- Home

- »

- Electronic Devices

- »

-

Point-of-Sale Terminal Market Size, Industry Report, 2030GVR Report cover

![Point-of-Sale Terminal Market Size, Share & Trends Report]()

Point-of-Sale Terminal Market Size, Share & Trends Analysis Report By Product (Fixed, Mobile), By Component (Hardware, Software, Services), By Deployment (Cloud, On-premise), By End-use (Restaurants, Retail), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-263-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

Point-of-sale Terminal Market Summary

The global point-of-sale terminal market size was estimated at USD 113,381.0 million in 2024 and is projected to reach USD 181,473.4 million by 2030, growing at a CAGR of 8.1% from 2025 to 2030. Point-of-Sale (POS) terminals are electronic devices designed to process card-based transactions across a wide range of establishments, including retail outlets, restaurants, hotels, gas stations, pharmacies, hospitals, and resorts.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, fixed pos terminals accounted for a revenue of USD 71,128.1 million in 2024.

- Mobile POS Terminals is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 113,381.0 Million

- 2030 Projected Market Size: USD 181,473.4 Million

- CAGR (2025-2030): 8.1%

- Asia Pacific: Largest market in 2024

The increasing adoption of cost-effective wireless communication technologies has significantly contributed to the expansion of the POS terminal market. These systems leverage wireless connectivity to enable seamless payment processing for goods and services.

Restaurants, bars, and food service providers heavily rely on POS technologies to streamline operations, manage inventory, monitor product movement, and track sales effectively. Modern POS systems often integrate various hardware components such as cash registers, barcode scanners, and computers, along with digital displays, to facilitate seamless online and offline transactions. The market is being propelled by the growing use of mobile-based POS terminals, advancements in payment technologies, and the widespread adoption of EMV (Europay, Mastercard, and Visa) standards. In addition, the expanding application of POS systems across the e-commerce and retail sectors is playing a significant role in driving market growth.

The point-of-sale terminal market has also been influenced by rising concerns regarding security and privacy, particularly in relation to data breaches. One key factor driving market growth is the increasing popularity of modern drive-thru services. Many businesses have begun adopting advanced POS systems to integrate their drive-thru lines, kitchen operations, and back-office functions, ensuring a more efficient and seamless order fulfillment process. For example, fast-casual chains such as Chipotle, Starbucks, and Panera have incorporated drive-thru features into several of their locations. Moreover, the growing adoption of mobile POS terminals has further opened new opportunities for market expansion, enabling businesses to provide faster, more flexible payment solutions.

The enhanced return on investment (ROI) provided by POS systems has positively influenced the market, encouraging greater adoption. In addition, the growing need for efficient customer and employee management, inventory tracking, and the integration of in-store and online sales through tablets has further fueled the demand for these solutions. The increasing popularity of contactless payments and the widespread adoption of Near Field Communication (NFC) devices across various industries have significantly boosted market growth. Moreover, remittance companies are introducing innovative solutions tailored to specific industry needs, driving profitability. POS systems enable retailers to streamline business operations and manage inventory more effectively, contributing to the point-of-sale terminal industry.

The benefits of modern drive-thru services, such as enhanced convenience, have significantly improved the overall customer experience, creating promising growth opportunities for the POS terminal market. However, challenges such as privacy concerns and the risk of data misuse, including potential card information leakage, remain significant barriers to market growth. In addition, a lack of awareness among consumers about the security risks associated with POS systems further restricts market expansion. The market also faces security challenges due to the exposed nature of these systems within networks, as they handle critical information that requires robust protection. Managing these systems, especially in rural areas, adds another layer of complexity to ensuring their security and operational integrity.

Product Insights

The fixed segment dominated the market and accounted for the revenue share of over 58.0% in 2024. The fixed POS segment is divided into kiosks and others. Large-scale vendors often opt for fixed POS terminals, driven by their substantial procurement and installation investments, which continues to support the growth of this segment. In addition, end-users with understanding of cloud and on-premises data storage solutions tend to prefer fixed POS systems for their ability to securely store data locally. These terminals are widely used for various functions, including bill printing, Customer Relationship Management (CRM), inventory control, and integration with diverse payment devices, making them a vital component in streamlining business operations.

The mobile segment is anticipated to grow at a CAGR of 10.8% during the forecast period. The mobile POS segment is divided into tablet and others.The growth is largely driven by the increasing adoption of in-store mobile payments by consumers worldwide. Mobile POS (mPOS) terminals enable transactions to be processed from any location within a store, enhancing flexibility and operational efficiency. Various end-users, particularly in the food service industry, such as restaurants, are increasingly implementing mPOS solutions to streamline payment processes during peak hours. This not only minimizes delays and prevents potential revenue loss but also boosts customer satisfaction. For example, Quick-Service Restaurants (QSRs) in China have adopted technologies such as digital kiosks and tablets for menu display and order placement. These innovations contribute to improved service delivery and customer experience, thereby propelling market growth.

