- Home

- »

- Petrochemicals

- »

-

Molybdenum Disulfide Market Size, Industry Report, 2030GVR Report cover

![Molybdenum Disulfide Market Size, Share & Trends Report]()

Molybdenum Disulfide Market Size, Share & Trends Analysis Report By Form (Powder, Crystals), By Application (Lubricants & Greases, Catalysts, Electronics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-611-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Molybdenum Disulfide Market Summary

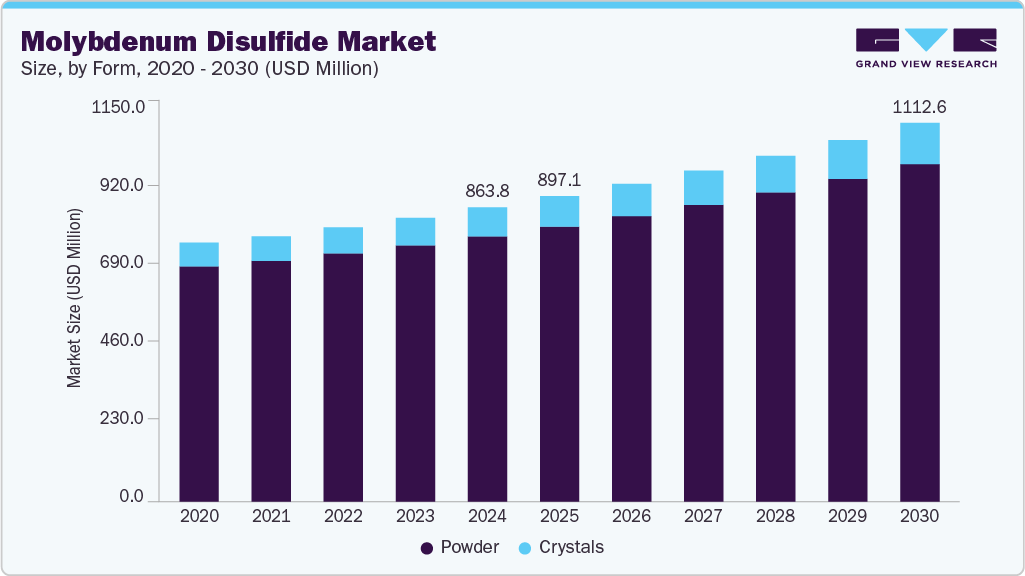

The global molybdenum disulfide market size was estimated at USD 863.8 million in 2024 and is projected to reach USD 1,112.6 million by 2030, growing at a CAGR of 4.4% from 2025 to 2030. The growth is attributed to molybdenum disulfide’s expanding role as a high-performance solid lubricant in automotive greases.

Key Market Trends & Insights

- Asia Pacific molybdenum disulfide market dominated with a share of 47.6% of the global market in 2024.

- China molybdenum disulfide market held a share of 57.5% in 2024 of the Asia Pacific market.

- By form, powdered molybdenum disulfide segment dominated with a market share of 90.2% in 2024.

- By application, lubricants and greases industry dominated the market with a share of 54.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 863.8 Million

- 2030 Projected Market Size: USD 1,112.6 Million

- CAGR (2025-2030): 4.4%

- Asia Pacific: Largest market in 2024

- Europe: Fastest growing market

Its exceptional friction-reducing and wear-resistant properties enhance durability and efficiency in vehicle components such as bearings, constant velocity joint, chassis parts, and gears. The products are widely used across diverse markets, including automotive, construction, mining, agriculture, and aerospace. They are compatible with nearly all grease thickener systems (e.g., lithium, polyurea, aluminum complex). Mid-size MoS₂ particles (~6 µm) are preferred for optimal load-carrying performance and surface smoothing, making these greases ideal for high-load, high-wear applications.Powder molybdenum disulfide (MoS₂) can perform under extreme pressures and in environments where traditional oils/greases are unsuitable, like in high vacuum, high temperature, and small clearances, which drives demand, supported by trends toward lightweight, durable, and low-maintenance mechanical systems in automotive, aerospace, electronics, and industrial machinery sectors.

