- Home

- »

- Advanced Interior Materials

- »

-

Package Boilers Market Size & Share, Industry Report, 2030GVR Report cover

![Package Boilers Market Size, Share & Trends Report]()

Package Boilers Market Size, Share & Trends Analysis Report By Type (Water-Tube Boilers, Electric Boilers, Hybrid Boilers), By Design (D-Type, A-Type), By Fuel Type (Oil, Gas, Coal ), By End Use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-608-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Package Boilers Market Summary

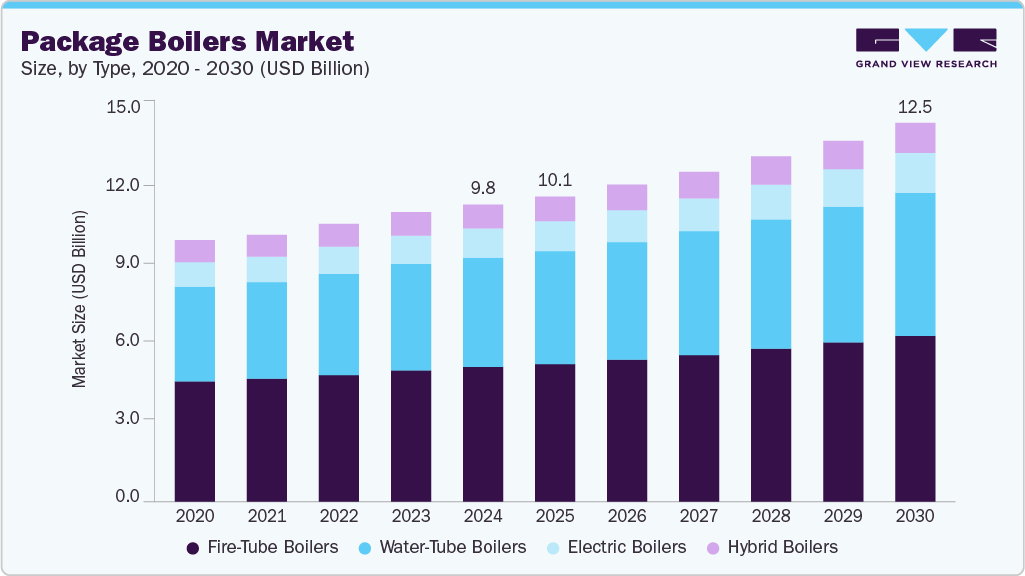

The global package boilers market size was estimated at USD 9.84 billion in 2024 and is projected to reach USD 12.51 billion by 2030, growing at a CAGR of 4.4% over the forecast period from 2025 to 2030. The market is steadily expanding, driven by rising industrial demand for efficient steam generation systems across food processing, chemicals, pharmaceuticals, and energy sectors.

Key Market Trends & Insights

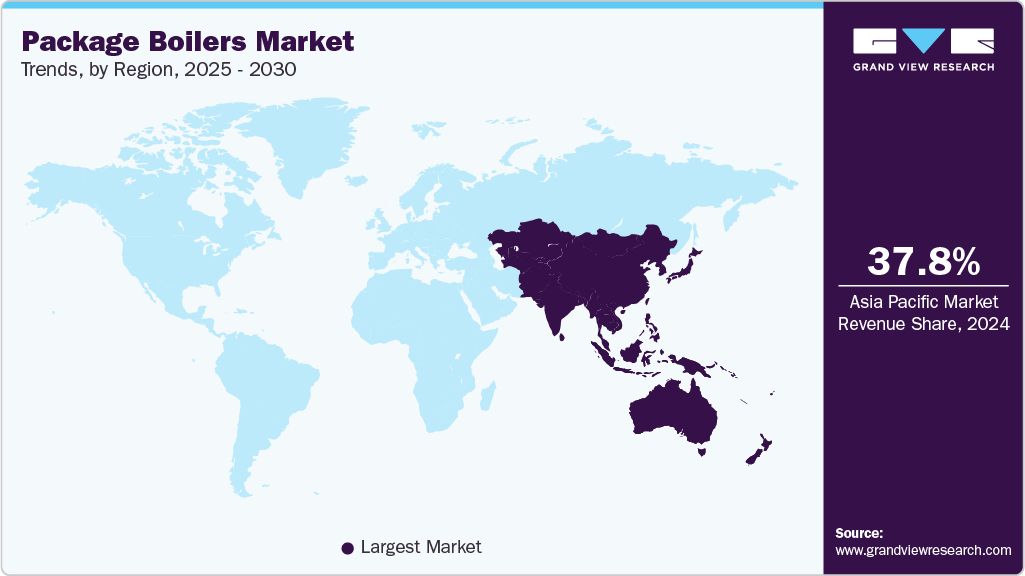

- The Asia Pacific region dominated the market and accounted for 37.8% in 2024.

