- Home

- »

- Medical Devices

- »

-

U.S. Urine Testing Cups Market Size, Industry Report, 2030GVR Report cover

![U.S. Urine Testing Cups Market Size, Share & Trends Report]()

U.S. Urine Testing Cups Market Size, Share & Trends Analysis Report By Sterility (Sterile, Non-Sterile), By Product (With Temperature Strip, Without Temperature Strip), By Application (Drug Testing), By End-use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-608-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Urine Testing Cups Market Trends

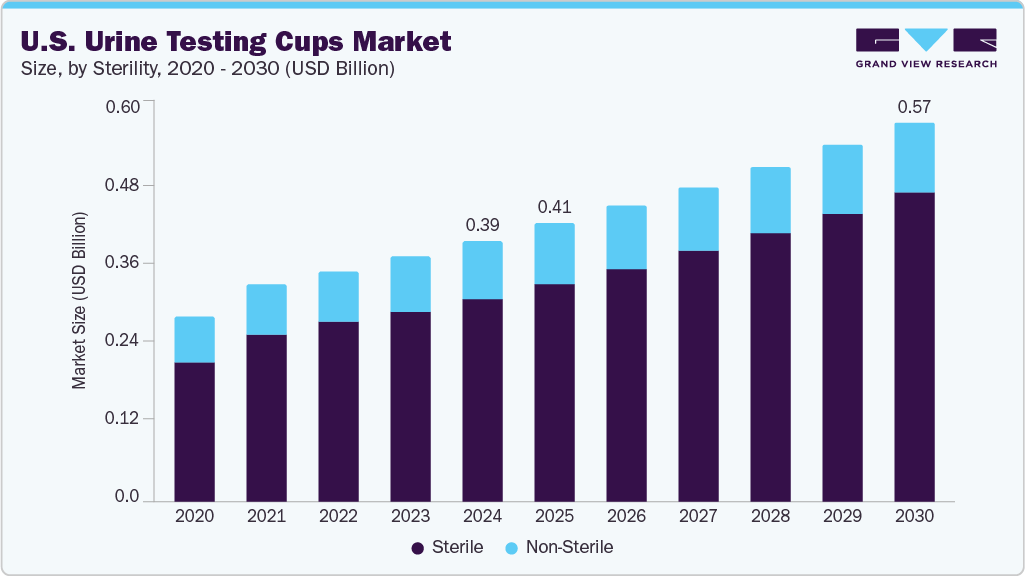

The U.S. urine testing cups market size was estimated at USD 0.39 billion in 2024 and is projected to grow at a CAGR of 6.46% from 2025 to 2030. The demand for urine testing cups is increasing due to the rising prevalence of drug abuse, growing use in disease detection and chronic condition monitoring, technological advancements, and the expanding need for point-of-care and home-based diagnostics.

The U.S. urine testing cups industry is experiencing robust growth, propelled by several key factors. The increasing prevalence of chronic conditions such as diabetes, kidney disease, and urinary tract infections necessitates regular urinalysis for effective disease management. For instance, according to the American Diabetes Association report published in 2023, over 38 million children and adults have diabetes in the U.S. In addition, according to the same source, over the past decade, the national healthcare costs related to diabetes have risen by USD 80 billion, climbing from USD 227 billion in 2012 to USD 307 billion in 2022. As a result, growing cases of diabetes and rising healthcare costs related to diabetes are expected to further fuel the market growth.

Technological advancements, including the development of automated analyzers and smartphone-compatible test strips, have enhanced the accuracy and convenience of urine testing. Moreover, the rising demand for point-of-care and home-based diagnostic tools aligns with the broader trend toward preventive healthcare and personalized medicine. These factors collectively contribute to the expanding adoption of urine testing cups across various healthcare settings in the U.S.

According to data updated by the American Kidney Fund in February 2025, approximately 35.5 million Americans are living with kidney disease, with nearly 555,000 undergoing dialysis and about 815,000 experiencing kidney failure. This significant rise in chronic kidney conditions underscores the growing reliance on urine testing for disease detection and long-term health monitoring. Urine testing cups provide a simple, non-invasive, and cost-effective method for identifying early signs of kidney dysfunction, enabling timely medical intervention. With kidney disease now affecting over 14% of American adults-and disproportionately impacting communities of color-the demand for regular screening tools like urine testing cups is rising. These devices play a critical role in managing chronic conditions and advancing preventive healthcare initiatives.

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. The U.S. urine testing cups market is characterized by growth owing to the rising prevalence of alcohol and drug use, such as cocaine, heroin, marijuana, among others, and the increasing incidence of chronic conditions such as kidney disease. According to American Addiction Centers, in 2023, approximately 28.9 million Americans aged 12 and older were affected by alcohol use disorder, representing about 10.2% of this demographic. Furthermore, according to the 2023 United States National Survey on Drug Use and Health (NSDUH), 19.2 million Americans aged 12 or older-approximately 6.8%-struggled with a marijuana use disorder in the past year.

