- Home

- »

- Advanced Interior Materials

- »

-

Specialty Tapes Market Size & Share, Industry Report, 2030GVR Report cover

![Specialty Tapes Market Size, Share & Trends Report]()

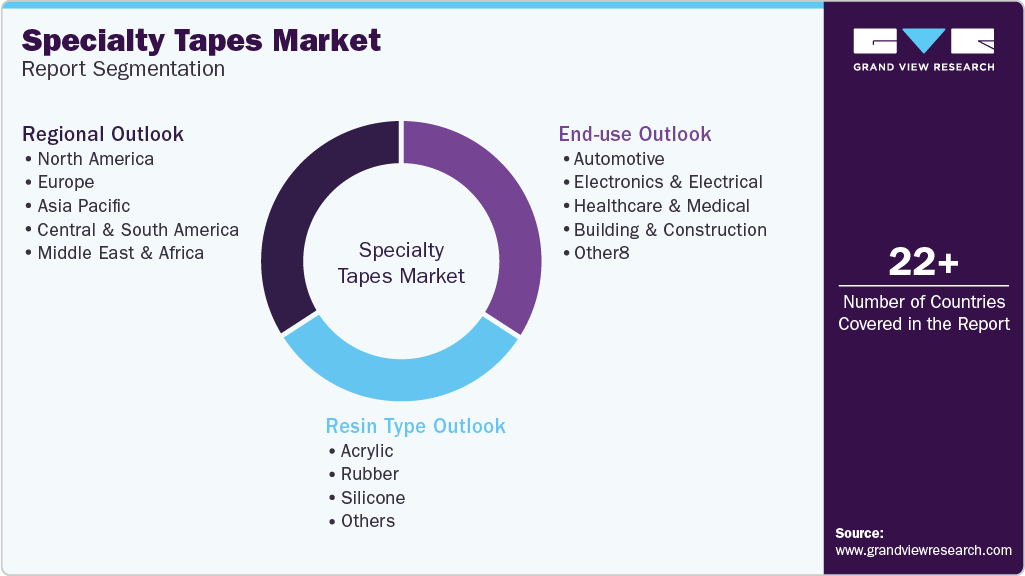

Specialty Tapes Market Size, Share & Trends Analysis Report By Resin Type (Acrylic, Rubber, Silicone), By End Use, By Region (North America, Asia Pacific, Europe, Central & South America, MEA), and Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-593-8

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Specialty Tapes Market Summary

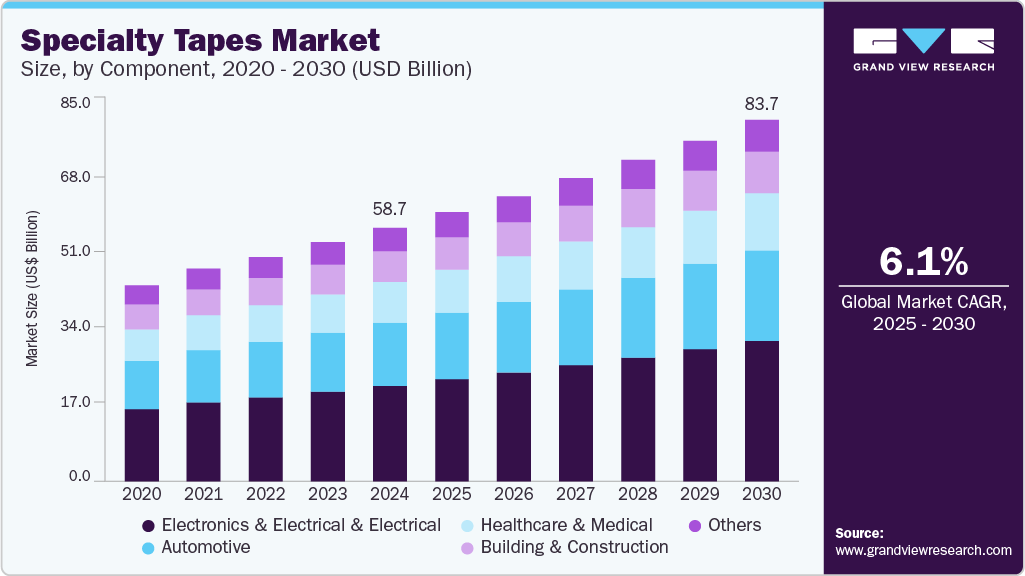

The global specialty tapes market size was estimated at USD 58.7 billion in 2024 and is projected to reach USD 83.7 billion by 2030, growing at a CAGR of 6.1% from 2025 to 2030. The ongoing advancement in electronic devices and consumer electronics contributes to the rising demand for specialty tapes.

