- Home

- »

- Medical Devices

- »

-

Smart Therapeutic Devices Market, Industry Report 2030GVR Report cover

![Smart Therapeutic Devices Market Size, Share & Trends Report]()

Smart Therapeutic Devices Market Size, Share & Trends Analysis Report By Devices, By Distribution, By End Use (Hospitals, Clinics, Home Care), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-606-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Smart Therapeutic Devices Market Summary

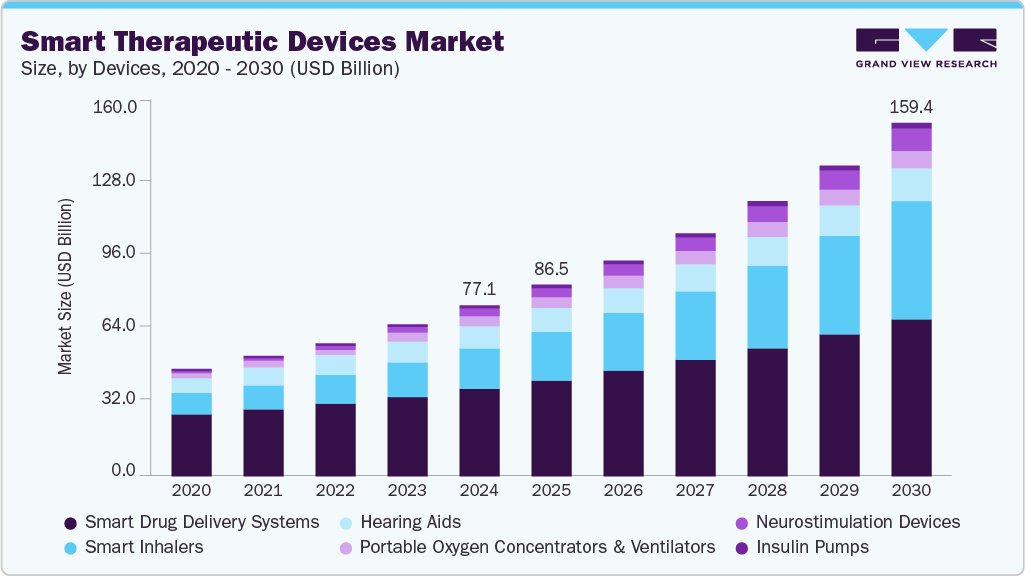

The global smart therapeutic devices market size was estimated at USD 77.12 billion in 2024 and is projected to reach USD 159.42 billion by 2030, growing at a CAGR of 12.99% from 2025 to 2030. This growth is attributed to technological advancements, rising prevalence of chronic diseases, and the growing demand for personalized and home-based care.

Key Market Trends & Insights

- North America dominated the smart therapeutic devices market with the largest revenue share in 2024.

- By device type, the smart drug delivery systems segment led the market with a revenue share of 51.14% in 2024.

- By distribution channel, the pharmacies segment led the market with a revenue share of 39.42% in 2024.

- By end use, the home care segment is expected to grow at the fastest CAGR during the forecast period

Market Size & Forecast

- 2024 Market Size: USD 77.12 Billion

- 2030 Projected Market Size: USD 159.42 Billion

- CAGR (2025-2030): 12.99%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

This growth is attributed to technological advancements, rising prevalence of chronic diseases, and the growing demand for personalized and home-based care. Moreover, increasing adoption of portable and connected devices-such as insulin pumps, smart inhalers, and neurostimulation systems-has significantly enhanced disease management capabilities, particularly for conditions like diabetes, asthma, COPD, and neurological disorders. The integration of AI, data tracking, and wireless connectivity enables real-time monitoring, patient engagement, and clinical decision-making, thereby improving treatment outcomes and patient adherence.With chronic disease management requiring continuous care, smart therapeutic devices bridge the gap between hospital visits and home-based healthcare, ultimately contributing to improved quality of life and reduced hospitalization rates. For instance, in July 2022, OMRON Healthcare launched a portable oxygen concentrator delivering 5L/min of >90% pure oxygen using PSA technology. Designed for home care, it features a compact, durable design with caster wheels for mobility.

