- Home

- »

- Advanced Interior Materials

- »

-

Natural Stone Market Size & Share, Industry Report, 2030GVR Report cover

![Natural Stone Market Size, Share & Trends Report]()

Natural Stone Market Size, Share & Trends Analysis Report By Product (Marble, Limestone, Sandstone, Granite, Travertine), By Application (Residential - New Construction, Residential - Remodeling), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-596-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Natural Stone Market Size & Trends

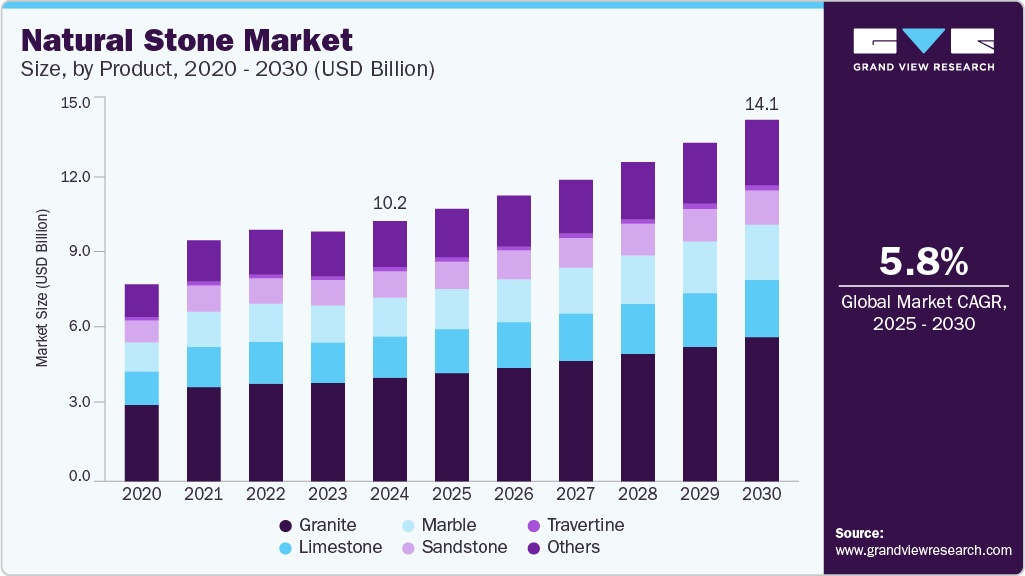

The global natural stone market size was estimated at USD 10.17 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The increasing demand for aesthetically appealing and durable building materials in residential and commercial construction is proliferating the market.

Key Highlights:

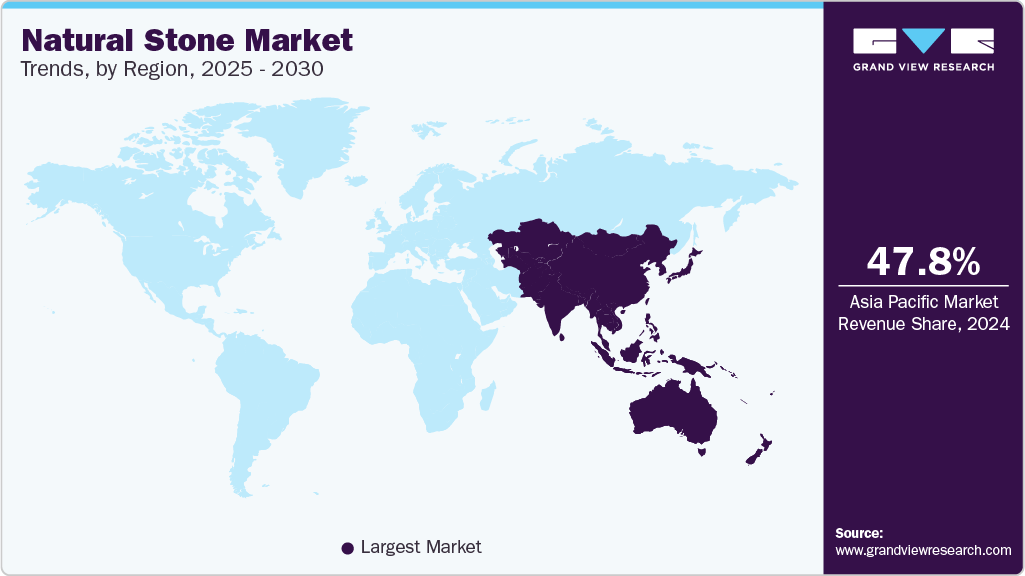

- Asia Pacific held 47.8% revenue share of the global natural stone market.

