- Home

- »

- Consumer F&B

- »

-

U.S. Energy Drinks Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Energy Drinks Market Size, Share & Trends Report]()

U.S. Energy Drinks Market Size, Share & Trends Analysis Report by Product (Energy Drinks, Energy Shorts), By Type (Organic, Conventional), By Packaging (Bottles, Cans), By Distribution Channel, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-807-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Energy Drinks Market Size & Trends

The U.S. energy drinks market size was estimated at USD 25.01 billion in 2024 and is expected to grow at a CAGR of 7.2% from 2024 to 2030. . The increasing demand for energy drinks among male consumers aged 18-34 has primarily driven the market. Consumers prefer these drinks as potential enhancers of both physical and cognitive performance. Beverages that are free from high sugar, glucose, and fructose corn syrups have gained popularity among health-conscious consumers. This has further led market players to actively promote these drinks as functional beverages that enhance energy levels, alertness, and overall physical vitality.

Moreover, the rising demand for natural and organic ingredients has significantly impacted the U.S. energy drinks industry due to health and well-being concerns. Consumers are increasingly seeking healthier alternative products offering transparency and sustainability in beverage production. This shift in consumer preferences has prompted energy drink manufacturers to reformulate their products using natural and organic ingredients, including fruit extracts, natural sweeteners such as stevia, and other organic sources of caffeine. In addition, the belief that natural and organic components offer superior nutritional benefits without synthetic additives fuels the product demand.

Furthermore, millennials and consumers, owing to their fast-paced lifestyles, drive market growth. Energy drinks with high caffeine content and quick energy boosts align well with modern lifestyles. Moreover, the health-conscious younger population is driving dynamic shifts in the energy drinks market. This has led manufacturers to offer low-sugar or sugar-free options, incorporating natural ingredients, vitamins, and antioxidants. In addition, energy drink makers are increasingly leveraging social media channels to reach their target audience effectively. These channels play a significant role in shaping consumer preferences and building brand loyalty, particularly among the age group between 18-40.

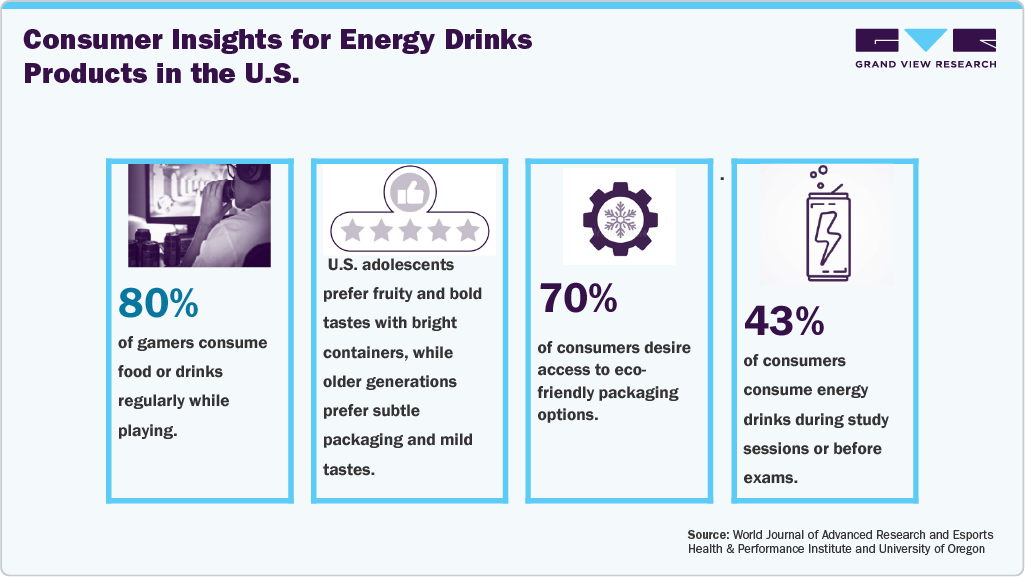

According to Mayo Clinic News Network, in 2022, energy drinks were the second most popular dietary supplement among young adults and teens in the U.S. Market players are actively promoting these beverages as functional drinks that enhance energy levels, alertness, and physical performance. According to a report published by the University of Oregon, adolescents in the U.S. prefer fruity and bold tastes with bright containers, while older generations prefer subtle packaging and mild tastes.