Component Insights

The hardware segment dominated the market and accounted for the revenue share of over 62.0% in 2024. The upgrading of legacy systems in developing regions is a significant growth driver. Small and medium-sized enterprises (SMEs), especially in emerging markets across Asia Pacific, Latin America, and Africa, are moving away from traditional cash registers to modern POS systems due to government initiatives promoting digitalization, financial inclusion, and formalization of unorganized retail. This modernization wave opens up a large market for cost-effective, durable, and scalable hardware solutions.

The software segment is expected to grow at a significant CAGR over the forecast period owing to the integration of analytics and business intelligence tools within POS software. Retailers and service providers are leveraging these capabilities to gain insights into customer behavior, sales trends, and inventory performance. By utilizing analytics, businesses can make data-informed decisions that enhance customer engagement, optimize stock levels, and improve operational efficiency.

Deployment Insights

The on-premise segment dominated the market and accounted for the revenue share of over 71.0% in 2024 due to the requirement for greater control, customization, and data ownership. Businesses in sectors such as high-end retail, hospitality, and healthcare often prefer on-premise deployments due to the sensitive nature of their data and the need for tailored system configurations that align closely with unique operational workflows.Offline functionality and system reliability also contribute to the growth of on-premise POS deployments. In environments where internet connectivity may be unstable or unreliable, such as remote locations, rural areas, or certain international markets, on-premise systems ensure uninterrupted operation.

The cloud segment is expected to grow at a significant CAGR over the forecast period, driven by the global shift toward digital transformation and the increasing demand for flexibility, scalability, and remote accessibility. One of the key drivers is the cost-effectiveness and lower upfront investment associated with cloud-based solutions. Unlike traditional on-premise systems, cloud POS platforms typically operate on a subscription-based model, allowing businesses, especially SMEs, to access advanced POS functionalities without the need for heavy infrastructure investment or maintenance costs.

End-use Insights

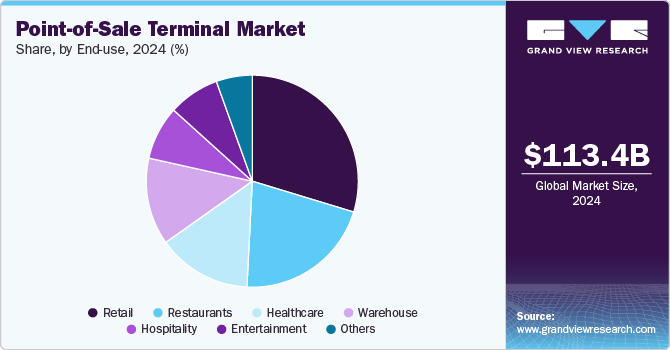

The retail segment dominated the market and accounted for the revenue share of over 29.0% in 2024 due to the global expansion of both brick-and-mortar and e-commerce retail operations. In addition to the rise of online shopping, physical retail stores remain crucial for customer engagement and experiential marketing. Retailers are increasingly adopting POS systems to enhance transaction speed, streamline inventory management, and deliver personalized customer experiences. Moreover, the emphasis on omnichannel retailing, where businesses aim to unify their online and offline sales channels also contributes to the growth of the segment. POS terminals, particularly those integrated with cloud-based systems, enable real-time synchronization of customer data, inventory levels, and sales transactions across all platforms.

The healthcare segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing need for streamlined administrative processes, accurate billing, and enhanced patient experiences. One of the primary growth drivers is the digitization of healthcare systems across both developed and emerging markets. Hospitals, clinics, pharmacies, and other healthcare providers are increasingly adopting POS systems to manage payments, inventory, and patient information more efficiently, replacing outdated manual systems and reducing administrative errors.

Regional Insights

The North America point-of-sale terminal market held a significant share of around 26.0% in 2024. The hospitality and healthcare sectors’ growing reliance on automation and payment efficiency is adding momentum to the POS terminal market. Restaurants, hotels, clinics, and pharmacies are using POS systems to streamline billing, manage reservations, monitor inventory, and offer faster service, all of which contribute to improved operational performance and customer satisfaction.

U.S. Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in the U.S. is expected to grow significantly at a CAGR of 5.9% from 2025 to 2030. Consumers in the U.S. are increasingly opting for digital wallets, NFC (Near Field Communication) payment methods, and QR code-based transactions, particularly in light of the COVID-19 pandemic.

Europe Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in Europe is anticipated to register a considerable growth from 2025 to 2030 due to the implementation of stringent regulatory frameworks such as the Payment Services Directive 2 (PSD2) and the General Data Protection Regulation (GDPR). PSD2, which mandates stronger authentication protocols for online payments, is driving the demand for more secure POS terminals that meet new compliance standards.