Increasing overall health awareness also boosts the use of urine testing cups for routine checkups. The demand for rapid, non-invasive, and cost-effective diagnostic tools fuels widespread adoption across healthcare and other sectors.

The U.S. urine testing cups market is experiencing notable innovation, with companies such as Advin Biotech and Premier Biotech introducing advanced features to enhance functionality and efficiency. Advin Biotech’s POCiT cup includes an integrated vessel that preserves a clean, removable specimen for confirmation testing or regulatory compliance, making it especially valuable in high-volume settings such as pain labs by reducing processing time. Meanwhile, Premier Biotech offers a portfolio of rapid, integrated test cups that prioritize accuracy, speed, ease of use, and customizable drug panels. These advancements reflect a strong focus on improving user experience, compliance, and adaptability, underscoring the market’s commitment to next-generation diagnostic solutions.

Regulatory agencies such as the Food and Drug Administration (FDA) establish quality and safety standards for medical devices, including urine testing cup products. These devices are classified into different categories based on the associated risk levels, with regulatory scrutiny varying accordingly.

The U.S. urine testing cups industry has seen a moderate level of mergers and acquisitions, driven by the need for expanded product portfolios and technological capabilities. Companies are strategically aligning to enhance distribution networks and enter new regional markets. These consolidations support innovation while maintaining competitive pricing and compliance with evolving healthcare regulations.

The U.S. market for urine testing cups is moderately fragmented, with numerous regional players competing based on product innovation, pricing, and regulatory compliance. While a few established companies hold significant market share, emerging players continue to enter with niche offerings and customized solutions. This competitive landscape fosters innovation but also creates pricing pressure and variability in product quality across regions.

Regional expansion in the U.S. urine testing cups market is actively driven by strategic investments and collaborations to address healthcare challenges.

Sterility Insights

Sterile urine testing cups dominated the market with a revenue share of 78.27% due to their critical role in ensuring sample integrity, accuracy, and safety across medical and forensic applications. These cups are designed to prevent contamination, making them essential for diagnostic testing, drug screening, and disease monitoring where precise results are vital. Their widespread use in hospitals, diagnostic labs, and law enforcement settings reflects growing regulatory emphasis on hygiene and reliability. As healthcare providers increasingly prioritize infection control and accurate diagnostics, the demand for sterile urine testing cups continues to outpace their non-sterile counterparts.

The non-sterile urine testing cups segment is expected to witness growth in the coming years, due to their cost-effectiveness and suitability for low-risk or preliminary testing environments. They are increasingly used in workplace drug testing, educational institutions, and at-home health monitoring, where sterility is less critical. Rising awareness and accessibility of self-testing options are also contributing to their growing demand.

Product Insights

Urine testing cups with temperature strips held the largest market share of 52.26% in 2024, due to their enhanced ability to ensure sample authenticity and reliability. The integrated temperature strip helps verify whether a urine sample is freshly collected, a critical factor in drug screening and forensic testing where sample tampering is a concern. These cups are widely preferred in clinical, workplace, and law enforcement settings for their added layer of verification, which supports compliance with regulatory standards. As the demand for accurate and trustworthy testing continues to rise, products with built-in temperature validation remain the preferred choice across various sectors.

Urine testing cups without temperature strips are gaining traction due to their affordability and suitability for non-critical testing environments. They are ideal for use in educational institutions, home testing, and wellness programs where strict verification protocols are not required. The simplicity and lower cost make them attractive for bulk screening initiatives. In addition, rising awareness of preventive healthcare is boosting their adoption in routine health monitoring.

Application Insights

The drug testing segment dominated the application landscape in the U.S. urine testing cups market in 2024, with the largest revenue share of 42.56%, driven by the widespread use of multi-drug test cups such as the iScreen, iCup, and E-Z Split Key. These all-in-one screening tools are highly efficient in detecting multiple substances, including amphetamines, cocaine, marijuana, opiates, and fentanyl from a single urine sample. Their convenience, reliability, and broad detection capabilities make them indispensable in workplaces, law enforcement, rehabilitation centers, and healthcare settings. As the need for rapid and accurate drug screening continues to grow, especially in response to rising substance abuse, this segment maintains a strong lead in market demand.

The disease detection segment is projected to grow at the fastest CAGR of 7.29% in the U.S. urine testing cups industry during the forecast period. This growth is fueled by advancements in medical diagnostics and increasing demand for early, non-invasive testing methods. As highlighted by Urteste S.A.'s development of a prototype IVD test capable of detecting brain tumors from urine samples, the scope of urinalysis is expanding far beyond traditional uses. This trend reflects a broader shift toward preventive healthcare and the rising adoption of urine testing cups to detect serious health conditions, including kidney disease, diabetes, and liver disorders.

