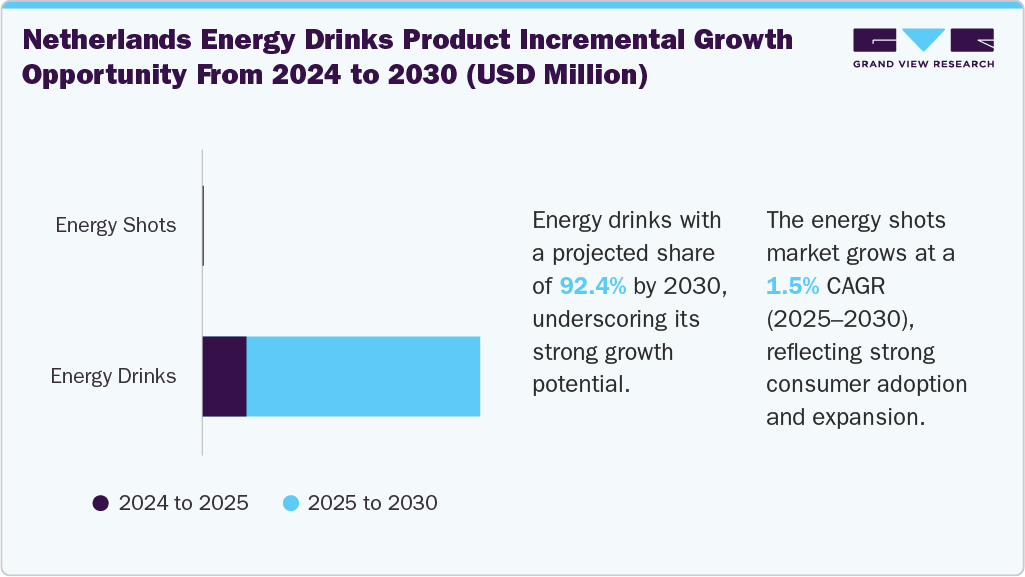

The energy drinks market accounted for the largest revenue share of 90.5% in 2024, primarily due to strong consumer demand driven by a health-conscious population seeking functional beverages that provide quick energy and mental alertness. The rise of fitness culture and increasing preference for innovative, low-sugar, and natural ingredient options have propelled market growth. For instance, brands like RockStar, under Vrumona, have successfully captured the market by offering sugar-free and reduced-sugar variants that appeal to Dutch consumers focused on wellness. In addition, widespread availability through supermarkets, convenience stores, and e-commerce platforms ensures easy access and convenience, supporting high sales volumes.

The energy shots market is projected to grow at a CAGR of 1.5% from 2025 to 2030, due to its appeal as a convenient, quick energy source for busy consumers seeking immediate alertness in a compact format. Energy shots are favored for their portability and ease of use, fitting well into fast-paced lifestyles where a rapid energy boost is needed without consuming a full-sized drink.

Type Insights

The conventional energy drinks market accounted for a revenue share of 92.4% of the Netherlands energy drinks market in 2024, as these products have established strong consumer trust by delivering consistent, immediate energy and mental alertness benefits. Conventional energy drinks typically contain caffeine, taurine, B vitamins, and sugar, which effectively meet the needs of younger, active consumers and working professionals managing busy lifestyles. For instance, well-known brands such as Red Bull, Monster, and RockStar dominate the market by offering classic formulations with familiar flavors and proven effects. The Netherlands’ health-conscious population also favors sugar-reduced or sugar-free variants within the conventional segment, which focus on low-sugar options. In addition, extensive distribution through supermarkets, convenience stores, and e-commerce platforms ensures broad accessibility.

The organic energy drinks market is projected to grow at a CAGR of 9.4% from 2025 to 2030, due to consumers increasingly preferring healthier, natural beverages free from synthetic pesticides, GMOs, and artificial additives. For instance, Wholesome Organics Co. launched the Clean Energy Shot in 2023, targeting health-conscious individuals seeking organic energy boosts with added wellness benefits. Rising awareness of the negative health effects of high sugar and synthetic ingredients in conventional energy drinks is pushing consumers toward organic alternatives. In addition, growing fitness culture, sustainability concerns, and demand for functional beverages with natural ingredients like guarana and green tea support market growth. The expanding availability of organic energy drinks through supermarkets and e-commerce platforms also enhances accessibility.

Packaging Insights

The canned energy drinks market accounted for a revenue share of 89.0% of the Netherlands energy drinks industry in 2024, primarily due to aluminum cans offering superior product preservation, convenience, and sustainability that align with Dutch consumer preferences and regulatory frameworks. Cans effectively protect energy drinks from light and oxygen, maintaining carbonation, flavor, and freshness, which is essential for quality-conscious consumers. Their lightweight and portable design suits the active, on-the-go lifestyle common in the Netherlands, especially among the urban population engaged in fitness activities like cycling and running. In addition, the Netherlands’ strong recycling infrastructure and strict EU regulations on single-use plastics encourage the use of recyclable aluminum cans over plastic bottles.