The UK point-of-sale terminal market is expected to grow rapidly in the coming years. SMEs are increasingly turning to affordable, cloud-based POS systems that are easy to deploy and manage, offering them a cost-effective alternative to traditional on-premise solutions. Cloud-based POS systems are particularly appealing because they offer scalability, remote management, and automatic updates without the need for extensive IT infrastructure or expertise.

The point-of-sale terminal market in Germany held a substantial market share in 2024. The increasing use of online shopping and contactless payment methods are increasingly contributing to the growth of the point-of-sale terminal market in the Germany.

Asia Pacific Point-of-Sale Terminal Market Trends

Asia Pacific is expected to register the highest CAGR of 9.5% from 2025 to 2030 due to the growth of the retail sector, both in physical stores and e-commerce. Retailers across the region are upgrading their POS infrastructure to provide better customer service, enhance the shopping experience, and integrate online and offline operations seamlessly. The rise of omnichannel retailing, where businesses aim to deliver a unified experience across physical stores, mobile apps, and e-commerce platforms, has increased demand for POS systems capable of synchronizing inventory, orders, and customer data across multiple channels.

The Japan point-of-sale terminal market is expected to grow rapidly in the coming years. Japan’s smart city and digital infrastructure development is creating new opportunities for the POS terminal market. As urban areas become more connected, with an emphasis on IoT (Internet of Things) and AI technologies, the demand for POS systems that can integrate seamlessly with smart city initiatives is rising.

The point-of-sale terminal market in China held a substantial market share in 2024. The Chinese government has been actively promoting cashless payments and the digitalization of financial services, which has led to an increase in POS terminal installations across various sectors, including retail, hospitality, and healthcare. Regulations that require businesses to comply with data security standards and payment industry certifications are also pushing the adoption of more secure and advanced POS systems.

Key Point-of-Sale Terminal Company Insights

Key players operating in the point-of-sale terminal industry are NCR VOYIX, Oracle Corporation, Toast, Inc., payabl, Revel Systems, and TouchBistro. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

In February 2025, NCR Voyix announced a strategic agreement with Worldpay, a UK-based provider of payment technology, to deliver a unified cloud-based software and payment solution tailored for retailers and restaurants. Through this partnership, NCR Voyix aims to integrate Worldpay’s advanced payment acquiring services into its offerings, enabling customers to access a seamless, all-in-one platform for both software management and payment processing.

In July 2024, Shift4, the parent company of Revel Systems, acquired a majority share in Vectron Systems AG, a European provider of point-of-sale (POS) systems for the restaurant and hospitality sectors. This strategic move is set to significantly expand Shift4's presence across the European market, granting access to Vectron’s extensive customer base and a robust distribution network comprising approximately 300 POS resellers.

In September 2023, POSaBIT Inc., point-of-sale system provider, launched POSaBIT POS 2.0. POSaBIT POS 2.0 is a scalable, agile, and user-friendly solutions that can adapt to changing market conditions.

Key Point-of-Sale Terminal Companies:

The following are the leading companies in the point-of-sale terminal market. These companies collectively hold the largest market share and dictate industry trends.

- Acumera, Inc.

- AURES Group

- HP Development Company, L.P.

- Ingenico

- NCR Voyix

- Oracle Corporation

- POSaBIT Inc.

- Presto Phoenix Inc.

- Revel Systems

- Square

- Toast, Inc.

- Toshiba Global Commerce Solutions

- TouchBistro

- Verifone

- Xenial, Inc.

Point-of-Sale Terminal Market Report Scope

Report Attribute

Details

Market size in 2025

USD 123.15 billion

Revenue forecast in 2030

USD 181.47 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, component, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Acumera, Inc.; AURES Group; HP Development Company, L.P.; Ingenico; NCR Voyix; Oracle Corporation; POSaBIT Inc.; Presto Phoenix Inc.; Revel Systems; Square; Toast, Inc.; Toshiba Global Commerce Solutions; TouchBistro; Verifone; Xenial, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point-of-Sale Terminal Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point-of-sale terminal market report based on product, component, deployment, end-use, and region.

Product Outlook (Revenue, USD Billion, 2018 - 2030)

Fixed

Kiosks

Others

Mobile

Tablet

Others

Component Outlook (Revenue, USD Billion, 2018 - 2030)

Hardware

Software

Services

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

Cloud

On-premise

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

Restaurants

FSR

Fine Dine

Casual Dine

QSR

Drive-Thru

Others

Institutional

Fast Casual

Drive-Thru

Others

Others

Retail

Supermarkets/Hypermarkets

Convenience Stores

Grocery Stores

Specialty Stores

Gas Stations

Others

Hospitality

Spas

Hotels

Resorts

Healthcare

Pharmacies

Others

Warehouse

Entertainment

Cruise Lines/Ships

Cinema

Casinos

Golf Clubs

Stadiums

Amusement Parks

Others

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

U.K.