Moreover, the trend toward personalized medicine continues to accelerate the adoption of smart technologies. For instance, in February 2024, Tandem Diabetes Care launched Tandem Mobi, the world's smallest durable automated insulin delivery system. This compact, wearable device offers full iOS mobile control, advanced Control-IQ technology, and compatibility with Dexcom CGMs, enabling personalized insulin therapy for users aged six and up.

According to the World Health Organization (WHO), as of 2024, noncommunicable diseases (NCDs) such as cardiovascular diseases, cancer, diabetes, and chronic respiratory conditions account for over 74% of global mortality annually. In response, the WHO is actively promoting greater investment in digital health solutions-including telemedicine and mobile health technologies-as a cost-effective strategy to manage and mitigate the impact of NCDs. Notably, an investment of merely USD 0.24 per patient per year in digital health interventions is projected to save over 2 million lives and prevent nearly 7 million acute events and hospitalizations over the next decade, thereby alleviating significant pressure on global healthcare systems.

These global imperatives are driving healthcare technology providers to expand and diversify their smart therapeutic device portfolios. A key example is GN’s February 2025 launch of ReSound Vivia, touted as the world’s smallest AI-powered hearing aid. Trained on 13.5 million real-world sentences, the device significantly enhances speech clarity in noisy environments while offering extended battery life of up to 30 hours for all-day use. GN also introduced ReSound Savi, a value-driven product line featuring Bluetooth LE Audio and Auracast broadcast capabilities-further democratizing access to advanced hearing solutions and aligning with global digital health priorities.

The COVID-19 pandemic significantly increased the demand for smart therapeutic devices like portable oxygen concentrators and ventilators became critical for managing respiratory complications. Smart inhalers, connected inhalers, and COPD management tools gained prominence due to the rise in respiratory illness awareness. On the other hand, insulin pumps, wearable injectors, and implantable drug delivery devices helped reduce hospital visits for chronic disease patients. The pandemic also pushed the adoption of neurostimulation and hearing devices through telehealth integration.

Case Study: Transforming Pediatric Asthma Management Through Smart Inhaler Innovation - The CareTRx Case Study

Background: Pediatric asthma impacts 1 in 10 children and is the most prevalent chronic condition in early childhood. Inconsistent medication adherence limits treatment effectiveness and increases healthcare costs. Children often miss doses due to a lack of supervision, underscoring the need for intelligent medication management tools.

Overview: Ximedica collaborated with Gecko Health Innovations to develop CareTRx, a connected inhaler attachment designed to improve medication adherence in children with asthma and COPD. The goal was to digitize standard inhalers to address common challenges such as missed doses and lack of caregiver oversight.

Gecko’s Innovation: Gecko Health Innovations, based in Cambridge, MA, built a proof-of-concept for CareTRx-a cloud-connected cap for metered dose inhalers that syncs with smartphones to track usage, provide reminders, and support better medication routines.

Ximedica’s Contribution: Leveraging its expertise in Connected Health, Human-Centric Design, and Consumer-Grade Packaging, Ximedica translated Gecko’s concept into a fully functional, clinically viable device. Their end-to-end services covered rapid prototyping, product lifecycle testing, cap design compatibility, and regulatory readiness.

Outcome: Ximedica successfully integrated Gecko’s software with custom-built hardware, facilitating clinical validation and prescription readiness. Their comprehensive development approach accelerated time-to-market and reduced overall development costs.