Key Market Trends & Insights

- Asia Pacific dominated the specialty tapes market with the largest revenue share of 39.96% in 2024.

- The specialty tapes market in China is the largest manufacturing hub in the Asia Pacific region.

- In terms of segment, the acrylic segment led the market with the largest revenue share of 47.52% in 2024.

- In terms of segment, the electronics & electrical segment led the market with the largest revenue share of 37.81% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 58.7 billion

- 2030 Projected Market Size: USD 83.7 billion

- CAGR (2025-2030): 6.1%

- Asia Pacific: Largest market in 2024

These tapes are critical in assembling components, insulation, thermal management, and electromagnetic shielding in smartphones, tablets, and other portable devices. With continued innovations in miniaturization and the rapid adoption of 5G, IoT, and wearable technologies, the need for precision-engineered tapes with high thermal conductivity and electrical insulation is growing rapidly.

Specialty tapes are widely used in medical applications such as wound care, surgical drapes, diagnostics, and wearable devices due to their skin-friendliness, breathability, and strong adhesion. With the growing prevalence of chronic diseases, an aging global population, and increased demand for at-home medical care, the need for advanced, high-performance tapes in the healthcare industry has surged, driving consistent market expansion.

Another significant growth driver is the automotive and transportation industry's increasing reliance on specialty tapes for light weighting, noise reduction, and bonding applications. As automakers strive to improve fuel efficiency and reduce emissions, specialty tapes provide an effective alternative to mechanical fasteners by reducing vehicle weight and simplifying assembly. Their ability to offer durability under extreme temperature and pressure conditions makes them indispensable in both interior and exterior automotive applications.

Market Concentration & Characteristics

The specialty tapes industry is characterized by a moderate to high degree of innovation, with manufacturers continuously developing advanced adhesive technologies, enhanced durability, and application-specific functionalities to meet the diverse needs of industries such as healthcare, automotive, and electronics.

The market also witnesses a significant level of merger and acquisition activities, as leading players aim to expand their global footprint, access new technologies, and strengthen their product portfolios. These strategic consolidations contribute to market consolidation, creating a competitive landscape dominated by a few key players with extensive R&D capabilities and broad distribution networks.

Regulatory compliance plays a pivotal role in shaping product development and market entry strategies, especially in sectors like healthcare and electronics, where safety, sustainability, and environmental standards are critical. The presence of service substitutes such as mechanical fasteners and sealants poses some level of competition; however, specialty tapes often provide superior performance, ease of use, and aesthetic benefits that maintain their market preference.

End-user concentration is high in certain applications, with industries like automotive and medical devices accounting for a significant share of demand, thereby influencing production trends and innovation priorities within the market.

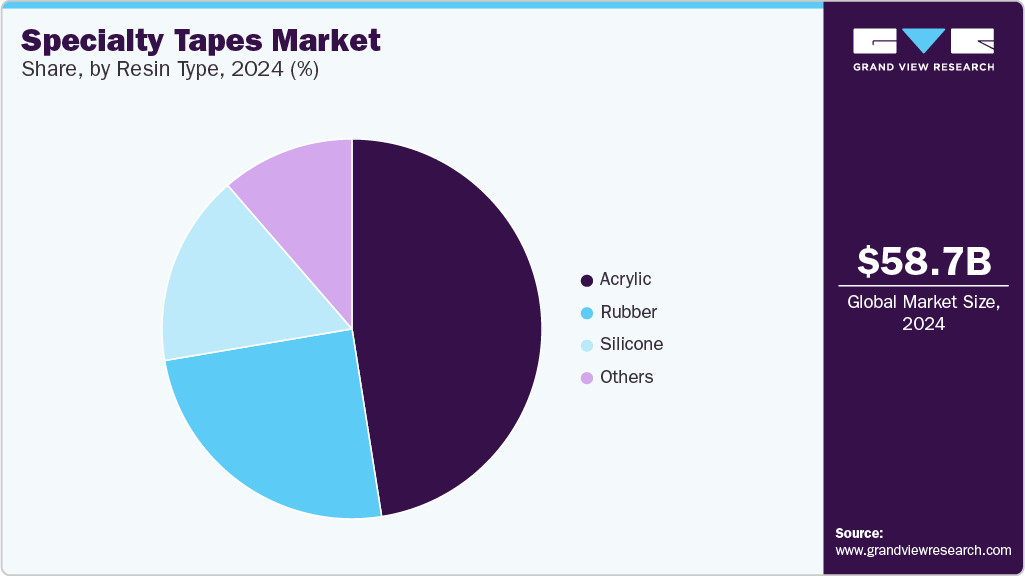

Resin Type Insights

The acrylic segment led the market with the largest revenue share of 47.52% in 2024, driven by its excellent adhesive properties and versatility across a wide range of substrates. Acrylic-based tapes offer superior resistance to environmental factors such as UV light, moisture, and temperature fluctuations, making them ideal for both indoor and outdoor applications. Their long-term performance and reliability have made them a preferred choice in critical sectors such as automotive, construction, and electronics, where durability and consistent adhesion are essential.

