- Home

- »

- Network Security

- »

-

Security Orchestration, Automation & Response Market Report 2030GVR Report cover

![Security Orchestration, Automation And Response Market Size, Share & Trends Report]()

Security Orchestration, Automation And Response Market Size, Share & Trends Analysis Report By Component (Solution, Services), By Application, By Deployment Mode, By Organization Size, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-108-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Security Orchestration, Automation & Response Market Summary

The global security orchestration, automation, and response market size was estimated at USD 1.72 billion in 2024 and is projected to reach USD 4.11 billion by 2030, growing at a CAGR of 15.8% from 2025 to 2030. The security orchestration, automation, and response (SOAR) market is a dynamic segment of cybersecurity focused on streamlining and automating security operations.

Key Market Trends & Insights

- North America security orchestration, automation and response market held a largest revenue share of 35.0% in 2024.

- The security orchestration, automation, and response market in the U.S. is expected to grow significantly over the forecast period.

- By component, the solution segment accounted for a market share of over 73.0% in 2024.

- By deployment mode, the cloud-based segment accounted for the largest share in 2024.

- By enterprise size, the large enterprises segment accounted for the largest share of 51.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.72 Billion

- 2030 Projected Market Size: USD 4.11 Billion

- CAGR (2025-2030): 15.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

SOAR platforms integrate various security tools, automate routine tasks, and enhance incident response through centralized dashboards and analytics. They help Security Operations Centers (SOCs) manage rising threat volumes, optimize workflows, and improve response times. With expanding digital infrastructures, organizations face a growing attack surface that strains cybersecurity teams. Traditional manual methods are no longer sufficient for handling complex, high-volume alerts. SOAR solutions automate triage, response playbooks, and investigations, allowing analysts to focus on critical threats. The growing frequency and complexity of cyberattacks ranging from ransomware and phishing to advanced persistent threats have made swift and effective incident response a critical need for organizations. Traditional manual response methods are often too slow to contain rapidly evolving threats, increasing the risk of data breaches, financial losses, and reputational damage.

SOAR (Security Orchestration, Automation, and Response) platforms address this challenge by automating repetitive tasks, correlating data from multiple security tools, and executing predefined response playbooks in real time. This enables faster detection, triage, and mitigation of incidents, minimizing the impact on operations. By reducing response time from hours to minutes, SOAR empowers security teams to stay ahead of attackers and ensure consistent, policy-driven responses. Additionally, automation reduces analyst fatigue and error rates, especially in high-alert environments. As threat actors become more sophisticated, organizations increasingly rely on SOAR to scale their defenses and enhance cyber resilience across diverse IT environments.

The adoption of SOAR is expected to grow among organizations due to its superior capabilities and applications across areas such as threat intelligence, compliance management, workflow management, and response procedures. SOAR offers orchestration layers that are highly effective in implementing plugins, such as common use cases, processes, and technologies, which help create pre-built workflows. These pre-built security workflows can then be automated, and the technology stack can be connected to handle routine tasks and processes. Thus, it assists security monitoring teams in taking fast responses against potential security threats and is aimed at supporting security orchestration, automation, and response (SOAR) market growth.

Vendor lock-in is a major factor hampering the market growth as proprietary SOAR platforms limit integration with other tools, restricting flexibility and customization. This can make it difficult for organizations to switch vendors or scale their security operations as needs evolve. Such dependency raises concern about long-term costs, adaptability, interoperability often delays purchasing decisions, as businesses prioritize future-proofing and operational agility.

Component Insights

The solution segment accounted for a market share of over 73.0% in 2024. Organizations require faster, more consistent responses as cyber threats grow more sophisticated. SOAR solutions address this by offering automated playbooks that enable immediate action based on predefined protocols. This minimizes dwell time, reduces the impact of attacks, and ensures compliance with incident response standards. Additionally, SOAR platforms are built to integrate seamlessly with existing security infrastructure, such as SIEM systems, endpoint detection and response (EDR), and ticketing tools without requiring major architectural changes. This interoperability enhances the overall efficiency of security operations, allowing organizations to maximize the value of their current tools while improving coordination and response capabilities.

The services segment is expected to grow at a significant CAGR during the forecast period. The security orchestration, automation, and response services segment includes maintenance, deployment, consultation, customer support, and training services. The growing demand for security orchestration, automation, and response solutions and software in various end-use industries, such as BFSI, IT and Telecom, retail, and healthcare to strengthen their security capabilities are the primary factors expected to support the segment growth in the security orchestration, automation, and response (SOAR) market over the forecast period.