Product Insights

The energy drinks segment held a revenue share of 94.0% of the U.S. revenue in 2024, due to strong demand from young adults, athletes, and busy professionals seeking quick and convenient energy boosts for physical and mental activities. This demand is driven by lifestyle factors such as long work or study hours and active sports participation. Leading brands like Red Bull and Monster have successfully capitalized on this by innovating with diverse flavors, functional ingredients, and targeted marketing campaigns linked to extreme sports, esports, and music festivals, enhancing brand appeal among millennials and Gen Z consumers. Retail dominance by supermarkets and hypermarkets, along with growing online sales channels, has made these products widely accessible. For instance, Red Bull’s strategic sponsorship of sports events and effective advertising have cemented its market leadership, contributing significantly to the overall revenue share of energy drinks in the U.S.

The energy shots segment is projected to grow at a CAGR of 1.0% from 2025 to 2030, due to increasing consumer demand for convenient, quick energy solutions that fit busy lifestyles. Energy shots are favored for their portability and concentrated caffeine content, appealing especially to millennials and working professionals who need instant mental and physical boosts without consuming larger energy drinks. The market growth is supported by innovation in product formulations, including natural and organic ingredients such as B vitamins, taurine, and adaptogens, which attract health-conscious consumers seeking functional benefits beyond energy. For instance, in 2024, 5-hour ENERGY’s introduction of specialized products such as Gamer Shot targets niche groups such as gamers, enhancing focus and sustained energy without jitters.

Type Insights

The conventional energy drinks segment accounted for a share of 91.7% of the U.S. revenue in 2024. Major players like Red Bull and Monster dominate this segment by offering classic formulations with proven energy-boosting ingredients such as caffeine, taurine, and B vitamins, which appeal broadly to young adults, athletes, and professionals seeking enhanced physical and mental performance. The segment benefits from extensive marketing campaigns tied to sports, esports, and music events, reinforcing its lifestyle image. In addition, conventional energy drinks offer a wide variety of flavors and packaging options, making them accessible and convenient for impulse purchases, especially in supermarkets and convenience stores. Despite rising interest in organic alternatives, the conventional segment’s familiarity, availability, and ongoing product innovation sustain its dominant market share in the U.S. energy drink industry.

The organic energy drinks segment is projected to grow at a CAGR of 9.3% from 2025 to 2030, due to rising consumer demand for healthier, natural beverage options free from synthetic pesticides, GMOs, and artificial additives. Increasing awareness of health and wellness encourages consumers to choose clean-label products with organic ingredients that provide energy without the negative effects associated with conventional energy drinks, such as high sugar and synthetic compounds. For instance, Wholesome Organics Co. launched Clean Energy Shot in 2023, targeting health-conscious individuals seeking organic energy boosts with added benefits. This trend is supported by a growing preference for functional beverages containing natural herbs and vitamins, like ashwagandha and ginseng, which appeal to both young adults and professionals. In addition, the shift toward organic products aligns with broader lifestyle changes emphasizing sustainability and wellness, further driving market growth despite the overall competitive energy.

Packaging Insights

The cans energy drinks segment held a share of 92.5% of the U.S. revenue in 2024. Metal cans offer superior convenience, product protection, and sustainability that strongly appeal to consumers and manufacturers alike. Cans provide a complete barrier against light and oxygen, preserving the beverage’s freshness and flavor for longer periods. They chill faster than other packaging, enhancing consumer experience, especially for on-the-go consumption. In addition, cans are lightweight, durable, and easy to stack, making them ideal for transport and retail display. From an environmental perspective, aluminum cans are highly recyclable-over 99% recycling rate-and can be recycled infinitely without quality loss, saving up to 95% of the energy required to produce new cans. This aligns well with growing consumer and regulatory focus on sustainability. Major energy drink brands like Red Bull and Monster exclusively use cans, leveraging their large printable surface for impactful branding and marketing. These combined factors make cans the preferred packaging format, driving their dominant market share in the U.S. energy drink industry.

