- Home

- »

- Advanced Interior Materials

- »

-

U.S. HVAC Insulation Market Size, Industry Report, 2030GVR Report cover

![U.S. HVAC Insulation Market Size, Share & Trends Report]()

U.S. HVAC Insulation Market Size, Share & Trends Analysis Report By Product (Pipe, Ducts, Acoustic Board), By Material (Mineral Wool, Plastic Foam), By Distribution Channel (Online, Offline), By Application, By End-use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-604-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

U.S. HVAC Insulation Market Size & Trends

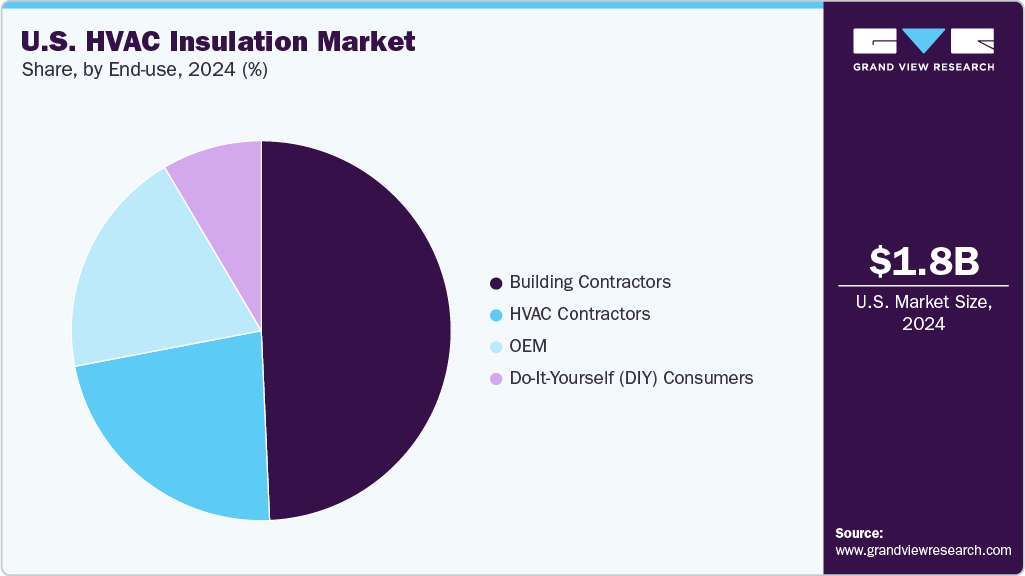

The U.S. HVAC insulation market size was estimated at USD 1.80 billion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2030. The U.S. HVAC insulation market is primarily driven by increasing investments in energy-efficient buildings and stringent government regulations aimed at reducing energy consumption. With buildings accounting for a significant portion of the country’s energy use, HVAC insulation plays a crucial role in minimizing heat loss and improving thermal performance, helping to lower energy bills and carbon emissions.

Additionally, rising awareness of environmental sustainability and the push for green building practices are fueling demand for advanced and eco-friendly insulation solutions such as elastomeric foam, fiberglass, and bio-based materials. The retrofit of existing infrastructure and growth in new commercial and residential construction projects also contribute to the expanding market. Technological advancements, including the integration of smart insulation systems and the development of vapor barriers and acoustic insulation, are enhancing product offerings and supporting the market’s steady growth trajectory.