Deployment Mode Insights

The cloud-based segment accounted for the largest market share in 2024. As organizations migrate their workloads to cloud environments to gain agility, scalability, and cost savings, their IT infrastructures become more complex and distributed. This transition significantly increases the attack surface, exposing more vulnerabilities across cloud, on-premises, and hybrid systems. To address these challenges, cloud-native SOAR solutions are gaining traction. These platforms are designed to orchestrate and automate security operations across diverse environments, enabling faster detection, analysis, and response to threats. Their ability to seamlessly integrate with cloud services and scale dynamically makes them ideal for modern enterprises seeking to secure their expanding digital footprint while maintaining operational efficiency and compliance in a rapidly evolving threat landscape.

The on-premises segment is expected to register a CAGR of 13.3% during the forecast period. On-premise security orchestration, automation, and response provide in-house SOAR software and solution offerings that ensures better control and security assurance across their networks, applications, and devices. Further, it offers organizations the utmost flexibility in adopting workflows, forming, and managing integrations, or building processes from scratch based on their focus areas and dynamic security environment. Thus, the defined factors are expected to strengthen the growth of the on-premise segment in the security orchestration, automation, and response (SOAR) market.

Organization Size Insights

The large enterprises segment accounted for the largest market share of over 51.0% in 2024. Large enterprises manage extensive IT infrastructures spanning multiple locations, resulting in thousands of daily security alerts from various systems and devices. This overwhelming volume makes it challenging for security teams to manually analyze and prioritize threats effectively. SOAR platforms address this by automating the triage process filtering, correlating, and categorizing alerts based on severity and context. Automated incident response workflows enable faster handling of routine threats, freeing analysts to focus on critical, high-priority incidents. This not only improves operational efficiency but also reduces analyst fatigue and the risk of errors caused by alert overload.

The SMEs segment is expected to register the highest CAGR of 16.3% during the forecast period. The demand for SOAR is growing among SMEs as it helps organizations with limited budgets and resources effectively handle their security postures. SOAR offers a sophisticated approach and automated processes requiring limited human interventions, effectively conserving time and money. The following capabilities assisting SMEs in saving costs and resources along with enhancing security awareness are the key factors driving the demand in the following segment.

Application Insights

The incident response segment accounted for the largest market share in 2024. As cyberattacks grow more frequent and complex, organizations face increasing pressure to respond quickly and effectively to minimize damage. Traditional manual incident response methods often struggle to keep pace with the evolving threat landscape. SOAR platforms address this challenge by automating and streamlining incident response processes, enabling security teams to detect, analyze, and contain threats faster. By leveraging automated workflows and predefined playbooks, SOAR significantly reduces the Mean Time to Respond (MTTR), ensuring that incidents are handled promptly and consistently. This rapid response capability helps limit operational downtime, reduces potential financial and reputational losses, and strengthens overall cybersecurity resilience in an increasingly hostile environment.

The threat intelligence segment is expected to grow at a significant CAGR during the forecast period. SOAR helps organizations in bridging the gap between threat intelligence and response-sharing processes. It collects security alert information and metrics from integrated security tools and external feeds, allowing a centralized representation in the SOAR platform. The SOAR security solution allows analysts to correlate information from different sources, prioritize alerts, filter out false positives, and identify the critical security tasks that require more effort and time. Thus, the application of security orchestration, automation, and response in areas of threat intelligence is expected to drive the market demand.