The bottles energy drink segment is projected to grow at a CAGR of 6.1% from 2025 to 2030, due to increasing consumer demand for convenient, sustainable, and premium packaging options. PET plastic bottles, which dominate this segment, offer significant environmental advantages over glass and aluminum, including lower greenhouse gas emissions, reduced energy and water use during production, and high recyclability, making them attractive to eco-conscious consumers. Their lightweight and durable nature also enhances portability and ease of use, supporting on-the-go lifestyles. For instance, PET bottles are 100% recyclable and can be made with recycled content, aligning with growing sustainability trends. In addition, bottles preserve beverage freshness and flavor effectively, appealing to health-conscious buyers seeking quality. The expanding availability of bottled energy drinks in supermarkets and convenience stores further boosts accessibility. These factors, combined with increasing awareness around environmental impact and consumer preference for functional, convenient packaging, drive steady growth in the bottles segment despite the overall dominance of cans in the energy drink market.

Distribution Channel Insights

The sales of energy drinks through off-trade held a share of around 84.5% of the U.S. revenue in 2024. Off-trade outlets-such as supermarkets, hypermarkets, convenience stores, and retail chains-provide extensive shelf space with diverse energy drink brands and flavors, allowing buyers to evaluate quality, ingredients, and pricing. These retail formats benefit from strategic locations, longer operating hours, and promotional activities like discounts and product displays, which encourage impulse buying and repeat purchases. For instance, supermarkets and hypermarkets dominate the distribution landscape by offering competitive pricing and a broad product range that caters to varied consumer preferences, including natural and organic options. Moreover, the convenience of one-stop shopping during routine grocery trips makes off-trade channels the preferred choice for many consumers. While on-trade venues like bars and clubs are growing, off-trade remains dominant due to its role in everyday consumption and widespread availability across urban and suburban areas.

Energy drinks sales through the on-trade are projected to grow at a CAGR of 5.3% from 2025 to 2030, driven by increasing consumer preference for experiential consumption in social settings like bars, clubs, and restaurants. Millennials and younger consumers favor unique energy drink flavors, mixology, and creative presentations that enhance nightlife and social gatherings. Energy drinks are often consumed as standalone beverages or mixed with alcohol in cocktails and mocktails, making them popular in on-trade venues. This trend is supported by the rise of urbanization and disposable incomes, which fuel demand for premium, convenient, and lifestyle-oriented products. For instance, energy drink brands collaborate with nightlife venues to promote special events and signature drinks, boosting visibility and sales. In addition, the functional benefits of energy drinks-such as improved alertness and stamina-align well with active social lifestyles, further encouraging consumption in on-trade environments.

Key U.S. Energy Drinks Company Insights

Key companies in the U.S. energy drinks industry maintain a competitive edge through continuous product innovation, including new flavors, sugar-free and natural ingredient formulations, and functional benefits targeting mental and physical performance. These companies leverage extensive distribution networks across supermarkets, convenience stores, and growing online retail channels to maximize consumer reach. Strategic partnerships, mergers, and acquisitions enable portfolio expansion and market penetration.

Key U.S. Energy Drinks Companies:

- Red Bull GmbH

- Taisho Pharmaceutical Holdings Co. Ltd.

- PepsiCo, Inc.

- Monster Beverage Corporation

- Lucozade Ribena Suntory Limited

- The Coca-Cola Company

- Amway Corp

- AriZona Beverages USA

- Living Essentials Marketing, LLC

- XYIENCE Energy

Recent Developments

-

In October 2024, STōK Cold Brew Coffee launched STōK Cold Brew Energy, a new energy drink combining smooth cold brew coffee with 195mg of caffeine, B vitamins, ginseng, and guarana to enhance focus and energy. This product expanded STōK’s portfolio by offering three creamy flavors- Mocha Cream, Vanilla Cream, and Caramel Cream- designed for busy consumers needing an extra boost during their day.

U.S. Energy Drinks Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.67 billion

Revenue forecast in 2030

USD 37.83 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, packaging, distribution channel

Country scope

U.S.

Key companies profiled

Red Bull GmbH; Taisho Pharmaceutical Holdings Co. Ltd.; PepsiCo, Inc.; Monster Beverage Corporation; Lucozade Ribena Suntory Limited; The Coca-Cola Company; Amway Corp; AriZona Beverages USA; Living Essentials Marketing, LLC; XYIENCE Energy

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Energy Drinks Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. energy drinks market report based on product, type, packaging, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Energy Drinks

-

Energy Shots

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."