- Home

- »

- Next Generation Technologies

- »

-

Team Collaboration Software Market, Industry Report, 2030GVR Report cover

![Team Collaboration Software Market Size, Share & Trends Report]()

Team Collaboration Software Market Size, Share & Trends Analysis Report By Deployment, By Software Type, By Application (Retail, Healthcare, BFSI, IT & Telecom), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-633-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Team Collaboration Software Market Trends

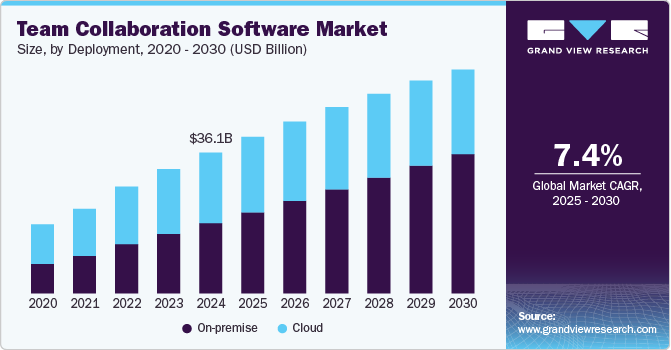

The global team collaboration software market size was valued at USD 36,114.2 million in 2024 and is expected to grow at a CAGR of 7.4% from 2025 to 2030. The growing shift toward unified digital workspaces is enabling remote and hybrid teams to collaborate more efficiently, with rising demand for real-time communication, document sharing, and integrated project management tools. Cloud-based solutions and mobile-first platforms are becoming standard, allowing seamless access across devices and locations. Additionally, the increasing integration of collaboration tools with CRM, ERP systems, and AI-powered analytics is enhancing workflow automation and team productivity, further fueling market growth.

The rise of AI-powered and automated features is transforming the team collaboration software market as organizations seek smarter, more efficient ways to work together. Collaboration platforms are embedding AI for automated meeting transcription and summarization, intelligent task assignment, and real-time language translation, while workflow automation tools streamline routine processes such as document approvals, notifications, and status updates without manual intervention. These capabilities reduce administrative overhead, accelerate decision‑making, and surface predictive insights on team performance. As businesses increasingly demand data-driven collaboration and hands-free task orchestration, AI and automation are reshaping the team collaboration software industry.

Additionally, the accelerating shift to hybrid and remote work models is a pivotal driver of market growth, as organizations seek unified platforms that support video conferencing, instant messaging, and shared workspaces across distributed teams. There is a rising emphasis on API integrations and workflow automation with HR systems enabling businesses to streamline operations, reduce manual tasks, and centralize data management. The adoption of AI-powered bots and low-code connectors is also gaining momentum, allowing companies to tailor workflows to dynamic business needs.

Furthermore, the integration of AI‑powered productivity and analytics features into collaboration suites, enabling smarter teamwork and data driven decision making. AI assistants automate task assignments, meeting summaries, and workflow optimizations, while built‑in analytics dashboards track team performance and project milestones in real time. These intelligent insights help managers identify bottlenecks, forecast resource needs, and streamline processes. As organizations seek more proactive, insight driven collaboration, demand for AI-enhanced team collaboration software continues to accelerate team collaboration software industry growth.

Moreover, the rising emphasis on seamless cross-platform interoperability is reshaping the market. Organizations now demand solutions that effortlessly integrate chat, video conferencing, file sharing, and task management across disparate tools and devices. Collaboration platforms are evolving to offer open APIs, prebuilt connectors, and unified interfaces that bridge legacy systems, SaaS applications, and on-premises infrastructure. This trend toward a cohesive digital workspace enhances user adoption, streamlines workflows, and reduces tool expansion. This shift drives higher adoption rates and propels the team collaboration software market expansion.

