- Home

- »

- Advanced Interior Materials

- »

-

Sealing Membranes Market Size, Industry Report, 2030GVR Report cover

![Sealing Membranes Market Size, Share & Trends Report]()

Sealing Membranes Market Size, Share & Trends Analysis Report By Product Type (Sheet Membranes, Liquid-Applied Membranes), By End Use (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-607-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Sealing Membranes Market Summary

The global sealing membranes market size was estimated at USD 11.76 billion in 2024 and is projected to reach USD 17.16 billion by 2030, growing at a CAGR of 6.5% from 2025 to 2030, driven by factors such as rapid urbanization, stringent building codes, and technological advancements. The demand for sealing membranes is rising due to the surge in construction activities worldwide.

Key Market Trends & Insights

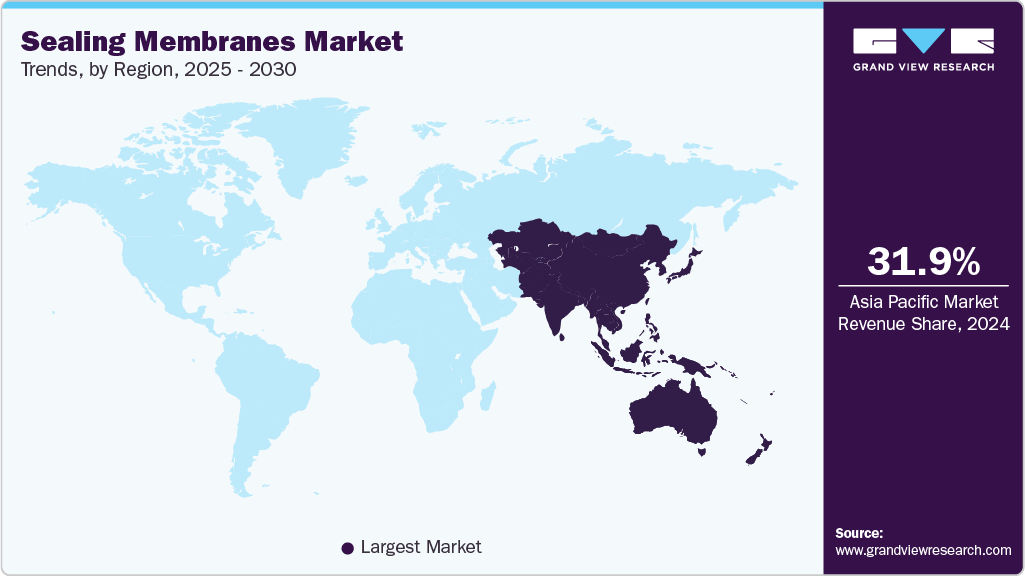

- Asia Pacific sealing membranes market dominated the global market and accounted for the largest revenue share of about 31.9 % in 2024.

- Sealing membranes market in China is a key growth engine within the Asia Pacific sealing membranes market.

- Based on product type, the liquid-applied membranes segment led the market and accounted for the largest revenue share of 65.1% in 2024

- Based on product type, the sheet membranes segment are the fastest-growing segment in the sealing membranes market

- Based on end use, the residential segment dominated the market and accounted for the largest revenue share of 44.7%, in 2024

Market Size & Forecast

- 2024 Market Size: USD 11.76 Billion

- 2030 Projected Market Size: USD 17.16 Billion

- CAGR (2025-2030): 6.5%

- Asia Pacific: Largest market in 2024

The demand for sealing membranes is rising due to the surge in construction activities worldwide. Urbanization and infrastructure development, especially in emerging economies such as India and China, necessitate durable waterproofing solutions to protect structures from water damage and enhance longevity. Additionally, the growing awareness of green building practices and the benefits of waterproofing membranes in preventing water ingress are contributing to market growth.Several factors are propelling the sealing membranes market forward. Stringent building regulations and standards require effective waterproofing to ensure structural integrity. The shift towards sustainable and energy-efficient construction practices has led to increased adoption of eco-friendly waterproofing membranes made from recycled or bio-based materials. Moreover, the integration of advanced technologies, such as nanotechnology and smart membranes with embedded sensors, is enhancing the performance and monitoring capabilities of waterproofing solutions.