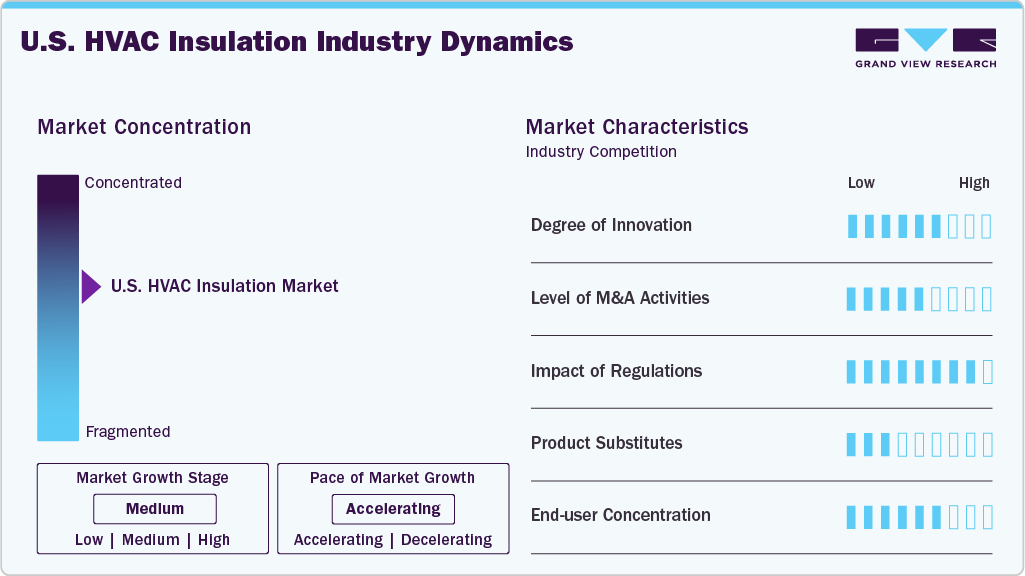

Market Concentration & Characteristics

The U.S. HVAC insulation market is moderately concentrated, with several leading global and regional manufacturers holding significant market shares. Major players such as Saint-Gobain, Johns Manville, and Knauf Insulation dominate the landscape, leveraging strong brand recognition and extensive distribution networks. However, the presence of numerous smaller and specialized companies contributes to a competitive environment, fostering innovation and customer choice.

Innovation in the U.S. HVAC insulation market is characterized by the development of advanced materials and technologies aimed at improving energy efficiency, fire resistance, and ease of installation. Manufacturers are investing in eco-friendly and sustainable insulation products, including bio-based and recycled materials, as well as enhanced formulations like aerogels and vacuum-insulated panels.

Mergers and acquisitions activity in the U.S. HVAC insulation market has been moderate, primarily driven by companies seeking to expand product portfolios, enter new geographic markets, or acquire innovative technologies. Strategic partnerships and acquisitions enable firms to enhance their competitive positioning and respond to evolving customer demands for high-performance and sustainable insulation solutions. While large-scale M&A deals are less frequent, targeted acquisitions of niche players and technology providers are common.

Regulatory impact plays a critical role in shaping the U.S. HVAC insulation market, with stringent building codes and energy efficiency standards such as the International Energy Conservation Code (IECC) driving demand for high-quality insulation products. Federal and state-level policies promoting energy conservation and greenhouse gas reduction encourage the adoption of advanced HVAC insulation materials. Additionally, fire safety regulations and environmental compliance requirements compel manufacturers to innovate and ensure their products meet rigorous safety and sustainability criteria.

Drivers, Opportunities & Restraints

The U.S. HVAC insulation market is primarily driven by increasing investments in energy-efficient buildings and stringent government regulations aimed at reducing energy consumption and carbon emissions. Growing awareness about thermal comfort, indoor air quality, and sustainability is encouraging the adoption of advanced insulation materials like elastomeric foam, fiberglass, and polyurethane. Additionally, federal infrastructure retrofitting initiatives and rising commercial construction activities are fueling demand for HVAC duct and pipe insulation.

Opportunities in the market arise from the expanding focus on green building practices and the development of innovative insulation solutions such as acoustic insulation, vapor barriers, and bio-based materials. The shift toward smart insulation systems integrated with digital monitoring and control technologies offers potential for enhanced energy savings and operational efficiency.

The market faces restraints from fluctuating raw material prices, which can increase production costs and impact profit margins for manufacturers and suppliers. High initial investment costs for advanced insulation technologies may also slow adoption among smaller construction firms or retrofit projects. Furthermore, the need for skilled labor to install specialized insulation systems and compliance with complex regulatory standards can pose challenges for market players.

