- Home

- »

- Advanced Interior Materials

- »

-

Screw Compressor Rental Market Size, Industry Report 2030GVR Report cover

![Screw Compressor Rental Market Size, Share & Trends Report]()

Screw Compressor Rental Market Size, Share & Trends Analysis Report By Type (Stationary, Portable), By Lubrication (Oil-Filled Compressor, Oil-Free Compressor), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-356-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Screw Compressor Rental Market Summary

The global screw compressor rental market size was valued at USD 4.01 billion in 2024 and is projected to reach USD 5.18 billion by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The market is expected to grow with a combination of industry needs and broader economic trends.

Key Market Trends & Insights

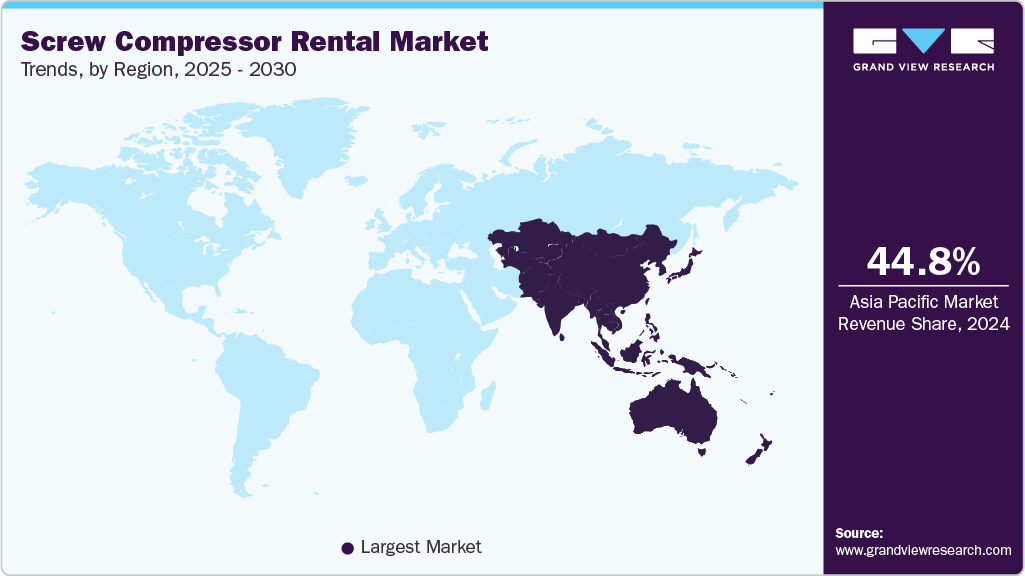

- Asia Pacific led the market and accounted for a revenue share of 44.8% in 2024.

- By type, the stationary type segment led the market, accounting for 58.3% of the global revenue share in 2024.

- By lubrication, the oil-filled segment accounted for 61.6% of the global market revenue share in 2024.

- By end use, the manufacturing end-use segment accounted for 40.1% of the global market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.01 Billion

- 2030 Projected Market Size: USD 5.18 Billion

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

Many industries require compressed air for short-term or project-based operations, where investing in a permanent compressor is not cost-effective. This is particularly prevalent in construction, mining, and oil & gas exploration projects, where the site may be operational for a limited time, making rentals a more viable option. Moreover, increasing emphasis on energy-efficient operations and the rise of industries where compressed air is critical. Additionally, technological advancements that enhance the performance, energy efficiency, or environmental footprint of screw compressors can expand the rental market by increasing the scope of Lubrication. The market is significantly influenced by industrial Lubrications, such as in the food and automotive industries, where compressed air is indispensable. The food industry relies on compressed air for various processes, including pneumatic conveying of ingredients, packaging, product handling, and refrigeration. Screw compressors are favored for their reliability and ability to provide oil-free air, ensuring the safety and hygiene of food products. Segments within the food industry, such as agricultural produce processing or seasonal food products, experience peak periods when there is a temporary need for additional compressed air capacity. Renting screw compressors offers a flexible solution to meet these seasonal demands without the need for permanent investment. The above factors are expected to positively influence the growth of the screw compressor rental market.