Innovation plays a crucial role in the sealing membranes market. Developments include self-healing membranes that can autonomously repair minor damages, extending the lifespan of waterproofing systems. Nanotechnology-based coatings offer improved water resistance and self-healing properties, enhancing durability. Smart membranes equipped with sensors allow real-time monitoring of moisture levels, enabling proactive maintenance and reducing long-term repair costs. These advancements are meeting the evolving demands of modern construction and infrastructure projects, ensuring structures are better protected against water ingress.

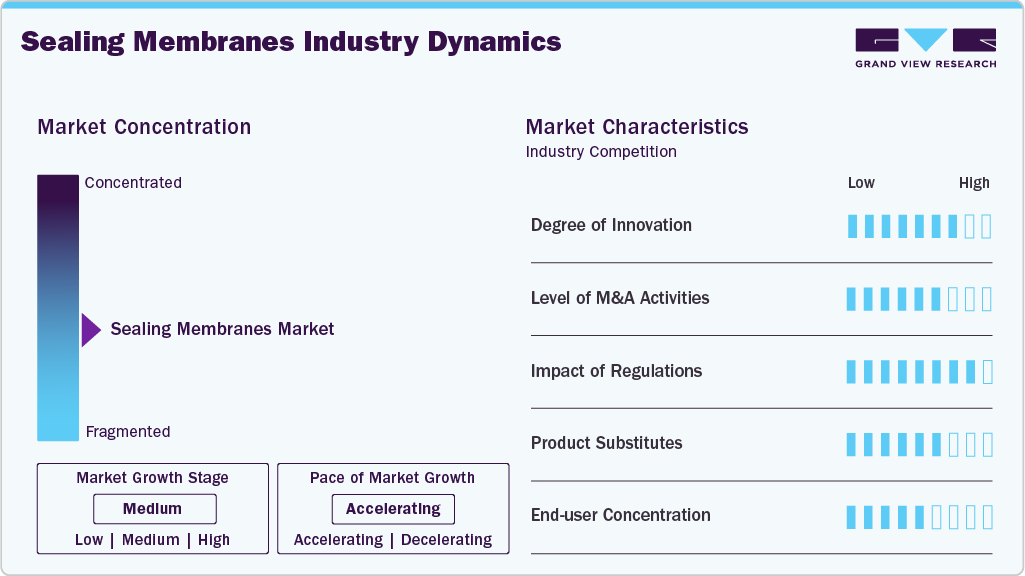

Market Concentration & Characteristics

The sealing membranes market is moderately concentrated, with a mix of global giants and regional players competing for market share. Major companies such as Sika AG, BASF SE, GCP Applied Technologies, and Mapei dominate through extensive product portfolios, strong distribution networks, and continuous investment in R&D. However, local and regional manufacturers also hold a significant share in emerging economies due to cost competitiveness and localized customer service. This mixed landscape fosters both innovation and price competition, with mergers and acquisitions further intensifying the concentration.

While sealing membranes are a primary solution for waterproofing in construction and infrastructure, several product substitutes pose competitive pressure. Alternatives such as liquid-applied membranes, waterproof coatings, bentonite clay panels, and crystalline waterproofing technologies are often considered based on cost, ease of application, and durability. These substitutes are gaining traction due to innovations that improve performance while reducing environmental impact. However, sheet-based sealing membranes still hold a competitive edge in high-performance and large-scale applications due to their proven reliability and resistance to structural movement.

Product Type Insights

The liquid-applied membranes segment led the market and accounted for the largest revenue share of 65.1% in 2024, fueled by their flexibility, seamless application, and adaptability to complex surfaces. Unlike sheet membranes, liquid membranes can easily coat irregular shapes and hard-to-reach areas, making them highly suitable for repair and refurbishment projects. Additionally, ongoing innovations in eco-friendly and fast-curing liquid formulations are driving adoption across residential and commercial sectors. This growth is further supported by rising demand for cost-effective waterproofing solutions that require less labor and time during installation.

Sheet membranes are the fastest-growing segment in the sealing membranes market, due to their proven reliability, ease of installation, and long-term durability. These prefabricated sheets made from materials such as bitumen, PVC, or thermoplastic polyolefin (TPO) provide consistent thickness and strong waterproofing performance, making them the preferred choice for large-scale construction projects such as commercial buildings, infrastructure, and roofing systems. Their capacity to accommodate structural movements and withstand harsh environmental conditions further enhances their dominance in both developed and emerging markets.