The powder is widely used as a dry lubricant across diverse applications due to its inherent low friction, high load-carrying capacity, and wear resistance. It is employed in burnished films for metal forming dies, piston skirts, O-rings, and electrical contacts; in sputtered coatings for aerospace and satellite mechanisms operating in vacuum environments; and in resin-bonded coatings for automotive pistons, fasteners, and precision components.

The demand for MoS₂ is driven by the growing application as a high-performance powder lubricant extensively used across various coating technologies, including solid film coatings, burnished films, sputtered coatings, and resin-bonded coatings. Typically, 1-5 µm thick, burnished films are applied to metal substrates such as metal forming dies, threaded parts, switches, liquid oxygen valves, and electronic contacts, providing long-lasting, low-friction, and wear-resistant surfaces.

Sputtered coatings and films, produced in vacuum environments, offer ultra-thin, highly adherent layers ideal for aerospace components and critical automotive parts that operate under extreme conditions, including deep space and high-vacuum applications. Resin-bonded coatings, incorporating MoS₂ with advanced organic resins like polybenzimidazole and polybenzothiazole, create dry, self-lubricating films used in automotive piston skirts to enhance fuel efficiency and engine durability, as well as in fasteners to ensure consistent friction and prevent over-tightening.

MoS₂ coatings, whether applied via sputtering, burnishing, or bonded formulations, excel in aerospace, automotive, and industrial applications where durability is critical under temperature, vacuum, and corrosive conditions. In precision components like Parker Hannifin’s CPI and A-LOK compression fittings, bonded MoS₂ coatings provide low-torque assembly, consistent remakes, and leak-tight performance even under extreme mechanical and environmental stresses. The versatility and reliability of MoS₂ continue to drive its adoption across next-generation engineering and high-performance mechanical systems.

However, the molybdenum disulfide market is constrained by the high cost of high-purity grades, raw material supply volatility, and technical challenges in applying coatings to complex parts.

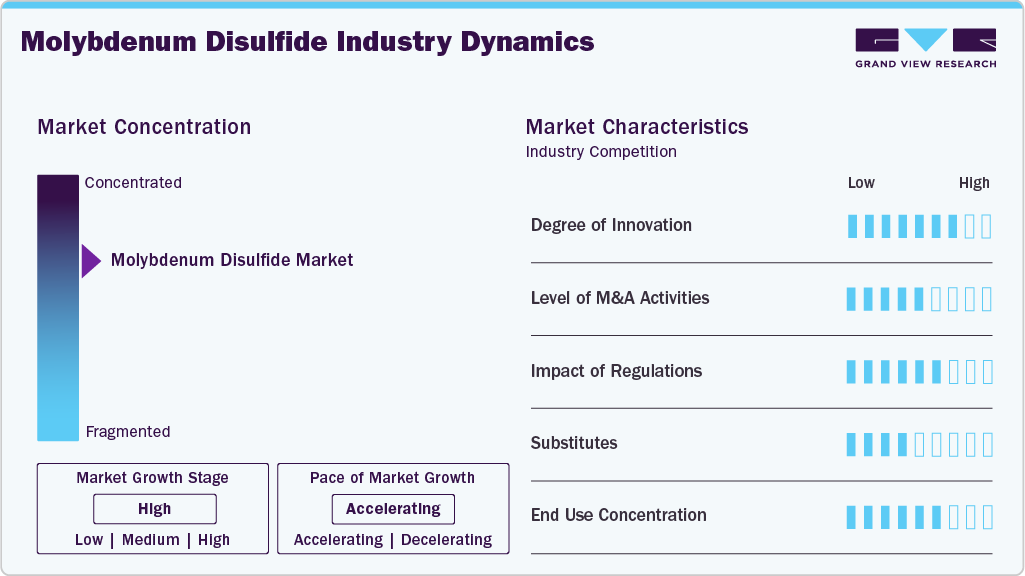

Market Concentration & Characteristics

The global molybdenum disulfide (MoS₂) market is concentrated, with a presence of companies, such as Freeport-McMoR, Climax Molybdenum among others focusing on engineered and high-purity MoS₂ products. These firms primarily serve high-value, performance-driven sectors such as aerospace, automotive, electronics, and industrial machinery. While commodity-grade MoS₂ is widely available for traditional lubricant applications, advanced grades (e.g., for sputtered coatings or electronics) remain niche and are typically produced in limited volumes with tight quality controls. Industry competition is stable but growing, with innovation centered particle engineering and advanced coating technologies.