The silicone segment is expected to grow at the fastest CAGR of 6.2% over the forecast period, driven by its superior performance characteristics in extreme environments. Silicone-based tapes offer exceptional thermal stability, making them ideal for applications that demand high heat resistance, such as electronics manufacturing, aerospace, and automotive assembly. Their ability to maintain adhesion across a wide temperature range ensures consistent performance, particularly in settings where other adhesives might degrade or fail. This thermal resilience is becoming increasingly important as industries advance toward high-performance and miniaturized components.

End Use Insights

The electronics & electrical segment led the market with the largest revenue share of 37.81% in 2024, driven by increasing complexity and miniaturization of electronic devices. Specialty tapes are widely used for insulation, thermal management, EMI/RFI shielding, and component bonding in smartphones, tablets, laptops, and other consumer electronics. As manufacturers strive to produce lighter, thinner, and more compact devices, the demand for high-performance tapes that can withstand heat, electrical stress, and tight space constraints has surged. This growing need for multifunctional adhesive solutions is propelling innovation and expanding the application of specialty tapes in the electronics sector.

The automotive segment is expected to grow at the fastest CAGR of 6.2% over the forecast period, driven by growing demand for lightweight, durable, and efficient bonding solutions. As automakers strive to reduce vehicle weight to improve fuel efficiency and meet stringent emissions regulations, specialty tapes have emerged as a preferred alternative to traditional mechanical fasteners. These tapes provide strong adhesion while contributing minimally to the overall weight of the vehicle. They are extensively used for bonding trim components, mounting emblems, and attaching interior and exterior panels, playing a critical role in both structural integrity and design flexibility.

Regional Insights

The specialty tapes market in the North America is driven by stringent regulatory standards across healthcare, automotive, and aerospace industries that demand high-performance, compliant bonding solutions. The region’s well-established healthcare infrastructure fuels demand for medical-grade tapes used in wound care, diagnostics, and surgical applications. Moreover, a strong focus on technological innovation and product customization is promoting the use of specialty tapes in advanced electronics and industrial assembly.

U.S. Specialty Tapes Market Trends

The specialty tapes market in the U.S. benefits from advanced R&D capabilities and the presence of leading manufacturers focused on innovation in adhesive technologies. The growing use of specialty tapes in the automotive, defense, and medical sectors, coupled with increasing consumer preference for smart and wearable devices, is supporting market growth. In addition, the country’s focus on energy efficiency and sustainable practices is encouraging the development of eco-friendly specialty tapes.

Asia Pacific Specialty Tapes Market Trends

Asia Pacific dominated the specialty tapes market with the largest revenue share of 39.96% in 2024, driven by rapid industrialization, urbanization, and significant growth in end-use industries such as electronics, automotive, and healthcare. Countries like India, Japan, South Korea, and especially China are investing heavily in advanced manufacturing processes, which require efficient bonding and insulation solutions. The rising production of consumer electronics and electric vehicles (EVs) in this region has also increased the demand for heat-resistant, double-sided, and conductive specialty tapes.

The specialty tapes market in China is the largest manufacturing hub in the Asia Pacific region, is a key growth engine for the specialty tapes industry. The country’s booming automotive and electronics sectors are major consumers of specialty tapes, especially with the rising penetration of EVs and 5G devices. In addition, government initiatives promoting smart manufacturing and green construction are pushing the adoption of eco-friendly and high-performance adhesive solutions, creating robust opportunities for specialty tape manufacturers.

Europe Specialty Tapes Market Trends

The specialty tapes market in Europe is largely influenced by its strict environmental regulations and high demand for sustainable and recyclable adhesive products. The automotive sector, especially in Germany and France, is a major driver, with growing demand for lightweight bonding materials to meet carbon reduction goals. Furthermore, the expansion of the healthcare and renewable energy industries is contributing to the rising use of specialty tapes in various technical and insulation applications.

The Germany specialty tapes market is also known for its high-precision engineering and strong automotive sector, plays a central role in the European industry. The country’s leadership in producing premium vehicles and its push toward electric mobility are accelerating demand for advanced tapes with thermal, acoustic, and structural bonding properties. German industries also emphasize compliance with EU environmental directives, promoting the adoption of solvent-free and recyclable specialty tapes.