Germany

France

Asia Pacific

China

India

Japan

Australia

South Korea

Latin America

Brazil

Middle East & Africa

UAE

Saudi Arabia

South Africa

Frequently Asked Questions About This Report

b. The global point-of-sale terminal market size was estimated at USD 113.38 billion in 2024 and is expected to reach USD 123.15 billion in 2025.

b. The global point-of-sale terminal market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 181.47 billion by 2030.

b. The fixed segment dominated the market and accounted for the revenue share of over 58.0% in 2024. The fixed POS segment is divided into kiosks and others. Large-scale vendors often opt for fixed POS terminals, driven by their substantial procurement and installation investments, which continue to support the growth of this segment.

b. The hardware segment dominated the market and accounted for the revenue share of over 62.0% in 2024. The upgrading of legacy systems in developing regions is a significant growth driver. Small and medium-sized enterprises (SMEs), especially in emerging markets across Asia Pacific, Latin America, and Africa, are moving away from traditional cash registers to modern POS systems due to government initiatives promoting digitalization, financial inclusion, and formalization of unorganized retail.

b. The on-premise segment dominated the market and accounted for the revenue share of over 71.0% in 2024 due to the requirement for greater control, customization, and data ownership. Businesses in sectors such as high-end retail, hospitality, and healthcare often prefer on-premise deployments due to the sensitive nature of their data and the need for tailored system configurations that align closely with unique operational workflows.

b. The retail segment dominated the market and accounted for the revenue share of over 29.0% in 2024 due to the global expansion of both brick-and-mortar and e-commerce retail operations. In addition to the rise of online shopping, physical retail stores remain crucial for customer engagement and experiential marketing.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Methodology segmentation & scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Point-of-Sale Terminal Variables, Trends & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.2. Market Restraints Analysis

3.3.3. Industry Opportunities

3.4. Point-of-Sale Terminal Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

Chapter 4. Point-of-Sale Terminal Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Point-of-Sale Terminal: Product Movement Analysis, 2024 & 2030 (USD Billion)

4.3. Fixed

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.2. Kiosks

4.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.3. Others

4.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Mobile

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2. Tablet

4.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.3. Others

4.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Point-of-Sale Terminal Market: Component Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Point-of-Sale Terminal: Component Movement Analysis, 2024 & 2030 (USD Billion)

5.3. Hardware

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Software

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Services

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Point-of-Sale Terminal Market: Deployment Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Point-of-Sale Terminal: Deployment Movement Analysis, 2024 & 2030 (USD Billion)

6.3. Cloud

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. On-premise

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Point-of-Sale Terminal Market: End Use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Point-of-Sale Terminal: End Use Movement Analysis, 2024 & 2030 (USD Billion)

7.3. Restaurants

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2. FSR

7.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2.2. Fine Dine

7.3.2.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2.3. Casual Dine

7.3.2.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.3. QSR

7.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.3.2. Drive-Thru

7.3.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.3.3. Others

7.3.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.4. Institutional

7.3.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5. Fast Casual

7.3.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5.2. Drive-Thru

7.3.5.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5.3. Others

7.3.5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.6. Others

7.3.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Retail

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.2. Supermarkets/Hypermarkets

7.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.3. Convenience Stores

7.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.4. Grocery Stores

7.4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.5. Specialty Stores

7.4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.6. Gas Stations

7.4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.7. Others

7.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Hospitality

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.2. Spas

7.5.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.3. Hotels

7.5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.4. Resorts

7.5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Healthcare

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.2. Pharmacies

7.6.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.3. Others

7.6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Warehouse

7.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Entertainment

7.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.2. Cruise Lines/Ships

7.8.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.3. Cinema

7.8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.4. Casinos

7.8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.5. Golf Clubs

7.8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.6. Stadiums

7.8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.7. Amusement Parks

7.8.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. Others

7.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Point-of-Sale Terminal Market: Regional Estimates & Trend Analysis

8.1. Point-of-Sale Terminal Share, By Region, 2024 & 2030 (USD Billion)

8.2. North America

8.2.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.2.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.2.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.2.6. U.S.