Automotive manufacturing processes, from assembly lines to painting and quality control, rely heavily on compressed air. Screw compressors are essential to ensure that these processes run smoothly and efficiently. The rental market caters to the automotive industry's need for high reliability and energy efficiency, especially during increased production or in setting up new production lines. The logistical aspects of delivering, installing, and maintaining rented screw compressors, especially in remote or challenging environments, can be significant. Additionally, ensuring that the compressors are properly maintained and quickly repaired when issues arise requires a substantial investment in service capabilities and can strain resources.

Market Concentration & Characteristics

The screw compressor market represents a specialized yet essential segment within the broader advanced materials and industrial equipment landscape, with its growth primarily driven by rising demand from the food processing and automotive industries. In the food sector, screw compressors play a critical role in processes such as pneumatic conveying of ingredients, packaging operations, product handling, and refrigeration, where clean, reliable, and continuous compressed air supply is essential. The automotive industry similarly relies on screw compressors for various manufacturing and assembly Lubrications.

The screw compressor rental market is characterized by a fragmented structure, as a wide range of regional and local service providers are offering rental services to meet the increasing demand for flexible, short-term compressor solutions. The market is in a relatively early stage of growth, though the pace of expansion is accelerating due to rising demand across various end-use industries. Innovation remains low, with technological advancements primarily focused on improving energy efficiency, reducing carbon emissions, and incorporating smart technologies such as IoT-enabled monitoring and predictive maintenance. These enhancements aim to optimize operational performance, minimize downtime, and reduce the total cost of ownership for users.

Merger and acquisition activity in the market is low to medium, with fewer large-scale strategic consolidations observed than in more mature industrial sectors. Regulatory impact is assessed as low to medium, depending on the region, with environmental and energy efficiency standards exerting a moderate influence on product offerings and adoption rates. The threat of product substitution is mild, as alternative compressor technologies may be viable for niche lubrications but generally fall short in efficiency, durability, and reliability in continuous, heavy-duty operations.

The market displays medium to high concentration among end users, driven by demand across various industries, such as construction, oil and gas, manufacturing, mining, and utilities. Each sector requires customized rental solutions aligned with specific operational conditions and compliance requirements. This extensive lubrication range continues to underscore the critical role of screw compressors in supporting industrial processes and infrastructure reliability.

Type Insights

The stationary type segment led the market, accounting for 58.3% of the global revenue share in 2024. The stationary market is strengthened by industries that require a continuous and reliable supply of compressed air but prefer not to incur the high capital and maintenance costs associated with ownership. The demand for flexible air supply solutions, the reluctance to invest in expensive machinery, the need for temporary air supply solutions during peak periods or for project-based work, and the desire for updated technology without the associated costs involved in purchasing are key factors contributing to the growth of this segment.

The portable segment caters to various Lubrications requiring flexibility and mobility in compressed air supply, from construction sites and road work to mining operations and outdoor events. This market thrives on the versatility of portable screw compressors, which are designed to be easily transported and quickly deployed in various field conditions, offering on-demand, efficient, and reliable air power. Key factors driving this market include the need for temporary and emergency air supply solutions, the rise in infrastructure projects & seasonal demand in industries such as agriculture and event management, and the avoidance of capital expenditure on equipment that may not be in constant use.

Lubrication Insights

The oil-filled segment accounted for 61.6% of the global market revenue share in 2024. The oil-filled market serves industries where high-quality, reliable compressed air is crucial, including manufacturing, automotive, and energy sectors, where oil-lubricated compressors are favored for their efficiency and durability. Key factors driving the growth of this segment include the demand for compressors that provide stable and continuous air flow with a lower risk of thermal degradation, particularly in heavy-duty and high-temperature industrial Lubrications. In addition, the flexibility of renting allows businesses to manage capital expenditure more effectively, adapt to fluctuating market demands, and ensure production continuity during maintenance or unexpected downtime.