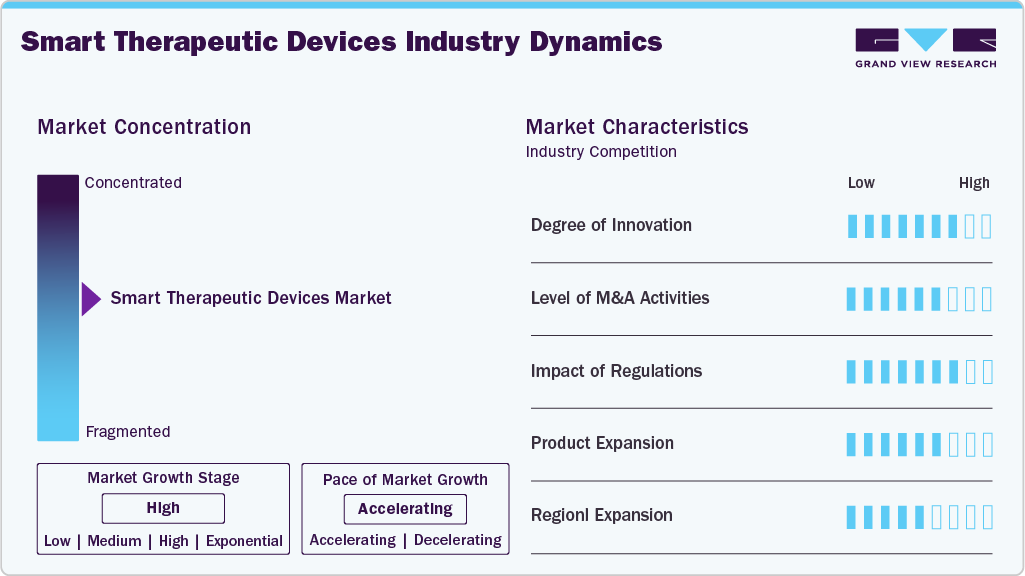

Market Concentration & Characteristics

The degree of innovation in the smart therapeutic devices industry is high, driven by advancements in AI, IoT, and wearable sensor technologies. Companies are developing devices that deliver therapy and provide real-time data, enabling personalized treatment. Innovations like closed-loop insulin pumps, neural implants, and AI-based pain management tools are transforming care delivery. The emphasis is shifting toward miniaturization, wireless connectivity, and patient engagement through smart health platforms.

The level of mergers and acquisitions in the smart therapeutic devices industry is rising as companies aim to improve technological capabilities and expand their product portfolios. Established players are acquiring startups with specialized wearables, AI, and remote monitoring technologies. This consolidation strengthens market positions and accelerates time-to-market for innovative solutions. For instance, in October 2024, Modivcare and Tenovi have partnered to deploy Adherium’s Hailie smart inhalers to improve respiratory care for patients with chronic conditions like asthma and COPD. This collaboration integrates Tenovi’s Cellular Gateway with Modivcare’s chronic condition management services, creating a cost-effective ecosystem that enables healthcare providers to monitor medication adherence remotely.

Regulatory frameworks play a crucial role in shaping the smart therapeutic devices industry. Devices must meet stringent safety, cybersecurity, and data privacy standards set by agencies like the FDA and EMA. While regulations ensure device efficacy and patient safety, the evolving nature of smart technologies poses compliance challenges. Recent FDA digital health guidelines have streamlined approval for software-based therapies, encouraging innovation while maintaining strict oversight of clinical outcomes. For instance, in August 2023, the FDA approved Roche's Accu-Chek Solo micropump. The tubeless, wearable insulin pump is interoperable with digital dosing systems for diabetes patients aged 2+. It enables personalized, connected insulin delivery and management.

The level of regional expansion is significant in the smart therapeutic devices industry. While North America leads in adoption, Asia-Pacific is rapidly emerging due to rising healthcare investments and chronic disease prevalence. Companies target untapped markets in India, China, and Southeast Asia with localized products and partnerships. In addition, favorable government initiatives and expanding telehealth infrastructure support broader market penetration and accelerate the global growth of smart therapeutic solutions.

Devices Type Insights

The smart drug delivery systems segment led the market with the largest revenue share of 51.14% in 2024. The growth is attributed to their ability to deliver precise medication dosages, reduce side effects, improve patient compliance, and the ability to monitor treatment responses in real time. These next-generation systems are particularly impactful in managing chronic and complex diseases such as neurological disorders, where precision and consistency in therapy are critical.

The growing necessity for such innovative solutions is highlighted by the World Health Organization’s (WHO) 2023 findings, which indicate that noncommunicable diseases (NCDs) currently account for nearly 75% of global deaths each year. Looking ahead, the burden of chronic illnesses-including cardiovascular diseases, cancer, diabetes, and respiratory conditions-is projected to intensify dramatically. By 2050, NCDs are expected to cause 86% of the anticipated 90 million annual deaths, marking a 90% surge in absolute mortality compared to 2019. This alarming trend highlights the urgent need for scalable, technology-enabled therapeutic interventions like SDDS to improve outcomes and reduce the strain on healthcare systems worldwide.