8.2.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.6.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.2.6.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.2.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.2.7. Canada

8.2.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.7.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.2.7.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.2.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.2.8. Mexico

8.2.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.8.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.2.8.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.2.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.2.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3. Europe

8.3.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.3.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.3.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3.6. UK

8.3.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.6.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.3.6.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.3.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3.7. Germany

8.3.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.7.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.3.7.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.3.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.3.8. France

8.3.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.8.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.3.8.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.3.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.3.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4. Asia Pacific

8.4.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.4.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.4.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.6. China

8.4.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.6.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.4.6.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.4.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.7. India

8.4.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.7.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.4.7.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.4.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.8. Japan

8.4.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.8.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.4.8.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.4.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.9. Australia

8.4.9.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.9.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.4.9.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.4.9.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.9.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.4.10. South Korea

8.4.10.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.10.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.4.10.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.4.10.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.4.10.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.5. Latin America

8.5.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.5.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.5.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.5.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.5.6. Brazil

8.5.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.6.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.5.6.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.5.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.5.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6. Middle East & Africa

8.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.6.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6.6. Saudi Arabia

8.6.6.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.6.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.6.6.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.6.6.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.6.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6.7. UAE

8.6.7.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.7.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.6.7.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.6.7.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.7.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

8.6.8. South Africa

8.6.8.1. Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.8.2. Market estimates and forecast by product, 2018 - 2030 (Revenue, USD Billion)

8.6.8.3. Market estimates and forecast by component, 2018 - 2030 (Revenue, USD Billion)

8.6.8.4. Market estimates and forecast by deployment, 2018 - 2030 (Revenue, USD Billion)

8.6.8.5. Market estimates and forecast by end use, 2018 - 2030 (Revenue, USD Billion)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Share Analysis

9.4. Company Heat Map Analysis

9.5. Strategy Mapping

9.5.1. Expansion

9.5.2. Mergers & Acquisition

9.5.3. Partnerships & Collaborations

9.5.4. New Product Launches

9.5.5. Research And Development

9.6. Company Profiles

9.6.1. Acumera, Inc.

9.6.1.1. Participant’s Overview

9.6.1.2. Financial Performance

9.6.1.3. Product Benchmarking

9.6.1.4. Recent Developments

9.6.2. AURES Group

9.6.2.1. Participant’s Overview

9.6.2.2. Financial Performance

9.6.2.3. Product Benchmarking

9.6.2.4. Recent Developments

9.6.3. HP Development Company, L.P.

9.6.3.1. Participant’s Overview

9.6.3.2. Financial Performance

9.6.3.3. Product Benchmarking

9.6.3.4. Recent Developments

9.6.4. Ingenico

9.6.4.1. Participant’s Overview

9.6.4.2. Financial Performance

9.6.4.3. Product Benchmarking

9.6.4.4. Recent Developments

9.6.5. NCR Voyix

9.6.5.1. Participant’s Overview

9.6.5.2. Financial Performance

9.6.5.3. Product Benchmarking

9.6.5.4. Recent Developments

9.6.6. Oracle Corporation

9.6.6.1. Participant’s Overview

9.6.6.2. Financial Performance

9.6.6.3. Product Benchmarking

9.6.6.4. Recent Developments

9.6.7. POSaBIT Inc.

9.6.7.1. Participant’s Overview

9.6.7.2. Financial Performance

9.6.7.3. Product Benchmarking

9.6.7.4. Recent Developments

9.6.8. Presto Phoenix Inc.

9.6.8.1. Participant’s Overview

9.6.8.2. Financial Performance

9.6.8.3. Product Benchmarking

9.6.8.4. Recent Developments

9.6.9. Revel Systems

9.6.9.1. Participant’s Overview

9.6.9.2. Financial Performance

9.6.9.3. Product Benchmarking

9.6.9.4. Recent Developments

9.6.10. Square

9.6.10.1. Participant’s Overview

9.6.10.2. Financial Performance

9.6.10.3. Product Benchmarking

9.6.10.4. Recent Developments

9.6.11. Toast, Inc.

9.6.11.1. Participant’s Overview

9.6.11.2. Financial Performance

9.6.11.3. Product Benchmarking

9.6.11.4. Recent Developments

9.6.12. Toshiba Global Commerce Solutions

9.6.12.1. Participant’s Overview

9.6.12.2. Financial Performance

9.6.12.3. Product Benchmarking

9.6.12.4. Recent Developments

9.6.13. TouchBistro

9.6.13.1. Participant’s Overview

9.6.13.2. Financial Performance

9.6.13.3. Product Benchmarking

9.6.13.4. Recent Developments

9.6.14. Verifone

9.6.14.1. Participant’s Overview

9.6.14.2. Financial Performance

9.6.14.3. Product Benchmarking

9.6.14.4. Recent Developments

9.6.15. Xenial, Inc.

9.6.15.1. Participant’s Overview

9.6.15.2. Financial Performance

9.6.15.3. Product Benchmarking

9.6.15.4. Recent Developments

List of Tables

Table 1 List of Abbreviation

Table 2 Global point-of-sale terminal market, 2018 - 2030 (USD Billion)

Table 3 Global point-of-sale terminal market, by region, 2018 - 2030 (USD Billion)

Table 4 Global point-of-sale terminal market, by product, 2018 - 2030 (USD Billion)

Table 5 Global point-of-sale terminal market, by component, 2018 - 2030 (USD Billion)

