- Home

- »

- Medical Devices

- »

-

U.S. Endoscopes Services Market, Industry Report, 2030GVR Report cover

![U.S. Endoscopes Services Market Size, Share & Trends Report]()

U.S. Endoscopes Services Market Size, Share & Trends Analysis Report By Product (Flexible Endoscopes, Rigid Endoscopes), By Origin (OEM Service Providers, Third-Party / Refurbished Service Providers), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-598-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Endoscopes Services Market Trends

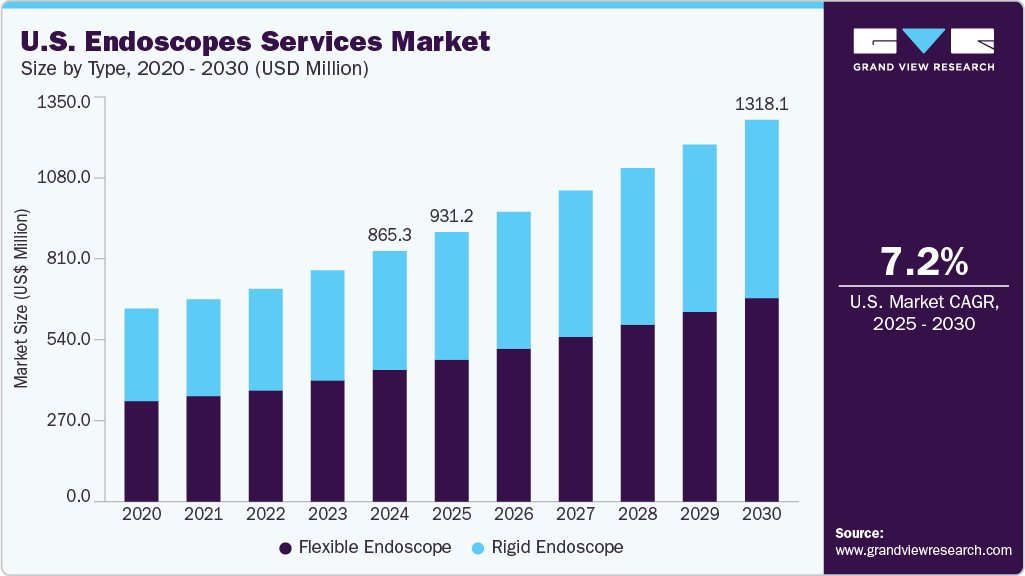

The U.S. endoscopes services market size was estimated at USD 865.26 million in 2024 and is expected to grow at a CAGR of 7.20% from 2025 to 2030. The market is anticipated to experience substantial growth due to the rising incidence of gastrointestinal diseases and cancers, leading to a rising need for endoscopic examinations. This surge is fueling the need for effective maintenance services to reduce the risk of procedure-related infections. Moreover, growing demand for minimally invasive surgeries, adherence to regulatory standards, advancements in cleaning and reprocessing technology, rising healthcare spending, and an enhanced emphasis on infection control strategies all contribute to the market's growth.

The rising number of endoscopic procedures in the U.S. highlights the essential need for ensuring the safety and optimal functioning of equipment. For instance, according to Gastroenterology Associates, PC., a provider of digestive healthcare in New York, 75 million endoscopic procedures are performed annually in the U.S., of which 51.5 million are gastrointestinal endoscopies. As more patients opt for these procedures, there is a corresponding need for reliable maintenance and repair services that ensure the efficacy and safety of endoscopes. This trend drives demand for various cleaning and reprocessing devices and services, propelling market growth.

Furthermore, according to the American Society for Gastrointestinal Endoscopy, "any facility where gastrointestinal endoscopy is conducted must implement a robust quality assurance program to ensure the proper reprocessing of endoscopes. Quality assurance programs for endoscopy should encompass systems that provide the consistent availability of the necessary equipment and supplies, and stringent procedures for reporting any potential issues." Thus, the stringent regulations imposed by regulatory authorities further boost the market's growth.

A growing number of successful clinical trials are anticipated to increase product approvals. For instance, in January 2023, Agilis Robotics, a developer of flexible robotic instruments, completed its second round of live animal testing for its proprietary endoscopic surgery robot. The results of these tests were satisfactory, showcasing the device's accuracy, efficacy, and safety. As a result, the increasing incorporation of robotics into endoscopic surgery is expected to contribute to a higher volume of procedures, thus fueling market growth.