Deployment Insights

The on-premise segment accounted for the largest share of over 50% in 2024. This growth is driven by enterprises seeking more control over their data and infrastructure, as on-premises solutions offer enhanced security, customization, and compliance capabilities. Companies in industries such as healthcare, finance, and government, where data privacy is critical, are increasingly opting for on-premises deployments to ensure tighter control over sensitive information while still benefiting from advanced collaboration features.

The cloud segment is expected to witness the highest CAGR of over 11% from 2025 to 2030, owing to the increasing demand for cloud-based platforms for effective team collaboration across enterprises, considering the rising number of people working remotely. Besides, these cloud platforms offer flexibility to access collaborative tools through smartphones. They also come with enriched features, including the capability of recording events to help review the proceedings later, thereby solidifying the dominance of this segment.

Software Type Insights

The communication & coordination software segment accounted for the largest market share in 2024. The widespread adoption of the Software as a Service (SaaS) model continues to transform how organizations implement and scale collaboration tools. SaaS-based solutions enable rapid deployment, lower dependency on internal IT infrastructure, and support continuous updates and innovation. This shift is enhancing the performance and reliability of team collaboration platforms, reducing latency, minimizing system downtime, and ensuring seamless communication and coordination across devices and geographies. As hybrid and distributed work environments become the norm, these trends are reinforcing the dominance of communication & coordination software in the market.

The conferencing software segment is expected to witness the fastest growth from 2025 to 2030, driven by the growing reliance on web conferencing as a primary mode of communication in modern organizations. A key trend is the widespread adoption of platforms like Microsoft Teams and Google Workspace, which have become essential tools for hosting virtual meetings and fostering collaboration. These solutions are at the forefront of workplace digital transformation, enabling real-time, organization-wide communication and enhancing productivity in remote and hybrid environments. The continued evolution of virtual meeting technologies and integration with broader collaboration ecosystems further drives this continued expansion.

Application Insights

The IT & Telecom segment accounted for the largest market share in 2024, owing to robust unified‑communications platforms that leverage high-speed networks, 5G connectivity, and edge‑computing capabilities to enable real-time voice, video, and data collaboration. Integrated IoT device management and secure network orchestration streamline field‑service workflows and interdepartmental coordination, enhancing operational efficiency and driving continued demand across telecom carriers and enterprise IT organizations.

The healthcare segment is expected to grow at the highest CAGR from 2025 to 2030, driven by emerging trends in real-time data sharing and the growing need for connected, collaborative environments. Healthcare providers are increasingly adopting team collaboration software to enhance employee engagement and facilitate the seamless exchange of updates, feedback, and ideas across departments and facilities.

Regional Insights

North America accounted for the largest share of over 37% in 2024, primarily driven by the region’s focus on rapid adoption of web conferencing solutions and collaboration portals by enterprises in the region. Moreover, easy access to high-speed internet is necessary for operating remote work models is expected to support the growth prospects of the regional market.

U.S. Team Collaboration Software Market Trends

The U.S. team collaboration software market is expected to grow at a CAGR of over 6% from 2025 to 2030, fueled by a relentless drive for innovation and digital modernization. The booming startup ecosystem, coupled with legacy enterprises accelerating cloud migrations and adopting agile workflows, is amplifying demand for unified collaboration platforms. Enhanced investment in remotework infrastructure and a growing emphasis on employee productivity tools further solidify the U.S. as a leading growth market.

Europe Team Collaboration Software Market Trends

Europe team collaboration software market is expected to grow at a CAGR of over 7% from 2025 to 2030, driven by a strong focus on digital transformation across both large enterprises and small-to-medium businesses. The shift towards remote and hybrid work models, especially post-pandemic, is driving the demand for advanced collaboration tools that facilitate seamless communication and productivity in the team collaboration software industry.

The U.K. product engineering services market is expected to experience the fastest growth in the coming years. The country benefits from a highly developed digital infrastructure and a strong focus on remote work adoption and hybrid working models. The U.K.'s advanced technology sectors, including finance, healthcare, and education, drive the demand for innovative team collaboration solutions that enhance productivity, streamline communication, and ensure seamless collaboration across geographically dispersed teams. As organizations in the U.K. increasingly prioritize digital transformation, the need for secure, scalable, and feature-rich collaboration platforms is intensifying, further driving market expansion.