- The natural stone market in the U.S. accounted for the largest market revenue share in North America in 2024.

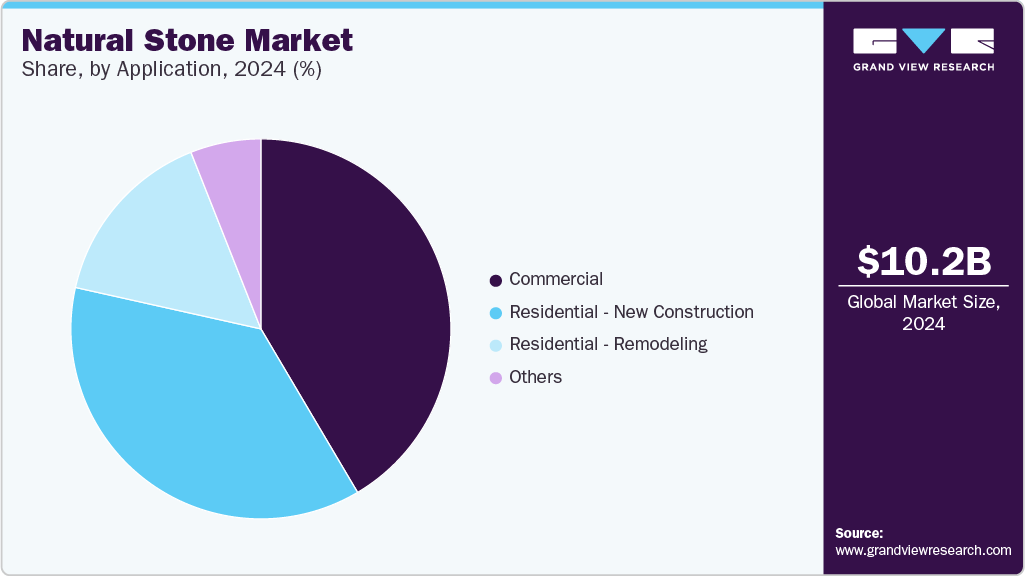

- By application, the commercial segment led the market with the largest revenue share of 41.5% in 2024.

- By product, the granite segment led the market with the largest revenue share of 39.6% in 2024.

Natural stones such as marble, granite, limestone, and sandstone are preferred for their unique textures, patterns, and longevity. With the rise in real estate development, especially in emerging economies, there is a heightened demand for premium natural stone flooring, countertops, wall cladding, and outdoor landscaping. Luxury residential projects increasingly incorporate natural stone due to its timeless appeal and the capacity to increase property value.

Another significant growth driver is the expanding application of natural stone in infrastructure projects. Governments worldwide are investing heavily in infrastructural development, including airports, metro stations, and public spaces, where natural stone is used extensively for pavements, facades, and monuments. As urban planning increasingly emphasizes durability and low maintenance, natural stone's resistance to weathering and its ability to withstand heavy foot traffic make it an ideal choice. Infrastructure modernization and public beautification projects, particularly in developing regions, continue to fuel the demand for natural stone.

The rising consumer awareness regarding eco-friendly construction materials has also significantly influenced the natural stone industry. As sustainability becomes a pivotal consideration in architectural and interior design, natural stones, being non-toxic and recyclable, align well with green building initiatives. Unlike synthetic alternatives, natural stone has a minimal carbon footprint during processing and can be reused or repurposed. In addition, the growing trend towards sustainable architecture and interior decoration has pushed designers and architects to incorporate more natural elements, including stone, to meet green certification standards.