End Use Insights

The hospital and clinics segment held the largest share of 44.39% in 2024, driven by the high volume of diagnostic and drug screening procedures conducted in these settings. Urine testing cups are essential tools in hospitals and clinics for routine health checkups, disease detection, pre-surgical assessments, and monitoring of chronic conditions. They are widely used for pregnancy testing, helping clinicians make timely and accurate diagnoses. Their ability to deliver quick and precise results makes them a preferred patient choice. Moreover, the increasing patient load and growing emphasis on early diagnosis and preventive care further solidify the strong demand for urine testing cups.

The home use segment is expected to grow the fastest in the coming years, driven by technological innovations that bring clinical-grade testing to home settings. A prime example is the URINE CHECK-ER, the world’s first cup-type urine analyzer, recently recognized at the CES Innovation Awards 2025. This device revolutionizes at-home urinalysis by replacing traditional, unsanitary strip-type tests with a user-friendly, app-connected solution that offers medical institution-level accuracy. Its ability to digitize and store results for telemedicine or clinical follow-up makes it particularly valuable for individuals in remote or underserved regions, reflecting a broader shift toward decentralized and accessible healthcare solutions.

Key U.S. Urine Testing Cups Company Insights

The key companies operating in the U.S. urine testing cups industry are expanding their product portfolios to gain a competitive advantage in the coming years.

Key U.S. Urine Testing Cups Companies:

- BD

- Abbott

- Labcon North America

- Quest Diagnostics

- Confirm BioSciences

- Alfa Scientific Designs, Inc.

- Medline Industries, LP

- Globe Scientific Inc

- CLIAWAIVED

- Clarity Diagnostics, LLC

- SARSTEDT AG & Co. KG

- Wondfo

Recent Developments

-

In October 2024, First Response announced the launch of the Multi Check Pregnancy Test Kit, featuring the innovative EasyCup-an advancement that redefines convenience in at-home pregnancy testing. EasyCup integrates a sample collection cup with a built-in test strip, offering a simple, mess-free experience that mirrors clinical urine collection practices. The kit also includes two Rapid Result pregnancy tests, providing added reassurance with fast, reliable results. By combining familiarity with innovation, the Multi Check Pregnancy Test Kit enhances user confidence and ease in early pregnancy detection.

-

In September 2024, PreAnalytiX, a joint venture between QIAGEN and BD, launched the PAXgene Urine Liquid Biopsy Set, enabling non-invasive urine sample collection and immediate stabilization of cell-free DNA. This innovative solution includes a collection cup and a nucleic acid stabilizing tube, advancing liquid biopsy capabilities.

U.S. Urine Testing Cups Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.41 billion

Revenue forecast in 2030

USD 0.57 billion

Growth rate

CAGR of 6.46% from 2025 to 2030

Base year for estimation

2024

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sterility, product, application, end use

Country scope

U.S.

Key companies profiled

BD; Abbott; Labcon North America; Quest Diagnostics; Confirm BioSciences; Alfa Scientific Designs, Inc.; Medline Industries, LP; Globe Scientific Inc.; CLIAWAIVED; Clarity Diagnostics, LLC; SARSTEDT AG & Co. KG; Wondfo

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Urine Testing Cups Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. urine testing cups market report based on sterility, product, application, and end use:

-

Sterility Outlook (Revenue, USD Million, 2018 - 2030)

-

Sterile

-

Non-Sterile

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

With Temperature Strip

-

Without Temperature Strip

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Testing

-

Pregnancy Testing

-

Disease Detection

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Home Use

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. urine testing cups market size was valued at USD 0.39 billion in 2024

b. The U.S. urine testing cups market is expected to grow at a CAGR of 6.46% from 2025-2030 to reach 0.57 billion by 2030.

b. Sterile urine testing cups segment dominated the market with a revenue share of 78.27% in 2024 due to their critical role in ensuring sample integrity, accuracy, and safety across medical and forensic applications.

b. Some of the key players include BD, Abbott, Labcon North America, Quest Diagnostics, Confirm BioSciences, Alfa Scientific Designs, Inc., Medline Industries, LP, Globe Scientific Inc, CLIAWAIVED, Clarity Diagnostics, LLC, SARSTEDT AG & Co. KG, and Wondfo.

b. The demand for urine testing cups in the U.S. is increasing due to the rising prevalence of drug abuse, growing use in disease detection and chronic condition monitoring, technological advancements, and the expanding need for point-of-care and home-based diagnostics.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."