The Germany team collaboration software market is fueled by the country’s strong industrial sectors, particularly manufacturing, automotive, and technology, which continue to drive the demand for advanced communication and collaboration tools. Additionally, Germany’s focus on digitalization and Industry 4.0 is pushing businesses to adopt integrated collaboration platforms that support remote work and seamless communication across geographically dispersed teams. This trend is creating significant opportunities for the market to evolve, providing solutions that enhance productivity, streamline workflows, and meet the growing demand for flexible and secure collaboration in the workplace.

Asia Pacific Team Collaboration Software Market Trends

The Asia Pacific team collaboration software market is expected to grow at a CAGR of over 8% from 2025 to 2030,driven by the ongoing digitization of businesses and the development of high-speed internet infrastructure in the region. Such developments are encouraging organizations to incorporate team collaboration software to optimize their workforce and facilitate effective interaction among employees. This demand for flexible, scalable solutions is further driving the need for customized collaboration platforms that cater to unique industry requirements, resulting in higher adoption rates across diverse sectors.Top of FormBottom of Form

The Japan team collaboration software market is gaining traction fueled by its technological innovation, particularly in sectors such as automotive, robotics, and electronics. The country’s strong focus on digital transformation, efficiency, and advanced automation drives the demand for specialized collaboration platforms that can enhance team productivity, streamline workflows, and improve communication across industries. Japan's emphasis on remote work solutions, coupled with its aging population, has also increased the need for intuitive, user-friendly software that supports accessibility and caters to diverse workforce needs, further boosting demand for personalized and innovative collaboration tools.

The China team collaboration software market is rapidly expanding. China’s focus on digital transformation and the growing adoption of remote and hybrid work models are significant drivers of the market. The government’s emphasis on technological innovation and digital infrastructure, combined with the push for smart cities, is accelerating the demand for advanced collaboration solutions. Additionally, efforts to improve data security and meet international standards are fostering market growth.

Key Team Collaboration Software Company Insights

Some of the key players operating in the market include Adobe and Cisco Systems, Inc.

-

Adobe has broadened its collaboration portfolio by embedding real-time co-editing and actionable review workflows across its Document Cloud and Creative Cloud platforms. By unifying seamless asset sharing with enterprise-grade security controls such as permissions management, audit trails, and encrypted cloud storage. Adobe enables cross-functional teams to iterate on content and documentation more efficiently. These enhancements position Adobe as a preferred collaboration solution for organizations prioritizing design excellence and secure, compliant workflows.

-

Cisco Systems, Inc. is a technology company providing services in networking, security, and collaboration solutions. Within the market, Cisco’s Webex suite offers a comprehensive platform that includes Webex Huddle for persistent virtual workspaces, Webex Desk Pro for integrated video and whiteboarding, and AI-driven noise suppression to enhance meeting quality. These tools enable seamless synchronization of whiteboards, files, and chat threads across meetings and channels, empowering organizations to streamline communication, boost productivity, and support hybrid work models

Zoom Video Communications, Inc. and Slack Technologies, LLC are some of the emerging market participants in the team collaboration software market.

-

Zoom Video Communications, Inc. delivers a unified collaboration platform that combines persistent messaging channels, advanced whiteboarding, and voice services. Zoom Workplace integrates persistent channels with Whiteboard 2.0,featuring AI-powered diagram recognition to facilitate ideation and visual collaboration. Coupled with integrated Zoom Phone archiving, the platform ensures seamless transitions between chat, voice, and collaborative sketching, empowering teams to maintain continuity and boost productivity in both hybrid and distributed work environments.

-

Slack Technologies, LLC is a provider of enterprise collaboration solutions, specializing in real-time messaging and workflow integration. Its enhanced “Threads+” feature organizes conversations into deep, nested discussions, while AI-driven summarization distills key points and action items automatically. With a broad ecosystem of app‑directory integrations and cross-workspace linking, Slack enables organizations to reduce email dependency, centralize operational notifications, and streamline team communications across disparate departments.