The oil-free segment is driven by industries that require high-quality, contaminant-free compressed air, such as pharmaceuticals, food & beverage, electronics, and healthcare. These industries value the oil-free screw compressors for their ability to deliver clean air, which is crucial for maintaining product purity and safety standards. A significant feature of this market is the emphasis on environmental compliance and energy efficiency, as oil-free compressors eliminate oil waste and reduce the risk of contamination, aligning with stringent regulatory standards for air quality. The flexibility of rental arrangements allows businesses to adjust to seasonal demands, temporary surge in production, or project-specific needs without heavy investment in permanent equipment.

End Use Insights

The manufacturing end-use segment accounted for 40.1% of the global market revenue share in 2024. The screw compressor is a crucial component of the manufacturing industry, providing flexible, cost-effective solutions for a wide range of air compression needs. A key feature of this market is the ability to offer manufacturers short-term and scalable air supply solutions, enabling them to overcome periods of increased demand or maintain productivity during equipment maintenance without the need for capital investment in additional permanent units. Moreover, the rental market caters to the industry's evolving needs by providing access to the latest compressor technologies, including oil-free and variable-speed models, which offer enhanced performance and environmental benefits.

The oil & gas segment is expected to grow at a significant pace, with the screw compressor rental market playing a pivotal role in supporting various operational demands, including exploration, drilling, production, and maintenance activities, wherein reliable, high-capacity compressed air solutions are required. These compressors are critical for a range of Lubrications, including pipeline testing, underbalanced drilling, gas lift, and flare gas recovery, where their efficiency and durability under harsh operating conditions are highly valued. One of the key features of this market is the provision of rugged, portable screw compressors that can be quickly deployed to remote or offshore locations, offering flexibility and reducing downtime during critical operations.

Regional Insights

The North America screw compressor rental market is expected to reach 875.4 million by 2030. The region is characterized by a strong demand, driven by various sectors including construction, manufacturing, oil & gas, and the burgeoning renewable energy sector. This market benefits from the region's advanced industrial base and the continuous push for innovation and efficiency improvements in operational processes. Its emphasis on sustainability and environmental compliance has led to increased adoption of oil-free screw compressors that minimize the risk of air contamination and are in line with strict environmental regulations.

U.S. Screw Compressor Rental Market

U.S. accounted for largest share of the regional screw compressor rental market in 2024. The U.S. screw compressor rental market is expected to maintain strong growth, fueled by sustained demand across key industries and the increasing adoption of advanced technologies that improve equipment performance and reliability. The rapidly growing construction sector in the U.S. plays a major role in driving demand for screw compressor rentals. Contractors often opt to rent compressors to fulfill short-term requirements, avoiding the high upfront costs associated with purchasing equipment.

Europe Screw Compressor Rental Market Trends

Europe screw compressor rental market is estimated to grow at a consistent CAGR over the forecast period, driven by the focus on energy efficiency, environmental sustainability, and advanced manufacturing and construction sectors. Europe's stringent environmental regulations have encouraged the adoption of oil-free screw compressors, which are preferred for their lower environmental impact and capability to provide clean, contamination-free air, crucial for industries such as pharmaceuticals, food & beverage, and electronics manufacturing. In addition to environmental considerations, the demand for rental screw compressors in Europe is bolstered by the need for flexibility in capital expenditure, allowing businesses to scale operations according to project demands without heavy investment in purchasing equipment.

Asia Pacific Screw Compressor Rental Market Trends

Asia Pacific led the market and accounted for a revenue share of 44.8% in 2024, driven by rapid industrialization, infrastructure development, and expansion of manufacturing activities across countries, including China, India, Japan, and Southeast Asia. This region benefits from a robust demand for flexible, cost-effective compressed air solutions in automotive, electronics, construction, and oil & gas industries. Screw compressors are valued for their efficiency, reliability, and ability to provide consistent air quality. Features that distinguish the Asia Pacific market include a strong emphasis on energy efficiency and environmental sustainability, prompting a shift toward oil-free screw compressors that meet stringent air quality standards. For instance, India's food processing sector's market size is estimated to grow from USD 307 billion in 2023 to USD 700 billion in 2030, driving demand for compressed air systems used in packaging, cleaning, and pneumatic operations. Many companies, especially SMEs and new entrants, prefer renting screw compressors to avoid high capital costs and ensure operational flexibility. Rentals also provide quick access to equipment that is energy-efficient and compliant with food-grade Lubrications. This trend is significantly boosting the screw compressor rental market.