The flourishing tourism and hospitality sector is also crucial in boosting the natural stone industry. High-end hotels, resorts, and cultural centres prioritize using premium stone in their construction to enhance aesthetic appeal and durability. Natural stones are often used for luxurious flooring, countertops, sculptures, and ornamental structures, offering a sense of elegance and permanence. With increasing travel and tourism, particularly in regions renowned for historical architecture, the demand for stone restoration and renovation projects has surged, further propelling market growth.

Lastly, technological advancements in stone processing and cutting techniques have significantly contributed to the market expansion. The advent of precision cutting, water-jet technology, and automated polishing machines has enhanced the efficiency and quality of stone finishing. This has enabled manufacturers to meet the high aesthetic standards required in modern construction. Improved extraction methods have also reduced material wastage, making natural stone more accessible and affordable. In addition, introducing innovative sealing and treatment solutions has enhanced the durability and maintenance of natural stone, thereby increasing its adoption in diverse climatic conditions.

Drivers, Opportunities & Restraints

The natural stone industry is primarily driven by the increasing demand for aesthetically appealing and durable materials in construction and architectural applications. With the surge in residential and commercial building projects, especially in developing economies, natural stones like granite, marble, limestone, and sandstone are being increasingly preferred for flooring, countertops, wall cladding, and landscaping. In addition, the growing trend towards luxurious and customized interiors has boosted the demand for natural stone due to its unique patterns, colors, and long-lasting nature. Furthermore, the rising focus on sustainable construction practices supports the adoption of natural stones, as they are eco-friendly and can be reused or recycled, aligning well with green building initiatives.

One of the significant opportunities within the natural stone industry lies in the expanding application of stones in infrastructural development. Governments worldwide are investing in large-scale projects, including metro stations, airports, public plazas, and cultural centers, where natural stones are favored for their aesthetic appeal and durability. In addition, the growing preference for sustainable and natural materials in architectural design opens up new avenues for market growth. Innovations in stone processing technologies, such as precision cutting and surface finishing, have made high-quality stones more accessible, creating opportunities for manufacturers to cater to both residential and commercial sectors. Moreover, the flourishing tourism and hospitality industries present lucrative prospects, as premium natural stones are increasingly used in luxury hotels, resorts, and heritage restoration projects.

Despite its growth potential, the natural stone industry faces several challenges. One of the major restraints is the high cost associated with quarrying, processing, and transporting natural stones, which can make them less competitive compared to synthetic alternatives. In addition, environmental concerns related to quarrying activities, including landscape disruption and ecological degradation, have led to stricter regulations and limitations on mining practices, affecting the supply chain. The availability of cheaper engineered stone products, which mimic the appearance of natural stones while offering enhanced durability and lower maintenance, also poses a threat to market growth. Moreover, fluctuations in raw material prices and supply chain disruptions can impact the overall profitability of natural stone manufacturers.

Product Insights

The granite segment led the market with the largest revenue share of 39.6% in 2024. The granite segment is experiencing substantial growth due to its superior physical properties, including durability, scratch resistance, and aesthetic versatility. These attributes make granite a preferred choice for interior and exterior applications such as countertops, flooring, wall cladding, and monuments. Its ability to withstand extreme weather conditions, high pressure, and heat enhances its appeal in residential and commercial construction projects.

The marble segment is anticipated to register at the fastest CAGR over the forecast period. Marble is widely used in high-end residential projects, upscale hotels, commercial lobbies, and heritage restorations due to its unique veining, polished finish, and classical elegance. As consumers increasingly seek premium materials to enhance interior spaces, demand for marble in flooring, countertops, wall cladding, and decorative elements has surged. The rise of modern architecture that blends traditional materials with contemporary designs contributes to the segment’s expansion.

Application Insights

The commercial segment led the market with the largest revenue share of 41.5% in 2024. The natural stones, such as granite, marble, and limestone, are widely used in constructing office buildings, retail outlets, shopping malls, hotels, and restaurants due to their aesthetic appeal and robustness. Natural stone's ability to enhance the visual appeal and luxury of commercial spaces, combined with its long-lasting durability, makes it an attractive choice for developers and architects working in high-traffic areas that require materials with both functionality and elegance.