Table 6 Global point-of-sale terminal market, by deployment, 2018 - 2030 (USD Billion)

Table 7 Global point-of-sale terminal market, by end use, 2018 - 2030 (USD Billion)

Table 8 Global fixed market by region, 2018 - 2030 (USD Billion)

Table 9 Global kiosks market by region, 2018 - 2030 (USD Billion)

Table 10 Global others market by region, 2018 - 2030 (USD Billion)

Table 11 Global mobile market by region, 2018 - 2030 (USD Billion)

Table 12 Global tablet market by region, 2018 - 2030 (USD Billion)

Table 13 Global others market by region, 2018 - 2030 (USD Billion)

Table 14 Global hardware market by region, 2018 - 2030 (USD Billion)

Table 15 Global software market by region, 2018 - 2030 (USD Billion)

Table 16 Global services market by region, 2018 - 2030 (USD Billion)

Table 17 Global cloud market by region, 2018 - 2030 (USD Billion)

Table 18 Global on-premise market by region, 2018 - 2030 (USD Billion)

Table 19 Global restaurants market by region, 2018 - 2030 (USD Billion)

Table 20 Global FSR market by region, 2018 - 2030 (USD Billion)

Table 21 Global fine dine market by region, 2018 - 2030 (USD Billion)

Table 22 Global casual dine market by region, 2018 - 2030 (USD Billion)

Table 23 Global QSR market by region, 2018 - 2030 (USD Billion)

Table 24 Global drive-thru market by region, 2018 - 2030 (USD Billion)

Table 25 Global others market by region, 2018 - 2030 (USD Billion)

Table 26 Global institutional market by region, 2018 - 2030 (USD Billion)

Table 27 Global fast casual market by region, 2018 - 2030 (USD Billion)

Table 28 Global drive-thru market by region, 2018 - 2030 (USD Billion)

Table 29 Global others market by region, 2018 - 2030 (USD Billion)

Table 30 Global others market by region, 2018 - 2030 (USD Billion)

Table 31 Global retail market by region, 2018 - 2030 (USD Billion)

Table 32 Global supermarkets/hypermarkets market by region, 2018 - 2030 (USD Billion)

Table 33 Global convenience stores market by region, 2018 - 2030 (USD Billion)

Table 34 Global grocery stores market by region, 2018 - 2030 (USD Billion)

Table 35 Global specialty stores market by region, 2018 - 2030 (USD Billion)

Table 36 Global gas stations market by region, 2018 - 2030 (USD Billion)

Table 37 Global others market by region, 2018 - 2030 (USD Billion)

Table 38 Global hospitality market by region, 2018 - 2030 (USD Billion)

Table 39 Global spas market by region, 2018 - 2030 (USD Billion)

Table 40 Global hotels market by region, 2018 - 2030 (USD Billion)

Table 41 Global resorts market by region, 2018 - 2030 (USD Billion)

Table 42 Global healthcare market by region, 2018 - 2030 (USD Billion)

Table 43 Global pharmacies market by region, 2018 - 2030 (USD Billion)

Table 44 Global others market by region, 2018 - 2030 (USD Billion)

Table 45 Global warehouse market by region, 2018 - 2030 (USD Billion)

Table 46 Global entertainment market by region, 2018 - 2030 (USD Billion)

Table 47 Global cruise lines/ships market by region, 2018 - 2030 (USD Billion)

Table 48 Global cinema market by region, 2018 - 2030 (USD Billion)

Table 49 Global casinos market by region, 2018 - 2030 (USD Billion)

Table 50 Global golf clubs market by region, 2018 - 2030 (USD Billion)

Table 51 Global stadiums market by region, 2018 - 2030 (USD Billion)

Table 52 Global amusement parks market by region, 2018 - 2030 (USD Billion)

Table 53 Global others market by region, 2018 - 2030 (USD Billion)

Table 54 North America point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 55 North America point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 56 North America point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 57 North America point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 58 U.S. point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 59 U.S. point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 60 U.S. point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 61 U.S. point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 62 Canada point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 63 Canada point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 64 Canada point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 65 Canada point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 66 Mexico point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 67 Mexico point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 68 Mexico point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 69 Mexico point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 70 Europe point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 71 Europe point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 72 Europe point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 73 Europe point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 74 UK point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 75 UK point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 76 UK point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 77 UK point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 78 Germany point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 79 Germany point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 80 Germany point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 81 Germany point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 82 France point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 83 France point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 84 France point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 85 France point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 86 Asia Pacific point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 87 Asia Pacific point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 88 Asia Pacific point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 89 Asia Pacific point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 90 China point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 91 China point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 92 China point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 93 China point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 94 India point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 95 India point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 96 India point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 97 India point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 98 Japan point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 99 Japan point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 100 Japan point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 101 Japan point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 102 Australia point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 103 Australia point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 104 Australia point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 105 Australia point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 106 South Korea point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 107 South Korea point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 108 South Korea point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 109 South Korea point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 110 Latin America point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 111 Latin America point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 112 Latin America point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 113 Latin America point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 114 Brazil point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 115 Brazil point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 116 Brazil point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 117 Brazil point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 118 Middle East & Africa point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 119 Middle East & Africa point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 120 Middle East & Africa point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 121 Middle East & Africa point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 122 UAE point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 123 UAE point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 124 UAE point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 125 UAE point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 126 Saudi Arabia point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 127 Saudi Arabia point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 128 Saudi Arabia point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 129 Saudi Arabia point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