The neurostimulation devices segment is expected to grow at the fastest CAGR during the forecast period, due to rising incidences of neurological disorders such as epilepsy, Parkinson’s disease, chronic pain, and depression. These devices provide non-invasive, focused treatments without surgery or heavy use of medicines. As more than 50 million people have epilepsy and mental health awareness grows, the need for new brain-stimulating treatments is rising fast. This is making neuromodulation devices an important part of the smart medical devices market.

Distribution Channel Insights

The pharmacies segment led the market with the largest revenue share of 39.42% in 2024. This is attributed to their widespread accessibility, trusted role in medication dispensing, and increasing integration of digital health solutions. Pharmacies are becoming key for distributing smart therapeutic devices such as smart inhalers, insulin pumps, and wearable monitors. Their growing role in chronic disease management and patient education further supports this trend, especially in aging and urban populations worldwide.

The online channel segment is expected to grow at the fastest CAGR during the forecast period, due to rising consumer demand for home-based care solutions and ease of access to advanced medical devices. smart devices such as portable oxygen concentrators, insulin pumps, hearing aids, and smart inhalers are increasingly being sold online. Devices such as wearable injectors, connected inhalers, and implantable drug delivery systems benefit from growing patient awareness, digital literacy, and preference for remote management of chronic conditions like asthma, diabetes, and neurological disorders.

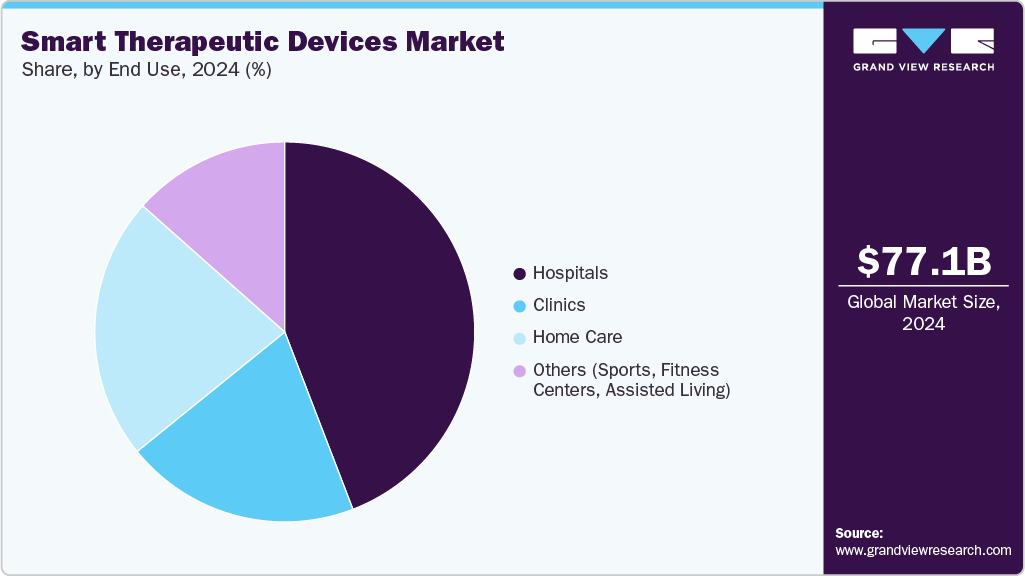

End Use Insights

The hospitals segment accounted for the largest market revenue share in 2024. This is attributed to the high adoption of advanced smart therapeutic devices for managing critical conditions such as Parkinson’s disease, chronic pain, COPD, and diabetes. Supporting this trend, a 2023 Health Affairs study based on the American Hospital Association Annual Survey revealed that approximately 65% of U.S. hospitals-representing 1,696 facilities-have integrated artificial intelligence or predictive analytics into their EHR systems. Hospitals are ramping up investments in AI-enabled therapeutic systems, smart insulin pumps, and remote monitoring wearables that seamlessly interface with hospital IT infrastructure. These technologies aim to bolster patient safety, reduce manual errors, and lower the incidence of hospital-acquired complications. Such factors are expected to drive the segment growth over the forecast period.