Product Insights

The pipe segment accounted for a revenue share of 30.6% in 2024, driven by the increasing need for thermal protection of HVAC piping systems that transport heated or cooled fluids. Pipe insulation helps prevent energy loss, condensation, and corrosion, thereby extending system life and improving operational efficiency. Rising construction activities and retrofitting projects in commercial and industrial sectors are fueling demand for advanced pipe insulation materials and solutions.

Pre-Insulated duct segment is expected to grow at a considerable CAGR of 5.1% from 2025 to 2030 in terms of revenue, due to increasing demand for energy-efficient HVAC solutions in commercial and residential buildings. Rising construction activities and stricter government regulations promoting sustainability and reduced energy consumption are key drivers. Additionally, advancements in insulation materials and growing awareness about indoor air quality and thermal comfort are encouraging the adoption of pre-insulated duct systems.

Material Insights

The plastic foam segment accounted for a revenue share of 59.9% in 2024 owing to driven by innovations in phenolic, PIR, PUR, and elastomeric foams. These materials offer low thermal conductivity, high moisture resistance, and lightweight properties, making them ideal for pipe and duct insulation in commercial HVAC applications. The ease of installation, combined with superior fire resistance and energy efficiency, is fueling the rising adoption of plastic foam insulation, especially in new construction and retrofit projects focused on sustainability and regulatory compliance.

The mineral wool segment is expected to grow at a significant CAGR of 4.1% from 2025 to 2030 in terms of revenue, driven by its excellent fire resistance, thermal insulation, and soundproofing properties. Widely used in both commercial and residential buildings, mineral wool, particularly glass wool and stone wool, is favored for its ability to enhance safety and acoustic comfort. Its abundant availability and cost-effectiveness further support its strong market presence, making it a preferred choice for HVAC systems that require durability and compliance with fire safety standards.

Application Insights

The commercial segment accounted for a share of 53.4% in 2024. The commercial segment dominates the U.S. HVAC insulation market, driven by the extensive use of HVAC systems in offices, malls, hospitals, and other commercial buildings. These facilities require efficient climate control and energy management to ensure occupant comfort and reduce operational costs, which fuels strong demand for high-performance insulation materials. The need to comply with stringent energy codes and sustainability goals in commercial construction further supports this segment’s leading position.

The residential segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2030 in terms of revenue, due to increasing consumer awareness about energy savings, indoor comfort, and health benefits. Homeowners prioritize insulation that provides stable indoor temperatures, reduces utility bills, and improves air quality. Rising investments in new housing and retrofit projects, along with government incentives for energy-efficient upgrades, are accelerating the adoption of advanced HVAC insulation solutions in residential buildings.

Distribution Channel Insights

Offline segment accounted for a revenue share of 80.0% in 2024,owing to the established relationships between manufacturers, distributors, contractors, and end-users. Traditional channels like direct sales, wholesalers, and specialty retailers offer personalized service, technical support, and on-site consultations that are critical for large-scale commercial and industrial projects. The preference for offline purchasing is also driven by the need for immediate product availability and hands-on inspection before installation.

The online segment is expected to grow at a considerable CAGR of 5.3% from 2025 to 2030 in terms of revenue, as digitalization transforms procurement practices in the construction and HVAC sectors. Increasing adoption of e-commerce platforms and digital marketplaces enables easier access to a wide range of insulation products, competitive pricing, and faster delivery options. The convenience of online ordering, combined with growing acceptance of remote project management and virtual consultations, is expanding the online channel’s share, especially among small contractors and residential customers seeking cost-effective solutions.

End-use Insights

The building contractors segment dominated with a revenue share of 49.3% in 2024, owing to contractors adopting advanced HVAC insulation materials to meet stringent energy codes and green building certifications, creating strong demand in both commercial and residential sectors. This growth is supported by government incentives for energy-efficient upgrades and the expanding construction industry, making building contractors a vital and expanding end-user group in the HVAC insulation market.