- The package boilers market in China dominates the Asia Pacific.

- By end use, the chemical & petrochemical end use segment dominated the market in 2024 by accounting for a share of 24.8%.

- By fuel type, the gas fuel type segment dominated the market in 2024 by accounting for a share of 42.8%.

- By type, the fire-tube boilers segment dominated the market in 2024 by accounting for a share of 45.2%.

Market Size & Forecast

- 2024 Market Size: USD 9.84 Billion

- 2030 Projected Market Size: USD 12.51 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

These boilers, pre-assembled and factory-tested, offer advantages such as quick installation, compact design, and minimal on-site construction, making them particularly attractive for facilities with space constraints or time-sensitive project requirements.

The shift toward automation and smart monitoring has also increased the adoption of advanced package boilers equipped with IoT-enabled sensors for real-time performance tracking and predictive maintenance. Environmental regulations are another key driver shaping the market, pushing industries to replace older, inefficient boilers with low-emission and energy-efficient models. As a result, there is growing interest in gas-fired and biomass-fueled package boilers that align with global decarbonization goals. Emerging markets in Asia Pacific and Latin America are seeing heightened demand due to rapid industrialization, while developed regions like North America and Europe focus on retrofitting and upgrading legacy systems. This combination of sustainability priorities, regulatory compliance, and process efficiency continues to drive innovation and investment in the market globally.

Market Concentration & Characteristics

The global package boilers industry is moderately fragmented, marked by a combination of major industrial equipment manufacturers and a wide array of regional players catering to localized and industry-specific requirements. While leading multinational companies dominate high-capacity and technically advanced segments, regional firms often provide cost-effective or customized boiler systems, especially in developing markets. Design differentiation in the sector hinges on thermal efficiency, operational reliability under demanding industrial conditions, and compliance with international safety and emissions standards. Manufacturers are increasingly channeling investments into R&D to create smarter, more fuel-efficient boilers integrated with automation and control systems to optimize process performance and reduce operating costs.

Regulatory frameworks governing emissions, energy efficiency, and workplace safety, enforced by agencies such as the U.S. Environmental Protection Agency (EPA), European Environment Agency, and local energy authorities, play a central role in shaping product development and competitive dynamics. The global push toward decarbonization and cleaner industrial processes is accelerating the shift from traditional coal-fired systems to gas-fired, biomass-fueled, and hybrid boilers. This transition is particularly visible in sectors such as food and beverage, petrochemicals, and pharmaceuticals, where compliance with environmental and energy regulations is critical to market access and operational sustainability.

The package boilers industry is poised for growth, particularly in emerging regions like Asia Pacific, Latin America, and the Middle East, driven by rapid industrialization and infrastructure expansion. However, the market faces challenges from alternative thermal energy systems and the rising preference for decentralized energy solutions, which reduce reliance on centralized steam generation. To stay competitive, manufacturers focus on modular, plug-and-play designs that offer greater fuel flexibility, mobility, and ease of integration, aligning with industry demands for lower total cost of ownership and minimal infrastructure requirements.

To stay competitive in this evolving landscape, boiler manufacturers must prioritize advancements in materials engineering, low-emission combustion technologies, and digital integration, such as IoT-enabled diagnostics, remote monitoring, and predictive maintenance features. A strong emphasis on sustainability, regulatory compliance, and adaptability to varied fuel sources will be key to securing market share in a global environment progressively demanding energy-efficient and environmentally responsible boiler solutions.