Key Team Collaboration Software Companies:

The following are the leading companies in the team collaboration software market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Asana, Inc.

- Avaya Inc.

- AT&T, Inc.

- Blackboard, Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Google LLC

- IBM Corporation

- Microsoft

- OpenText Corporation

- Oracle

- Slack Technologies, LLC

- Zoom Video Communications, Inc.

Recent Developments

-

In April 2025, AT&T, Inc. expanded its Network Edge Collaboration service by integrating private 5G technology to enable ultra-low‑latency video conferencing and secure field‑site file sharing. This new initiative enhances the collaboration experience by offering faster, more reliable connections for remote teams, improving communication in high-demand environments. Through this upgrade, AT&T aims to support industries with greater security, efficiency, and real-time collaboration capabilities, further driving the growth of its enterprise-focused communication solutions.

-

In March 2025, Adobe announced a strategic collaboration with Amazon Web Services (AWS) aimed at enhancing its customer experience offerings. The collaboration, effective immediately, combines Adobe's expertise in Customer Experience Orchestration with AWS's advanced cloud services. This partnership is designed to help marketing and creative teams deliver customer experiences more quickly, precisely, and at scale, empowering businesses to meet the demands of the digital era better.

-

In March 2025, Cisco Systems, Inc. launched Webex Huddle, a persistent virtual workspace designed to automatically sync whiteboard sketches, files, and chat threads across meetings and channels. This new initiative enhances collaboration by offering seamless integration and real‑time updates, allowing teams to maintain continuity across discussions. With this update, Cisco aims to streamline communication, improve workflow efficiency, and provide a more cohesive experience for hybrid teams, further strengthening its position in the team collaboration software market.

Team Collaboration Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 40,159.0 million

Revenue forecast in 2030

USD 57,403.8 million

Growth Rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, software type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, UK, Germany, France, China, Japan, India, South Korea, Australia, Brazil, Mexico, UAE, Saudi Arabia, South Africa

Key companies profiled

Adobe; Asana, Inc.; Avaya Inc.; AT&T, Inc.; Blackboard, Inc.; Cisco Systems, Inc.; Citrix Systems, Inc.; Google LLC; IBM Corporation; Microsoft; OpenText Corporation; Oracle; Slack Technologies, LLC; Zoom Video Communications, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Team Collaboration Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the team collaboration software market report based on deployment, software type, application, and region:

-

Team Collaboration Software Market Deployment Outlook (Revenue, USD Million, 2018- 2030)

-

Cloud

-

On-premise

-

-

Team Collaboration Software Market Software Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Conferencing Software

-

Communication & Coordination Software

-

-

Team Collaboration Software Market Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

BFSI

-

IT & Telecom

-

Retail

-

Healthcare

-

Logistics & Transportation

-

Education

-

-

Team Collaboration Software Market Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global team collaboration software market size was estimated at USD 36,114.2 million in 2024 and is expected to reach USD 40,159.0 million in 2025.

b. The global team collaboration software market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030 to reach USD 57,403.8 million by 2030.

b. Some key players operating in the global team collaboration software market include Adobe; Asana, Inc.; Avaya Inc.; AT&T, Inc.; Blackboard, Inc.; Cisco Systems, Inc.; Citrix Systems, Inc.; Google LLC; IBM Corporation; Microsoft; OpenText Corporation; Oracle; Slack Technologies, LLC; Zoom Video Communications, Inc.

b. The on-premise segment accounted for the largest share of over 50% in 2024. This growth is driven by enterprises seeking more control over their data and infrastructure, as on-premises solutions offer enhanced security, customization, and compliance capabilities.

b. The communication & coordination software segment accounted for the largest market share in 2024, owing to the widespread adoption of the Software as a Service (SaaS) model, which continues to transform how organizations implement and scale collaboration tools.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."