The threat of substitution is moderate, alternatives like graphite, hexagonal boron nitride, and advanced polymer-based lubricants compete in some applications, though MoS₂ maintains a strong position due to its superior load-carrying capacity, thermal stability, and versatility across extreme environments, which aligns with trends toward durable, energy-efficient mechanical systems.

Form Insights

Powdered molybdenum disulfide (MoS₂) segment dominated with a market share of 90.2% in 2024. The growth is attributed to its use in high-performance greases, threaded connections, and anti-galling coatings owing to its excellent friction-reducing and wear-resistant properties. The material’s high purity and tailored particle sizes further enable its adaptability across diverse industrial and technological domains. For instance, the product by ACS Material is used primarily as a high-performance lubricant and additive in greases and threaded connections and as a catalyst for desulfurization processes in petroleum refineries. Its high purity, stability, and fine particle control make it suitable for demanding industrial applications.

The crystal form of Molybdenum disulfide (MoS₂) is the fastest growing segment known for its exceptional lubricity and anti-galling properties; it owes its performance to a unique layered crystal structure where weakly bonded lamellae slide easily under load, reducing friction to extremely low levels with ~0.025 coefficient of friction. Its crystal nature prevents it from being squeezed under extreme pressure, making it an ideal boundary lubricant in high-stress environments.

Application Insights

Lubricants and greases industry dominated the market with a share of 54.6% in 2024. Molybdenum disulfide (MoS₂) is used in gear oils as a solid lubricant additive to enhance load-carrying capacity and reduce friction and wear, particularly under boundary lubrication conditions where fluid films may break down. In gear oil formulations, MoS₂ is typically dispersed at 0.1% to 3% concentrations, with fine particle sizes (1-2 µm) ensuring effective dispersion even in highly viscous oils. It forms a protective film on metal surfaces, preventing catastrophic seizure during high-load or start-stop operations. This is especially beneficial in gears with significant sliding contact, such as worm gears, helical gears, and hypoid gears, where the lamellar MoS₂ structure minimizes friction and metal-to-metal contact, improving gear life and efficiency.

Molybdenum disulfide (MoS₂), a low-toxicity, earth-abundant 2D material, is gaining prominence in heterogeneous organic catalysis for reactions such as hydrogenation, hydrodesulfurization, C-C coupling, and photocatalysis. Its catalytic efficiency can be enhanced by increasing surface area, creating sulfur/molybdenum vacancies, phase engineering (1T/2H), doping with transition metals, and forming nanocomposites.

Dry MoS₂’s layered structure offers abundant active sites and stability under extreme conditions, making it an attractive solid catalyst for sustainable, scalable chemical transformations. Ongoing research focuses on optimizing these modifications and expanding applications in green chemistry and fine chemical synthesis.

Additionally, Molybdenum disulfide (MoS₂) is an efficient catalyst in hydrogen evolution reactions, energy storage systems (like lithium-ion batteries), and environmental remediation through photocatalysis. Its layered structure and tunable active sites enable selective catalytic processes, including hydrodesulfurization of oil products, making it valuable for sustainable energy and chemical transformation applications.

Regional Insights

Asia Pacific molybdenum disulfide marketdominated with a share of 47.6% of the global market in 2024, driven by its rising demand in advanced electronics, energy storage, and industrial lubrication sectors. A major market driver is the region's expanding EV and electronics manufacturing base, particularly in China, Japan, and South Korea, which is fueling the adoption of MoS₂ for solid lubricants, thin-film transistors, and battery technologies. The products' excellent mechanical flexibility and tunable electrical and thermal properties are highly promising materials for energy harvesting in piezoelectric, triboelectric, and thermoelectric nanogenerators. Its ability to efficiently convert mechanical vibrations, friction, and temperature gradients into electrical energy drives its adoption in flexible, low-power, and sustainable electronics, supporting the global shift toward greener energy solutions amidst the current energy crisis.