Drivers, Opportunities & Restraints

The package boilers industry is primarily driven by rapid industrialization across emerging economies, rising demand for efficient and compact steam generation systems, and stricter environmental regulations promoting cleaner energy sources. Industries such as food processing, chemicals, pharmaceuticals, and power generation are increasingly adopting package boilers due to their space-saving design, faster installation, and low operational costs. The growing shift toward natural gas and biomass as fuel sources also supports the adoption of high-efficiency, low-emission boiler technologies.

Despite strong growth potential, the market faces restraints such as high initial capital investment and limited flexibility for scale adjustments post-installation. In addition, stringent regulatory approval processes and operational challenges in retrofitting old systems with modern package boilers can slow adoption. The rise of alternative decentralized heating technologies and integrated energy systems also presents competitive challenges, particularly in regions with advanced energy infrastructure.

Significant opportunities lie in integrating smart technologies such as IoT-based performance monitoring, remote diagnostics, and predictive maintenance, which enhance efficiency and reduce downtime. Growing investments in green manufacturing and energy-efficient infrastructure, especially in Asia Pacific, the Middle East, and Africa, create favorable conditions for expansion. Moreover, the increasing preference for modular and hybrid fuel boiler systems offers new avenues for innovation and market penetration, especially in off-grid or energy-sensitive environments.

Type Insights

The fire-tube boilers segment dominated the market in 2024 by accounting for a share of 45.2%. Fire-tube boilers hold a strong position in the market due to their robust design and suitability for operations requiring lower-pressure steam and consistent load profiles. They are especially favored in food processing, textile manufacturing, and small-scale chemical production sectors, where compact footprint and simplified maintenance are critical.

Electric boilers are emerging as a niche yet rapidly growing segment within the market, driven by increasing regulatory pressure to decarbonize industrial operations and the rising availability of renewable electricity. These boilers are particularly attractive in facilities with strict emission controls or limited fossil fuel infrastructure, such as pharmaceutical cleanrooms, high-tech manufacturing environments, and urban district heating systems.

Design Insights

D-type design segment dominated the market in 2024. D-Type package boilers are favored in industries requiring high steam output and efficient fuel utilization within a compact footprint. Their design, characterized by a central furnace with water walls and a D-shaped configuration of tubes, offers superior thermal efficiency and high-pressure capabilities. This makes them ideal for continuous, demanding operations in petrochemicals, refineries, and large-scale power generation sectors.

A-Type package boilers are designed for applications where space constraints and high-capacity steam generation coexist, particularly in marine, offshore, and remote industrial installations. Their vertically aligned, twin-drum structure provides excellent circulation and balanced heat distribution, allowing for efficient operation even in compact or mobile environments. The primary driver for A-Type boiler adoption is their structural stability and adaptability to rugged conditions, making them well-suited for modular and skid-mounted systems.

Fuel Type Insights

The gas fuel type segment dominated the market in 2024 by accounting for a share of 42.8%. Gas-fired package boilers represent a dominant segment in the market due to their high thermal efficiency, lower emissions, and ease of integration into existing industrial infrastructure. Natural gas and, increasingly, biogas are favored for their clean combustion characteristics, which align with global decarbonization goals and stringent emissions regulations.

Biomass-fired package boilers are gaining traction as industries seek low-carbon alternatives to traditional fossil fuels. These boilers utilize organic materials such as wood chips, agricultural residues, and pelletized waste, offering a renewable and often locally sourced fuel option. Their appeal lies in reducing greenhouse gas emissions while supporting circular economy practices by repurposing waste streams.

End Use Insights

The chemical & petrochemical end use segment dominated the market in 2024 by accounting for a share of 24.8%. In the chemical & petrochemical sector, package boilers play a vital role in providing consistent and high-pressure steam for distillation, reaction heating, and other critical processes. These industries often operate under extreme conditions, requiring boilers that offer robust performance, corrosion resistance, and adaptability to fluctuating load demands.

In the food and beverage industry, package boilers are essential for cooking, sterilization, pasteurization, and cleaning-in-place (CIP) operations. The sector demands highly reliable steam generation systems with precise temperature control and compliance with sanitary standards. Package boilers offer a compact, energy-efficient solution that can be rapidly deployed in facilities with space limitations.