The bottles energy drink segment is projected to grow at a CAGR of 3.5% from 2025 to 2030. Bottles, especially PET, offer durability and the ability to reseal, allowing consumers to drink energy beverages gradually rather than all at once, which appeals to busy lifestyles and fitness enthusiasts. In addition, growing health awareness encourages brands to innovate with low-sugar and vitamin-fortified formulations in bottle packaging, attracting health-conscious consumers. Environmental concerns also drive the adoption of recyclable and sustainable bottle materials, aligning with stricter regulations and consumer preferences in markets like the Netherlands. Expanding distribution through supermarkets, convenience stores, and e-commerce channels further supports steady growth in the bottles segment despite the dominance of cans. These factors collectively contribute to moderate but consistent market expansion.

Distribution Channel Insights

The sales of energy drinks through off-trade accounted for a revenue share of 84.5% in 2024, as it offers wide accessibility and convenience through supermarkets, hypermarkets, convenience stores, and online platforms where consumers can easily find diverse energy drink options. Major retail chains stock a broad range of products, including popular brands, as well as growing selections of reduced-sugar and natural variants that appeal to the health-conscious Dutch population. The ability to physically inspect products in-store or access detailed product information online builds consumer trust and supports informed choices.

Energy drinks sales through the on-trade are projected to grow at a CAGR of 4.4% from 2025 to 2030, due to increasing consumer demand for immediate consumption in social venues such as bars, clubs, and restaurants. On-trade channels offer unique opportunities for brands to engage consumers with exclusive product launches, limited editions, and experiential marketing, enhancing brand loyalty and appeal. For instance, energy drink brands often collaborate with music festivals and sporting events to create immersive experiences that attract younger consumers seeking both energy and social interaction. In addition, the growing nightlife culture and the rising popularity of energy drink mixers with alcoholic beverages boost on-trade consumption. Premium pricing and the convenience of ready-to-drink formulations further drive sales in these venues. These factors, combined with targeted marketing and the social nature of on-trade consumption, support steady growth in energy drink sales through on-trade channels in the Netherlands.

Key Netherlands Energy Drinks Company Insights

Key companies in the Netherlands energy drinks market sustain their competitive positions by focusing on innovation in sugar-free and natural ingredient formulations that cater to rising health consciousness among consumers. They utilize extensive distribution networks covering supermarkets, convenience stores, and expanding e-commerce platforms to maximize market reach. Strategic marketing initiatives, including sponsorships of sports and cultural events, enhance brand visibility and consumer engagement.

Key Netherlands Energy Drinks Companies:

- Red Bull GmbH

- Suntory Holdings Limited

- PepsiCo, Inc.

- Monster Beverage Corporation

- Lucozade Ribena Suntory Limited

- The Coca-Cola Company

- Amway Corp

- Keurig Dr. Pepper, Inc

- Vitamin Well AB

- Congo Brands

Netherlands Energy Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.28 billion

Revenue forecast in 2030

USD 1.68 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, packaging, distribution channel

Country scope

Netherlands

Key companies profiled

Red Bull GmbH; Suntory Holdings Limited; PepsiCo, Inc.; Monster Beverage Corporation; Lucozade Ribena Suntory Limited; The Coca-Cola Company; Amway Corp; Keurig Dr. Pepper, Inc.; Vitamin Well AB; Congo Brands

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Netherlands Energy Drinks Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Netherlands energy drinks market report based on product, type, packaging, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Drinks

-

Energy Shots

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

Frequently Asked Questions About This Report

b. The Netherlands energy drinks market size was estimated at USD 1.22 billion in 2024 and is expected to reach USD 1.28 billion in 2025.

b. The Netherlands energy drinks market is expected to grow at a compounded growth rate of 5.6% from 2025 to 2030 to reach USD 1.68 billion by 2030.

b. The energy drinks market accounted for a share of 90.5% of the Netherlands revenue in 2024, primarily due to strong consumer demand driven by a health-conscious population seeking functional beverages that provide quick energy and mental alertness

b. Some key players operating in the Netherlands energy drinks market include Red Bull GmbH; Suntory Holdings Limited; PepsiCo, Inc.; Monster Beverage Corporation; The Coca-Cola Company; Keurig Dr. Pepper, Inc ; Vitamin Well AB ; Congo Brands and others

b. Key factors that are driving the market growth include increasing health consciousness and evolving consumer preferences for functional beverages. Dutch consumers are increasingly seeking energy drinks with natural ingredients, reduced sugar content, and added vitamins to support active lifestyles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."