China molybdenum disulfide market held a share of 57.5% in 2024 of the Asia Pacific market, driven by strong domestic demand from lubricants, metallurgy, and catalyst sectors, supported by the country’s dominance in molybdenum mining and refining. A key market driver is China's industrial focus on energy-efficient machinery and green technologies, which spurs demand for MoS₂ in high-performance lubricants and as a catalyst in petrochemical desulfurization. In 2024, China maintained its position as the world’s largest molybdenum producer, with output rising by 5% to 294.8 million pounds, up from 281.8 million pounds in 2023.

Europe Molybdenum Disulfide Market Trends

Europe's molybdenum disulfide market witnessed a CAGR of 4.7% from 2025 to 2030, driven by stringent sustainability and performance standards across automotive, aerospace, and industrial machinery sectors, which demand advanced lubrication and wear-resistant solutions. The region's focus on fuel efficiency and emissions reduction strongly supports MoS₂ adoption in high-performance greases and coatings. Supplies of refined molybdenum products, including MoS₂, catering to European metallurgical and chemical markets with a focus on quality and circular economy practices. Demand for technical-grade MoS₂ for lubricants and catalysts, addressing demand in precision industries. The market is characterized by high regulatory compliance and specialty application growth, making Europe a premium market for engineered MoS₂ products.

North America Molybdenum Disulfide Market Trends

The North American molybdenum disulfide (MoS₂) market is witnessing steady growth, fueled by strong demand for advanced lubricants in aerospace, defense, and high-performance automotive applications. A key driver is the region’s leadership in semiconductor innovation and next-generation electronics, where MoS₂ is used in thin-film transistors, sensors, and photonic devices due to its tunable electronic properties. The market also benefits from expanding applications in energy storage and green catalysis. Suppliers in this region are increasingly focused on delivering high-purity engineered MoS₂ for niche, high-value markets, moving beyond bulk materials to meet the evolving needs of precision manufacturing and sustainable technologies.

Middle East & Africa Molybdenum Disulfide Market Trends

The Middle East molybdenum disulfide (MoS₂) is fueled by the expansion of the oil & gas and heavy industrial sectors, which rely on MoS₂-based lubricants and coatings for high-temperature, high-load machinery used in refineries, drilling, and mining. Demand for MoS₂ as a catalyst in hydrodesulfurization (HDS) processes is rising as regional refiners upgrade to meet stricter sulfur content regulations. Companies like Freeport-McMoRan and Luoyang Shenyu Molybdenum supply high-purity MoS₂ for these applications, while Songxian Exploiter Molybdenum Co. is increasing export penetration through competitively priced technical grades. Local distribution partnerships and alignment with large energy and mining operators remain key to market entry and sustained growth in this region.

Latin America Molybdenum Disulfide Market Trends

The Latin American molybdenum disulfide (MoS₂) market is gradually expanding, driven primarily by demand from mining, heavy machinery, and agricultural equipment sectors, where MoS₂-based lubricants are used to improve equipment durability under harsh operating conditions. The push for more efficient and sustainable industrial operations in Brazil and Argentina encourages adopting MoS₂ in high-performance greases and metal-forming applications. Strong molybdenum mining operations, as key upstream contributors to feedstock, enabling stable regional supply chains for MoS₂ production.

Key Molybdenum Disulfide Market Company Insights

Some of the key players operating in the molybdenum disulfide market include KANTO KAGAKU and SUMICO LUBRICANT CO., LTD.

- KANTO KAGAKU, headquartered in Tokyo, Japan, is a well-established leader in producing and supplying high-purity chemicals and advanced materials for the electronics, pharmaceutical, and specialty chemical industries. The company’s Molybdenum Disulfide (MoS₂) portfolio is engineered to meet stringent performance requirements in electronics, optoelectronics, and precision coatings, offering superior purity, controlled particle size, and excellent thermal and tribological properties. KANTO KAGAKU’s ongoing R&D focuses on advancing 2D materials and semiconductor-grade MoS₂ for emerging applications such as flexible electronics, sensors, and energy storage devices. With decades of expertise in ultra-high purity manufacturing, a strong commitment to quality and regulatory compliance, and collaborative partnerships with leading academic and industrial players, KANTO KAGAKU continues to drive innovation in functional materials for next-generation technologies across global markets.

2D Semiconductors. And Structure Probe, Inc. are emerging market participants in the molybdenum disulfide market.