End Use Insights

The residential sector dominated the market and accounted for the largest revenue share of 44.7% in 2024, mainly due to the global rise in housing construction and renovation activities. Homeowners and builders prioritize waterproofing solutions to protect foundations, roofs, and basements from water damage, which drives steady demand for sealing membranes. Increasing awareness about the importance of moisture protection in prolonging the life of residential structures, combined with government incentives for improving housing quality, further reinforces the dominance of the residential segment.

The commercial segment is the fastest growing market for sealing membranes, propelled by expanding urban infrastructure, office complexes, retail centers, and industrial facilities. Commercial projects often demand higher-performance waterproofing solutions due to larger scale and more complex structural requirements. Additionally, stricter building codes and sustainability standards in commercial construction are pushing for advanced, durable, and eco-friendly sealing membranes. This, coupled with increased investments in commercial real estate globally, is driving rapid growth in this segment.

Regional Insights

Asia Pacific sealing membranes market dominated the global market and accounted for the largest revenue share of about 31.9 % in 2024, driven by rapid urbanization, booming construction activities, and increasing infrastructure investments in countries like China, India, and Southeast Asia. The region’s growing residential and commercial building projects, coupled with rising awareness about waterproofing and durability, have significantly boosted demand. Government initiatives promoting sustainable construction and improvements in building codes further support market growth. The presence of a large number of local manufacturers alongside international players creates a dynamic and competitive market environment in Asia Pacific.

Sealing Membranes Market in China is a key growth engine within the Asia Pacific sealing membranes market due to its massive construction industry and government focus on infrastructure modernization. Rapid urban development, expansion of industrial zones, and government mandates on environmental and building safety standards are driving widespread adoption of advanced sealing membranes. The country’s emphasis on green buildings and sustainable materials also encourages the use of eco-friendly waterproofing solutions, making China a highly lucrative market for both domestic and international sealing membrane manufacturers.

North America Sealing Membranes Market Trends

North America represents a mature yet steadily growing market for sealing membranes, characterized by high construction standards and significant renovation projects. The U.S. leads this region with stringent building codes and strong demand for sustainable and energy-efficient waterproofing products. Commercial construction, especially in sectors like healthcare, education, and retail, fuels the demand for high-performance membranes. Innovation and technological advancements by market leaders contribute to the region’s steady market expansion.

U.S. Sealing Membranes Market Trends

U.S. is the largest market in North America for sealing membranes, supported by robust residential construction, growing commercial real estate development, and renovation projects. Strict regulatory frameworks such as those enforced by the International Code Council (ICC) and sustainability certifications like LEED push the adoption of advanced and eco-friendly waterproofing membranes. Additionally, increasing investment in infrastructure repairs and flood prevention measures drives demand in both private and public sectors.

Europe Sealing Membranes Market Trends

Europe’s sealing membranes market is shaped by strict environmental regulations, a focus on energy-efficient building materials, and a high rate of refurbishment in historic and aging structures. Countries like Germany, France, and the UK lead in adopting innovative waterproofing technologies, supported by growing construction and infrastructure development. The demand for sustainable and recyclable materials is particularly strong, driving manufacturers to develop green sealing membrane solutions that comply with EU standards.

Germany sealing membranes market is growing as the country stands out as a key market in Europe due to its stringent building codes, advanced construction industry, and commitment to sustainability. The country’s emphasis on durable, energy-efficient waterproofing membranes for both new builds and renovations boosts demand. Germany’s leadership in green construction practices encourages the adoption of eco-friendly sealing membranes, making it a focal point for manufacturers investing in R&D and innovation.

Central & South America Sealing Membranes Market Trends

The Central & South America sealing membranes market is growing steadily, fueled by expanding urbanization and infrastructure development in countries like Brazil, Argentina, and Mexico. While still developing compared to North America and Europe, increasing construction projects, especially in residential and commercial sectors, are driving demand. Challenges such as economic fluctuations and regulatory variability exist, but rising awareness about waterproofing benefits and investments in sustainable building materials create positive market prospects.