The growing adoption of minimally invasive surgery (MISs) is expected to boost the U.S. endoscopes industry over the forecast period. Key advantages include high patient acceptance rates, reduced pain, cost-effectiveness, and lower chances of complications. Surgeons are increasingly favoring robotic & endoscopic surgeries over conventional open surgeries due to the numerous benefits they offer.

Benefits of Minimally Invasive Surgeries

-

Shorter Hospital Stay and Recovery Time: Patients undergoing minimally invasive surgeries typically experience shorter hospital stays and faster recovery times. This enhances patient comfort and reduces the burden on healthcare facilities.

-

Reduced Postoperative Complications: Minimally invasive surgeries significantly lower the risk of postoperative complications compared to traditional open surgeries. The smaller incisions reduce the chances of infection and other surgical complications.

-

Economic Viability: Minimally invasive surgeries are often more cost-effective than open surgeries. The shorter hospital stays and quicker recoveries reduce overall healthcare costs, making these procedures economically viable alternatives.

-

Decreased Blood Loss: These surgeries result in less blood loss during procedures, which is crucial for patient safety and recovery.

Market Concentration & Characteristics

The U.S. endoscopes services market is characterized by a moderate degree of innovation, with new technologies and methods being developed and introduced regularly. For instance, in June 2022, Getinge launched an improved version of the ED-Flow automated endoscope reprocessor, providing advanced digital connectivity and data management to its endoscope reprocessing customers.

Due to several factors, the U.S. endoscope services market is characterized by medium mergers and acquisitions activity, including the desire to expand the business to cater to the growing demand for maintenance and repair services and maintain a competitive edge. For instance, in June 2021, STERIS plc acquired Cantel Medical, a provider of infection prevention services and products to life sciences, dental, endoscopy, & dialysis customers.

Regulations are crucial in shaping the market, as they ensure patient safety and maintain the efficacy of endoscopes. Regulatory bodies such as the CDC (Centers for Disease Control and Prevention) and FDA (Food and Drug Administration) have established standards and guidelines for reprocessing and cleaning endoscopes to reduce the risk of infections associated with endoscopic procedures.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. For instance, in December 2022, PENTAX Medical America introduced the PlasmaTYPHOONdry, an endoscope drying solution. It was developed to enhance traceability and productivity, and this system further advances endoscope drying to improve patient safety.

Product Insights

By product, the flexible endoscope segment held a significant revenue share of 52.56% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period.Furthermore, factors driving the market include an increase in the prevalence of chronic diseases affecting internal body systems, the advantages of flexible endoscopes compared to other devices, and growing awareness for early diagnosis of these conditions. Inflammatory bowel diseases (IBD), stomach & colon cancers, respiratory infections, and tumors, among others, require the use of these devices for diagnosis. As a result, the growth in the incidence of these diseases has increased demand for these flexible devices. For instance, in 2025, the American Cancer Society, Inc. estimated that there were about 30,300 new cases of stomach cancer (12,580 in women and 17,720 in men) in the U.S. and 107,320 new cases of colon cancer and 44,850 new cases of rectal cancer. Thus, such a rise in the prevalence of cancers increases the demand for flexible endoscopes, which require maintenance services that boost market growth.

The rigid endoscope segment is anticipated to grow at the significant CAGR over the forecast period. Technological advancements play an essential role in driving the rigid endoscope services market. Continuous improvements in optical imaging, durability of materials, and integration with digital and robotic surgery systems enhance the capabilities and lifespan of rigid endoscopes. These advancements lead to increased investment in high-end equipment, which requires regular servicing, calibration, and repairs to ensure optimal performance and compliance with stringent medical standards.

Origin Insights

By origin, the OEM (Original Equipment Manufacturer) service providers segment dominated the market with a revenue share of 54.45% in 2024. OEMs have a distinct advantage in delivering high-quality and dependable servicing and support for the endoscopes they manufacture, covering routine maintenance and repair services. A key factor driving the OEM market is healthcare providers' belief in these manufacturers to maintain their products according to original specifications. This commitment ensures consistent performance and adherence to regulatory standards, especially in surgical and diagnostic settings. For example, companies such as Olympus Corporation, Fujifilm Holdings Corporation, Steris, and Pentax Medical (Hoya Corporation) offer comprehensive maintenance and repair services.

The third-party / refurbished service providers segment is anticipated to grow at a fastest CAGR over the forecast period. Many healthcare facilities, including smaller clinics, ambulatory surgical centers, and organizations in emerging markets, frequently opt for refurbished and reprocessed endoscopes as a reasonable alternative to new equipment. This approach enables these providers to obtain advanced diagnostic and surgical instruments at a significantly lower cost while still maintaining functionality and performance, contributing to the growth of this market segment. For example, companies such as MD Endoscopy, Probo Medical, and United Endoscopy offer refurbished endoscopes and repair services.