The home care segment is expected to grow at the fastest CAGR during the forecast period, due to increasing patient preference for convenient, cost-effective treatment outside clinical settings. Smart therapeutic devices such as wearable injectors, insulin pumps, portable oxygen concentrators, and connected inhalers enable continuous care for chronic conditions like diabetes, COPD, and heart failure at home. The aging population, rise in remote monitoring technologies, and expanding availability of user-friendly, app-integrated devices further drive demand for home-based smart healthcare solutions.

Regional Insights

North America dominated the smart therapeutic devices market with the largest revenue share in 2024, due to its highly developed healthcare infrastructure, rising prevalence of chronic diseases, and rapid adoption of digital health technologies. The presence of major market players, high patient awareness, and favorable reimbursement policies further fuel demand. Increasing government support for telehealth and remote monitoring has also accelerated the use of smart drug delivery and wearable devices.

U.S. Smart Therapeutic Devices Market

The smart therapeutic devices market in the U.S. is driven by a high incidence of diabetes, cardiovascular diseases, and respiratory ailments. According to a CNBC report of January 2023, over 37 million Americans have diabetes, and many rely on insulin pumps and continuous glucose monitors. Strong regulatory support from the FDA for digital health innovations and a tech-savvy population encourage the use of smart therapeutic devices for personalized and home-based care.

Europe Smart Therapeutic Devices Market

The smart therapeutic devices market in Europe is experiencing significant growth due to increasing healthcare digitalization and government initiatives supporting remote care. Countries like Germany and France are investing in eHealth infrastructure. The EU Medical Device Regulation (MDR) has also standardized safety across smart therapeutic products. Growing elderly populations and chronic disease cases are pushing demand for neurostimulation devices, smart inhalers, and implantable drug delivery systems.

The UK smart therapeutic devices market is growing significantly. The National Health Service (NHS) actively integrates smart therapeutic solutions into chronic disease management programs. High rates of asthma, COPD, and mental health conditions make devices like connected inhalers, deep brain stimulation systems, and smart drug delivery systems essential. Government support for digital innovation and widespread telehealth adoption has further boosted demand for at-home and wearable therapeutic devices.

The smart therapeutic devices market in Germany is driven by its advanced healthcare infrastructure, high health insurance coverage, and aging population. The country has a strong prevalence of neurological disorders, cardiovascular diseases, and diabetes, which increases the demand for smart drug delivery systems and neurostimulation devices. Government support for digital health through the Digital Healthcare Act (DVG) promotes the adoption of connected health devices. Germany's focus on precision medicine and personalized care fuels innovation and usage of wearable and implantable therapeutic technologies.

Asia Pacific Smart Therapeutic Devices Market

The smart therapeutic devices market in Asia-Pacific is witnessing strong market growth driven by a combination of demographic and technological factors. A rapidly expanding population, coupled with a rising incidence of chronic conditions such as diabetes and cardiovascular disease, is fueling demand for advanced therapeutic solutions. Governments across the region are actively investing in telemedicine and remote monitoring platforms to address the healthcare access gap in rural and underserved areas. Simultaneously, growing smartphone penetration and a rising middle-class population are accelerating the adoption of connected health technologies.

Furthermore, the region’s aging demographic profile highlights the increasing relevance of smart drug delivery systems and neurostimulation devices, particularly in managing age-related and metabolic disorders. This dynamic landscape presents a significant opportunity for market participants to introduce scalable, AI-enabled therapeutic innovations tailored to regional healthcare priorities.

The China smart therapeutic devices market is showing significant growth due to its massive population, rapid urbanization, and government support for healthcare innovation. These devices are in demand for managing diabetes, stroke rehabilitation, and respiratory diseases, which are highly prevalent conditions in the country. The Chinese government's "Healthy China 2030" initiative promotes the adoption of AI and smart therapeutic technology, encouraging the growth of connected inhalers, smart injectors, and implantable devices.