The residential - remodelling segment is anticipated to register at the fastest CAGR over the forecast period. The residential remodeling segment plays a pivotal role in driving the market growth as homeowners increasingly invest in upgrading their living spaces with high-quality, visually appealing materials. Natural stones like marble, granite, travertine, and slate are favored for kitchen countertops, bathroom vanities, flooring, wall accents, and outdoor landscaping due to their aesthetic elegance and long-lasting performance.

Regional Insights

The natural stone market in North America is anticipated to grow at a significant CAGR during the forecast period. The Expanding infrastructure projects across North America significantly contribute to the demand for natural stone. Government initiatives, such as the U.S. Infrastructure Investment and Jobs Act, allocate substantial funds toward developing roads, bridges, and public buildings. Natural stones like granite and limestone are preferred for these projects due to their durability and aesthetic appeal. In addition, the rapid urbanization in metropolitan areas necessitates the construction of residential and commercial buildings, further propelling the market. In June 2024, SiteOne Landscape Supply expanded its footprint in Canada by acquiring Cohen & Cohen Natural Stone, a wholesale distributor of hardscape products in Ottawa. This acquisition marked SiteOne's fourth of the year, enhancing its ability to provide landscape supplies in eastern Canada.

U.S. Natural Stone Market Trends

The natural stone market in the U.S. accounted for the largest market revenue share in North America in 2024. Significant investments in infrastructure projects across the U.S. bolster the demand for natural stone. Government-backed initiatives, including transportation hubs, municipal buildings, and educational institutions, increasingly incorporate materials like limestone and sandstone for their structural resilience and timeless appeal. In addition, urbanization trends in states such as Florida and New York fuel the need for durable and aesthetically pleasing materials in high-rise developments and coastal constructions.

Asia Pacific Natural Stone Market Trends

Asia Pacific dominated the natural stone market with the largest revenue share of 47.8% in 2024. The Asia Pacific region has seen a surge in construction and infrastructure projects, particularly in countries like China and India. This uptick in development has increased the demand for natural stone in applications such as flooring, wall cladding, and decorative elements. The region's abundant natural stone resources and advancements in quarrying and processing technologies have further facilitated market growth.

As urbanization continues and architectural preferences evolve, the Asia Pacific market is poised for sustained expansion. In December 2024, the inaugural ASEAN Stone Exhibition was launched in Ho Chi Minh City, Vietnam. Organized by MMI Asia, a subsidiary of Messe München GmbH, this event marked Southeast Asia's first dedicated natural stone exhibition.

Europe Natural Stone Market Trends

The natural stone market in Europe is witnessing increased demand for natural stone, particularly in applications like flooring, countertops, and wall cladding. Homeowners and developers favor natural stone for its timeless beauty and durability. In commercial spaces, natural stone conveys a sense of luxury and permanence, making it a popular choice for hotels, office buildings, and retail establishments.

Latin America Natural Stone Market Trends

The natural stone market in Latin America is anticipated to grow at a significant CAGR during the forecast period. Advancements in stone processing technologies have enhanced the efficiency and precision of natural stone fabrication in Latin America. Innovative techniques such as CNC milling, waterjet cutting, and laser engraving allow for intricate designs and finishes, expanding the application of natural stone in modern architecture and interior design. These technological improvements reduce waste and lower production costs, making natural stone more accessible and appealing for various construction applications.

Middle East & Africa Natural Stone Market Trends

The natural stone market in the Middle East & Africa is anticipated to grow at the fastest CAGR during the forecast period. Rapid urbanization and ambitious infrastructure projects are major drivers of the market growth in the MEA region. In the Middle East, countries like Saudi Arabia and the UAE invest heavily in construction projects, including residential complexes, commercial buildings, and public infrastructure. These developments increase the demand for natural stones such as granite, marble, and limestone, which are valued for their durability and aesthetic appeal. Similarly, in Africa, urban expansion in countries like Nigeria and Ethiopia is fueling the need for high-quality building materials, further boosting the natural stone industry.