Latin America Specialty Tapes Market Trends

The specialty tapes market in Latin America is anticipated to grow at a significant CAGR during the forecast period. In Latin America, infrastructure development and expanding automotive and construction sectors are fueling demand for specialty tapes. Countries such as Brazil and Mexico are witnessing increased industrial activity, which drives the need for efficient sealing, bonding, and insulating solutions. The relatively low cost of manufacturing in the region is attracting foreign investments, which in turn is boosting the specialty tapes industry as a critical auxiliary material.

Middle East & Africa Specialty Tapes Market Trends

The specialty tapes market in the Middle East & Africa is being driven by infrastructural expansion, particularly in the construction and oil & gas sectors. The growing demand for durable, weather-resistant tapes in harsh environmental conditions has spurred innovation in high-performance adhesive products. In addition, increasing healthcare investments and a gradual rise in consumer electronics usage are also contributing to market development in this region.

Key Specialty Tapes Company Insights

Some of the key players operating in market include 3M, Nitto Denko Corporation

-

3M’s specialty tapes portfolio includes double-sided tapes, VHB (very high bond) tapes, masking tapes, and electrically conductive tapes. These products are used for bonding, insulating, protecting, and sealing in critical applications that demand durability and reliability.

-

Nitto Denko Corporation leverages its proprietary polymer synthesis and adhesive technologies to cater to sectors such as healthcare, automotive, aerospace, and semiconductors. Its specialty tape offerings include heat-resistant tapes, optical films, anti-corrosion tapes, and adhesive sheets tailored for high-end electronic devices and cleanroom applications.

tesa SE, Lintec Corporation are some of the emerging market participants in specialty tapes industry.

-

tesa SE, a subsidiary of Beiersdorf AG, is a Germany-based global provider of adhesive solutions and tapes. Known for its precision and quality, tesa focuses on developing adhesive technologies that meet stringent industrial and regulatory requirements, especially in the automotive and electronics sectors. Its specialty tapes range from double-sided adhesive tapes, foam tapes, masking tapes, and high-temperature-resistant tapes to optical-grade adhesive films.

-

Lintec Corporation has a strong innovation pipeline and integrates sustainable practices into its product development strategy. Its specialty tape portfolio includes pressure-sensitive tapes, semiconductor-related adhesive films, surface protection films, and cleanroom-compatible tapes.

Key Specialty Tapes Companies:

The following are the leading companies in the global specialty tapes market. These companies collectively hold the largest market share and dictate industry trends.:

- 3M Company

- Nitto Denko Corporation

- tesa SE

- Lintec Corporation

- Avery Dennison Corporation

- Scapa Group Plc

- Intertape Polymer Group, Inc.

- Berry Global Inc.

- Saint-Gobain Performance Plastics Corporation

Recent Developments

- In May 2021, Intertape Polymer Group, a prominent producer of tapes and films, introduced PEFR, a new flame-retardant polyethylene (PE) tape. Designed for heavy-duty use, the tape is well-suited for applications in healthcare settings, laboratories, shipyards, and construction environments.

Specialty Tapes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 62.2 billion

Revenue forecast in 2030

USD 83.7 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin type, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

3M Company; Nitto Denko Corporation; tesa SE; Lintec Corporation; Avery Dennison Corporation; Scapa Group Plc; Intertape Polymer Group, Inc.; Berry Global Inc.; and Saint-Gobain Performance Plastics Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Specialty Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global specialty tapes market report based on resin type, end use, and region.

-

Resin Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Acrylic

-

Rubber

-

Silicone

-

Others

-

-

End use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Automotive

-

Electronics & Electrical

-

Healthcare & Medical

-

Building & Construction

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global specialty tapes market size was estimated at USD 58.7 billion in 2024 and is expected to reach USD 62.2 billion in 2025.

b. The global specialty tapes market is expected to grow at a compound annual growth rate of 6.1% from 2025 to 2030 to reach USD 83.7 billion by 2030.

b. The acrylic segment led the market and accounted for the largest revenue share of 47.50% in 2024, driven by its excellent adhesive properties and versatility across a wide range of substrates.

b. Some of the prominent companies in the specialty tapes market include 3M Company, Nitto Denko Corporation, tesa SE, Lintec Corporation, Avery Dennison Corporation, Scapa Group Plc, Intertape Polymer Group, Inc., Berry Global Inc., and Saint-Gobain Performance Plastics Corporation.

b. Key factors driving the specialty tapes market include growing demand from automotive, electronics, and healthcare industries, along with increasing preference for lightweight, high-performance, and application-specific adhesive solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."