The smart therapeutic devices market in India is emerging due to its large population base, increasing lifestyle diseases like diabetes and hypertension, and rapid digital transformation in healthcare. With over 77 million people living with diabetes, the demand for smart insulin pumps, wearable injectors, and mobile-connected health devices is rising. India's focus on telemedicine, via Ayushman Bharat Digital Mission, and growing smartphone usage make remote monitoring and home-based care more accessible.

Latin America Smart Therapeutic Devices Market

The smart therapeutic devices market in Latin America is expanding due to rising healthcare awareness and increasing incidence of chronic illnesses. Access to smart therapeutic devices is improving with digital health initiatives in countries like Mexico, Colombia, and Argentina. Public-private partnerships and mobile health programs are helping bridge this gap, especially for smart inhalers, wearable injectors, and remote therapy tools.

Middle East & Africa Smart Therapeutic Devices Market

The smart therapeutic devices market in the Middle East & Africa is growing gradually, primarily due to increasing chronic disease cases, urbanization, and an increase in modernized healthcare. Wealthier nations like the UAE and Saudi Arabia are investing in AI and connected health solutions, boosting demand for smart therapeutic devices.

Key Smart Therapeutic Devices Company Insights

The market is highly fragmented, with many small and large players operating in this space. This leads to intense competition between smaller players to sustain their position. Strategies such as new product launches and partnerships are playing a key role in propelling the market growth.

Key Smart Therapeutic Devices Companies:

The following are the leading companies in the global smart therapeutic devices market. These companies collectively hold the largest market share and dictate industry trends.

- Inogen, Inc.

- Presspart Verwaltungs GmbH.

- Cognita Labs

- adherium

- Medtronic

- Hoffmann-La Roche AG

- Insulet Corporation

- Audicus

- Eargo, Inc.

- Nidek Medical Products, Inc.

- AptarGroup, Inc.

- Koninklijke Philips N.V.,

- Drive Devilbiss International

- Tandem Diabetes Care, Inc.

- Ypsomed

- GN Hearing

- Cochlear Ltd.

- Sonova.

- Boston Scientific Corporation

- Abbott.

- Nevro Corp.

Recent Developments

-

In February 2025, the FDA has approved Medtronic's BrainSense Adaptive deep brain stimulation device. This device dynamically adjusts to abnormal brain signals in Parkinson's patients, offering personalized symptom management and reducing reliance on medications.

“A deep brain stimulator is a brain pacemaker: similar to a cardiac pacemaker, except you insert electrodes in the brain to stimulate brain neurons,”

-Dr. Helen Bronte-Stewart, professor of neurology, neurological sciences, and neurosurgery at Stanford University

-

In February 2025, GN launched ReSound Vivia, the world's smallest AI-powered hearing aid, featuring a Deep Neural Network trained on 13.5 million sentences. It enhances speech clarity in noise, offers all-day battery life, and includes Intelligent Focus, which adjusts sound based on the user's gaze direction. GN also introduced ReSound Savi, an essential range with Bluetooth LE Audio and Auracast support.

“With ReSound Vivia, we've fundamentally reimagined how AI can enhance the hearing experience. Our unique Intelligent Focus feature mimics natural human behavior, allowing the AI to prioritize sounds based on where the user is looking, not just how loud they are. This creates a far more intuitive and natural listening experience, seamlessly integrating with the user's own perception of their environment. It's not just about amplifying sound; it's about intelligently enhancing the sounds that matter most. And we are not stopping here - all the knowledge, capabilities, and research we have acquired will be applied across other GN products and projects, furthering innovation across the Group."

-Brian Dam Pedersen, Chief Technology Officer, Head of Research and Technology at GN

-

In September 2024, the FDA authorized the first over-the-counter hearing aid software, allowing Apple AirPods Pro to function as customizable hearing aids for adults with mild to moderate hearing loss. This software utilizes iOS HealthKit for personalization and was found in clinical studies to be as effective as professionally fitted devices. This development aims to increase accessibility and reduce the stigma associated with hearing aids.