Table 130 South Africa point-of-sale terminal market, by product 2018 - 2030 (USD Billion)

Table 131 South Africa point-of-sale terminal market, by component 2018 - 2030 (USD Billion)

Table 132 South Africa point-of-sale terminal market, by deployment 2018 - 2030 (USD Billion)

Table 133 South Africa point-of-sale terminal market, by end use 2018 - 2030 (USD Billion)

List of Figures

Fig. 1 Point-of-Sale Terminal Market Segmentation

Fig. 2 Market landscape

Fig. 3 Information Procurement

Fig. 4 Data Analysis Models

Fig. 5 Market Formulation and Validation

Fig. 6 Data Validating & Publishing

Fig. 7 Market Snapshot

Fig. 8 Segment Snapshot

Fig. 9 Competitive Landscape Snapshot

Fig. 10 Point-of-Sale Terminal: Industry Value Chain Analysis

Fig. 11 Point-of-Sale Terminal: Market Dynamics

Fig. 12 Point-of-Sale Terminal: PORTER’s Analysis

Fig. 13 Point-of-Sale Terminal: PESTEL Analysis

Fig. 14 Point-of-Sale Terminal Share by Product, 2024 & 2030 (USD Billion)

Fig. 15 Point-of-Sale Terminal, by Product: Market Share, 2024 & 2030

Fig. 16 Fixed Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 17 Kiosks Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 18 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 19 Mobile Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 20 Tablet Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 21 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 22 Point-of-Sale Terminal Share by Component, 2024 & 2030 (USD Billion)

Fig. 23 Point-of-Sale Terminal, by Component: Market Share, 2024 & 2030

Fig. 24 Hardware Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 25 Software Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 26 Services Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 27 Point-of-Sale Terminal Share by Deployment, 2024 & 2030 (USD Billion)

Fig. 28 Point-of-Sale Terminal, by Deployment: Market Share, 2024 & 2030

Fig. 29 Cloud Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 30 On-premise Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 31 Point-of-Sale Terminal Share by End Use, 2024 & 2030 (USD Billion)

Fig. 32 Point-of-Sale Terminal, by End Use: Market Share, 2024 & 2030

Fig. 33 Restaurants Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 34 FSR Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 35 Fine Dine Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 36 Casual Dine Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 37 QSR Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 38 Drive-Thru Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 39 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 40 Institutional Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 41 Fast Casual Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 42 Drive-Thru Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 43 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 44 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 45 Retail Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 46 Supermarkets/Hypermarkets Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 47 Convenience Stores Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 48 Grocery Stores Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 49 Specialty Stores Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 50 Gas Stations Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 51 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 52 Hospitality Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 53 Spas Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 54 Hotels Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 55 Resorts Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 56 Healthcare Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 57 Pharmacies Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 58 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 59 Warehouse Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 60 Entertainment Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 61 Cruise Lines/Ships Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 62 Cinema Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 63 Casinos Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 64 Golf Clubs Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 65 Stadiums Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 66 Amusement Parks Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 67 Others Market Estimates and Forecasts, 2018 - 2030 (Revenue, USD Billion)

Fig. 68 Regional Market place: Key Takeaways

Fig. 69 North America Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 70 U.S. Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 71 Canada Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 72 Mexico Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 73 Europe Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 74 UK Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030) (USD Billion)

Fig. 75 Germany Point-of-Sale Terminal Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 76 France Point-of-Sale Terminal Market Estimates and Forecasts, (2018 - 2030) (USD Billion)

Fig. 77 Asia Pacific Point-of-Sale Terminal Market Estimates and Forecast, 2018 - 2030 (USD Billion)

Fig. 78 China Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 79 India Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 80 Japan Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 81 Australia Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 82 South Korea Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 83 Latin America Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 84 Brazil Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 85 MEA Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 86 Saudi Arabia Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 87 UAE Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 88 South Africa Point-of-Sale Terminal Market Estimates and Forecasts, 2018 - 2030 (USD Billion)

Fig. 89 Key Company Categorization

Fig. 90 Company Market Positioning

Fig. 91 Key Company Market Share Analysis, 2024

Fig. 92 Strategic FrameworkWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- POS Terminal Product Outlook (Revenue, USD Billion, 2018 - 2030)

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- POS Terminal Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Hardware

- Software

- Services

- POS Terminal Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

- Cloud

- On-premise

- POS Terminal End-use Outlook (Revenue, USD Billion, 2018 - 2030)

- Restaurants

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurants

- POS Terminal Region Outlook (Revenue, USD Billion, 2018 - 2030)

- North America

- North America POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- North America POS Terminals Market, by Component

- Hardware

- Software

- Services

- North America POS Terminals Market, by Deployment

- Cloud

- On-premise

- North America POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- U.S.