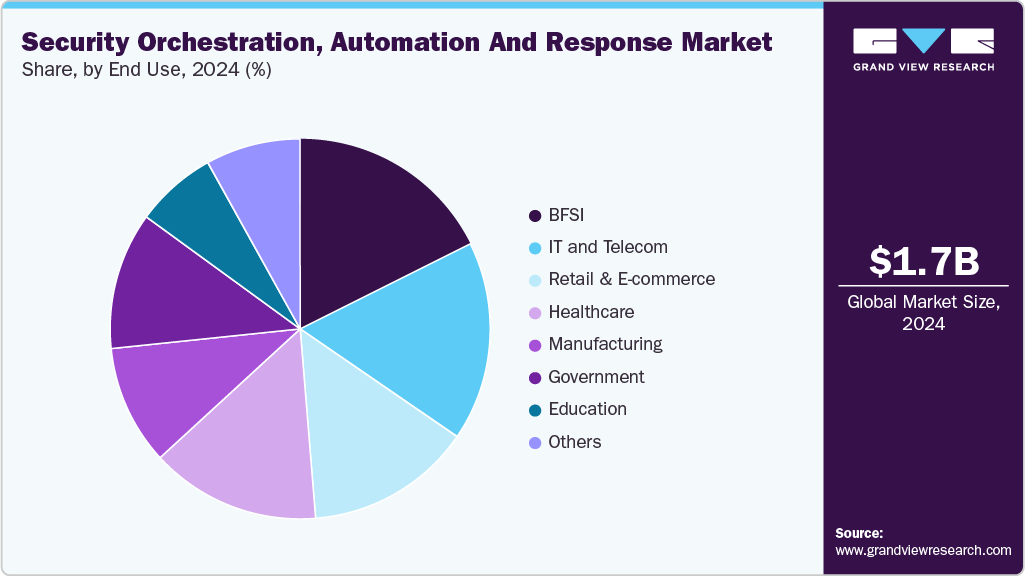

End-use Insights

The BFSI segment accounted for the largest market share in 2024. The BFSI sector faces elevated risks of cyber threats and financial fraud due to its handling of sensitive personal and transactional data, making it a frequent target for cybercriminals. SOAR platforms address these risks by automating key functions such as threat detection, incident triage, and response, enabling real-time mitigation of threats and reducing potential fraud. Additionally, BFSI institutions operate under strict regulatory frameworks like GDPR, PCI-DSS, GLBA, and FFIEC. SOAR solutions aid in compliance by automating documentation, enforcing security policies, and maintaining detailed audit trails. This ensures regulatory alignment while enhancing the speed, consistency, and accountability of incident response across the financial ecosystem.

The retail & e-commerce segment is expected to grow at a CAGR of 18.1% during the forecast period. The growth of omnichannel retailing including web, mobile apps, in-store systems, and social commerce has significantly expanded the attack surface for retailers. This complexity increases the likelihood of cyber threats across multiple entry points. SOAR platforms address this by offering centralized visibility and coordination, allowing security teams to monitor, detect, and respond to incidents across all digital touchpoints efficiently. This ensures consistent protection and faster incident resolution in multi-channel retail environments.

Regional Insights

North America security orchestration, automation, and response market held a significant share of over 35.0% in 2024. North America leads in adopting advanced cybersecurity technologies, with many enterprises already having mature and layered security infrastructures. This readiness allows seamless integration of SOAR platforms, enabling incident response automation, improving operational efficiency, and significantly reducing response times to evolving threats across complex digital environments.

U.S. Security Orchestration, Automation, and Response Market Trends

The security orchestration, automation, and response (SOAR) industry in the U.S. is expected to grow significantly from 2025 to 2030. The U.S. hosts leading SOAR vendors such as Palo Alto Networks, IBM, Splunk, and Rapid7, fostering a highly innovative cybersecurity landscape. This strong vendor presence ensures continuous product advancement, widespread availability, and active partner ecosystems, all accelerating market adoption and enhancing customer access to advanced SOAR solutions.

Europe Security Orchestration, Automation, and Response Market Trends

The security orchestration, automation, and response (SOAR) market in Europe is expected to grow at a CAGR of 16.1% from 2025 to 2030. Europe has some of the world’s most stringent data protection laws, including the General Data Protection Regulation (GDPR) and the NIS2 Directive. These frameworks mandate rapid breach detection, response, and documentation making SOAR solutions essential for compliance and efficient incident management.

The UK security orchestration, automation, and response (SOAR) market is expected to grow rapidly in the coming years. The UK frequently faces advanced cyber threats, including nation-state attacks targeting critical infrastructure, finance, and government sectors. SOAR helps security teams automate threat detection, accelerate response, and maintain operational continuity against increasingly complex attacks.

The Germany security orchestration, automation, and response (SOAR) market held a substantial market share in 2024. As a leader in advanced manufacturing and automation (Industry 4.0), German industries are increasingly targeted by cyberattacks. SOAR platforms help protect operational technology (OT) and industrial control systems (ICS) by integrating IT and OT security and automating incident response.

Asia Pacific Security Orchestration, Automation, and Response Market Trends

The security orchestration, automation, and response (SOAR) market in the Asia Pacific is expected to grow at the highest CAGR of 18.4% from 2025 to 2030. The rising technology adoption, including connected web applications, IoT devices, and interface technologies across industries such as BFSI, IT and Telecom, retail, and others, is increasing the demand for robust security solutions in the region. SOAR ensures cost-effectiveness by reducing dependency on security analysts and helping emerging and small players in the region to handle security challenges more effectively are the key factors expected to drive the demand for security orchestration, automation, and response solutions and services in the Asia Pacific region.

The security orchestration, automation, and response (SOAR) market in China held a substantial market share in 2024. China’s massive digital infrastructure expansion, including widespread cloud migration and smart city initiatives, increases the complexity and scale of IT environments. SOAR solutions are essential to automate security operations and manage threats efficiently across hybrid and multi-cloud systems.

The Japan security orchestration, automation, and response (SOAR) Market held a substantial market share in 2024. With the growing adoption of cloud services and digital technologies, Japanese enterprises require advanced security automation to manage distributed environments and hybrid cloud setups. SOAR platforms facilitate centralized orchestration and consistent response across diverse IT assets.

The security orchestration, automation, and response (SOAR) market in India is growing due to India’s rapid digital growth, cloud adoption, and initiatives like Digital India which has broadened the IT environment and increased cyber risks. SOAR solutions play a vital role by automating security processes, enabling efficient threat management and response across complex, hybrid, and distributed infrastructure, enhancing overall cybersecurity resilience.