The HVAC contractors segment is expected to grow at a significant CAGR of 5.2% from 2025 to 2030 in terms of revenue, due to increasing construction and renovation activities across residential and commercial sectors. Rising demand for energy-efficient and sustainable HVAC systems, driven by stricter government regulations and incentives like tax credits, is encouraging contractors to adopt advanced insulation solutions. Additionally, the growing integration of smart HVAC technologies and the need for professional installation and maintenance services are further supporting this segment’s expansion.

Key U.S. HVAC Insulation Company Insights

Some key players operating in the market include ROCKWOOL A/S, Saint-Gobain Technical Insulation, and Johns Manville.

-

ROCKWOOL A/S is a Danish multinational company specializing in stone wool insulation products that enhance energy efficiency, fire safety, and acoustic performance in buildings. With a strong global presence across Europe, North America, and Asia, ROCKWOOL serves diverse sectors including construction, marine, and industrial markets. Their stone wool insulation is known for its sustainability, durability, and excellent thermal and fire-resistant properties, making it a leading choice for both residential and commercial applications.

-

Saint-Gobain Technical Insulation is a division of the French multinational Saint-Gobain Group, offering advanced insulation solutions tailored for industrial, commercial, and HVAC applications. The company focuses on energy-efficient and sustainable insulation products that improve thermal performance and reduce environmental impact. With a broad portfolio and global reach, Saint-Gobain Technical Insulation supports various industries by providing reliable, high-quality insulation materials designed to meet stringent safety and efficiency standards.

Key U.S. HVAC Insulation Companies:

- Johns Manville

- Saint-Gobain Technical Insulation

- ROCKWOOL A/S

- Armacell.

- Glassrock Insulation Co.

- Climatech International

- Knauf Insulation

- Lindner SE

- Owens Corning

- Insulapack

Recent Developments

-

In October 2024,Knauf Group announced an agreement to acquire Texnopark’s Rock Mineral Wool insulation division, including a modern manufacturing facility in Tashkent, Uzbekistan. The plant features advanced electric melting technology that supports low CO2 emissions during production.

U.S. HVAC Insulation Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.03 billion

Revenue forecast in 2030

USD 2.54 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, application, end-use

Country scope

U.S.

Key companies profiled

Johns Manville; Saint-Gobain Technical Insulation; ROCKWOOL A/S; Armacell.; Glassrock Insulation Co.; Climatech International; Knauf Insulation; Lindner SE; Owens Corning; Insulapack

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. HVAC Insulation Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. HVAC insulation market report based on product, material, application, distribution channel, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pipe

-

Ducts

-

Acoustic Board

-

Pre-Insulated Duct

-

Flexible Duct Insulation

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Phenolic, PIR & PUR

-

Glass Wool

-

Stone Wool

-

-

Plastic Foam

-

Elastomeric Foam

-

Polyethylene

-

Mineral Wool

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Application Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Residential

-

Industrial

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

OEM

-

Building Contractors

-

HVAC Contractors

-

Do-It-Yourself (DIY) Consumers

-

Frequently Asked Questions About This Report

b. The U.S. HVAC insulation market size was estimated at USD 1.80 billion in 2024 and is expected to be USD 2.03 billion in 2025.

b. The U.S. HVAC insulation market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 2.54 billion by 2030.

b. The commercial segment accounted for a share of 53.4% in 2024. The commercial segment dominates the U.S. HVAC insulation market, driven by extensive use of HVAC systems in offices, malls, hospitals, and other commercial buildings.

b. Some of the key players operating in the U.S. HVAC insulation market include Johns Manville; Saint-Gobain Technical Insulation; ROCKWOOL A/S; Armacell.; Glassrock Insulation Co.; Climatech International; Knauf Insulation; Lindner SE; Owens Corning; and Insulapack.

b. Key factors driving the U.S. HVAC insulation market include stringent energy efficiency regulations, rising construction activities, and growing awareness of indoor air quality and thermal comfort.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."