Middle East & Africa Sealing Membranes Market Trends

The Middle East & Africa region is witnessing growing demand for sealing membranes, supported by rapid infrastructure projects, urban development, and commercial construction in countries like the UAE, Saudi Arabia, and South Africa. Harsh climatic conditions and the need for durable waterproofing solutions in extreme heat and occasional heavy rainfall drive market growth. Large-scale government investments in smart cities, renewable energy projects, and real estate development also boost adoption, although market maturity varies significantly across countries in this region.

Key Sealing Membranes Company Insights

Some of the key players operating in the market include Sika AG and BASF SE

-

Sika AG is a Swiss multinational specialty chemical company known for its expertise in construction chemicals and materials. It offers a broad range of products, including sealing membranes, adhesives, concrete admixtures, and roofing solutions, serving the building, civil engineering, and industrial markets worldwide.

-

BASF SE, headquartered in Germany, is one of the world’s largest chemical producers. Its construction chemicals division provides innovative waterproofing and sealing solutions, including the MasterSeal product line, catering to residential, commercial, and infrastructure projects globally.

GCP Applied Technologies Inc. and DuPont are some of the emerging market participants in the sealing membranes market.

-

GCP Applied Technologies is a global supplier of specialty construction products, including waterproofing membranes, concrete admixtures, and specialty chemicals. It is known for products like Bituthene and PREPRUFE, which are widely used in below-grade waterproofing and building envelope protection.

-

DuPont is a leading American multinational corporation specializing in science and innovation across multiple sectors including construction materials. Its portfolio includes advanced sealing membranes, protective coatings, and building materials designed to enhance durability and sustainability in construction projects.

Key Sealing Membranes Companies:

The following are the leading companies in the sealing membranes market. These companies collectively hold the largest market share and dictate industry trends.

- Sika AG

- BASF SE

- GCP Applied Technologies Inc.

- DuPont

- Pidilite Industries

- Carlisle Companies Inc.

- Hydranautics.

- Saint-Gobain Weber

- Fosroc International Limited.

- Renolit SE

Recent Developments

-

In January 2023, Sika introduced the SikaMembran Outdoor, a vapor-proofing membrane designed for exterior applications, enhancing durability and energy efficiency. The SikaMembran system is a high-performance vapor control system comprising of various EPDM sheet membranes providing vapor control layers and waterproof barriers for curtain walls.

-

In January 2020, BASF introduced the MasterSeal 730 UVS, a waterproofing membrane designed for integral sealing of below-grade structures, offering enhanced durability and UV resistance. MasterSeal 730 UVS is a pre-applied, high-density polyethylene (HDPE) sheet waterproofing membrane treated with unique pressure-sensitive adhesive and protective coating to enable good adhesion with concrete surfaces without requiring additional protective screed.

Sealing Membranes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.53 billion

Revenue forecast in 2030

USD 17.16 billion

Growth rate

CAGR of 6.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Sika AG; BASF SE; Saint-Gobain Weber; DuPont; Pidilite Industries; Carlisle Companies Inc.; Hydranautics; GCP Applied Technologies Inc.; Renolit SE; and Fosroc International Limited.

Customization scope

Free report customization (equivalent to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sealing Membranes Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sealing membranes market report based on production type, end use, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sheet Membranes

-

Liquid-Applied Membranes

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global sealing membranes market size was estimated at USD 11.76 billion in 2024 and is expected to reach USD 12.53 billion in 2025.

b. The global sealing membranes market is expected to grow at a compound annual growth rate of 6.5% from 2025 to 2030 to reach USD 17.16 billion by 2030.

b. The liquid-applied membranes segment led the market and accounted for the largest revenue share, 65.1%, in 2024, due to their flexibility, seamless application, and adaptability to complex surfaces.

b. Sika AG, BASF SE, GCP Applied Technologies Inc., DuPont, Pidilite Industries, Carlisle Companies Inc., Hydranautics, Saint-Gobain Weber, Renolit SE, and Fosroc International Limited are prominent companies in the sealing membranes market.

b. Key factors driving market demand include rapid urbanization, stringent building regulations, increasing infrastructure investments, and growing emphasis on sustainable and durable waterproofing solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."