Regional Insights

The Asia Pacific region dominated the market and accounted for 37.8% in 2024. The market is rapidly expanding, driven by industrialization, urbanization, and increasing power needs in emerging economies. Countries are investing heavily in infrastructure, manufacturing, and energy sectors. Despite some challenges related to environmental concerns, the market growth is supported by adoption of efficient boilers and government initiatives promoting cleaner energy.

China Package Boilers Market Trends

The package boilers market in China dominates the Asia Pacific with its vast industrial base and growing energy demands. Rapid urbanization, expanding power plants, and infrastructure projects fuel demand for package boilers. The government’s push for emission control and energy efficiency accelerates the adoption of advanced technologies, making China one of the fastest-growing markets globally.

India package boilers market is witnessing strong growth due to increasing industrial activity and rising energy requirements. The expanding manufacturing sector drives boiler demand, especially in textiles, chemicals, and food processing. Government initiatives promoting energy efficiency and cleaner technologies are gradually encouraging the replacement of outdated boilers with modern package units.

North America Package Boilers Market Trends

The package boilers market in North America is driven by industrial growth and increasing energy demand in sectors such as manufacturing, oil & gas, and power generation. Advanced technologies and stringent environmental regulations have encouraged the adoption of efficient and low-emission boilers. The region's focus on reducing carbon footprints and upgrading aging infrastructure fuels market growth.

The U.S. package boilers market is supported by strong industrial and commercial sectors requiring reliable steam and hot water generation. Infrastructure modernization investments and regulatory mandates for emissions reduction are pushing companies to replace old boilers with efficient package units. The growing emphasis on energy efficiency and sustainable solutions further boosts market prospects.

Europe Package Boilers Market Trends

The package boilers market in Europe is characterized by increasing emphasis on sustainability, driven by stringent regulations such as the EU’s Green Deal and decarbonization goals. Industrial sectors in the region are upgrading to more efficient and eco-friendly boilers. The market is competitive with a strong presence of innovative technologies focusing on reducing fuel consumption and emissions.

Germany package boilers market leads Europe due to its robust industrial and manufacturing sectors. The country’s stringent energy efficiency standards and environmental regulations prompt widespread adoption of high-efficiency package boilers. Germany's focus on renewable energy integration and carbon neutrality also influences boiler technologies and applications.

The package boilers market in the UK is growing due to the demand for package boilers, which is propelled by ongoing infrastructure developments and the modernization of aging industrial equipment. Energy efficiency mandates and climate change policies encourage the replacement of conventional boilers with advanced, energy-saving package units. The market also sees growth in commercial applications such as hospitals and universities.

Latin America Package Boilers Market Trends

The package boilers market in Latin America is growing steadily, supported by increasing industrialization and energy infrastructure development. Countries are upgrading facilities to improve efficiency and comply with environmental standards. The market faces challenges like economic volatility, but investments in sectors such as oil & gas and manufacturing maintain steady demand.

Brazil package boilers market is bolstered by its extensive industrial base and energy sector growth. The demand is driven by bioenergy, pulp and paper, and chemical industries requiring reliable steam generation. Environmental regulations and a focus on sustainable energy solutions encourage the adoption of efficient package boilers to reduce operational costs and emissions.

Middle East & Africa Package Boilers Market Trends

The package boilers market in the Middle East & Africa is growing with the region’s expanding industrial and power generation activities. Oil & gas remains a key driver, alongside infrastructure development and water treatment projects. Increasing awareness about energy efficiency and emission controls is pushing the adoption of modern package boilers, although market growth varies significantly between countries.

Saudi Arabia package boilers market is primarily driven by its large oil & gas industry and increasing industrial diversification efforts. Government initiatives under Vision 2030 promote modernization and energy efficiency in industrial processes. The demand for reliable and efficient package boilers is growing to support power generation, petrochemicals, and water desalination projects.

Key Package Boilers Company Insights

Some of the key players operating in the market include Babcock & Wilcox Enterprises, Inc. and Bosch Industriekessel GmbH.

-

Established in 1867, Babcock & Wilcox Enterprises, Inc. (B&W) is a U.S.-based company headquartered in Akron, Ohio. Renowned for pioneering the water-tube boiler, B&W has a rich history of innovation in steam generation technology. The company offers diverse products and services, including advanced steam generation systems, environmental solutions, and digital transformation tools. Their global presence spans approximately 30 countries, serving various industries such as power generation, waste management, and municipal utilities.