-

Structure Probe, Inc., headquartered in the United States, is an emerging player in the Molybdenum Disulfide (MoS₂) market, specializing in high-purity MoS₂ materials for advanced research and precision applications. The company’s MoS₂ product portfolio supports cutting-edge developments in electron microscopy, materials characterization, and nanoelectronics. Structure Probe’s R&D efforts focus on delivering MoS₂ with superior crystallinity, controlled particle morphology, and consistent quality tailored to the stringent requirements of scientific and industrial research communities. Through strong ties with academic institutions and technology innovators, Structure Probe is driving the use of MoS₂ in high-performance coatings, semiconductor research, and next-generation electronic devices, positioning itself as a trusted partner in enabling advanced material solutions.

Key Molybdenum Disulfide Companies:

The following are the leading companies in the molybdenum disulfide market. These companies collectively hold the largest market share and dictate industry trends.

- 2D Semiconductors

- ACS Material

- Sisco Research Laboratories Pvt. Ltd.

- KANTO KAGAKU

- Luoyang Tongrun Nano Technology Co., Ltd. (TRUNNANO)

- SUMICO LUBRICANT CO., LTD.

- Merck KGaA

- Nanografi Advanced Materials.

- Songxian Exploiter Molybdenum Co.

- Structure Probe, Inc.

- VCI & LUBRICANTS LLC

- Comp12

Recent Developments

-

In October 2024, Sisco Research Laboratories Pvt. Ltd. (SRL) has expanded its global reach by establishing new distributorships in Brazil and Greece, enhancing market access for its molybdenum disulfide and other advanced materials. This move strengthens SRL’s ability to serve scientific and industrial customers in these regions, supporting growth in research, coatings, and specialty chemical applications.

-

In June 2023, Researchers at TU Wien have developed a self-forming solid lubricant system where molybdenum and selenium react under mechanical stress to create molybdenum diselenide (MoSe₂) flakes that dramatically reduce friction exactly where needed. This innovation offers major advantages for high-temperature, vacuum, and space applications, providing a more efficient, durable alternative to conventional lubricants.

Molybdenum Disulfide Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 897.1 million

Revenue forecast in 2030

USD 1,112.6 million

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Tons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America Middle East & Africa

Country scope

U.S.; Canada; Mexico, UK; Germany; Italy; France, Spain, China; India; Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa

Key companies profiled

2D Semiconductors.; ACS Material; Sisco Research Laboratories Pvt. Ltd.; KANTO KAGAKU; Luoyang Tongrun Nano Technology Co., Ltd.; SUMICO LUBRICANT CO., LTD.; Merck KGaA; Nanografi Advanced Materials.; Structure Probe, Inc.; VCI & LUBRICANTS LLC; Songxian Exploiter Molybdenum Co.

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Molybdenum Disulfide Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global molybdenum disulfide market report based on form, application, and region.

-

Form Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Powder

-

Crystals

-

-

Application Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

Lubricants & Greases

-

Catalysts

-

Electronics & Semiconductors

-

Coatings & Additives

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

France

-

UK

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global molybdenum disulfide market size was estimated at USD 863.82 million in 2024 and is expected to reach USD 897.1 million in 2025.

b. The global molybdenum disulfide market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 1,112.6 million by 2030.

b. The Asia Pacific dominated the molybdenum disulfide market with a share of 47.59% in 2024. This is attributable to the strong demand from the automotive, electronics, and industrial machinery sectors, along with significant mining and lubricant manufacturing activity in countries like China and Japan.

b. Some key players operating in the molybdenum disulfide market include 2D Semiconductors., ACS Material, Sisco Research Laboratories Pvt. Ltd., KANTO KAGAKU, Luoyang Tongrun Nano Technology Co., Ltd., SUMICO LUBRICANT CO., LTD., Merck KGaA, Nanografi Advanced Materials., Structure Probe, Inc., VCI & LUBRICANTS LLC, Songxian Exploiter Molybdenum Co.

b. The molybdenum disulfide market is driven by increasing demand for high-performance lubricants, rising use in electronics and semiconductors, growing applications in the automotive and aerospace sectors, and expanding mining and industrial activities requiring durable, heat-resistant materials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."