China Screw Compressor Rental Market

The screw compressor rental market of China is estimated to grow at a significant CAGR over the forecast period. China market is expanding, primarily fueled by the country's expansive manufacturing sector, ongoing infrastructure projects, and increasing investments in renewable energy sources. As one of the world's largest economies, China's demand for reliable and efficient compressed air solutions spans across several industries, including automotive, electronics, construction, and renewable energy sectors, which are integral to its industrial growth and development strategy. A distinctive feature of the Chinese market is its strong emphasis on technological innovation and sustainability, leading to a rising preference for energy-efficient and environmentally friendly screw compressors, particularly oil-free models that minimize contamination risks. The rental model's appeal in China lies in its flexibility, allowing businesses to scale operations without the considerable capital outlay required for purchasing new equipment.

Key Companies & Market Share Insights

Key market players strengthen their market position by adopting strategies such as joint ventures, technical collaborations, capacity expansions, and mergers and acquisitions. In addition, manufacturers enhance production efficiency by developing cost-effective, high-quality manufacturing processes.

Key Screw Compressor Rental Companies:

The following are the leading companies in the screw compressor rental market. These companies collectively hold the largest market share and dictate industry trends.

- Lewis System

- CAPS Australia

- Atlas Copco Group

- Caterpillar.

- Metro Air Compressor

- Stewart & Stevenson.

- United Rentals, Inc.

- Ingersoll Rand

- Aggreko

- Air Energy Group, LLC

- BOGE

- KAESER KOMPRESSOREN

Recent Developments

-

In March 2025, AERZEN Rental Solutions expands its U.S. footprint with new facility in Phoenix, Arizona, which enhances western region service capabilities, strengthening the delivery of reliable, efficient, and cost-effective air compression solutions, including their rental service offerings.

-

In August 2024, Hokuetsu Industries America, Corp., introduced AIRMAN PDSF750 dual-pressure air compressor. The new compressor offers exceptional flexibility and performance, especially for the rental equipment industry

Screw Compressor Rental Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.18 billion

Revenue Forecast in 2030

USD 5.18 billion

Growth Rate

CAGR of 4.4% from 2025 to 2030

The base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, Lubrication, End Use, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, South Korea, Australia, Saudi Arabia, UAE, South Africa, Brazil, Argentina

Key companies profiled

Lewis System, CAPS Australia, Atlas Copco Group, Caterpillar., Metro Air Compressor, Stewart & Stevenson., United Rentals, Inc., Ingersoll Rand, Aggreko, Air Energy Group LLC, BOGE, KAESER KOMPRESSOREN

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Screw Compressor Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global screw compressor rental market report based on type, lubrication, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Portable

-

-

Lubrication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil-filled Compressor

-

Oil-free Compressor

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare & Medical

-

Manufacturing

-

Oil & Gas

-

Mining

-

Chemical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

SouthKorea

-

Australia

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global screw compressor rental market size was estimated at USD 3.87 billion in 2023 and is expected to reach USD 4.01 billion in 2024

b. The global screw compressor rental market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 5.18 billion by 2030

b. Asia Pacific dominated the screw compressor rental market with a revenue share of 44.5% in 2023. The screw compressor rental market in the Asia Pacific region is experiencing significant growth, driven by rapid industrialization, infrastructure development, and the expansion of manufacturing activities across countries like China, India, Japan, and Southeast Asia

b. Some of the key players operating in the screw compressor rental market include Lewis System CAPS Australia, Metro Air Compressor, Stewart & Stevenson LLC, United Rentals Inc., Ingersoll-Rand plc, Aggreko plc, Atlas Copco AB, Air Energy Group LLC, Caterpillar Inc., BOGE KOMPRESSOREN Otto Boge GmbH & Co. KG, Kaeser Kompressoren SE

b. The demand for screw compressor rental market emerges from a combination of industry needs and broader economic trends. Many industries require compressed air for short-term or project-based operations, where investing in a permanent compressor is not cost-effective

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."