Key Security Orchestration, Automation And Response Company Insights

The key market players in the global security orchestration, automation, and response (SOAR) market include Corporation, Splunk Inc., Palo Alto Networks, Microsoft Corporation, Logpoint, Rapid7, ServiceNow, Siemplify, Fortinet, Inc., Swimlane SOAR, SentinelOn, BlackBerry Limited., AT&T, KnowBe4, Inc., and Tines. The companies are focusing on various strategic initiatives, including new Solution development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Security Orchestration, Automation, And Response Companies:

The following are the leading companies in the security orchestration, automation, and response (SOAR) market. These companies collectively hold the largest market share and dictate industry trends.

- AT&T

- BlackBerry Limited.

- Fortinet, Inc.

- Google - Siemplify

- IBM Corporation

- KnowBe4, Inc.

- Logpoint

- Microsoft Corporation

- Palo Alto Networks

- Rapid7

- SentinelOn

- ServiceNow

- Splunk Inc.

- Swimlane SOAR

- Tines

Recent Developments

-

In April 2025, Splunk announced that Splunk SOAR is now offered as a native SaaS on Microsoft Azure, enabling automation of security workflows and faster response by integrating Azure services and third-party tools. It supports Microsoft Sentinel, Defender, and Entra ID, allowing users to enhance threat detection and streamline security operations efficiently.

-

In April 2025, Rapid7 introduced its Managed Detection & Response (MDR) for Enterprise, a fully managed and customizable service designed for complex, distributed environments. This offering provides 24/7 protection, integrating proprietary and legacy systems, and tailoring detection logic to specific organizational needs. It enhances threat monitoring and streamlines incident response through close collaboration between Rapid7's Security Operations Center and internal teams.

-

In March 2025, Tines expanded its partnership with Elastic to offer an integrated solution combining Elastic's Search AI Platform with Tines' Workflow Automation. This collaboration aims to enhance security and observability by providing AI-driven analytics and automated workflows, enabling faster issue resolution, improved operational efficiency, and reduced costs for organizations.

Security Orchestration, Automation And Response Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.98 billion

Market Size forecast in 2030

USD 4.11 billion

Growth rate

CAGR of 15.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Market Size in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Market Size forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment mode, organization size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

IBM Corporation; Splunk Inc.; Palo Alto Networks; Microsoft Corporation; Logpoint; Rapid7; ServiceNow; Google - Siemplify; Fortinet, Inc.; Swimlane SOAR; SentinelOn; BlackBerry Limited.; AT&T; KnowBe4, Inc.; Tines

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Orchestration, Automation & Response Market Report Segmentation

This report forecasts market Size growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global security orchestration, automation, and response (SOAR) market report based on component, application, deployment mode, organization size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Threat Intelligence

-

Network Forensics

-

Incident Response

-

Compliance

-

Others

-

-

Deployment Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Organization Size Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large enterprises

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Government

-

Retail & E-commerce

-

Healthcare

-

Banking, Financial Services, and Insurance (BFSI)

-

IT and Telecom

-

Manufacturing

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security orchestration automation and response market size was estimated at USD 1.72 billion in 2024 and is expected to reach USD 1.98 billion by 2025.

b. The global SOAR market is expected to grow at a compound annual growth rate of 15.8% from 2025 to 2030 to reach USD 4.11 billion in 2030.

Which segment accounted for the largest security orchestration automation and response market share?b. The cloud-based segment accounted for a market share of over 60.0% in 2024. Cloud-based security orchestration, automation, and response can be termed a platform as a service solution. It offers organizations a flexible product offering allowing them to choose offerings based on their usage demand, budget, time, and business objectives. It is a cost-effective, flexible way of threat-identifying, unmasking vulnerabilities, alert sharing, and handling routine security tasks across servers, endpoint devices, and networks.

b. Some key players operating in the user and entity behavior analytics market include IBM Corporation, Splunk Inc., Palo Alto Networks, Microsoft Corporation, Logpoint, Rapid7, ServiceNow, Siemplify, Fortinet, Inc., Swimlane SOAR, SentinelOn, BlackBerry Limited., AT&T, KnowBe4, Inc., and Tines.

b. The rising cybersecurity skill gap constantly drives the demand for automated threat detection and response processes. The demand for SOAR is rising among organizations because it can alleviate alert fatigue, automate routine tasks, and simplify threat detection and response processes. It helps organizations to focus on complex and critical threats that require more effort and time by automating a series of processes such as threat detection, alert sharing, and documenting sources of cyber threats. Security orchestration, automation, and response solution utilize the gathered information and activates playbooks that use automation and orchestration to execute response tasks. It frees up security teams allowing them to focus on critical security projects and business objectives.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."