““Hearing loss is a significant public health issue impacting millions of Americans. Today’s marketing authorization of an over-the-counter hearing aid software on a widely used consumer audio product is another step that advances the availability, accessibility and acceptability of hearing support for adults with perceived mild to moderate hearing loss,”

--Michelle Tarver, M.D., Ph.D., acting director of the FDA's Center for Devices and Radiological Health.

-

In February 2024, Aptar Pharma, a global provider of drug delivery systems and active material science solutions, launched HeroTracker Sense, an innovative digital respiratory health solution designed to convert traditional pressurized metered dose inhalers (pMDIs) into smart, connected healthcare devices. This cutting-edge technology enables real-time monitoring and data-driven management of respiratory conditions, enhancing treatment adherence and supporting more personalized patient care.

“The launch of HeroTracker Sense positions Aptar’s digital respiratory portfolio as a world leading offering, providing insights into patient behaviors and how that will lead to a change in the way the patient interacts with their device, and their understanding of their indication. We see this as a product for the future and one that will demonstrate significant value, creating real world evidence that can aid the support of reimbursement models in numerous different markets”

-Marcus Bates, Director, Business Development, Digital Healthcare, Aptar Pharma.

Smart Therapeutic Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 86.57 billion

Revenue forecast in 2030

USD 159.42 billion

Growth rate

CAGR of 12.99% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapeutic devices, distribution, end use and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; and Kuwait

Key companies profiled

Inogen, Inc.; Presspart Verwaltungs GmbH.; Cognita Labs; Adherium; Medtronic; Hoffmann-La Roche AG; Insulet Corporation; Audicus; Eargo, Inc.; Nidek Medical Products, Inc.; Koninklijke Philips N.V.; Drive Devilbiss International; Tandem Diabetes Care, Inc.; Ypsomed; GN Hearing; Cochlear Ltd.; Sonova.; Boston Scientific Corporation; Abbott; Nevro Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Therapeutic Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart therapeutic devices market report based on devices, distribution, end use and regions.

-

Devices Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable Oxygen Concentrators & Ventilators

-

Insulin Pumps

-

Hearing Aids

-

Neurostimulation Devices

-

Spinal Cord Stimulation

-

Deep Brain Stimulation

-

Transcranial Magnetic Stimulation

-

-

Smart Inhalers

-

Asthma & COPD Management

-

Connected Inhalers with Data Tracking

-

-

Smart Drug Delivery Systems

-

Wearable Injectors

-

Implantable Drug Delivery Devices

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmacies

-

Online Channel

-

Direct-to-Consumer (DTC)

-

Others (Hypermarkets, Specialty Retailers)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Home Care

-

Others (Sports, Fitness Centers, Assisted Living)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global smart therapeutic devices market size was estimated at USD 77.12 billion in 2024 and is expected to reach USD 86.57 billion in 2020.

b. The global smart therapeutic devices market is expected to grow at a compound annual growth rate of 12.99% from 2025 to 2030 to reach USD 159.42 billion by 2030.

b. North America dominated the smart therapeutic devices market with a share of 35.94%% in 2024. This is attributable to its highly developed healthcare infrastructure, rising prevalence of chronic diseases, and rapid adoption of digital health technologies. The presence of major market players, high patient awareness, and favorable reimbursement policies further fuel demand.

b. Some key players operating in the smart therapeutic devices market include Inogen, Inc.; Presspart Verwaltungs GmbH.; Cognita Labs; Adherium; Medtronic; Hoffmann-La Roche AG; Insulet Corporation; Audicus; Eargo, Inc.; Nidek Medical Products, Inc., Koninklijke Philips N.V., Drive Devilbiss International, Tandem Diabetes Care, Inc., Ypsomed, GN Hearing, Cochlear Ltd., Sonova., Boston Scientific Corporation, Abbott, Nevro Corp.

b. Key factors that are driving the market growth include technological advancements, rising prevalence of chronic diseases, and the growing demand for personalized and home-based care. Moreover, increasing adoption of portable and connected devices—such as insulin pumps, smart inhalers, and neurostimulation systems—has significantly enhanced disease management capabilities, particularly for conditions like diabetes, asthma, COPD, and neurological disorders

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."