- U.S. POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- U.S. POS Terminals Market, by Component

- Hardware

- Software

- Services

- U.S. POS Terminals Market, by Deployment

- Cloud

- On-premise

- U.S. POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- U.S. POS Terminals Market, by Product

- Canada

- Canada POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Canada POS Terminals Market, by Component

- Hardware

- Software

- Services

- Canada POS Terminals Market, by Deployment

- Cloud

- On-premise

- Canada POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- Canada POS Terminals Market, by Product

- Mexico

- Mexico POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Mexico POS Terminals Market, by Component

- Hardware

- Software

- Services

- Mexico POS Terminals Market, by Deployment

- Cloud

- On-premise

- Mexico POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- Mexico POS Terminals Market, by Product

- North America POS Terminals Market, by Product

- Europe

- Europe POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Europe POS Terminals Market, by Component

- Hardware

- Software

- Services

- Europe POS Terminals Market, by Deployment

- Cloud

- On-premise

- Europe POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- U.K.

- U.K. POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- U.K. POS Terminals Market, by Component

- Hardware

- Software

- Services

- U.K. POS Terminals Market, by Deployment

- Cloud

- On-premise

- U.K. POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- U.K. POS Terminals Market, by Product

- Germany

- Germany POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Germany POS Terminals Market, by Component

- Hardware

- Software

- Services

- Germany POS Terminals Market, by Deployment

- Cloud

- On-premise

- Germany POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- Germany POS Terminals Market, by Product

- France

- France POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- France POS Terminals Market, by Component

- Hardware

- Software

- Services

- France POS Terminals Market, by Deployment

- Cloud

- On-premise

- France POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- France POS Terminals Market, by Product

- Europe POS Terminals Market, by Product

- Asia Pacific

- Asia Pacific POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Asia Pacific POS Terminals Market, by Component

- Hardware

- Software

- Services

- Asia Pacific POS Terminals Market, by Deployment

- Cloud

- On-premise

- Asia Pacific POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- China

- China POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- China POS Terminals Market, by Component

- Hardware

- Software

- Services

- China POS Terminals Market, by Deployment

- Cloud

- On-premise

- China POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- China POS Terminals Market, by Product

- India

- India POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- India POS Terminals Market, by Component

- Hardware

- Software

- Services

- India POS Terminals Market, by Deployment

- Cloud

- On-premise

- India POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- India POS Terminals Market, by Product

- Japan

- Japan POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Japan POS Terminals Market, by Component

- Hardware

- Software

- Services

- Japan POS Terminals Market, by Deployment

- Cloud

- On-premise

- Japan POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- Japan POS Terminals Market, by Product

- Australia

- Australia POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Australia POS Terminals Market, by Component

- Hardware

- Software

- Services

- Australia POS Terminals Market, by Deployment

- Cloud

- On-premise

- Australia POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- Australia POS Terminals Market, by Product

- South Korea

- South Korea POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- South Korea POS Terminals Market, by Component

- Hardware

- Software

- Services

- South Korea POS Terminals Market, by Deployment

- Cloud

- On-premise

- South Korea POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- South Korea POS Terminals Market, by Product

- Asia Pacific POS Terminals Market, by Product

- Latin America

- Latin America POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Latin America POS Terminals Market, by Component

- Hardware

- Software

- Services

- Latin America POS Terminals Market, by Deployment

- Cloud

- On-premise

- Latin America POS Terminals Market, by End-use

- Restaurant

- FSR

- Fine Dine

- Casual Dine

- QSR

- Drive-Thru

- Others

- Institutional

- Fast Casual

- Drive-Thru

- Others

- Others

- FSR

- Retail

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Specialty Stores

- Gas Stations

- Others

- Hospitality

- Spas

- Hotels

- Resorts

- Healthcare

- Pharmacies

- Others

- Warehouse

- Entertainment

- Cruise Lines/Ships

- Cinemas

- Casinos

- Golf Clubs

- Stadiums

- Amusement Parks

- Others

- Restaurant

- Brazil

- Brazil POS Terminals Market, by Product

- Fixed

- Kiosks

- Others

- Mobile

- Tablet

- Others

- Fixed

- Brazil POS Terminals Market, by Component

- Hardware

- Software

- Services

- Brazil POS Terminals Market, by Deployment

- Cloud

- On-premise