Key Natural Stone Company Insights

Some of the key players operating in the market include ARO Granite Industries Ltd., Dermitzakis Bros S.A., and others.

-

ARO Granite Industries Ltd's product portfolio encompasses various natural stone offerings, including granite slabs, tiles, cut-to-size products, and engineered quartz stone slabs. The company's manufacturing facilities boast advanced machinery, such as 20-headed polishing lines, enabling the production of various finishes like polished, flamed, honed, brushed, leather, and caress. AGIL processes over 100 shades of granites and quartzites sourced from countries like India, Brazil, Norway, Finland, Iran, Africa, and Ukraine.

-

Dermitzakis Bros S.A. offers a diverse range of marble Products, including Thassos Snow White, Pirgon White, Lucina, Arabesco, Talos, Travertine, Perla Beige, Oasis Green, and Silver Gray. Dermitzakis Bros S.A. offers these materials in various forms such as blocks, slabs, tiles, and custom-cut pieces, catering to applications in flooring, wall cladding, countertops, and decorative elements. Their commitment to quality is underscored by ISO 9001 certification, and they employ advanced technologies like CNC milling and CAD/CAM systems to ensure precision and excellence in their products.

Key Natural Stone Companies:

The following are the leading companies in the natural stone market. These companies collectively hold the largest market share and dictate industry trends.

- ARO Granite Industries Ltd.

- Dermitzakis Bros S.A

- Dimpomar

- Levantina y Asociados de Minerales S.A.

- Margraf SPA

- Mumal Marbles Pvt. Ltd.

- Polycor Inc.

- Ranamar Marble

- Temmer Marble

- Topalidis S.A.

- Xishi Group Ltd.

Recent Developments

-

In February 2025, Anatolia, a Canadian-based global leader in natural stone manufacturing, launched a series of new curated natural stone collections that blend timeless elegance with innovative craftsmanship. The company’s portfolio features sophisticated finishes, textures, and colors to meet classic and contemporary aesthetic demands. These collections include various premium stone products such as dolomite, marble, travertine, limestone, and pebble mosaics, each selected for their exceptional quality, craftsmanship, and beauty.

-

In July 2024, Antolini introduced AzerocarePlus, an innovative and patented treatment designed to enhance the durability and strength of natural stone surfaces such as marble, onyx, soft quartzite, and travertine. This process protects these stones from etching and staining caused by acidic and organic substances like lemon juice, wine, and vinegar, making kitchen countertops and bathroom surfaces more resilient to everyday wear and tear.

Natural Stone Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.64 billion

Revenue forecast in 2030

USD 14.11 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

ARO Granite Industries Ltd.; Dermitzakis Bros S.A; Dimpomar; Levantina y Asociados de Minerales S.A.; Margraf SPA; Mumal Marbles Pvt. Ltd.; Polycor Inc.; Ranamar Marble; Temmer Marble; Topalidis S.A.; Xishi Group Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Stone Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural stone market report based on the product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Marble

-

Limestone

-

Sandstone

-

Granite

-

Travertine

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential - New Construction

-

Residential - Remodeling

-

Commercial

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global natural stone market size was estimated at USD 10.17 billion in 2024 and is expected to reach USD 10.64 billion in 2025.

b. The global natural stone market is expected to grow at a compound annual growth rate of 5.8% from 2025 to 2030 to reach USD 14.11 billion by 2030.

b. The granite segment dominated the market with a revenue share of over 39.0% in 2024.

b. Some of the key vendors of the global natural stone market are ARO Granite Industries Ltd., Dermitzakis Bros S.A, Dimpomar, Levantina y Asociados de Minerales S.A., Margraf SPA, Mumal Marbles Pvt. Ltd., Polycor Inc., Ranamar Marble, Temmer Marble, Topalidis S.A., Xishi Group Ltd.; among others.

b. The key factor that is driving the growth of the global natural stone market is the growing demand for aesthetically appealing, durable, and sustainable construction materials in residential, commercial, and infrastructural projects across emerging and developed economies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."