-

Bosch Industriekessel GmbH, a division of Bosch Thermotechnik GmbH, has been a leading manufacturer of industrial boiler systems for over 150 years. Headquartered in Gunzenhausen, Germany, the company specializes in producing customized steam, hot water, and heating boilers ranging from 175 kg/h to 55,000 kg/h. With manufacturing facilities in Germany and Austria, Bosch Industriekessel serves customers in more than 140 countries, offering solutions for various sectors, including manufacturing, energy supply, and public facilities.

Key Package Boilers Companies:

The following are the leading companies in the package boilers market. These companies collectively hold the largest market share and dictate industry trends.

- Indeck Power Equipment Company

- Babcock & Wilcox Enterprises, Inc

- Cleaver-Brooks

- Rentech Boiler Systems, Inc.

- Bosch Industriekessel GmbH

- Clayton Industries

- IHI Corporation

- Hurst Boiler & Welding Co, Inc.

- Johnston Boiler

- Isgec Heavy Engineering Ltd.

- Kawasaki Thermal Engineering Co., Ltd.

- Danstoker A/S

- astebo gmbh

- Babcock Wanson

- Sussman Electric Boilers

Recent Developments

-

In February 2025, Cleaver-Brooks introduced myBoilerRoom, a cutting-edge digital solution to improve boiler efficiency, boost reliability, and reduce facility costs. This platform leverages data-driven asset management to help facilities precisely and effectively optimize their boiler operations.

-

In September 2023, Babcock Wanson launched the LV-Pack, a low-voltage industrial electric boiler with steam capacities ranging from 600 kg/h to 8,400 kg/h and a design pressure of up to 18 barg. This product was developed to help meet Europe’s energy efficiency standards and greenhouse gas reduction targets.

Package Boilers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.08 billion

Revenue forecast in 2030

USD 12.51 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Type, design, fuel type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Indeck Power Equipment Company; Babcock & Wilcox Enterprises, Inc.; Cleaver-Brooks; Rentech Boiler Systems, Inc.; Bosch Industriekessel GmbH; Clayton Industries; IHI Corporation; Hurst Boiler & Welding Co, Inc.; Johnston Boiler; Isgec Heavy Engineering Ltd; Kawasaki Thermal Engineering Co., Ltd.; Danstoker A/S; astebo gmbh; Babcock Wanson; Sussman Electric Boilers

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Package Boilers Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global package boilers market report based on type, fuel type, design, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fire-Tube Boilers

-

Water-Tube Boilers

-

Electric Boilers

-

Hybrid Boilers

-

-

Fuel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil

-

Gas

-

Coal

-

Biomass

-

Electric

-

-

Design Outlook (Revenue, USD Billion, 2018 - 2030)

-

D-Type

-

A-Type

-

O-Type

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Chemical & Petrochemical

-

Oil & Gas

-

Paper & Pulp

-

Pharmaceuticals

-

Textile

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Spain

-

Italy

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global package boilers market size was estimated at USD 9.84 billion in 2024 and is expected to reach USD 10.08 billion in 2025.

b. The package boilers market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 12.51 billion by 2030.

b. The gas fuel type segment dominated the market in 2024 by accounting for a share of 42.8%. Gas-fired package boilers represent a dominant segment in the market due to their high thermal efficiency, lower emissions, and ease of integration into existing industrial infrastructure.

b. Some of the key players operating in the market are Indeck Power Equipment Company, Babcock & Wilcox Enterprises, Inc, Cleaver-Brooks, Rentech Boiler Systems, Inc., Bosch Industriekessel GmbH, Clayton Industries, IHI Corporation, Hurst Boiler & Welding Co, Inc., Johnston Boiler, Isgec Heavy Engineering Ltd, Kawasaki Thermal Engineering Co., Ltd., Danstoker A/S, astebo gmbh, Babcock Wanson, Sussman Electric Boilers.

b. Key factors driving the package boilers market include rapid industrialization, growing demand for efficient steam generation in sectors like food processing, chemicals, and power, and the need for compact, easy-to-install boiler systems. Additionally, rising energy efficiency regulations and the shift toward cleaner fuels are boosting adoption.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."