Key U.S. Endoscopes Services Company Insights

Key participants in the market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key U.S. Endoscopes Services Companies:

- Olympus Corporation

- Fujifilm Holdings Corporation

- Steris

- Pentax Medical (Hoya Corporation)

- MD Endoscopy

- Probo Medical

- United Endoscopy

- Wassenburg Medical, Inc.

- Boston Scientific Corporation

- Surgical Solutions, LLC.

Recent Developments

-

In March 2025, the U.S. Food and Drug Administration (FDA) granted de novo clearance for Nanosonics’ automated endoscope cleaning system known as CORIS. This marks a significant advancement in the field of medical device sterilization, particularly for flexible endoscopes used in procedures such as colonoscopy. The de novo clearance for Nanosonics’ approach initially greenlights CORIS’ use with an Olympus video endoscope designed for colonoscopy, the Evis Exera III. The company said it plans to cover all major categories of flexible endoscopes in time.

-

In June 2023, Olympus launched the new Olympus ETD, an endoscope washer disinfector. It was introduced in two versions, ETD Premium and ETD Basic, and was developed for endoscope reprocessing as part of the company's Infection Prevention portfolio.

U.S. Endoscopes Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 931.20 million

Revenue forecast in 2030

USD 1,318.07 million

Growth rate

CAGR of 7.20% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, origin

Country scope

U.S.

Key companies profiled

Olympus Corporation; Fujifilm Holdings Corporation; Steris; Pentax Medical (Hoya Corporation); MD Endoscopy; Probo Medical; United Endoscopy; Wassenburg Medical, Inc.; Boston Scientific Corporation; Surgical Solutions, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Endoscopes Services Market Report Segmentation

This report forecasts revenue growth and provides U.S. level an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. endoscopes services market report based on product and origin:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Flexible Endoscopes

-

By Indication and Product

-

Urological Endoscope

-

Flexible Cystoscopes

-

Fiber

-

Video

-

-

Flexible Ureteroscopes

-

Fiber

-

Video

-

-

-

ENT Endoscope

-

Flexible Rhinolaryngoscopes

-

Fiber

-

Video

-

-

-

Bronchoscope

-

Flexible Bronchoscopes

-

Fiber

-

Video

-

-

-

GI Endoscope

-

Colonoscopes

-

Gastroscopes

-

Enteroscopes

-

Gastroscopes

-

Enteroscopes

-

-

Duodenoscopes

-

Ultrasound Endoscopes

-

Sigmoidoscopes

-

-

Gynecological Endoscope

-

-

-

Rigid Endoscopes

-

By Indication and Product

-

Laparoscope

-

Rod Lens Laparoscopes

-

Video Laparoscopes

-

-

Arthroscope

-

Large-Joint Arthroscopes

-

Small-Joint Arthroscopes

-

-

Urological Endoscope

-

ENT (Ear, Nose, Throat) Endoscope

-

Rigid Rhinoscopes

-

Rigid Laryngoscopes

-

-

Bronchoscope

-

Rigid Bronchoscopes

-

-

Gynecological Endoscope

-

Rigid Hysteroscopes

-

-

-

-

-

Origin Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM (Original Equipment Manufacturer) Service Providers

-

Third-Party / Refurbished Service Providers

-

Frequently Asked Questions About This Report

b. The U.S. endoscopes services market size was estimated at USD 865.26 million in 2024 and is expected to reach USD 931.20 million in 2025.

b. The U.S. endoscopes services market is expected to grow at a compound annual growth rate of 7.20% from 2025 to 2030 to reach USD 1.31 billion by 2030.

b. The flexible endoscope segment held the largest market share of 52.56% in 2024. Factors driving the market include an increase in the prevalence of chronic diseases affecting internal body systems, the advantages of flexible endoscopes compared to other devices, and growing awareness for early diagnosis of these conditions.

b. Some key players operating in the U.S. endoscopes services market include Olympus Corporation, Fujifilm Holdings Corporation, Steris, Pentax Medical (Hoya Corporation), MD Endoscopy, Probo Medical, United Endoscopy, Wassenburg Medical, Inc., Boston Scientific Corporation, Surgical Solutions, LLC.

b. The market is anticipated to experience substantial growth due to the rising incidence of gastrointestinal diseases and cancers, leading to a rising need for endoscopic examinations. This increase drives the demand for efficient maintenance services to mitigate the risk of infections related to these procedures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."